Get Instant Detailed CIBIL Score Report for Free

A CIBIL score is a three digit number between 300 to 900 that denotes your creditworthiness. The nearer your score is to 900, the higher is your creditworthiness. A high score means that you are an individual who has been handling your finances responsibly and paying your dues on time. You will easily qualify for potential credit. A score above 750 is considered good for the approval of loans or credit cards in India. On the other hand, if you have a low score below 650, then lenders are likely to reject your application for loans, credit cards, or any other credit product. They will see you as a risky borrower and will not have the confidence to lend to you. Even if some financial institutions are willing to sanction your loan or credit card, you may have to pay very high interest rates and face unfavorable loan terms. So, it is essential to maintain a good CIBIL score by checking your CIBIL report regularly.

What is a CIBIL Score

CIBIL or Credit Information Bureau (India) Limited (CIBIL) is the most reputed among the four credit information companies licensed by the Reserve Bank of India. The three other credit bureaus are Experian, Equifax, and Highmark. CIBIL India is a subsidiary of TransUnion, an American MNC group. It maintains credit files for around 600 million individuals and 32 million businesses. The most reputed credit score in India is the CIBIL score.

Benefits of Checking Your CIBIL Score Online at Wishfin

Wishfin is the official partner of TransUnion and gives an authentic and accurate CIBIL score. You can check your CIBIL score for free on Wishfin, this is because we believe that good credit health is a stepping stone to a successful financial life. Here are some benefits of checking your CIBIL score on Wishfin

- Checking your score on Wishfin is always free of cost, and it does not reduce your score or negatively impact it in any way. This is why more than 7 million people have already checked their CIBIL Score online for free with Wishfin.

- You do not have to enter all your details each time you check your score. All you have to do is log in to Wishfin with your OTP and your registered mobile number.

- Wishfin has the best in class data security and privacy protocols. So, your details will be safe, and you can check your CIBIL score safely.

- You are given 2 options to check the score. You can login into the Wishfin website and navigate to the CIBIL section. Else, you can download the Wishfin app from the Android Google Playstore or Apple iOS Appstore.

- You can also view your detailed CIBIL report with ease.

- On the app, you can also follow your progress over time by seeing your past scores.

Difference Between a Credit Score and a CIBIL Score

CIBIL score is a Credit Score generated by a credit rating agency called TransUnion. TransUnion CIBIL is the gold standard of Credit Scores and the only one that counts while seeking finance. While there are several Credit Bureaus that issue credit scores, CIBIL is the one that holds most weight with banks. Now, a Credit Score is like your financial report card with a numerical representation of your credit health. A CIBIL score can range from 300 to 900 in India and CIBIL score above 750 is considered good for the approval of loans or credit cards. While evaluating any sort of credit application, the lender checks your credit score and your credit history before going ahead with the application.

Therefore you can not point out a better score because every agency has its parameters to calculate the credit score and the Cibil TransUnion is one of them. Usually a Cibil Score of 750 and above is enough to get quick approval for a loan or debt.

Credit Score - Check Free CIBIL Score Online

Wishfin is the best way to check your CIBIL Score for Free, as more than 7 million satisfied users have already been discovered! On Wishfin, you can check your CIBIL score every month for free without paying any charges for calculation. It is important to make a Cibil Check because banks look at your CIBIL Score before giving you any type of loan. Wishfin enables you to monitor your Credit Health and Credit History over time and take steps to improve it. You can also download the detailed CIBIL Report that allows you to check your credit repayment status, on-time EMIs, loan enquiries, and much more – at zero cost. If required, Wishfin also suggests financial products such as loans, credit cards, and balance transfers that may have a positive impact on your credit history.

What is the Full Form of CIBIL?

The Term Cibil stands for “Credit Information Bureau India Limited” and it is a company that is engaged in managing and keeping credit records of different companies, firms, and individuals based on which the lenders disburses the loan. The Banks and other lending institutions submit the information to Cibil based on which this company calculates the Cibil Score.

How to Check Free CIBIL Score Online at Wishfin?

Wishfin is the official partner of TransUnion for giving authentic and accurate CIBIL Scores. Wishfin gives you the original authentic CIBIL score free because we believe that good credit health is a stepping stone to enabling good finances for our customers. Another advantage is that Wishfin is free of cost no matter how many times you check Cibil’s score online (and not just for the first time). Also, checking your Score on Wishfin does not reduce your score or negatively impact it in any way – no matter how many times you check your score with us. This is why more than 7 million people have already checked their CIBIL Score online for free with Wishfin.

Plus, no need to do it again. Next time you want to check your score, all you have to do is log in to Wishfin with OTP using your registered mobile number, and you’re good to go!

And with best-in-class data security and privacy protocols, ease of staying credit healthy comes with complete security and peace of mind! You also have the choice of either logging into the Wishfin website and go to the CIBIL section or downloading the Wishfin app from the Android Google Playstore or Apple iOS Appstore. Additionally, there is an option to download your detailed CIBIL report easily. On the app, you can also track your progress over time by seeing your past scores.

How to Check CIBIL Score by PAN Card and Aadhaar Card?

Your PAN card enables credit rating agencies to identify your credit records accurately. So, your PAN number is necessary to check your CIBIL score. While verifying your CIBIL, keep your PAN card handy and make sure that the name and date of birth you enter match those on your PAN card. Here are the steps to check your CIBIL score by PAN card on Wishfin:

Step 1: Navigate to ‘CIBIL Score’ on the Wishfin portal or use the Wishfin App.

Step 2: Provide the PAN Card number.

Step 3: Enter your name and date of birth according to your PAN card.

Step 4: Enter details such as gender, email address, residential address, net monthly income, employment status, city, and mobile number.

Step 5: Click ‘Submit’ to know your score.

Your CIBIL score cannot be checked directly using your Aadhaar card . The Credit Information Bureau India Limited needs your PAN card to access your credit history and generate your score. However, the Aadhaar can sometimes serve as an additional ID proof during the registration process.

How to Check Free CIBIL Score on WhatsApp?

You can check your CIBIL score on Wishfin using Whatsapp. It is now as easy as chatting with a friend. All the user has to do is give a missed call to +91-8287151151. You will receive a WhatsApp message from Wishfin. You will be asked to give a few details like

- Your Full Name

- Your PAN Number

- Your Residential Address

- Your Email Id

You just have to answer these questions and you will get your latest CIBIL score in your Whatsapp chat box.

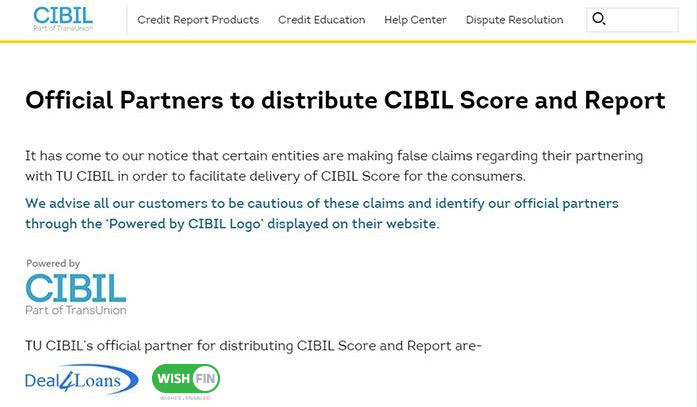

Is Wishfin an Official Partner of CIBIL?

Wishfin is the first official fintech partner of TransUnion CIBIL (Credit Information Bureau (India) Limited). This authorizes Wishfin to present you with the score generated by TransUnion. At Wishfin, we are all about trust and transparency. So, here is a link from CIBIL’s official portal for your reference:

https://www.cibil.com/official-partners

Does checking CIBIL Score multiple times affect overall Credit Score?

CIBIL score can be checked in two ways - On one side, CIBIL checks are requested by financial institutions to ascertain an individual’s creditworthiness. This happens when a person applies with the institution for a loan or credit card. During the evaluation process, a CIBIL inquiry is triggered by the institution in the background. However, the bank or NBFC can check your CIBIL report only after getting the approval from the applicant. The decision to approve the loan is partly based on your CIBIL score and the information in your CIBIL report. This is called a hard inquiry. If your CIBIL score is already very mediocre, then a hard inquiry will knock off your CIBIL score by a few points. Multiple hard inquiries will have a drastic impact on your CIBIL score. So, the key takeaway from this is that you should not apply for loans or credit cards without knowing your credit situation. Also, do not apply for credit as soon as your application is rejected. Evaluate why you got rejected and take steps to improve your financial position - Your CIBIL score lender.

On the other hand, when individuals check the score by themselves online to monitor their credit health, it is called a soft inquiry. Your CIBIL score does not get impacted by such types of inquiries.

If your score is low, you see it before the bank does. Say your score is lower than 700, then you can improve your score over time by optimizing your credit situation and following the score-boosting advice given by Wishfin. If you are interested, Wishfin can also show you financial products with high approval probability so that you may fulfill your immediate need and get started on the path of healthy credit. Once you are confident about your score, you can apply in a more targeted manner, increasing the chances of disbursal and reducing the risk of multiple bank-initiated credit inquiries.

What are the benefits of having a good CIBIL Score?

Credit facilities, such as credit cards or loans, are provided based on a thorough check of numerous factors. These factors include your relationship with the lender, employment status and history, age, and more. Amongst these factors, CIBIL score is considered as one of the most important factors.

Banks evaluate your creditworthiness and capacity for repayment based on your CIBIL score. Therefore having a good CIBIL score not only helps you get approval in the first place but also affects the quality of debt available to you. A good CIBIL score makes a person eligible for better deals on loans and credit cards. So, what to do if your CIBIL score is poor? There are lenders who will give you a loan even for a low CIBIL score, but you will have to pay higher interest, and the loan terms may not be favorable to you. Further, you can opt for secured loans such as loan against property, gold loans, etc. by placing these assets as collateral or security. But the options are still limited.

Some banks and NBFCs may give loans or credit cards even with a CIBIL score of 0 or -1. But, these may be at exorbitant rates of interest, offering very low credit limits and stringent repayment terms. Getting a loan on good terms, which you can provide viably service is more important. Here are some pros of maintaining a good CIBIL score

- Increases eligibility for loans - A higher consumer CIBIL score means that lenders will be more comfortable in lending you a bigger amount with better loan terms

- Gives access to best Credit Cards - Some of the premium credit cards offer great benefits in addition to deals and offers. Most of these cards have a good CIBIL score as a prerequisite.

- Lower rate of interest - People wonder why they do not get a loan at the advertised lowest rate of interest. It could be because of a subpar cibil score in addition to other factors such as income, repayment capacity. Those having a positive payment history and a high score are more likely to get a lower rate on loans.

- To build and maintain a credit history - Good credit health does not stop at getting a good score just when you need a loan. What you do with that loan, and how you repay it affects your future score. Maintaining a good CIBIL score, whether you are seeking a loan or not helps you maintain overall financial discipline. Paying credit card bills and EMIs on time, not taking multiple loans and credit cards even though you can afford it now and your score allows it shows that you are not overdependent on credit and can handle your finances responsibly.

Please note that a score of 0 or -1 is not necessarily bad. It only means you have zero credit history and CIBIL score. The moment you start using a credit card or paying EMIs, your credit history will build up and so will your credit score. This will make you eligible for better options in the future.

What is a Good CIBIL Report?

A CIBIL report is a single unified document that provides a detailed overview of your credit history across different lenders over a significant time period. It is a comprehensive report that provides details of an individual’s or corporate entity’s borrowing history and repayment record. The credit report includes the following information and you can download a free Cibil report via Wishfin.

- Personal details of an applicant (name, age, gender and address)

- Employment details and earnings

- Number of hard enquiries made by potential lenders

- Records of previous and current loans along with the repayment history

- Any defaults on loans

- Total credit limit and the amount spent monthly (Credit Utilisation Ratio)

- The details of settled loans, if any

- Any credit card payment defaults

- Credit score

This report provides lenders with detailed information on the applicant’s creditworthiness based on previous and current credit behavior. Based on the report, lenders determine whether to give you a loan or not. But more importantly, it provides you with an opportunity to analyze your credit habits and take corrective action if needed. Being aware is the first step to good financial health. As the number of loans and credit cards pile up, even the most disciplined among us can lose sight of our credit situation. And this is not to be taken lightly, because whether you like it or not, all your credit habits get recorded by financial institutions – it’s like karma. So, a CIBIL report is especially empowering because it helps you understand the workings of credit better and keeps you one step ahead.

How is CIBIL Report Generated?

Credit Information Bureau of India Limited (CIBIL), India’s first Credit Information Company, collects and maintains the records of an individual’s and non-individuals’ (commercial entities) credit-related transactions such as loans and credit cards. These records are given by banks and other lenders every month to the credit bureau. Using these details, a Credit Information Report (CIR) and credit score are generated. When you check your score on Wishfin, you see this exact score and report generated by TransUnion.

How is Cibil Score Calculated?

Member banks and financial institutions report the details related to the credit activity of the customers to the bureaus. This includes data about each loan or credit card repayment made by the customer during the period and even the late or skipped payments. The report comprises new loan applications, interest rates, the credit limit on cards, and the status of all loan accounts including those ‘written-off' or ‘settled’ or ‘closed’. After a complex statistical analysis of the provided information, the CIBIL score is calculated. Timely repayments generally lead to a good score. Applicants with a high score have better chances of getting a loan or a credit card.

Factors Affecting CIBIL Score

A CIBIL score is influenced mainly by the factors - Repayment history, credit utilization ratio, age of credit, credit mix, the number of hard inquiries, and errors in the credit report. Let us now analyze these factors in depth.

Repayment History:

The repayment history is the most important factor that impacts the CIBIL score. Timely repayments of credit card bills and loan EMIs have a positive impact on your score. Payment defaults or missed payments on the other hand bring down your credit score. Also, when you miss credit card bill payments or just pay only the minimum amount due, you will be charged interest on the carried forward balance. A few missed credit card bill payments or payment of only the minimum amount due will lead to huge accumulation of debt. This will lead to a debt trap.

Solution

Always make timely repayments of your loan EMIs and credit card bills. In order not to miss payments, set up auto pays and payment alerts.

Age of credit:

Age of credit is an important parameter in determining your CIBIL score. A longer credit history enables the lender to have greater confidence in you. Old credit card accounts which have a good repayment history and long term association with financial institutions. give a favorable impression with potential lenders. Besides, closing old credit card accounts reduces the overall available credit limit, thus increasing the credit utilization ratio.

Solution:

So, do not close such old credit card accounts and try to keep them active by making small purchases and paying the bills on time.

Credit Utilization Ratio :

Your credit utilization ratio (CUR) is defined as the percentage of credit you have utilized to the credit available to you. Experts recommend a CUR within 30%. Having a high CUR will give the impression to lenders that you are over-dependent on credit. A low credit utilization ratio has a positive impact on your CIBIL score, and you are more likely to get loan approvals.

Solution:

Maintain a CUR within 30%. Make judicious purchases and do not overspend.

Number of Hard Inquiries :

Whenever you apply for a credit product, the lender checks your credit report or credit score. This is referred to as a hard inquiry. It shows up in the enquiry section of your credit report. Too many hard credit enquiries may hurt your credit score drastically.

Solution:

To prevent this, do not apply for multiple credit frequently.

Errors in Your Credit Report:

Sometimes, credit card issuers or credit bureaus may enter wrong information in your credit report regarding your loan status or repayments. Other wrong details could include erroneous personal details, duplicate accounts, accounts which are active but not your own (Due to identity theft). These could be bringing down your CIBIL score.

Solution:

Monitor your CIBIL credit report regularly for any discrepancies. If you identify any, raise a dispute with CIBIL and rectify them

Debt Consolidation/Debt Optimization/Debt Restructuring:

Why keep 4 credit cards and 3 loans running when you can make do with 2? Close down loan accounts and credit cards that you don’t use much. Say, you have been paying 36% interest on your credit card, it would be wise to take a personal loan at less than half the interest rate, pay off the credit card liability, terminate the card, and pay off the personal loan using more manageable EMIs. Also, look for options such as turning your credit card outstanding into EMI. This helps you stay clear of the debt trap and these smart decisions will reflect in an improved score.

Utilize Balance Transfer Opportunities:

This one is somewhat related to the earlier point but deserves a spot of its own. A balance transfer is shifting to another loan with better interest rates and terms. Why continue suffering the same product when better options become available? You can easily do so for products such as personal loans and home loans and reduce your liabilities, possibly shrinking your EMIs and improving your CIBIL score! You can keep an eye on balance transfer offers recommended by Wishfin every time you check your CIBIL score on the website.

Credit Mix:

A diverse portfolio of credit including credit cards, secured, and unsecured loans have a positive impact on your credit score. It demonstrates to lenders that you are capable of handling various types of credit simultaneously.

Solution:

Have a good credit mix of revolving credit (credit cards), loans, and mortgages. Also, ensure to maintain a balanced ratio between secured and unsecured loans.

How to Improve or Increase CIBIL Score?

A good Credit Score is like good health – there are only upsides and no downsides. Whether you choose to seek credit using it or not becomes secondary. The fact that it gives you access to healthy credit if and when you need it is a reassuring feeling. It only strengthens your financial options and keeps you on track though positive habit formation. To get the best deals on credit cards and loans, your score must be good. In India, banks and NBFCs would consider your application only if you have a good credit score. Once you understand the factors affecting your score, taking steps to improve it be it becomes easier. Here are some recommended measures to improve your CIBIL score:

- On-time, Every-time’ Payments - Always pay your Credit Card Bills on time. Never miss the due date. Ensure that your EMI deductions are not delayed for any reason. This will demonstrate your credit discipline and establish your repayment credibility.

- Debt Consolidation/Debt Optimization/Debt Restructuring - Why keep 4 credit cards and 3 loans running when you can make do with 2? A tight ship is easier to steer. Close down loan accounts and credit cards that you don’t use much. Say, you have been paying 36% interest on your Credit Card, it would be wise to take a Personal Loan at less than half the interest rate, pay off the Credit Card liability, terminate the card, and pay off the Personal Loan using more manageable EMIs. Also, look for options such as turning your Credit Card outstanding into EMI. This helps you stay clear of the debt trap and these smart decisions will reflect in an improving score. Bring down your Credit Utilization percentage and ensure a healthy ratio of secured to unsecured loans. It’s an ongoing process. Keep optimizing.

- Utilize Balance Transfer Opportunities - This one is somewhat related to the earlier point but deserves a spot of its own. A balance transfer is shifting to another loan with better interest rates and terms. Why continue suffering the same product when better options become available? You can easily do so for products such as Personal Loans and Home Loans and reduce your liabilities, possibly shrinking your EMIs and expanding your Cibil Score! And it’s a virtuous circle – the more your score improves, the better the deals that become available to you. You can keep an eye on balance transfer offers that get unlocked depending on your score using Wishfin’s recommendation engine, every time you check your CIBIL for free on Wishfin!

- No Credit History? Try for a Small Loan or a basic Credit Card - This may sound counterintuitive. But if you have no credit history yet ( and hence a 0, -1 score), it might be a good idea to start building one by applying for an entry-level credit product, even if you don’t need it. Why? Because you have to start somewhere and you don’t want to be stuck with no cibil score when you need finance. But a word of caution – don’t get carried away. Just because a loan with a high credit limit is available does not mean you take it. Opt for something which is manageable and involves regular repayment, so that you can establish a positive repayment pattern. You can move on to the big stuff when your Cibil Score gets going as fast as your career!

Why is my CIBIL Score Zero or Negative? What does a CIBIL Score of 0, -1, or 1 to 5 mean?

Seeing a 0, negative, or a single-digit CIBIL Score can be alarming for new borrowers. In most cases, there is no reason to worry, but definitely, some reason to take constructive action. Such scores indicate that the individual has no credit history or an inadequate one.

A CIBIL score of 0 indicates NH or No history, i.e., no records of the borrower can be found. A CIBIL score of -1 means that the credit history of the borrower is NA or not available. It may also imply an inadequate credit record or that fewer than 6 months’ worth of records is available (Not enough to generate a score).

A CIBIL score ranging from 1-5 denotes the magnitude of risk that a lender may face while lending to a fresh borrower. 5 means less risk. 1 means more risk.

Why is my CIBIL Score is not getting generated?

Sometimes, people raise queries like “Why am I unable to check my CIBIL score?”. It can be due to many possible reasons. The systems at TransUnion identify you and your records based on the details that exist in your banking records. Often, this information is provided by you to banks a long time ago. Details like phone numbers, addresses, and employment details change with time but are often not updated in your banking records. Sometimes, while filling the CIBIL form, one puts in the latest details or the details he can recall. But if there’s a mismatch with the banking records, as a privacy feature, CIBIL does not show you the score, because it has not been able to identify you with sufficient certainty. In such cases, it is best to review all details in your banking records and write to CIBIL using the contact us page on their official website. If there is a discrepancy, only they can help rectify it.

Frequently Asked Questions (FAQs)

Below are few questions for CIBIL Score

You can find the exact Cibil Score on Wishfin by providing your basic details. All you need is to enter your name, PAN, City, Income, Employment Status, Mobile Number, Email ID, and Date of Birth to find the exact Cibil Score. If your score is 750 and above then you can easily apply for credit cards, personal loans, home loans, and other types of loans.

Recent Articles

See more articles