IDFC First Bank Balance Check Number

Last Updated : July 10, 2025, 6:19 p.m.

Keeping track of your account balance is essential for effective financial management. IDFC First Bank provides multiple convenient options for performing an IDFC First Bank balance check, allowing you to monitor your funds effortlessly. From using the IDFC First Bank balance check number to accessing digital platforms like mobile banking, this guide details all the ways to stay updated on your account balance.

Why Check Your IDFC First Bank Account Balance?

Regularly checking your account balance helps you:

- Track your spending and avoid overspending.

- Plan your budget accurately.

- Detect unauthorized transactions quickly.

- Ensure you have sufficient funds for transactions or bill payments.

With IDFC First Bank’s user-friendly services, performing an IDFC First Bank balance check is quick, secure, and hassle-free. Below are the most effective methods to check your balance.

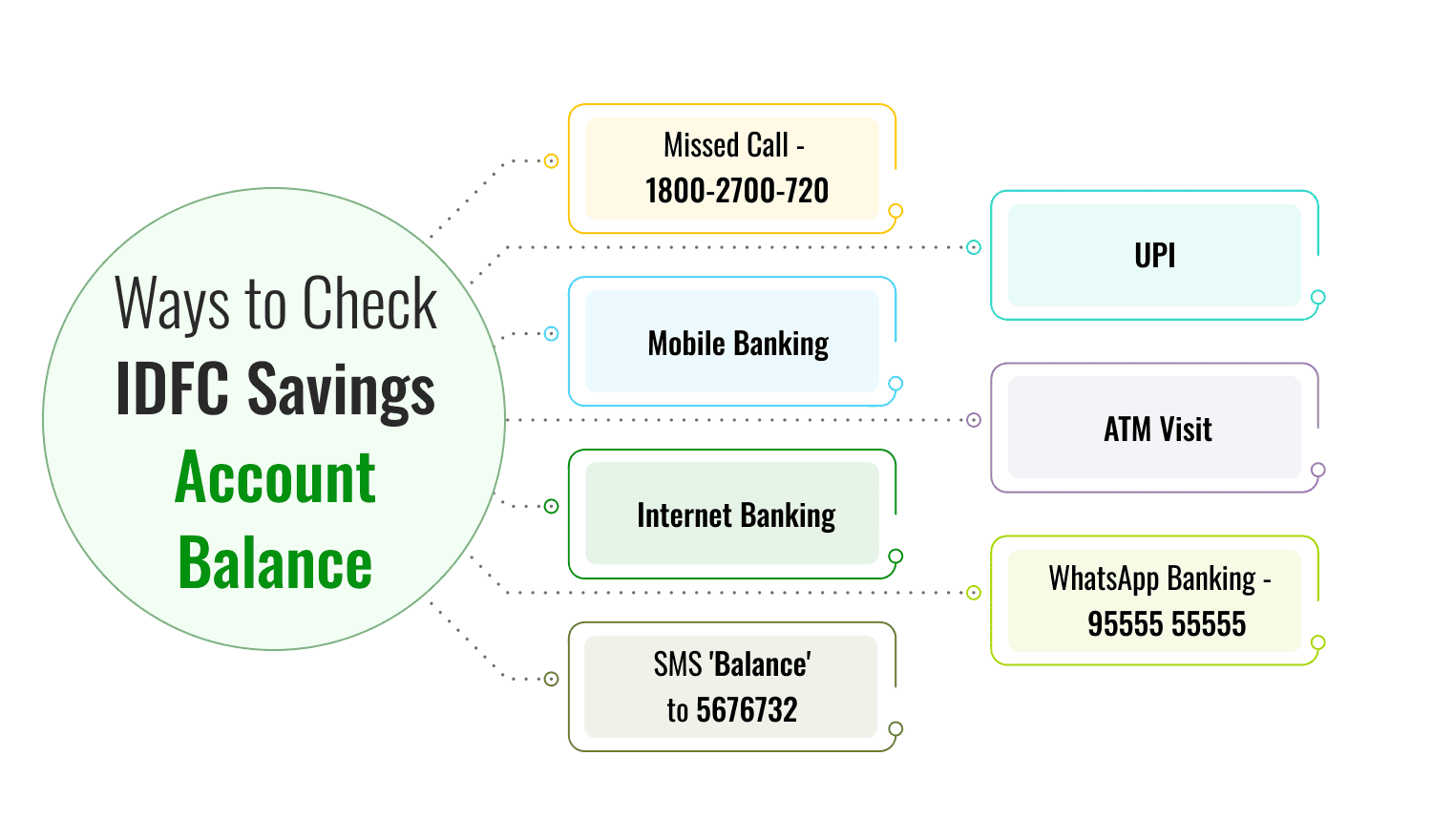

Methods for IDFC First Bank Balance Check

You must see the easy techniques that will help you to know the available balance in the IDFC First Bank Savings Account. Let’s explore all these methods:-

IDFC First Bank Balance Check Through a Missed Call

One of the simplest ways to check your account balance is by using the IDFC First Bank balance check number. This toll-free service allows you to get your balance instantly via SMS.

Steps to Use the Missed Call Service:

- Dial 1800-2700-720 from your registered mobile number.

- The call will disconnect automatically after a short ring.

- You’ll receive an SMS from IDFC First Bank with a message like, “Thank You for calling IDFC Bank! You will obtain an SMS for your request shortly.”

- Within seconds, another SMS will display your account balance.

Remember you should give a missed call on the toll-free number from your registered mobile number and then you will receive the balance SMS on the same number.

IDFC First Bank Balance Check Through SMS

IDFC First Bank’s SMS banking service lets you check your balance by sending a text message from your registered mobile number.

- Open your messaging app.

- Type BAL or BALANCE followed by a space and the last 4 digits of your account number (e.g., BAL 1234).

- Send the SMS to 5676732 or 9289289960.

- You’ll receive an instant SMS with your current account balance.

Request | SMS text (Sent through the registered number) | Details |

|---|---|---|

Balance | BAL / BALANCE or BAL / BALANCE | View the account balance in your customer ID. |

IDFC First Bank Balance Check Through ATM

IDFC FIRST Bank account holders can easily check their account balance at any nearby ATM . A valid debit card and a 4-digit ATM PIN are required to use this service. Follow these simple steps for balance enquiry through an ATM:

Steps for IDFC FIRST Bank Balance Enquiry via ATM:

- Insert your IDFC FIRST Bank debit card into the ATM slot.

- Select your preferred language from the options displayed.

- Enter your 4-digit ATM PIN securely when prompted.

- Choose the option labeled “Account Summary” or “Balance Enquiry”.

- Your account balance will be displayed on the screen. You may also opt to receive a printed receipt for the same.

IDFC FIRST Bank Balance Check Through Netbanking

IDFC FIRST Bank account holders can conveniently check their balance through net banking, which offers a range of banking services without the need to visit a branch. These services include viewing account balances, mini statements, loan details, and more. Customers must complete their net banking registration to use this service.

Steps to Check IDFC FIRST Bank Balance via Netbanking:

- Visit the official IDFC FIRST Bank portal.

- Click on “Log In” located at the top-right corner of the homepage.

- Log in to your net banking account using your User ID and Password.

- Once logged in, you’ll be directed to your dashboard, where your account balance and other details will be displayed.

IDFC First Bank Balance Check Through Mobile Application

IDFC FIRST Bank account holders can easily check their account balance through the IDFC First Bank mobile banking application. The app provides a secure and convenient way to manage your banking needs, including balance inquiries, fund transfers, and more. Here's how you can check your balance using the mobile app:

Steps to Check IDFC FIRST Bank Balance via Mobile Application:

- Download and Install the App: If you haven't already, download the IDFC FIRST Bank Mobile Banking App from the Google Play Store or Apple App Store.

- Log in to the App: Open the app and log in using your User ID and MPIN or other authentication methods set up on your account.

- Navigate to ‘Account Summary’ or ‘Balance Enquiry’: Once logged in, go to the ‘My Accounts’ or ‘Account Summary’ section of the app.

- View Your Balance: Your available balance for all linked accounts will be displayed on the screen.

IDFC First Bank Balance Check Whatsapp Number

You can easily check your IDFC FIRST Bank account balance through WhatsApp, making it a quick and convenient option. Follow the steps below to use this service:

Steps to Check Balance via WhatsApp:

- Save the IDFC FIRST Bank WhatsApp number 95555 55555 on your phone.

- Open WhatsApp and send a message with the text “Hi” to the saved number.

- You will receive a menu with various options.

- Select the relevant option for balance enquiry.

- Alternatively, type “I want to know my balance” in the chat.

- You will instantly receive your real-time account balance in the chat window.

Key Features of WhatsApp Banking:

- User-Friendly : Interact with the service like chatting with a bank representative.

- Real-Time Updates : Get your account balance and other details instantly.

- Secure Access : Available only for customers with their mobile number registered with the bank.

- No Additional App Required : Use WhatsApp, an app most users already have on their phones.

IDFC First Bank Balance Check Through Passbook

Account holders can easily check their account balance by updating their passbook at the nearest IDFC FIRST Bank branch. The passbook provides a detailed record of all debit and credit transactions made through the account. Here's how it works

- You can visit the nearest IDFC FIRST Bank branch to get your passbook updated. The passbook will provide a detailed record of all debit and credit transactions made through your account.

- By updating your passbook, you can easily view the exact balance available in your account along with a history of recent transactions.

This is a great option if you prefer having a physical record of your account activity.

IDFC First Bank Balance Check Through UPI APP

Account holders can conveniently check their balance using any UPI-enabled app. UPI (Unified Payments Interface) apps such as Google Pay, PhonePe, Paytm, or the IDFC FIRST Bank app provide a quick and secure way to manage your bank account. Here's how you can check your IDFC FIRST Bank account balance using a UPI app.

Steps to Check Balance via UPI App:

- Install a UPI App: Download any UPI-enabled app from the Google Play Store or Apple App Store if you don’t already have one. (E.g., Google Pay, PhonePe, Paytm, or the IDFC FIRST Bank app).

- Register Your Bank Account: Open the app and complete the registration using your mobile number linked to your IDFC FIRST Bank account. Set up your UPI PIN if it’s not already configured.

- Go to ‘Check Balance’ Option: Navigate to the ‘Check Balance’ or ‘Account Balance’ section in the app.

- Enter Your UPI PIN: Authenticate by entering your UPI PIN.

- View Your Balance: The app will display your IDFC FIRST Bank account balance on the screen.

Tips for a Secure IDFC First Bank Balance Check

- Use Registered Devices: Always use your registered mobile number or secure devices for banking transactions.

- Protect Your Credentials: Never share your PIN, MPIN, or net banking password with anyone.

- Enable Biometrics: Use fingerprint or Face ID for added security on the mobile app.

- Verify Sources: Download the IDFC First Bank app only from official stores (Google Play Store or Apple App Store) and avoid third-party links.

- Regular Updates: Keep your mobile number and email ID updated with the bank to receive SMS alerts and e-statements.

Conclusion

IDFC FIRST Bank provides several convenient options for account holders to check their account balance, ensuring ease of access and flexibility. Among these, the Balance Check Number offers a quick and effortless way to stay updated on your account balance without visiting a branch or using the internet. With such diverse options, customers can choose the method that suits their needs best. The IDFC Bank Balance Check Number remains one of the simplest and most efficient ways to monitor the account balance, ensuring you stay in control of your finances anytime, anywhere.

Frequently Asked Questions (FAQs)

What is the IDFC FIRST Bank balance check number?

Is the missed call balance enquiry service free of charge?

Can I use the balance check number if my mobile number is not registered with the bank?

How long does it take to receive the account balance via SMS?

Can I use this service for multiple accounts linked to the same mobile number?

Is the balance check service available 24/7?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement