HDFC Bank IMPS Charges

Last Updated : June 30, 2025, 12:55 p.m.

Immediate Payment Service (IMPS) is a real-time, 24/7 interbank electronic fund transfer system in India, managed by the National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India (RBI). HDFC Bank offers IMPS as a fast and secure way to transfer funds instantly using mobile banking, net banking, or ATMs. It allows transfers via mobile number and Mobile Money Identifier (MMID), account number and IFSC code, or Aadhaar number, making it ideal for urgent payments, bill settlements, or personal transfers.

HDFC Bank IMPS Fees 2026

- Up to ₹1,000 : ₹3.50 + GST

- ₹1,001 to ₹1 lakh : ₹5 + GST

- ₹1 lakh to ₹5 lakh : ₹15 + GST

- Inward Transactions : Free

HDFC Bank IMPS Limits in 2026

HDFC Bank’s Immediate Payment Service (IMPS) allows instant fund transfers with specific daily limits based on the transfer mode:

- MMID-Based Transfers : ₹5,000 per day (using mobile number and Mobile Money Identifier).

- Account-Based Transfers : ₹5 lakh per day (using account number and IFSC code).

- Aadhaar-Based Transfers : ₹5 lakh per day, subject to KYC compliance.

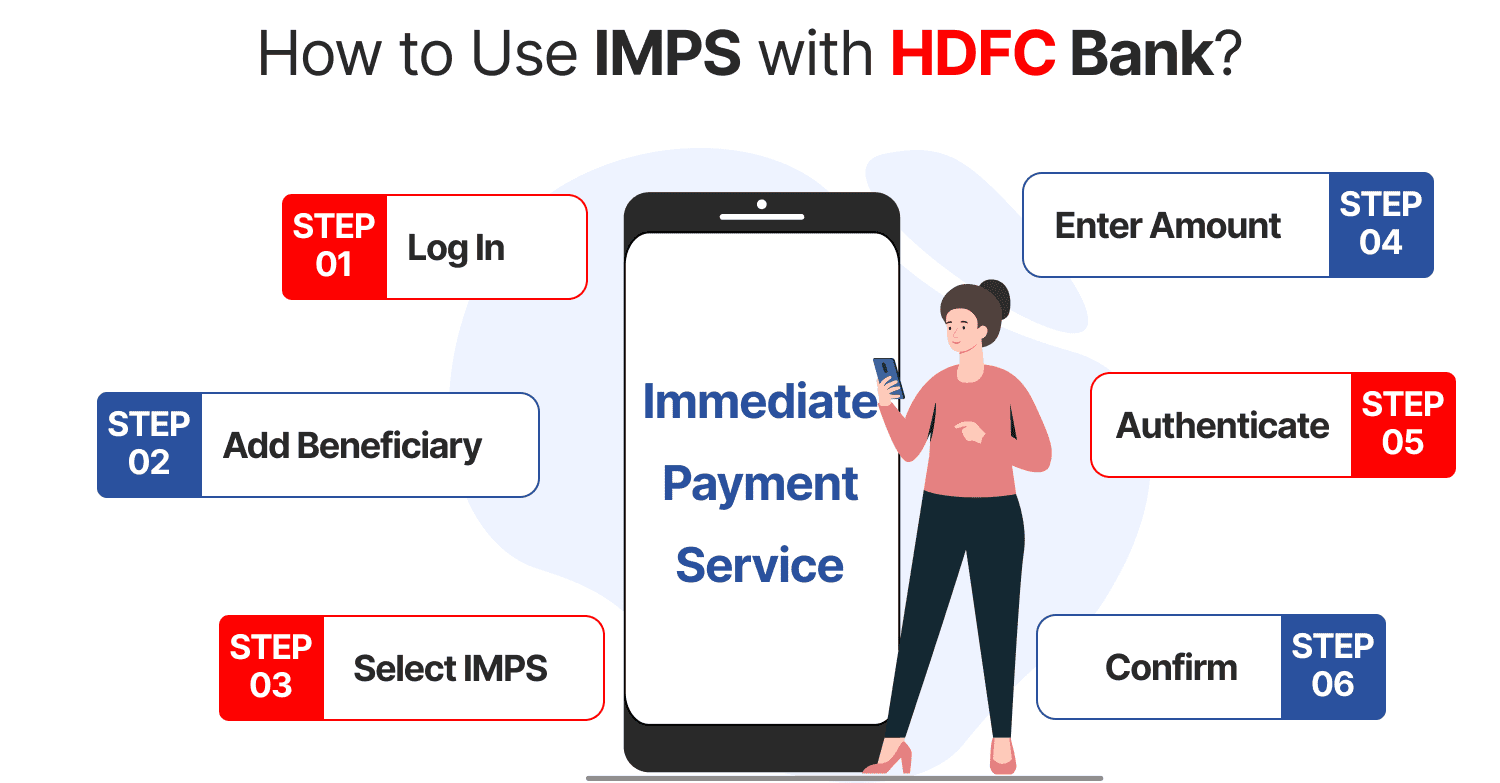

How to Use IMPS with HDFC Bank?

- Log In : Access the HDFC Mobile Banking App or net banking portal.

- Add Beneficiary : Enter the recipient’s account number and IFSC code or mobile number and MMID.

- Select IMPS : Choose IMPS as the transfer mode.

- Enter Amount : Input the amount within the daily limit.

- Authenticate : Verify with OTP or MPIN.

- Confirm : Submit the transaction for instant transfer.

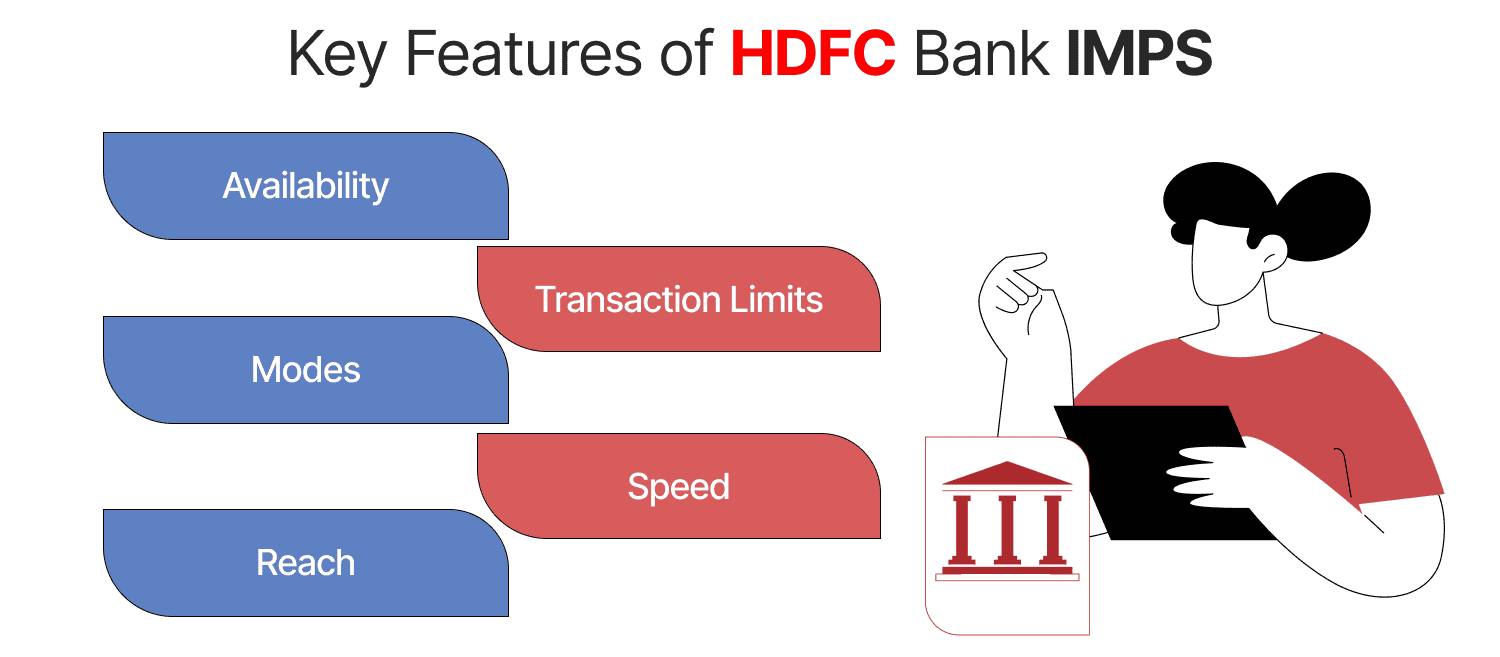

Key Features of HDFC Bank IMPS

- Availability : Operates 24/7, including weekends and holidays.

- Transaction Limits : Up to ₹5,000 per day for MMID-based transfers and ₹5 lakh for account-based transfers.

- Modes : Accessible via HDFC Mobile Banking App , net banking, or ATMs.

- Speed : Funds are credited instantly to the recipient’s account.

- Reach : Supports transfers to any IMPS-enabled bank account in India.

Steps to Transfer Money via HDFC Bank IMPS

HDFC Bank offers multiple platforms for IMPS transfers, including the HDFC Mobile Banking App, net banking, and ATMs. Below are the steps for each method.

Using HDFC Mobile Banking App

- Download and Log In: Install the HDFC Mobile Banking App from the Google Play Store or Apple App Store. Log in using your customer ID and password or MPIN.

- Add Beneficiary:

- Navigate to “Fund Transfer” or “Pay” in the app.

