Best Personal Loan Apps in India

Last Updated : June 16, 2025, 5:19 p.m.

Finding quick access to funds during a financial crunch can be challenging, especially when traditional banks and NBFCs take several days to process personal loan applications and often require a high credit score. In such situations, turning to digital lending platforms becomes a faster and more convenient alternative.

That's where India's top personal loan apps come into play. These platforms are designed to offer short-term personal loans with minimal paperwork, instant approvals, and flexible eligibility, making them ideal for covering urgent expenses or unexpected financial emergencies.

If you're uncertain about which app to rely on for personal loans in India, this blog will walk you through the most trusted and widely used digital lending platforms. You’ll be able to compare features, eligibility, and benefits to choose the one that best fits your needs.

List of Instant Personal Loan Apps in India

The list of the fastest instant personal loan apps in India.

| Lending Applications | Interest Rate (In %) | Loan Amount (In INR) | Loan Tenure |

|---|---|---|---|

KreditBee | starts from 12% p.a to 28.5% p.a. | from ₹6,000 to ₹10 Lakhs | from 6 months to 60 months |

Upwards | 18% - 32% p.a | Up to 5 lakh | 6 to 24 months |

Starting from 9% p.a (Depending upon the loan amount) | Upto 5 lakh | 12- 60 months | |

1.4 to 2.3% per month | INR 5,000 - INR 5 lakh | 3 to 60 months | |

2.5% per month | Up to INR 3 lakhs | 90 days to 1.5 years | |

Freecharge | Starting at 11.25% P.A. | Up to 5 lakhs | Up to 120 months |

True Balance | Starting from 2.4% per month | Starting from ₹5,000 - ₹2,00,000 | 6 - 12 Months |

1.16% per month (14% annually) | Up to 10 lakh | Up to 5 years | |

Starting from 10% p.a.- 31% p.a. | From 40,000 up to 55 lakhs | 12 to 84 months | |

Starting from 14% p.a. | Up to 5 lakh | 3 to 36 months | |

Starting from 18% p.a. | From INR 3,000 to 5 lakh | 3 to 24 months | |

Kissht | Depends on the various factors at the time of borrowing. | Up to INR 5,00,000 | Up to 36 months |

Exploring the Varieties of Online Loan Apps in India

Below, we have listed several instant personal loan apps to assist with your funding needs in case of an emergency:

KreditBee

KreditBee is an online platform that connects borrowers with RBI‑licensed NBFCs and banks, offering instant personal loans ranging from ₹6,000 to ₹10 lakh with tenures of 6 to 60 months. It’s a completely paperless, end‑to‑end digital solution—registration to disbursal can happen in around 10 minutes, and funds are credited directly into your bank account.

Here are the steps to apply for a KreditBee personal loan online:

- Sign up with your mobile number.

- Fill in basic details to check eligibility.

- Upload KYC documents for verification.

- Add your bank account details.

- Select the loan amount and tenure.

- Receive the loan directly in your bank account.

Upwards

Among the many options available, Upwards stands out as one of the top personal loan apps in India. It offers personal loans of up to ₹5 lakhs with flexible repayment tenures of up to 24 months, starting at an interest rate of 18% p.a. Since this is an unsecured loan, no collateral is required. Instead, the loan approval is based on your credit score and eligibility. Upwards also ensures a hassle-free experience with minimal documentation and convenient repayment options.

Here are the steps for you to apply for a loan from Upwards:-

- Enter your loan requirements and some basic information in the application.

- Upload your KYC documents.

- Fill out an application.

- A personal loan application is typically approved within 24 hours.

- Digital signature

- Loans get disbursed to your account.

EarlySalary (Fibe)

EarlySalary’s (Fibe) online loan app may offer you a personal loan of up to INR 5,00,000 at an interest rate starting from 9% p.a. You can apply if you meet their loan eligibility standards. There are four main criteria you need to satisfy:

- Age – The applicant should be between 19 – 55 years

- Income Criteria – Applicants should have a minimum monthly in-hand salary of ₹20,000.

- Citizenship – Must be an Indian citizen

- KYC – Must have all the required documents.

Follow these steps on how to apply for a loan from EarlySalary (Fibe):

- Install the EarlySalary (Fibe) app on your phone and complete the mobile number verification process.

- Submit basic documents and details.

- Choose your desired loan amount once your profile has been approved.

- The funds are deposited into your bank account.

PaySense

PaySense is a digital lending platform that provides short-term personal loans specifically designed for working professionals. It enables users to access funds in as little as 5 hours to cover various personal expenses. With loan amounts of up to ₹5 lakhs available for both salaried and self-employed individuals, PaySense stands out among other online lending apps. Its popularity stems from competitive interest rates, flexible repayment options, easy EMI plans, minimal paperwork, fast approval, and swift disbursal.

Easy 3-step-by-step process to apply for a loan at PaySense:

Step 1: Check Eligibility & Choose a Loan Plan

Provide some basic information to find out if you're eligible for a PaySense instant personal loan. Once approved, you’ll be assigned a Credit Line—this is the maximum loan amount you’re eligible for. From there, you can select your preferred loan amount, EMI, and repayment tenure to customize your plan.

Step 2: Upload KYC & Complete Formalities

Upload your KYC documents and digitally sign the loan agreement along with a NACH mandate form. The NACH form allows automatic EMI deduction from your bank account, helping you avoid missed payments. The entire process is 100% paperless and usually takes just 2 working hours for approval.

Step 3: Get Funds in Your Bank Account

After approval and completion of the process, the loan amount is instantly disbursed to your registered bank account. It’s that quick and hassle-free with PaySense.

CASHe

CASHe, a fintech offering by Aeries Financial Technologies Pvt. Ltd., provides short-term personal loans of up to ₹3 lakhs to young salaried professionals through a user-friendly and efficient mobile app. What sets CASHe apart is its use of the Social Loan Quotient (SLQ) – an innovative algorithm that generates a comprehensive credit profile, offering insights beyond what traditional banks and credit bureaus can access.

Step-by-step procedure to apply for a personal loan with CASHe:

- Download the CASHe app and register.

- Complete your KYC.

- Tap on ‘Get Loan’ and select ‘Instant Personal Loan’.

- Choose your loan amount and tenure.

- Wait for quick verification and approval.

- Receive the loan amount directly in your bank account within minutes.

Freecharge

Freecharge ranks among the top personal loan apps in India, providing pre-qualified instant personal loans of up to ₹5 lakhs. These loans come with minimal paperwork, quick processing, and highly competitive interest rates. While the loans are disbursed by Axis Bank, you don't need to hold an account with the bank to be eligible for a loan through Freecharge.

Steps and procedure to apply for a personal loan at Freecharge:

- Tap on ‘Get Now’ to go to the Axis Bank login page.

- Enter your mobile number and DOB or PAN to begin the application.

- Don’t know your Customer ID? Just SMS ‘CustID’ to 5676782 from your registered mobile number.

True Balance

True Balance offers quick, hassle-free online personal loans for financial emergencies, ensuring you get support exactly when you need it. They offer two primary loan options: Cash Loans and Level-Up Loans. Cash Loans are available from Rs. 5,000 to Rs. 2,00,000 with a repayment period of 6 to 12 months. Level Up Loans are specifically designed for students, offering loan amounts of up to ₹30,000.

Here’s a step-by-step guide to applying for a personal loan through True Balance:

- Complete KYC - Start by uploading your PAN, Aadhaar, and a selfie for quick identity verification.

- Choose Your Loan - Select the loan amount and EMI tenure that fits your needs.

- Verify Eligibility – Enter some basic information to quickly assess your loan eligibility online.

- Get Funds Disbursed - Upload your salary or bank statements, enable auto-debit, and receive the loan amount in just a few minutes.

Moneyview

MoneyView offers personal loans of up to ₹10 lakhs with a seamless online application process and minimal documentation. You can choose a repayment period up to 5 years at an interest rate of 1.16% per month (14% annually). The app features a fast and simple application process, and upon approval, the funds are disbursed promptly. With its user-friendly interface and secure platform, MoneyView is a dependable option for personal loans.

Process to apply for a personal loan with Moneyview:

- Download the app and sign in.

- Check your eligibility in just a few minutes.

- Choose your loan amount and repayment tenure.

- Complete your KYC and verify income details.

- Have the funds credited to your bank account within minutes.

Bajaj Finserv

Bajaj Finserv offers an instant personal loan app where you can borrow from INR 40,000 up to INR 55 lakhs. Choose a repayment period that suits you, from 12 to 84 months, with interest rates starting from 10% p.a.- 31% p.a. The app offers a quick and straightforward loan application process, allowing you to access the financial assistance you need with ease and speed.

- Download the Bajaj Finserv app from the Google Play Store or Apple App Store.

- Sign in using your registered mobile number and the OTP sent to it.

- Navigate to the personal loan section and submit your application.

- Once approved, the loan amount will be credited directly to your bank account.

ZestMoney

ZestMoney is a leading fintech platform focused on consumer lending across India, catering to the credit needs of over 300 million households underserved by traditional financial institutions such as banks and credit card providers. Even with little or no credit history, you can still benefit from ZestMoney’s services. The platform offers instant loan approvals of up to ₹5 lakhs at competitive interest rates starting from 14% per annum, along with a range of flexible EMI options customised to fit your budget.

Steps to follow -

- Register – Confirm your mobile number to set up your ZestMoney account.

- Enable Credit – Fill out your profile, upload your KYC documents, and configure your repayment method.

- Shop with ZestMoney – Use your credit at 1000+ partner stores.

- Build Eligibility – Make timely repayments to become eligible for a personal loan.

- Get a Loan – Once eligible, avail a personal loan with no extra documentation.

Note: ZestMoney offers instant personal loans only to users with an active ZestMoney credit facility. Don’t have one yet? No worries — sign up and get started today!

LazyPay

LazyPay is a digital lending platform designed to meet your urgent financial needs by offering instant personal loans. You can borrow amounts ranging from ₹3,000 to ₹5 lakhs with minimal documentation and a fully online application process. The platform provides instant approval decisions, and repayments are made easy with flexible EMI plans spread over 3 to 24 months. It’s a convenient solution for those seeking quick access to funds without the hassle of lengthy procedures.

Steps to follow to apply for a personal loan with LazyPay:

- Step 1 - Enter basic details to check your loan eligibility.

- Step 2 - Complete the application process on the LazyPay app.

- Step 3 - Receive XpressCash instantly in your bank account.

Kissht

Kissht is a user-friendly app that provides swift personal loans to support you during financial emergencies or help you achieve personal goals. You can avail of loans of up to ₹5 lakhs with minimal paperwork and no need for collateral. The entire process is online, ensuring quick approvals and fast fund disbursal. With flexible repayment plans, Kissht makes loan management simple and stress-free.

Step-by-step process to apply for a personal loan with Kissht:

- Step 1: Mobile Verification – Open the Kissht app, enter your mobile number, and confirm it using the OTP sent to you.

- Step 2: Submit Personal Details – Fill in essential information like your name, date of birth, residential address, and employment details.

- Step 3: Complete Digital KYC – Upload your PAN card and Aadhaar for quick and seamless identity verification.

- Step 4: Get Funds Instantly – After approval, the loan amount will be swiftly transferred to your bank account.

Documents Required for Quick Personal Loans

Just like instant personal loans, quick loans also require mandatory documentation to assess your creditworthiness and repayment ability. On any of the apps via which you want to apply for a loan, you will be required to upload the following KYC documents:

Identity Proof - Submit a copy of your Aadhaar card, passport, voter ID, or driving licence to verify your identity.

Address Proof - Documents like utility bills, rental agreement, or Aadhaar card are accepted as valid proof of residence.

Income Proof - Provide salary slips, bank statements, Form 16, or ITR to demonstrate your income and loan repayment capacity.

Employment Proof (Salaried): Submit documents such as your appointment letter, offer letter, or employee ID card.

Business Proof (Self-Employed) - Self-employed applicants may need to provide a business registration certificate, GST details, or a partnership deed.

Credit Score Although not a document, your credit score significantly impacts loan approval. A score of 750+ improves your chances.

Why Choose an Instant Personal Loan App?

Instant personal loan apps are transforming how people borrow by offering fast, paperless, and flexible loan options. Here's why they are becoming the go-to choice for borrowers in India:

- Quick Loan Approvals - Unlike traditional loans, instant loan apps can disburse funds within hours, making them ideal for urgent financial needs.

- 100% Paperless Process - Skip the paperwork. Upload your KYC documents online and complete the entire process digitally—no branch visits required.

- Fully Digital Loan Application - You can apply from anywhere using a mobile app or website. Fill out the form, upload documents, and track the status—all online.

- Attractive Interest Rates - Many apps offer competitive interest rates. You can compare options to choose the most cost-effective loan for your needs.

- Automated EMI Repayments - Enable auto-debit to make sure your EMIs are paid on time. This helps maintain a good credit score and avoids late payment charges.

- Flexible Repayment Tenure - Choose your loan amount, repayment period, and EMI schedule as per your convenience, giving you full control over repayment.

- In-App EMI Calculator - Most apps include an EMI calculator, so you can estimate your monthly payment and plan your finances before borrowing.

- No Need for Local Lenders - Avoid high-interest informal borrowing. Loan apps are backed by regulated NBFCs or banks, offering transparent terms and safer lending.

- Easy Online Loan Management - Check your loan status, download statements, track EMIs, and update documents—all from within the app.

- Final Tip Before Applying - Always compare interest rates, processing fees, and prepayment terms across lenders. This ensures you get the best deal with no surprises later.

- Make Smarter Borrowing Decisions - Instant personal loan apps offer speed, transparency, and flexibility. When used wisely, they are a reliable tool to handle unexpected expenses or short-term financial goals.

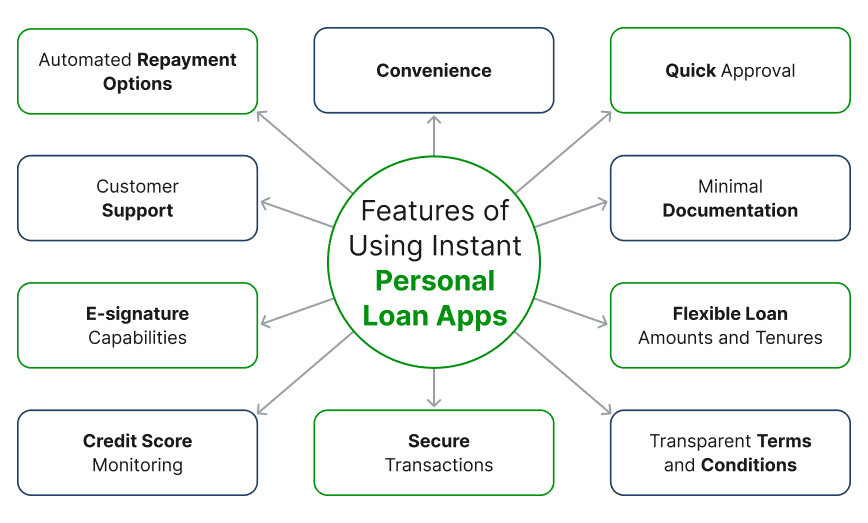

Features of Using Instant Personal Loan Apps

Here are the key features of using an instant personal loan app:

Convenience: Using loan apps offers the convenience of applying for a loan from anywhere, at any time, directly from your smartphone. This eliminates the need for physical visits to a bank or financial institution.

Quick Approval: Most loan apps provide quick approval processes, with some apps approving loans within minutes or hours of application submission.

Minimal Documentation: Loan apps typically require minimal documentation, simplifying the application process and reducing the hassle of gathering extensive paperwork.

Flexible Loan Amounts and Tenures: Users can often choose their desired loan amounts and tenures based on their financial needs and repayment capabilities.

Transparent Terms and Conditions: Loan apps generally provide transparent information regarding interest rates, fees, and repayment terms, allowing users to make informed decisions.

Secure Transactions: Reputable loan apps prioritize the security of user data and financial transactions, employing encryption and other security measures to safeguard sensitive information.

Credit Score Monitoring: Some loan apps offer users the ability to monitor their credit scores, providing insights into their creditworthiness and potential loan eligibility.

E-Signature Capabilities: Many loan apps facilitate the e-signing of loan agreements, eliminating the need for physical signatures and paperwork.

Customer Support: Users of loan apps often have access to customer support services, allowing them to seek assistance or clarification on any aspect of the loan application or repayment process.

Automated Repayment Options: Loan apps may feature automated repayment options, enabling users to set up recurring payments for their EMIs, enhancing convenience and ensuring timely repayments.

These features collectively contribute to making the process of applying for and managing personal loans more accessible, efficient, and user-friendly for individuals seeking financial assistance.

Conclusion

The best personal loan apps in India offer a fast, secure, and hassle-free borrowing experience, especially for those who need urgent funds without having to visit a bank. With features such as instant approval, minimal documentation, flexible tenures, and digital Know Your Customer (KYC) processes, these apps have made personal loans more accessible to a wider audience.

Whether you're a salaried individual or a self-employed professional, opting for a trusted, RBI-registered platform ensures you get the right loan amount at competitive rates, straight from your smartphone. If you're exploring your financing options, don’t forget to check out the Best Personal Loans in India to find the perfect match for your needs.

Frequently Asked Questions (FAQs)

Which is the best personal loan app in India?

Are personal loan apps safe to use?

How quickly can I get a loan through an app?

What documents are required for app-based personal loans?

Do personal loan apps charge processing fees?

How do I repay my loan from an app?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

Personal Loan

- Personal Loan

- Personal Loan Eligibility Calculator

- Personal Loan EMI Calculator

- Personal Loan Interest Rates

- Pre-approved Personal Loan in India

- Personal Loan Top Up in India

- Personal Loan Balance Transfer

- Apply Personal Loan on WhatsApp

- Personal Loan for Unemployed

- Personal Loan for Government Employees

- Personal Loan Without CIBIL Score

- Minimum CIBIL Score for Home Loan

Personal Loan Calculator by Top Banks

- HDFC Personal Loan EMI Calculator

- ICICI Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- IndusInd Bank Personal Loan EMI Calculator

- RBL Bank Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- IDFC First Bank Personal Loan EMI Calculator

- Tata Capital Personal Loan EMI Calculator

- SMFG India Credit Personal Loan EMI Calculator

- Standard Chartered Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- Axis Bank Personal Loan EMI Calculator