Best Fuel Credit Cards in India

Last Updated : Sept. 28, 2024, 3:49 p.m.

A fuel credit card is a card that is specifically curated to benefit frequent fuel purchasers. They help you save on fuel and enable you to get free fuel or cut down on your fuel costs. These cards offer cashback, rewards, accelerated rewards, and valueback on fuel purchases made at fuel pumps across India. Besides offering rewards on fuel, they can also provide significant benefits across other categories such as entertainment, shopping, dining, etc. With the rise in the prices of fuel like petrol and diesel, it is ideal to use a fuel credit card to cut down on fuel costs. Let us now look at the Top fuel credit cards in India for 2024.

Top Fuel Credit Cards in India 2024

|

Credit Card |

Joining fee |

Annual or renewal fee |

|---|---|---|

|

IndianOil RBL Bank XTRA Credit Card |

INR 1500 |

INR 1500 |

|

INR 1499 |

INR 1499 |

|

|

INR 500 |

INR 500 |

|

|

INR 500 |

INR 500 - Waived off on spending Rs. 3.5 lakhs in a year. |

|

|

INR 500 |

INR 500 |

|

|

INR 449 |

INR 449 |

|

|

INR 199 |

INR 199 |

|

|

INR 499 |

INR 499 waived off on spends of Rs. 1,50,000 or more in a year. |

|

|

HPCL BoB Energie Credit Card |

INR 499 (Levied in the first statement) |

INR 499 (Waived off on spending Rs. 50,000 in a year) |

|

INR 499 |

INR 499 waived off on spends of Rs. 1,50,000 or more in a year |

Before looking into the key features of these cards, let us understand the types of fuel credit cards, eligibility to apply for a fuel credit card, and how to choose the right card?

Types of Fuel Credit Cards

Fuel credit cards can be co-branded or non co-branded.

Co-branded fuel credit cards

These are credit cards that are rolled out by tie ups between banks and specific fuel companies. They offer higher rewards when used at the partner fuel stations. For instance, with the IndianOil you will get accelerated 15 fuel points per Rs. 100 spent at IndianOil fuel stations (Subject to a maximum of 2,000 fuel points per month). This will help you save considerably on refueling at IndianOil petrol pumps.

Non Co-branded fuel cards

Non co-branded fuel cards can be used at fuel stations of any brand. They usually offer consistent value back or rewards across several outlets. So, if you are not a person who uses only one brand most often and refuel at multiple brands, then you can go in for a non co-branded fuel credit card.

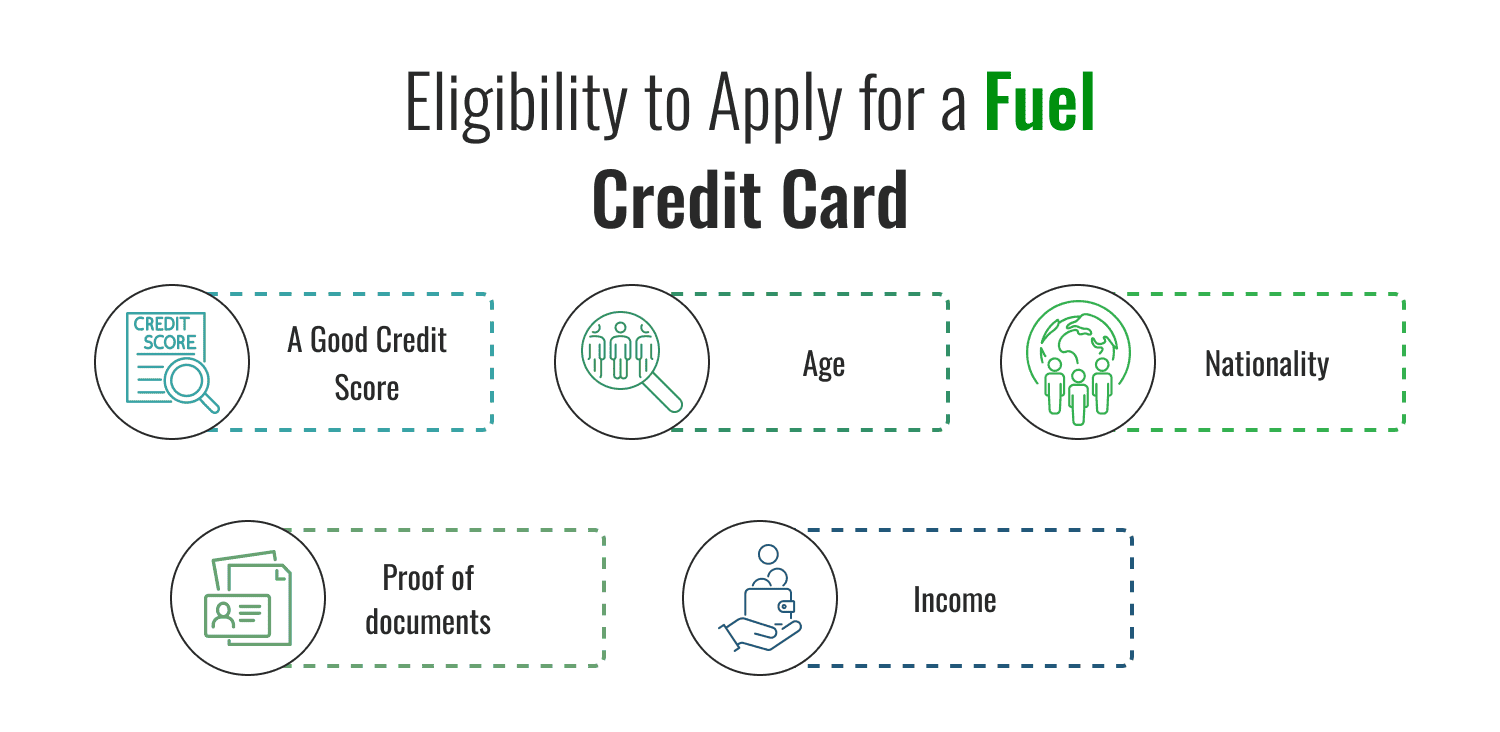

Eligibility to Apply for a Fuel Credit Card

The eligibility for a fuel credit card varies across banks. However, there are some common eligibility criteria. They are as follows:

-

A good credit score:

You should have a good credit score with no credit defaults. Usually a

credit score

of 750 and above is considered excellent.

-

Age:

The main card holder has to be between 21 to 65 years old and the add on cardholder must be at least 18 years old.

-

Nationality:

The individual must be an Indian resident.

-

Income:

The applicant must have a steady source of income whether salaried or self-employed. This will vary across card issuers with the minimum monthly income typically starting from Rs. 20,000 for the salaried and Rs 3 lakhs for the self-employed.

- Proof of documents: All the essential documents such as Aadhaar, birth certificate, ITR etc. must be submitted with accurate details.

How to Choose the Right Fuel Credit Card?

-

Check the ease with which you can redeem reward points:

Before applying for a fuel credit card, check the redemption process for the points. With some cards, you can easily redeem the reward points at fuel stations, while with others, you will have to convert the points to use them for other purchases. It is ideal to go in for a card with which you can redeem the points instantly.

-

Fees and charges:

The fees and charges associated with the credit card needs to be assessed before applying for it. The high fees and charges associated with the card should not nullify the effect of discounts and benefits you get from the card.

-

Identify which brand you are loyal to:

If you use a particular brand more often, then go in for a co-branded fuel credit card. Many fuel credit cards are co- branded with specific fuel companies. Choosing a card associated with the fuel brand will help you save considerably.

-

Evaluate the spend based benefits:

All fuel credit cards will offer milestone benefits, spend based benefits, annual fee waiver benefits, etc. You need to analyze and compare these benefits and choose the card according to your spend patterns. For instance, the BPCL SBI Card Octane which provides gift vouchers from popular brands on reaching milestone spends of Rs. 3 lakhs will be highly beneficial if you are able to spend around Rs. 3 lakhs in a year (Around 25,000 in a month) to avail the milestone perks.

-

Evaluate based on valueback and cap on rewards

-

Evaluate which card provides the highest return: Check and compare the value back provided by various fuel credit cards. Then, choose the one that provides the highest return in terms of valueback. For instance, when you compare the credit cards. For instance, if you take the IndianOil RBL Bank XTRA Credit Card, BPCL SBI Octane, IDFC FIRST Power Plus, and the IndianOil Axis Bank credit cards, they each have a value back of up to 8.5%, up to 7.25%, up to 6.5%, and up to 5% respectively. So, the RBL bank credit card enables you to get more liters of free fuel every year based on the valueback percentage.

-

Assess the cap on rewards: It is not just enough to choose a card based on the value back but also to analyze the cap on reward points. Most fuel credit cards have a cap on the number of reward points credited on reaching milestone spends or crossing that. For example, the BPCL SBI Octane offers a cap of 2,500 reward points per month on fuel spends beyond a point. So, a card user whether he spends 10,000 rupees or 20,000 rupees per month with the BPCL SBI Octane card will get only 2,500 reward points. Hence, it is more lucrative to get a card that offers a cap on the maximum transaction value like the IndianOil Axis Bank credit card. This card offers a limit of Rs. 5000 on the maximum transaction value. Once you exceed it, you can earn rewards on the base rate.

-

-

Check if you need other lifestyle benefits:

Other needs apart from fuel may not be very important for individuals who possess multiple credit cards. However, it can be very useful for people who just want to own a single card. They can then choose the card based on their lifestyle habits. For instance, the Indian Oil Axis Bank credit card offers 5x reward points for grocery shopping online.The card also offers accelerated rewards on online shopping, thus making it a highly worthy choice for online shoppers.

- Go in for cards that offer a fuel surcharge waiver: When you use cards that give you a surcharge waiver, you can save on each fuel purchase. So, you will be saving considerably on fuel each month. Suppose, say you are spending Rs. 400 per day on fuel. Then if there is a 1% surcharge, you will be paying 404 rupees each day for fuel. Over the month, this will add up to 120 rupees. If you go in for a card that offers a fuel surcharge waiver, then you can save this 120 rupees each month. However, there may be some cards that place an upper cap on the fuel surcharge waiver up to Rs. 250 or Rs. 500 per month based on your spends.

Top Fuel Credit Cards in India 2024 - Fuel Benefits and Other Key Benefits

IndianOil RBL Bank XTRA Credit Card

This is a co-branded card by IndianOil and RBL Bank. It offers exciting rewards for the frequent fuel buyers by enabling them to save amply up to 250 liters on fuel. It also provides attractive benefits across other categories like shopping, dining, and other luxuries.

Fuel benefits

- Get 250 liters of free petrol annually as fuel points.

- Get a value back of 8.5% at IndianOil fuel stations

- Get 15 accelerated fuel points per Rs. 100 spent at IndianOil fuel stations (Subject to a maximum of 2,000 fuel points per month).

- Redeem reward points at Indian Oil fuel stations at the rate of 1 fuel point = INR 0.5

- Get a fuel surcharge waiver of 1% up to INR 200 each month.

Other key benefits

- Get an annual fee waiver on spending INR 2,75,000 per year.

- Get 2 fuel points per INR 100 spent on your other purchases - Whether shopping, dining, or others.

BPCL SBI Card Octane

This card helps you maximize savings on fuel spends and also offers ample rewards on other categories like dining, movies, grocery, departmental stores, and retail purchase spends.

Fuel benefits

- Get a value back of 7.25% on BPCL fuel expenses.

- Get 25x reward points on fuel purchases at BPCL petrol pumps (Up to a maximum of 2500 reward points per billing cycle).

- Get a fuel surcharge waiver of 1% (Up to Rs. 100 per month) on BPCL fuel spends up to Rs. 4,000.

Other key benefits

- Get a Welcome bonus of 6000 reward points equivalent to INR 1500 on paying the annual fee.

- Get 4 complimentary visits per year to domestic VISA lounges in India

- Get 10X rewards on dining, movies, groceries, and departmental store spends.

- Get a fee waiver on annual spends of Rs. 2 lakhs and an e-gift voucher of Rs. 2,000 on annual spends of Rs. 3 lakhs.

ICICI HPCL Super Saver Credit Card

Besides providing excellent advantages for fuel, this card gives appealing discounts at supermarkets and departmental stores. Apply for this card and enjoy super privileges.

Fuel benefits

- Get a 5% cashback on fuel

- Get an additional cashback of 1.5% on all fuel purchases at HPCL outlets through the HP Pay app.

- 1% fuel surcharge waiver applicable on all fuel spends up to Rs. 4,000.

Other key benefits

- Earn 2 reward points per Rs. 100 spent on retail purchases, except fuel.

- Get 1 complimentary domestic airport lounge access per quarter on reaching milestone spends of Rs. 35,000 in the previous calendar quarter.

- Get a welcome benefit of 2,000 reward points on activation and fee payment

- Personal accident cover

- 24/7 concierge services

- 5% cashback (In reward points) on grocery, utility, and departmental store purchases.

- Get a discount of 25% on movie ticket bookings up to Rs. 100 per transaction.

- Exclusive dining benefits under the ICICI Bank Culinary Treats Programme.

- 24X7 Road Side Assistance (RSA) Services.

IndianOil Axis Bank Credit Card

This card is curated to reward you abundantly on every fuel transaction. It offers value back in the form of accelerated reward points at IndianOil outlets. It also gives you awesome benefits on online shopping.

Fuel benefits

- Get a cashback of 4% in the form of 20 EDGE reward points per Rs. 100 spent on fuel purchases made at IOCL.

- Get a cashback of 100% up to Rs. 250 as EDGE rewards on the 1st fuel spend made within the first 30 days.

- Get a fuel surcharge waiver of 1% up to Rs. 50 per month on fuel spends of Rs. 400 to Rs. 4,000.

Other key benefits

- Get 1 EDGE reward point per Rs. 100 on other spends. 1 EDGE reward point = Rs. 0.20

- Get a discount of 15% at partner restaurants via EazyDiner

- Get your annual fee waived on reaching milestone spends of Rs. 3.5 lakhs.

- Get 1% value back by earning 5 reward points per Rs. 100 spent on online shopping.

IndianOil HDFC Credit Card

This card helps you to save generously on fuel up to 50 liters and thus promises unmatched fuel benefits. It also rewards you across categories like grocery and bill payments. Apply for this card and make the most out of your travel.

Fuel benefits

-

You can earn up to 50 liters of free fuel every year by using the IndianOil HDFC Credit Card in the following ways.

- Earn 5% of your spends as fuel points at IndianOil outlets - In the first 6 months, get a maximum of 250 fuel points per month. After the 6 months from card issuance, get a maximum of 150 fuel points

- Earn 1 fuel point per Rs. 150 spent on other purchases.

- Fuel points accumulated with this credit card are valid for two years from the date of accrual.

- Get a 1% fuel surcharge waiver on all fuel transactions, applicable on transactions starting from 400 and above.

Other key benefits

- Get an annual fee waiver on spends more than Rs. 50,000 in the previous year.

- Complimentary membership to the IndianOil XTRAREWARDS Program

- Get 5% of your spends on grocery and bill payments as fuel points (Get up to a maximum of 100 fuel points per month on each category).

IndianOil Kotak Credit Card

Enjoy a rewarding experience across fuel, groceries, dining, and much more with this card. Get peerless rewards with each and every spend and trip.

Fuel Benefits

- Save 4% as reward points on IndianOil fuel spends. Get 24 reward points per INR 150 spent. The upper cap on reward points is 1200 points per statement cycle.

- Further, the card offers a fuel surcharge waiver of 1% on transactions in the range of Rs. 100 to Rs. 5,059 done only at IndianOil outlets, with a maximum surcharge waiver of Rs. 100.

Other key benefits

- Enjoy a welcome bonus of 1000 reward points on spending INR 500 within 30 days of issuing the card.

- Save 2% back as reward points on grocery and dining spends. Earn 12 reward points per INR 150 spent, subject to a maximum of 800 reward points.

- Earn 3 reward points per INR 150 spent.

- You will accumulate 0.5% reward points per INR 150 spent across all categories on all UPI credit card transactions.

- Get an annual fee waiver on spending INR 50,000 in the previous anniversary year.

ICICI Bank HPCL Coral Credit Card

This card helps you to save on multiple categories including fuel, entertainment, dining, and more. So apply for this card and enjoy an all round rewarding experience.

Fuel Benefits

- Get a cashback of 2.5% on fuel purchases at HPCL pumps on a minimum transaction of Rs. 500.

- Get a fuel surcharge waiver of 1% on fuel transactions of up to Rs. 4,000 at HPCL pumps.

Other key benefits

- Get 2 reward points per Rs. 100 spent on all retail purchases, except fuel.

- Get an annual fee reversal on reaching milestone spends of Rs. 50,000 in a year.

- Get a 25% discount (Up to Rs. 100) on movie tickets booked via BookMyShow. This offer can be availed twice a month.

- Get a dining discount of 15% on dining at more than 800 restaurants through the Culinary treats program.

IDFC First HPCL Power Credit Card

This card is a great option for HPCL brand loyalists who are looking to save on their HPCL fuel expenses. It provides an abundant value back of 6.5% on fuel. Besides fuel, this card lets you save on utility expenses, groceries, retail transactions, and Fastag recharge.

Fuel Benefits

- Get a cashback of Rs. 250 as welcome benefit on the first HPCL fuel transaction of Rs. 250 or above.

- Save up to 5% on your fuel expenses, up to Rs. 7000 annually. This is enough to buy you 65 plus liters of fuel.

- Enjoy a fuel surcharge waiver of 1%

- Save 1.5% as payback rewards through the HP Pay App.

Other key benefits:

- Welcome benefits worth Rs. 2250 within 30 days of card issuance

- Exciting lifestyle privileges like complimentary roadside assistance, personal accident cover, etc.

- Affordable and dynamic interest rates beginning at 9% per annum.

- Get reward points on every UPI transaction.

- 0% interest on withdrawing cash from ATM

- Save 2.5% in the form of rewards on utility expenses and grocery.

- Save 2.5% in the form of rewards on the IDFC First FASTag recharge.

- Earn 2x rewards on other retail transactions.

HPCL BoB Energie Credit Card

This card offers exclusive privileges on fuel enabling you to get a whopping 80 liters of free fuel. Other premium privileges include welcome bonus, annual fee waiver, reward points across utilities and departmental stores, and more.

Fuel Benefits

- Accumulate 24 reward points per Rs.150 spent at HPCL retail outlets.

- Enjoy a bonus cashback of 1.5% as payback at HPCL fuel pumps on fuel transactions done through the HP Pay app.

- Get up to 80 liters of free fuel.

- Enjoy a fuel surcharge waiver of 1% on all HPCL fuel purchases in the range of Rs. 400 to Rs. 5,000. This also includes fuel transactions made through the HP Pay app.

Other key benefits

- Enjoy a welcome bonus of Rs.500 on spending Rs. 5000 or more within 60 days of issuing the card.

- Get your annual fee waived on reaching milestone spends of Rs. 50,000 in the previous year.

- Avail up to 2% savings i.e. 10 reward points per Rs. 150 spent on utility and departmental stores.

- Get 2 reward points per Rs. 150 spent across other categories.

- Get 4 complimentary airport lounge visits (1 per quarter) at partner domestic lounges.

- Enjoy a discount of 25% (Up to Rs. 100) on buying at least 2 tickets for each transaction at Paytm movies.

IDFC First Power + Credit Card

This card helps you enjoy seamless savings on fuel, groceries, movie tickets, and other every day expenses. Apply for this card and feel powered up.

- Get welcome offer of Rs. 500 as cashback on the 1st HPCL fuel transaction and 5% cashback up to Rs. 1,000 on the 1st EMI transaction.

- Enjoy up to 6.5% savings on HPCL fuel.

- Avail up to 5% savings on IDFC Fastag recharges on HPCL fuel.

Key benefits

- 25% off on movie tickets (Up to Rs. 100) once every month.

- Get 4 complimentary access to domestic airport lounges per year

- Get complimentary roadside assistance, personal accident cover, and interest free ATM cash withdrawals.

- Get an additional value back of 1.5%

- Get 5% savings on grocery and utilities.

- Annual fee waiver on spending Rs. 1,50,000 or more annually.

- Get 3x rewards per Rs. 150 on other everyday expenses.

Conclusion

Fuel credit cards help a lot in saving on fuel. However, you should choose your card prudently by comparing between cards for factors such as rewards, fees, and other lifestyle benefits. Also, you must pay your bills on time. You can compare and apply for credit cards here at Wishfin.

Frequently Asked Questions (FAQs)