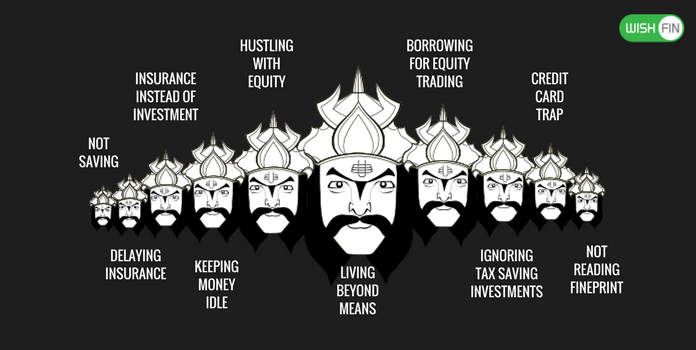

Faced with Financial Ravan? These are 10 Habits You Need to Overcome.

Last Updated : Sept. 29, 2017, 11:40 p.m.

Dussehra celebrates the victory of good over evil. Its defining image is that of Ram overcoming Ravan by targeting each of his ten heads. The battle is rather symbolic of our internal struggles… The ten heads, of course, representing the negative aspects of the self, such as arrogance, greed, etc.

So as an ode to this auspicious day, we list how each one of us can slay Ten Harmful Financial Habits to put us on the path to financial health and prosperity.

1. Saving Too Little, Too Late

‘I live for the day and I’ll start saving when the need arises.’ Such thinking is the root cause of financial ruin. Have a monthly saving target – a minimum of 20% of income. Aim to earn at least 12 to 15 percent of return on your savings (after securing enough for contingencies)

2. Delaying health insurance

No one gets younger with time, at least biologically. So, there is a direct cost associated with a delay in taking health insurance. Three key reasons – Age of the applicant is a big determinant of your premium amount. So, a young person can get health insurance at a steal. The older you get, the more likely you are to have some health issues, which will raise your premiums. Also, taking an insurance early is a way to lock yourself at a low premium. The premium of a policy you had taken in 2005 will feel negligible in 2017, but the premium for the policy you take in 2017, is bound to pinch! Take health insurance at an early age, and you’ll be insured from inflation!

3. Confusing Insurance for Investment

A lot of insurance policies are marketed as investment schemes by dangling the carrot of a large payout after the policy matures. Simple mathematics will tell you that Insurance is not a sound ‘Investment’ relative to a plethora of other alternatives available with a similar risk profile. Look at Insurance for what it is – a hedge against future risk; a security umbrella for peace of mind.

4. Keeping Idle Cash in FDs Instead of Investing in MF

You have worked so hard and saved up all that money. Congrats for that. But it would be a pity if your savings are languishing in a savings account only to earn you around 6 %, while inflation takes a bite out of your returns. Resolve to make your savings work harder by investing in more dynamic investment options such as Liquid Funds which give you good returns along with enhanced liquidity.

5. Not Investing Regularly via SIP and Trying to Time Markets

Too many people buy stocks when the markets are surging and panic sell when the markets get too turbulent to bear – following classic herd behaviour will ensure that you lose money in the long run. The Equity Market is not a beast you should try to tame or game. Rather you should learn to manage it with discipline and make the most of it. If you are looking to grow your money sustainably, the best option is to invest systematically using SIPs, which offset market volatility in the long run and earn you good returns over time. Be patient. Be disciplined. Do not be reactive. Don’t look to make a quick buck.

6. Taking a Loan to Trade in Equities

This is a cardinal sin which is to be avoided at all costs. It is almost as bad as taking a loan to gamble. This is because, markets may go up or down, so may your returns. But your loan burden won’t get any lighter. Essentially, it’s not a good idea to invest money that you do not have. If the market goes down, your loan will ensure you sink faster.

7. Not Taking Advantage of Tax Saving Investment Options and Deductions

This is a low hanging fruit. If you don’t pick it, all you will be left with is regret and more taxes. Section 80C and other similar tax exemptions are designed to give you a twofold benefit – you save taxes, plus you end up having the saved money invested in instruments that give you a good return. So, not doing it not only cost you in taxes, but also in terms of opportunity.

8. Paying Only the Min. Due on Credit Cards, Getting Stuck in High-interest Debt Trap

When you close your eyes, the problem doesn’t go away. Similarly, when you pay off the minimum due, your credit card debt doesn’t go away. What makes it worse is that you may become complacent, miss out payments and risk sinking deeper into a debt trap. This is a bad habit, you need to discard right away. Unless you want the thrill of compounding dues being charged at the rate of around 36% annually, pay off your entire Credit Card debt as soon as possible. If you can’t, stick to debit cards.

9. Not Reading the Fine-Print

Financial products can be complicated. Most people try to deal with this problem by buying blind and avoiding any due-diligence (or by taking ‘expert’ advice). Not done. Unless you want to be surprised with unexpected fees, pre-payment charges, unreasonable terms, it pays to do your home-work, compare products and only opt for a product once you are sure of all the details. Make sure you make an informed call while choosing a financial product, no exceptions.

10. Living Beyond Your Means

Well, this one is straightforward enough, but also the most common of financial Ravans, may be since before the time of Ravan. Those tempting EMIs and Trillion Dollar Sales, do not mean that you spend the money that you don’t have. A quick affordability analysis before you ‘Add to Cart’ is your best bet to maintain financial sobriety. Save in a disciplined manner, invest regularly, and only allow yourself those spending binges as gratification. Trust us, it feels good and keeps you financially healthy.