- Select “Add Payee” and choose “IMPS.”

- Enter the beneficiary’s details:

- Account-Based: Account number, IFSC code, and payee name.

- MMID-Based: Mobile number and MMID (7-digit code provided by the recipient’s bank).

- Aadhaar-Based: Recipient’s Aadhaar number.

- Confirm with OTP sent to your registered mobile number. Beneficiary activation takes ~30 minutes.

- Initiate IMPS Transfer:

- Go to “Fund Transfer” and select “IMPS.”

- Choose the added beneficiary.

- Enter the amount (up to ₹5,000 for MMID-based, ₹5 lakh for account/Aadhaar-based).

- Add a remark (optional) for transaction reference.

- Authenticate: Verify the transaction using MPIN or OTP sent to your registered mobile number.

- Confirm and Submit: Review details and submit. Funds are credited instantly, with an SMS/email confirmation.

Using HDFC Net Banking

- Log In: Visit HDFC Bank’s net banking portal and log in with your customer ID and password.

- Add Beneficiary:

- Go to “Funds Transfer” > “Add a Payee.”

- Select “IMPS” and enter the beneficiary’s account number and IFSC code, mobile number and MMID, or Aadhaar number.

- Authenticate with OTP. Activation takes ~30 minutes.

- Initiate Transfer:

- Select “IMPS” under “Funds Transfer.”

- Choose the beneficiary, enter the amount, and add a remark (optional).

- Authenticate: Verify using OTP or transaction password.

- Submit: Confirm details and submit. The transfer is processed instantly.

Using the HDFC Bank ATM

- Visit an ATM: Insert your HDFC debit card and enter your PIN.

- Select Fund Transfer: Choose “Fund Transfer” > “IMPS.”

- Enter Details: Input the beneficiary’s savings account number, IFSC code, and amount. (Note: MMID-based transfers may not be available at all ATMs.)

- Confirm: Verify details and submit. Funds are transferred instantly, with a transaction receipt provided.

Beneficiary Details for HDFC Bank IMPS Transfer

HDFC Bank offers three primary methods for IMPS transfers: account-based, MMID-based, and Aadhaar-based. Here’s what you need for each:

1. Account-Based IMPS Transfer

- Beneficiary Name : Full name of the recipient as per their bank account.

- Account Number : The recipient’s bank account number.

- IFSC Code : The 11-digit Indian Financial System Code of the recipient’s bank branch (e.g., HDFC0000123 for HDFC Bank branches).

- Bank Name : Name of the recipient’s bank (optional, as IFSC often suffices).

- Purpose/Remark (Optional) : A brief note for transaction reference (e.g., “Bill Payment”).

2. MMID-Based IMPS Transfer

- Beneficiary Mobile Number : The recipient’s mobile number registered with their bank for IMPS.

- MMID (Mobile Money Identifier) : A 7-digit code provided by the recipient’s bank, linked to their account.

- Beneficiary Name : Full name of the recipient (optional but recommended for verification).

- Purpose/Remark (Optional) : A note for tracking the transaction.

Use Case : Suitable for quick transfers using just a mobile number, with a daily limit of ₹5,000.

3. Aadhaar-Based IMPS Transfer

- Aadhaar Number : The recipient’s 12-digit Aadhaar number linked to their bank account.

- Beneficiary Name : Full name of the recipient (optional but advised).

- Purpose/Remark (Optional) : A reference note for the transaction.

Use Case : Useful for transfers without needing bank account details, with a daily limit of ₹5 lakh, subject to Aadhaar linkage and KYC compliance.

How to Add Beneficiary for HDFC Bank IMPS?

Before initiating an IMPS transfer, you must add and activate the beneficiary via HDFC Bank’s platforms:

- Log In : Access the HDFC Mobile Banking App or net banking portal with your customer ID and password or MPIN.

- Navigate to Fund Transfer :

- In the mobile app, go to “Pay” > “Fund Transfer.”

- In net banking, select “Funds Transfer” > “Add a Payee.”

- Select IMPS : Choose “IMPS” as the transfer mode.

- Enter Beneficiary Details :

- For account-based: Input account number, IFSC code, and name.

- For MMID-based: Enter mobile number, MMID, and name.

- For Aadhaar-based: Provide the Aadhaar number and name.

- Authenticate : Verify using OTP sent to your registered mobile number.

- Activation : Beneficiary activation takes ~30 minutes. Once activated, you can initiate the transfer.

Frequently Asked Questions (FAQs)

What details are needed for an HDFC Bank IMPS account-based transfer?

Can I use IMPS with just a mobile number for HDFC Bank?

Is Aadhaar mandatory for HDFC Bank IMPS transfers?

How long does it take to activate a beneficiary for HDFC IMPS?

What happens if I enter wrong beneficiary details for HDFC IMPS?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement