Best Apps to Pay Rent with Credit Card in India

Last Updated : Oct. 9, 2024, 11:59 a.m.

Since rent is a periodical payment of considerable size that occurs every month, you can pay it with your credit card in exchange for rewards and improved cash flow. Using a credit card , you can settle your rent bill with just a swipe and pay later. The 45 day interest free period that credit cards give provides you with plenty of time to accumulate the necessary cash to pay the rent. Nowadays, there are many apps online to pay the rent using credit cards at the cheapest rates. Let us now discuss about some of the best online apps in India in 2025 to pay rent with credit cards.

Top Apps to Pay Rent Using Credit Cards

Here is a list of some of the best online apps to pay rent with credit cards:

App | Convenience Fee |

|---|---|

PhonePe | 1.70% plus GST |

PayZapp | 2.5% plus GST |

MyGate | 1.99% |

ePayRent | 1.99% |

NoBroker | 1% plus GST |

RedGirraffe | 0.39% plus GST |

Magicbricks | 0% |

CRED | 1% to 1.75% plus GST |

Freecharge | 0.9% |

BharatNXT | 1.25% to 1.45% |

PayMatrix | 1.5% to 2.5% |

Best Apps for Paying Rent Using Credit Cards - Key Highlights

Let us now look at the key features and benefits of some rent payment apps for paying rent with credit cards.

PhonePe

PhonePe is one of the most reputed digital payment platforms in India. You can perform multiple operations like sending money, recharging, paying bills, and a lot more in just a few simple clicks. By using PhonePe, you can also get access to several insurance products and investment options.

Key Benefits of Rent Payment using Credit Card on PhonePe

- You can earn cashback and rewards when you pay rent using PhonePe

- The minimum rent payment amount allowed by PhonePe is Rs. 1,000 and the maximum is Rs. 100,000.

- The amount you can pay may differ based on your bank account and payment mode.

- On successful rent payment, the money will be disbursed to your landlord’s account within two working days.

- Phone Pe provides a feature to automate your rent payments.

- You can communicate with your landlord through the app.

- PhonePe allows the use of American Express cards to pay the rent.

- You can pay rent using the card by just paying a nominal convenience fee.

- There is no convenience fee for rent payments made using UPI .

PayZapp

This online payment app rolled out by HDFC Bank also acts as a digital wallet and a virtual card. You can use it to pay for online and offline services like paying bills, online shopping, rent payment, sending money, etc. without using your bank account or cards.

Key Benefits of Rent Payment using Credit Card on PayZapp

- You can earn bonus cashback on making rent payments using PayZapp.

- You can complete the bill payment instantly using PayZapp. However, it may take up to 4 days to process the transaction in some cases.

- You can automate the rent payments, so that there is no delay in making the payment.

- You can avail an interest free credit period ranging from 30 to 45 days.

- By making rent payments on time, you can improve your credit score and credit history.

- You can furnish rent receipts to claim HRA exemption on filing income tax.

MyGate

MyGate is a well known comprehensive community management app that is curated to serve communities with safety, security, and ease. Among the many elevated services offered by it to take community management to a highly organized level, it has introduced a new feature of rent payment. Some of the other services offered by the app include apartment security management, day to day home services, and a dashboard to manage day to day operational activities.

Key Benefits of Rent Payment using Credit Card on MyGate

- You can earn significant rewards and welcome bonuses on paying the rent on MyGate

- Get 45 to 60 days of interest free credit

- You can download the rent receipts and claim HRA exemption on filing income tax.

- Paying rent using your credit card on this app can help you improve your credit score.

ePayRent

ePayRent is a simplified platform connecting the tenants and landlords. It also makes the process of paying the rent online easy and convenient. You will be privileged to enjoy an interest free credit period of up to 45 days. Paying rent on time using credit cards will help you improve your credit score and also earn you reward points.

Key Benefits of Rent Payment using Credit Card on ePayRent

- Making payments through credit cards can safeguard your payments. This means that the confidential information is secured and encrypted.

- You can download the rent receipts or get them immediately through email. You can download them to claim HRA exemption.

- You can redeem the reward points earned for rent payments done through ePayRent.

CRED

CRED is an app that you can just tap to make your payments securely and seamlessly. You can make instant payments with your app. You can login to the CRED app and apply for CRED rent pay service at a transaction fee in the range of 1% to 1.75% according to your credit card network.

Key Benefits of Rent Payment using Credit Card on CRED

- Users can earn reward points that can be used for discounts and deals from premium brands. The amount is directly transferred to the landlord’s bank account.

- When rent is paid for the first time using the Axis Bank credit card , you will get a cashback of Rs. 500.

- You can earn up to 10x reward points if you pay the rent using the IDFC Bank credit card .

- The rewards earned in the form of CRED coins can be used to purchase products and services from CRED partners.

- The rent payment amount can be transferred directly to the landlord’s bank account.

- On paying a rent of minimum Rs. 10,000 using your RuPay credit card via the CRED app, you will get a discount of Rs. 250. You can avail this deal only once during the offer period.

- You will also get an auto applied cover of Rs. 1 lakh.

NoBroker

NoBroker enables you to pay rent with your credit card with ease. You can make all the payments related to your property in one place - rent, maintenance, deposit, token, etc. Major credit cards like Visa and Mastercard can be used to make seamless payments. You will also be privileged to enjoy 45 days of interest free credit period depending on your credit card statement date.

Key Benefits of Rent Payment using Credit Card on NoBroker

- NoBroker Provides up to 30,000 reward points on your Visa and Mastercard

- Earn rewards, cashback, or air miles depending on your credit card, bank, and account type.

- You can get a 50% off on referrals by inviting your friends.

- You can also earn reward points on your annual spends using your credit card

- You can receive the payment receipt instantly to your email

- Your landlord will receive the rent within 2 working days of paying it using your credit card.

- Get 45 days interest free credit period.

RedGirraffe

You can make high value recurring payment services through this platform. Payments that can be made through this platform are education fees, society charges, rent, etc. The platform is linked to many banks and hence has a low fee. Thus, it is highly cost effective. It requires minimal set up time.

Key Benefits of Rent Payment using Credit Card on RedGirraffe

- You can earn reward points, cashback, cash points, and gift cards when you make your payment using a credit card on RedGirraffe.

- Earn 5% as RedGirraffe cash points each month, subject to a maximum of Rs. 3000. Thus enjoy huge savings.

- You can redeem these cash points for purchases across 260 plus brands.

- Get 45 to 56 days of interest free credit period.

- Paying rent through credit card on RedGirraffe is very cost effective. There are no hidden charges. There is a transaction charge of 0.39% per transaction plus GST (i.e. Rs. 39 plus GST for every Rs. 10,000 paid).

- You will get an automated pre-filled rent receipt

- Get automated digital payment advice.

- Improve your credit score by paying rent through your credit card. Then, be eligible for cheaper bank loans.

- Most comprehensive illness and surgery coverage.

- You will be provided with a personalized dashboard.

MagicBricks

Magicbricks is one of the leading real estate apps in India. It brings one of the most intuitive property search app experiences in india. You can search for properties for the purpose of selling, renting, or also buying through this app. Not only this, you can easily pay the rent using this app. The platform offers enhanced security and speed to pay your rent.

Key Benefits of Rent Payment using Credit Card on MagicBricks

- You can earn miles, cashback, discounts on popular brands, and reward points on every property payment with your credit card. The upper limit on reward points is Rs. 30,000.

- Enjoy up to 45 days of interest free credit period on your credit card.

- Enjoy seamless rent payment through credit cards on the Mastercard and Visa networks.

- The processing fee is minimal.

- Get enhanced security for your rental payments with this credit card.

- Rent payments reach the landlords’ accounts within one day.

- Magicbricks gives its users free rent insurance. It lets you secure your future rent payments. When you pay rent through credit cards on MagicBricks, you will

- Enjoy free rental insurance up to Rs. 1 lakh for death due to accident and permanent disability.

- For temporary disability, you will get up to Rs. 5000 per week for 2 years.

- Generate rent receipts for all payments made on NoBroker Pay.

- You can submit your rent receipts to claim HRA exemption upon income tax filing.

- You will get 80C and 80D tax exemption benefits.

FreeCharge

The app offers a fast, simple, and secure way to make your payments. When you make rental payments through credit cards, debit cards, or netbanking, you can earn significant rewards on the payments. Freecharge places a high upper cap on the amount of rent that can be transferred in a day, which is up to 2 lakhs.

Key Benefits of rent payment using credit card on Freecharge

- Quick transfer of rent as it gets credited instantly. Even under exceptional circumstances, the rent gets credited as early as two days.

- You can earn rewards, cashback, and air miles on the rent payment made using your credit card based on your card scheme. You can earn up to 3x EDGE reward points or or cashback while paying rent with Axis Bank credit cards.

- A minimal convenience fee of 1.1% is charged on every transaction that you make from your credit card to pay rent.

- You can add multiple landlords or up to 3 landlords at a time.

BharatNXT

BharatNXT is a free app for iPhone that permits all credit card networks, including Visa, Rupay, and Mastercard. This app provides a great platform for very easy and convenient rent payment. The types of rents you can pay with BharatNXT include residential rent, commercial rent, rental deposits, society maintenance fees, lease payments, vacation payment rentals, and storage unit rental fees. Using this platform, you can add your landlord as a beneficiary and send the money to their bank account.

Key Benefits of Rent Payment using Credit Card on BharatNXT

- Earn up to 1 to 3% instant rewards on every transaction.

- Get up to 50 days of free credit upon paying suppliers’ rent, education, and utilities.

- Earn cashback on every transaction.

- BharatNXT does not require a credit check, making it accessible to a broad range of users.

- BharatNXT is available to any individual since it does not do a credit check. It helps in improving your credit score.

PayMatrix

Pay Matrix is yet another notable platform for making your monthly rent payments. Tenants can conveniently pay rent using a credit card and also access their rent receipts and rent agreements online from this centralized platform.

Key Benefits of rent payment using credit card on PayMatrix

- You can earn exciting cashback, up to 2% rewards, and discounts from Paymartrix and its partners.

- You can improve your credit score through timely repayments.

- Using a credit card to pay rent on PayMatrix can help in cashing out funds at low or zero cost.

- You can use your credit card for some short term cash requirements.

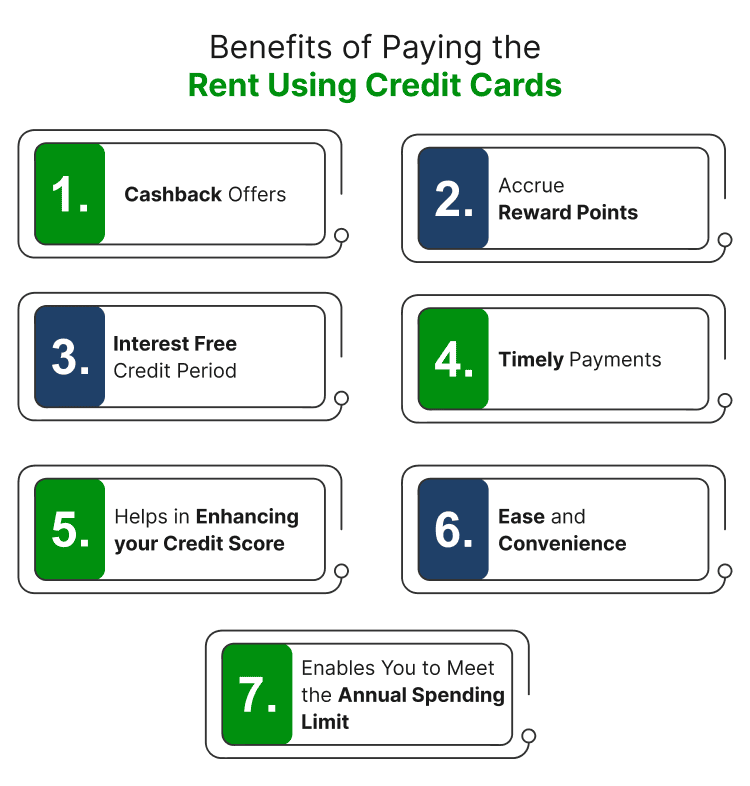

Benefits of Paying Rent through a Credit Card

Here are some reasons why you should pay rent with a credit card:

- Cashback offers: Credit cards often come with attractive cashback offers and deals. You will get a percentage of your rent payment as cashback when you pay with credit card. This accrued cashback will add to your savings over time.

- Accrue reward points: You often get reward points on credit card transactions. You can later redeem them for discounts or gifts. Paying rent with your credit card can help you accumulate these points, which can be redeemed against popular brands.

- Interest free credit period: Paying rent with your credit card gives you the privilege to get an interest free credit period. In this period, you do not have to pay interest on the rent payments using your credit card. Most credit cards have an interest free credit period of 45 days.

- Timely payments: If your salary is credited at a later date than your rent payment date, then you don’t have to worry about how you will get the cash to pay your rent. Your credit card will come to your rescue and help you make the payment in a timely manner. Thus, you do not have to explain about delays to your landlord, and you can also pay the rent during the interest free credit period.

- Helps in Enhancing your credit score: Your credit score is a 3 digit number between 300 and 900. When lenders want to give you loans, they essentially look at your credit score. Hence, it is important to have a good one. Making timely rent payments with the help of your credit card will enhance your credit score. Paying your rent with your credit card, especially if you make large transactions can enable you to boost your credit score. However, you should keep your CUR within limit.

- Ease and convenience: Paying rent using a credit card is a simple process. On many platforms, you just have to enter your landlord’s details once. Then, you can automate your payments every month. This helps in paying the rent without feeling cumbersome every time.

- Enables you to meet the annual spending limit: Many credit cards offer annual fee waivers on anniversary milestone spends. If you are unable to meet this spending limit, then paying rent regularly can contribute considerably to the annual spending limit.

Disadvantages of Paying Rent with Credit Cards

Here are some reasons to not pay rent using credit cards:

- Fees: Credit card payments often come with high processing fees or service charges. This may be anywhere in the range of 2% to 4%. So, if you are doing it every month, it will lead to quite a sum being paid. For instance, if you are paying a rent of 40,000 every month and the service charge is 3%, then you are paying an additional Rs. 1200 every month.

- Debt accumulation: If you have to pay the rent using your credit card every month, maybe you should ponder over the quantum of the rent. It could be too high for you. It may result in debt in the due course. So, you should think about changing to a house with lower rentals.

- Impact on credit score: If you pay your rent through credit card and your credit card balance becomes too high due to this considering that rent payments are huge, then you may not be able to pay your bills on time. This will have a negative effect on your credit score .

- Missing payments: When the rent payments are automated, the payments may get missed when the card expires or the credit limit is exceeded.

- Restrictions: Some banks have stopped giving reward points for rent payments while others have lowered the number. There may also be an upper cap on the number of transactions, processing fees, etc. Check with your credit card issuer if there are any such limitations in place.

- Interest on your balance: If you do not make timely payments of your credit card bills and also if you do not pay the bill in full, then interest on the balance will pile up. The colossal interest plus the processing fee will eventually result in a huge sum to be paid.

Points to Keep in Mind When Paying the Rent Using Credit Cards

Although paying rent with credit cards is highly beneficial, there are some important things that you should consider before paying rent using credit cards. They are as below:

- Transaction fees: Be aware of any transaction fees that the app or your credit card issuer may levy for rent payments.

- Interest Rates: High interest rates may be charged if you do not pay your credit card balance completely every month.

- Rewards and cashback: Before you pay rent using the credit card on the app, check if these payments are eligible for rewards and cashback in order to accrue maximum benefits.

- Low annual fees: Make sure that your credit card has low annual fees.

- Credit Limit: Ensure that the credit limit of your credit card is enough to cover your rent without exceeding the limit. If the limit is exceeded, it will have a negative impact on your credit score.

- Billing cycle: Know about and understand the billing cycle of your credit card to handle your cash flow and avoid late fees.

- Credit utilization ratio: Monitor your credit utilization ratio regularly since using it more than what is required will prove to be detrimental to your credit score.

- Alternative Payment methods: Compare the costs and benefits of using a credit card with other payment methods like bank transfers or direct debits.

- Security: Use your credit card only on trusted and credible apps to safeguard you from financial frauds.

- Terms and Conditions: read and understand the terms and conditions of both the rent payment app and the credit card issuer for rent payments.

- Do not reveal sensitive details: You should not disclose confidential information of your credit card like the CVV, expiry date, or the credit card number. Banks or financial institutions will not ask for such sensitive information.

- Report card loss: If you lose your credit card, contact the bank and immediately ask them to block the card.

- Opt for two factor authentication: Whenever it is possible, you can go in for the two factor authentication for credit cards. This will give you an additional level of security when using your credit card.

- Do not share OTPs with anyone: When you pay rent using your credit card, do not disclose the OTPs with anyone.

Conclusion

Before you choose an online app to pay the rent using credit cards, you should compare between them and check which is most suitable for you in terms of convenience fee, rental insurance, reward points etc. Then you can select the appropriate one.

Frequently Asked Questions (FAQs)