Federal Bank IMPS Charges

Last Updated : July 1, 2025, 2:45 p.m.

Immediate Payment Service (IMPS) is a popular real-time fund transfer system in India, enabling instant, 24/7 interbank transactions through mobile banking, internet banking, or ATMs. Federal Bank, a leading private sector bank in India, offers IMPS through platforms like FedMobile and FedNet, ensuring seamless and secure money transfers. If you're searching for the latest Federal Bank IMPS charges, transaction limits, and how to use this service, this comprehensive guide is for you.

What is IMPS and How Does the Federal Bank Support It?

IMPS , or Immediate Payment Service, is a real-time electronic fund transfer system managed by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI). It allows users to transfer money instantly using a mobile number and Mobile Money Identifier (MMID) or account number and IFSC code . Federal Bank facilitates IMPS through:

- FedMobile : The mobile banking app for quick transfers.

- FedNet : The internet banking platform for secure transactions.

- ATMs and SMS : Additional channels for IMPS transfers.

With Federal Bank IMPS , you can send or receive money 24/7, even on weekends and holidays, making it a convenient option for urgent payments, bill settlements, or peer-to-peer transfers.

Federal Bank IMPS Fees in 2026

While Federal Bank is known for its customer-friendly services, IMPS charges can vary based on the transaction amount, account type, and banking channel used.

No Charges for Inward IMPS Transactions : Federal Bank does not levy fees for receiving funds via IMPS.

- Outward IMPS Transaction Charges : Charges for sending money through IMPS typically range from ₹2.5 to ₹15 + GST, depending on the transaction amount. Some sources suggest Federal Bank may offer free IMPS transfers for certain account types or transactions below ₹1,000, but this is subject to confirmation.

- General Industry Charges for Reference :

- Up to ₹1,000: Free or ₹2.5 + GST

- ₹1,001 to ₹10,000: ₹2.5 to ₹5 + GST

- ₹10,001 to ₹1,00,000: ₹5 to ₹10 + GST

- ₹1,00,001 to ₹2,00,000: ₹10 to ₹15 + GST

- Above ₹2,00,000 (up to ₹5,00,000): ₹15 to ₹20 + GST

Federal Bank IMPS Transaction Limits

Federal Bank adheres to RBI and NPCI guidelines for IMPS transaction limits, ensuring flexibility for users. The limits for Federal Bank IMPS transfers in 2025 are:

- Minimum Transaction Amount : ₹1 (some banks may set a higher minimum, so verify with Federal Bank).

- Maximum Transaction Amount : ₹5,00,000 per transaction, with a daily limit of ₹5,00,000 or ₹10,00,000 for verified beneficiaries, depending on the account type.

- Non-Beneficiary Transfers : Limited to a quick pay limit (typically ₹5,000 to ₹10,000 without adding a beneficiary).

For higher limits, you can request a limit enhancement through Federal Bank’s customer care or branch services, subject to account type and transaction history.

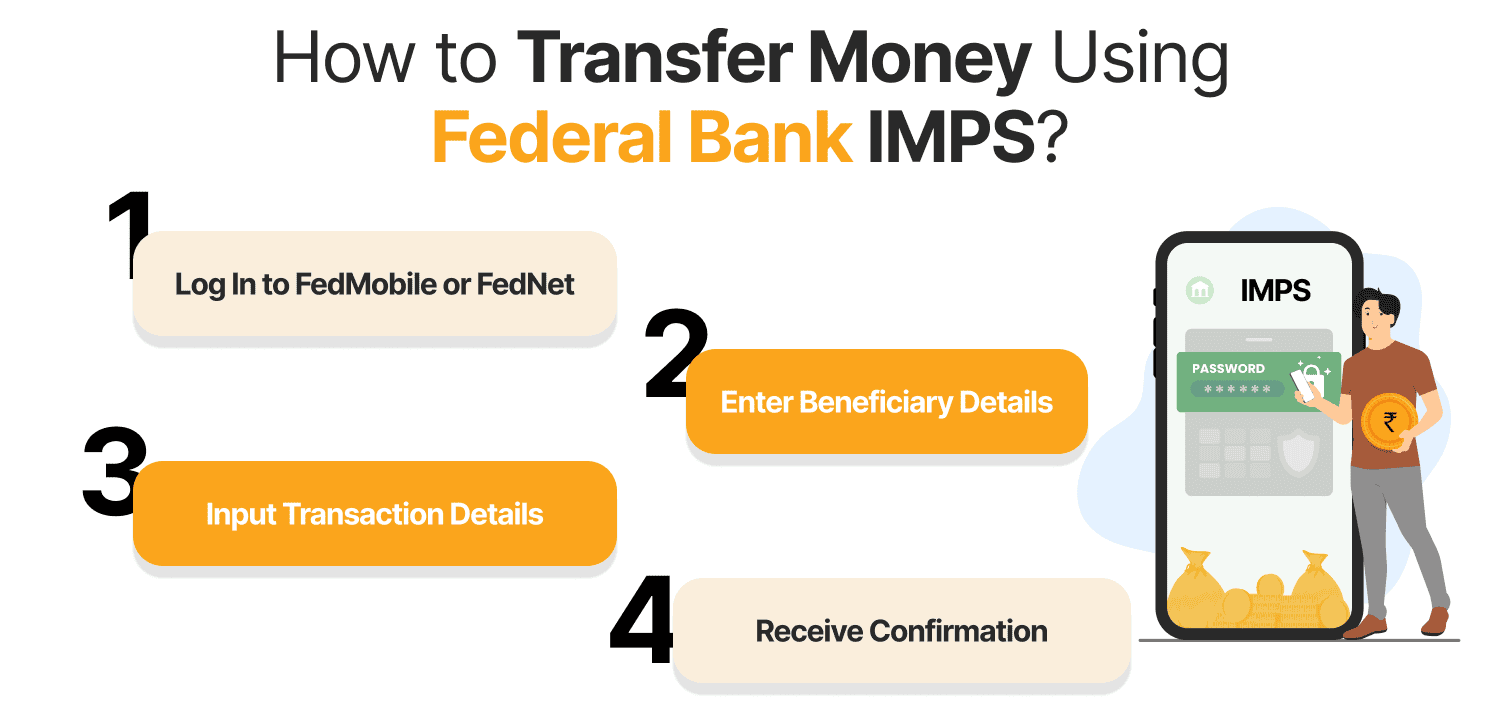

How to Transfer Money Using Federal Bank IMPS?

Using Federal Bank IMPS is simple and secure. Follow these steps to transfer funds:

- Log In to FedMobile or FedNet :

- Open the FedMobile app or FedNet internet banking portal.

- Navigate to the "Fund Transfer" section and select "IMPS" or "Smart Transfer."

- Enter Beneficiary Details :

- For Person-to-Person (P2P) : Use the beneficiary’s mobile number and 7-digit MMID.

- For Person-to-Account (P2A) : Use the beneficiary’s account number and IFSC code.

- Input Transaction Details :

- Enter the amount to transfer and your MPIN (Mobile Banking Personal Identification Number).

- Verify the details and confirm the transaction.

- Receive Confirmation :

- The beneficiary’s account is credited instantly, and you’ll receive a transaction reference number via SMS or email for future reference.

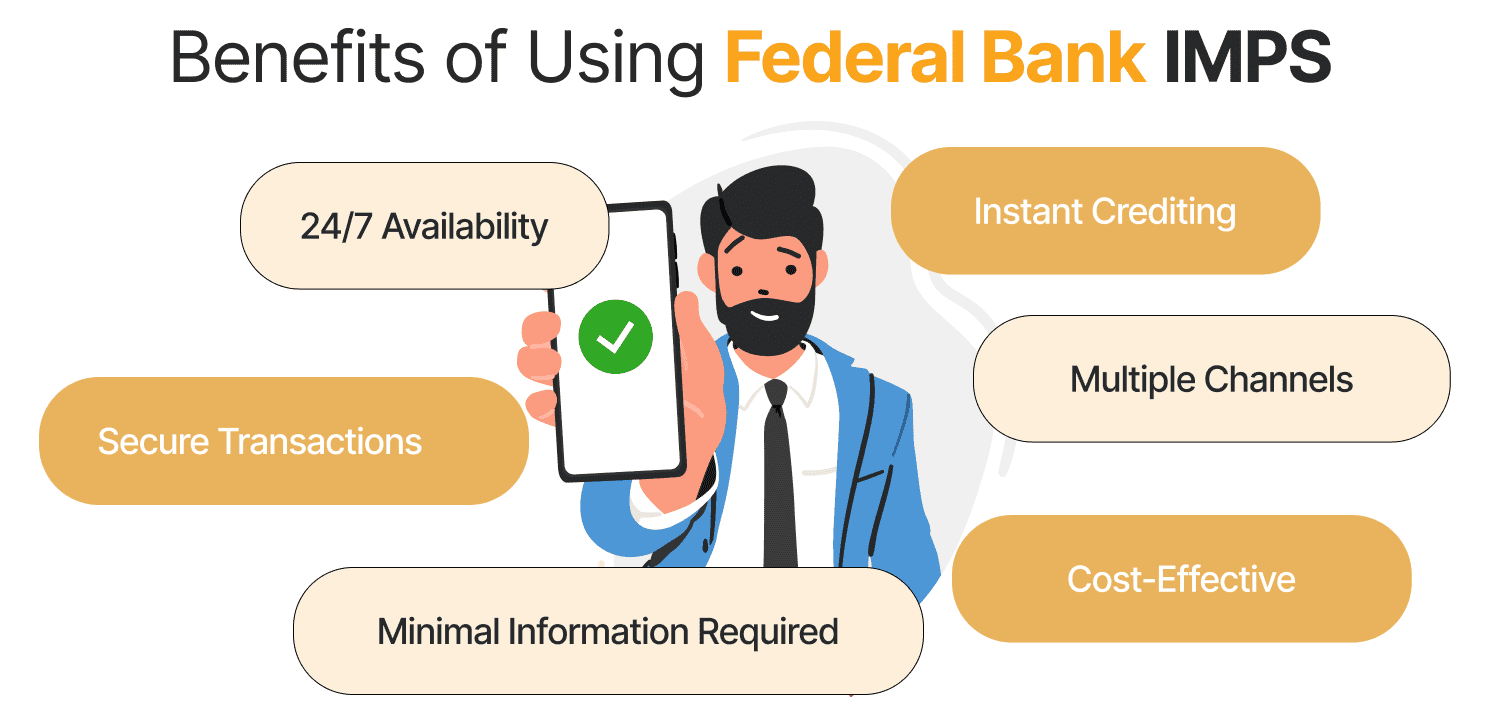

Benefits of Using Federal Bank IMPS

Here’s why Federal Bank IMPS is a preferred choice for instant fund transfers:

- 24/7 Availability : Transfer money anytime, including weekends and holidays.

- Instant Crediting : Funds reach the beneficiary’s account within seconds.

- Secure Transactions : OTP-based authentication and encrypted communication ensure safety.

- Multiple Channels : Use FedMobile, FedNet, ATMs, or SMS for flexibility.

- Minimal Information Required : Transfer funds using just a mobile number and MMID for P2P transactions.

- Cost-Effective : Competitive IMPS charges compared to other banks, with potential waivers for specific accounts.

Comparing Federal Bank IMPS Charges with Other Banks

To provide context, here’s how Federal Bank IMPS charges (estimated) compare with other major banks in 2025:

- State Bank of India (SBI) : Free for IMPS transactions up to ₹5,00,000.

- HDFC Bank : ₹3.5 to ₹15 + GST, depending on the amount (free for Imperia/Preferred customers).

- ICICI Bank : ₹5 to ₹15 + GST, based on transaction size.

- Kotak Mahindra Bank : Free for mobile app transfers; ₹5 + GST via net banking.

- Federal Bank : Likely free for low-value transactions (up to ₹1,000) and ₹5 to ₹20 + GST for higher amounts (exact charges to be confirmed).

Always check Federal Bank’s official website for the latest fee structure, as charges may vary based on account type or promotional offers.

Conclusion

Federal Bank IMPS charges are designed to be affordable, with no fees for inward transactions and competitive rates for outward transfers. While exact charges may vary, they typically align with industry standards, ranging from free for small transactions to ₹15–₹20 + GST for higher amounts. With a maximum daily limit of ₹5,00,000 (or higher for verified beneficiaries), Federal Bank IMPS is ideal for both personal and business transactions.

Frequently Asked Questions (FAQs)

What are the IMPS charges for Federal Bank in 2025?

What is the maximum IMPS transaction limit for Federal Bank?

How can I transfer money using Federal Bank IMPS?

Are there any free IMPS transactions with the Federal Bank?

How can I check the latest Federal Bank IMPS charges?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement