Wanna Know the Best Savings Account for Pensioners? Read This

Last Updated : Sept. 17, 2024, 3:07 p.m.

As you approach or reach retirement at age 58 or 60, your regular income might come to an end, but that doesn’t have to disrupt your lifestyle. You can now enjoy quality time with your loved ones without financial worry. Many banks offer special savings accounts for pensioners with interest and extra benefits for a comfortable retirement. Let’s dive into some of the best savings accounts for pensioners.

List of Banks Offering Best Savings Account for Pensioners

Bank | Account Type | Interest (in per annum) | Fee & Charges ( Non Maintenance of Minimum Average Balance ) | Minimum Quarterly/ Monthly Average Balance |

|---|---|---|---|---|

SBI | Senior Citizens Savings Scheme | Up to 8.20% | NIL | NIL |

Axis Bank | Pension Savings Account Senior Privilege Savings Account | Up to 4% Up to 3.5% | NIL INR 6% of the shortfall from the average balance requirement | NIL ₹10,000 in metros and urban centres |

Bank of Baroda | Pensioners Savings Bank Account | Up to 4% | NIL | NIL |

IDBI Bank | Pension Saving Account | Up to 4% | NIL | NIL |

HDFC Bank | Senior Citizens Account | Up to 4% | 6% of the shortfall from the average balance requirement or ₹600, whichever is lower | ₹5,000 ₹1,00,000 |

PNB | PNB Pension Savings Account | Up to 4% | NIL | NIL |

Bank of India | SB Account for Pensioners | Up to 4% | NIL | NIL |

Kotak Mahindra Bank | Grand Savings Account | Up to 6% | ₹150-500 | ₹10,000 |

RBL Bank | Seniors First Savings Bank Account | Up to 7.5% | - | ₹5,000 |

IndusInd | Senior Savings Account | Up to 4% | Nil | ₹10,000 |

SBI Senior Citizen Savings Scheme

The SBI Senior Citizen Savings Scheme (SCSS) is a government-backed savings program offered by the State Bank of India (SBI). It’s personalized for senior citizens in India and provides them with a steady income and financial stability during retirement.

Features and benefits:

- The minimum amount required to deposit for this scheme is Rs. 1,000.

- The deposit cannot exceed Rs. 1.5 lakh.

- After the maturity period of 5 years, the account can be extended for 3 more years.

- The depositor can nominate more than 1 person.

Axis Bank Senior Savings Account

Axis Bank offers two types of savings account for pensioners: the Pension Savings Account and the Senior Privilege Savings Account. Let's explore the main features of each of these accounts:

Pension Savings Account - Features and benefits:

- Earn up to 4% interest on day-to-day balances.

- Get a whopping withdrawal limit of INR 40,000 at ATMs.

- A Personal Accident Insurance cover of Rs. 2 lakh is available.

- Receive free and unlimited multicity chequebooks.

Senior Privilege Savings Account - Features and benefits:

- Get a personalized senior ID card to avail discounts at healthcare centres.

- Receive a complimentary 6-month Sony LIV subscription.

- Earn a 0.5% preferential rate on Fixed Deposits / Recurring Deposits.

- Debit card is available at a nominal fee of INR 200.

Bank of Baroda Pensioners Savings Bank Account

This is the best bank account for senior citizens in india.The Baroda Pensioners Savings Bank Account is designed for pensioners. It comes with a free debit card, unlimited checks, automatic savings options, overdraft options, and more. There’s also an option to nominate someone on the account.

Features and benefits:

- The account can only be opened with a minimum deposit of Rs. 5.

- Enjoy an overdraft facility and free unlimited chequebooks.

- Get access to netbanking facility for paying bills, online shopping, and more.

- Receive accidental death insurance of Rs. 1 lakh under the BOBCARD scheme.

IDBI Pension Savings Account

The IDBI Pension Savings Account is designed with your needs in mind, enabling you to bank from anywhere at any time. This account offers special privileges and ensures faster, simpler transactions. This best senior citizen bank account also includes value-added services with exclusive offers for a hassle-free banking experience.

Features and benefits:

- No charges for non-maintenance of the monthly average balance.

- Receive personalized multi-city chequebook.

- Get an international ATM cum debit card.

- Enjoy five free ATM transactions at other bank ATMs in non-metro locations.

HDFC Savings Accounts for Seniors

With HDFC, senior citizens can easily open savings accounts with two main options available. One is the Senior Citizens account, which includes free insurance benefits, a lifetime free debit card, and many other privileges. The other is the Speciale Senior Citizens account, which offers investment benefits, complimentary doorstep banking, and more. Below are the key features of each account:

Senior Citizens Account - Features and benefits

- Get hospitalization coverage of Rs. 50,000 per annum.

- With the free international debit card, get a cash withdrawal limit of Rs. 50,000 per day.

- Also, receive a shopping limit of Rs. 3.5 lakh per day.

- Receive 5% cashback on partner merchants like Snapdeal, Payzapp, and more.

Speciale Senior Citizen Savings Account - Features and benefits

- Get a 25% discount on demat debit transactions.

- Receive cyber insurance cover of up to Rs 1.5 lakh.

- Get complimentary doorstep banking for services, such as cheque pickup.

- Avail exclusive discounts on healthcare and medicines.

PNB Pension Savings Account

The PNB Pension Savings Account is tailored for retirees looking to manage their pension funds efficiently. It offers convenient features like direct deposit of pension payments, easy withdrawals, and minimal service charges. Account holders can benefit from additional perks such as low-balance requirements and preferential interest rates.

Features and benefits

- Get free 50 cheque leaves per year

- A nomination facility is available with this best senior citizen bank account.

- Get an overdraft facility of Rs. 1,00,000/- or 4 times the monthly pension, whichever is lower.

- Get a free SMS alert facility.

Bank of India Pensioners Account

Bank of India offers a Pensioners Account designed to meet your banking needs during retirement. This Savings Account provides various benefits to make your retirement more comfortable. It’s a secure and dependable choice for enjoying your golden years without stress.

Features and benefits

- Get free cheque leaves with this pensioner savings account.

- Enjoy up to 10 free transactions at BOI ATM.

- Enjoy up to 5 free transactions at ATMs other than BOI.

- Avail Group Personal Accident Death Insurance cover of Rs. 5,00,000.

Kotak Mahindra Bank Grand Savings Account

Grand is thoughtfully designed to enhance the golden years of your life. It offers flexible balance maintenance and convenient features like a callback facility via SMS. Account holders also receive a complimentary one-year membership to GetSetUp and enjoy benefits such as Kotak Rewards, discounts on locker rentals, and other exciting offers.

Features and benefits

- Get a year subscription to GetSetUp - a virtual community for senior citizens.

- Receive an overdraft of up to 85% on your Fixed Deposit.

- With Grands Saving Programme, earn interest up to 7%.

- Enjoy netbanking facility to pay your bills, electricity, and more.

RBL Seniors First Savings Account

The RBL Seniors First Savings Account is made for senior citizens. It offers higher interest rates to grow your savings and easy banking for daily needs. Seniors also get special deals with this account, making it a good choice for managing money simply and effectively.

Features and benefits

- Get exclusive healthcare benefits with the complimentary Medibuddy membership.

- Get a 25% discount on first-year locker rentals.

- Receive complimentary and unlimited IMPS , NEFT , and ATM transactions.

- Also, enjoy a free doorstep banking facility.

IndusInd Senior Citizen Savings Account

Enjoy special banking benefits in your retirement with IndusInd Bank’s Senior Citizen Savings Account. This account is designed for seniors, offering exclusive benefits aimed at providing peace of mind. It gives you higher returns on your deposits and access to services tailored just for you.

Features and benefits

- Enjoy the benefits of nil non-maintenance charges.

- Get 35% off on lockers for a year.

- You can earn 0.5% extra on FDs.

- Get a free zero-balance account for 2 family members.

Who Can Open a Savings Account for Pensioners?

- An Indian citizen aged 58 or 60 years.

- An employee of the Central Government and Civil Ministry (under the Central Government Civil Pension Scheme).

- Employees of the Armed Forces (Army, Navy, Air Force) under the Defense Pension Scheme.

- An employee of a Provident Fund Organization or existing members of the ‘Member of Employees’ Family Pension Scheme’.

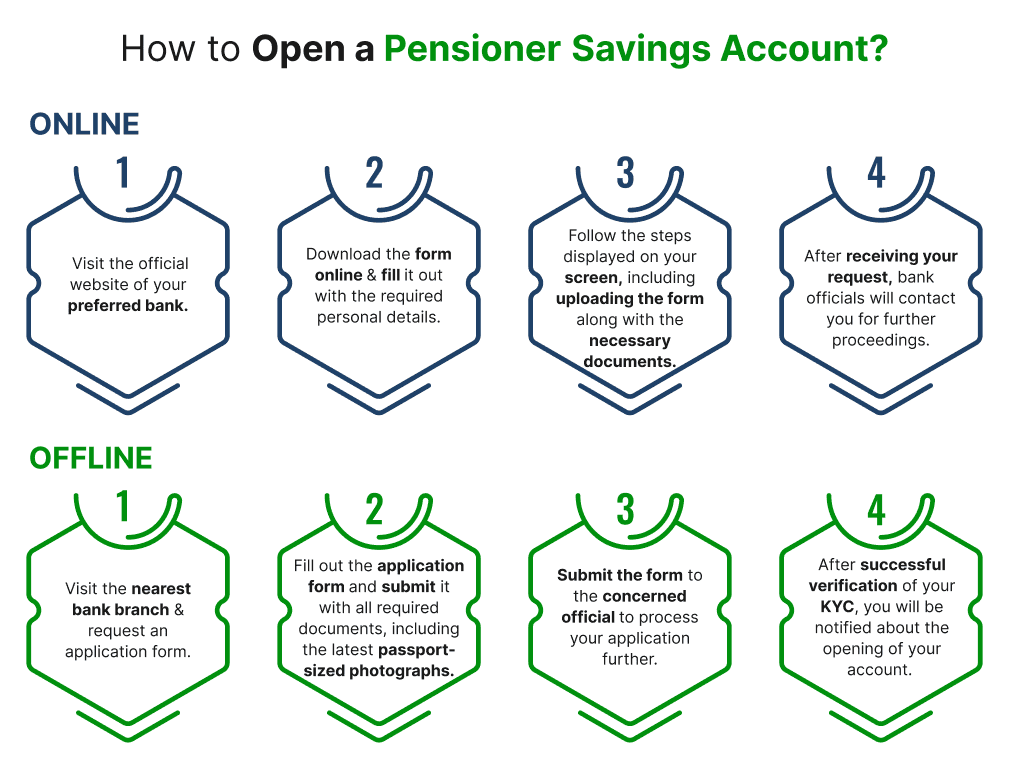

How to Open a Pensioner Savings Account?

Opening these accounts is an easy and hassle-free process. Pensioners can either open their savings account online or offline.

Online:

- Visit the official website of your preferred bank.

- Download the form online and fill it out with the required personal details.

- Follow the steps displayed on your screen, including uploading the form along with the necessary documents.

- After receiving your request, bank officials will contact you for further proceedings.

Offline:

- Visit the nearest bank branch and request an application form.

- Fill out the application form and submit it with all required documents, including the latest passport-sized photographs.

- Submit the form to the concerned official to process your application further.

- After successful verification of your KYC, you will be notified about the opening of your account.

Documents Required

- Recent passport-sized photographs (2 or 4)

- Duly filled and signed application form

- Identity Proof: PAN Card, Driving License, Passport, Voter’s ID, or Aadhaar Card

- Address Proof: Passport, Driving License, Voter’s ID, Aadhaar Card, Utility Bill, Bank Statement, or updated Bank Account Passbook (not more than 3 months old)

- Signature Proof: PAN Card, Driving License, or Passport

- Proof of Retirement

- Any other document requested by the bank

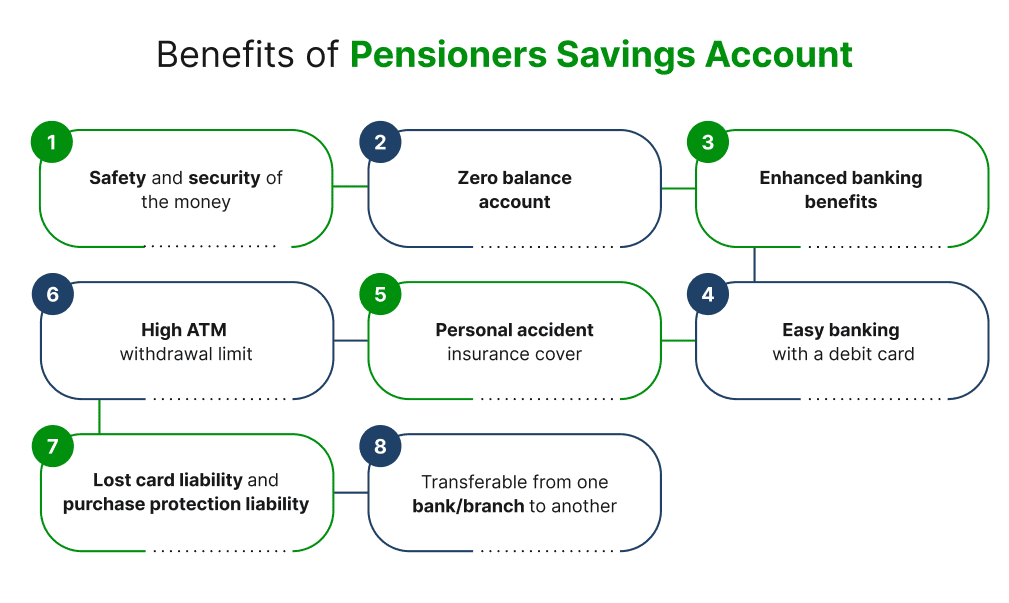

Features & Benefits

- Safety and security of the money

- Zero balance account

- Enhanced banking benefits

- Easy banking with a debit card

- Personal accident insurance cover

- High ATM withdrawal limit

- Lost card liability and purchase protection liability

- Transferable from one bank/branch to another

Points to Ponder

- Some banks also allow you to open a joint account with your spouse only.

- No minimum balance is required to open this account, which means it’s a zero balance opening account.

- An applicant needs to open his/her pensioner savings account 6 months prior to the date of retirement.

Frequently Asked Questions (FAQs)

What are the eligibility criteria for opening a pensioner savings account?

How can I open a pensioner savings account?

What documents are required to open a pensioner savings account?

Are there any specific benefits for pensioners with a savings account?

Can I open a joint savings account as a pensioner?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement