UCO Bank Mini Statement

Last Updated : July 8, 2025, 12:30 p.m.

UCO Bank being one of India’s largest government owned commercial banks, gives instant banking solutions to all of its customers, the bank has developed innovative and simplified banking techniques. To make sure that the customers are able to keep a track of their transaction history, UCO Bank provides various options to get the UCO Bank Mini Statement. Customers do not need to necessarily visit the bank branch to get their mini statement. There are various methods by which the customers can access the mini statement of their account using their mobile phones or internet.

What is a UCO Bank Mini Statement?

A UCO Bank mini statement provides a snapshot of your recent account transactions, typically showing the last 3 to 10 debit and credit activities. It’s a quick and efficient way to monitor your account, manage your finances, and detect any unauthorized transactions without visiting a bank branch. By using the UCO Bank mini statement number, you can access this information instantly from anywhere.

How to Get Your UCO Bank Mini Statement?

There are various methods to get a UCO Bank mini statement. Some of the methods are as follows:

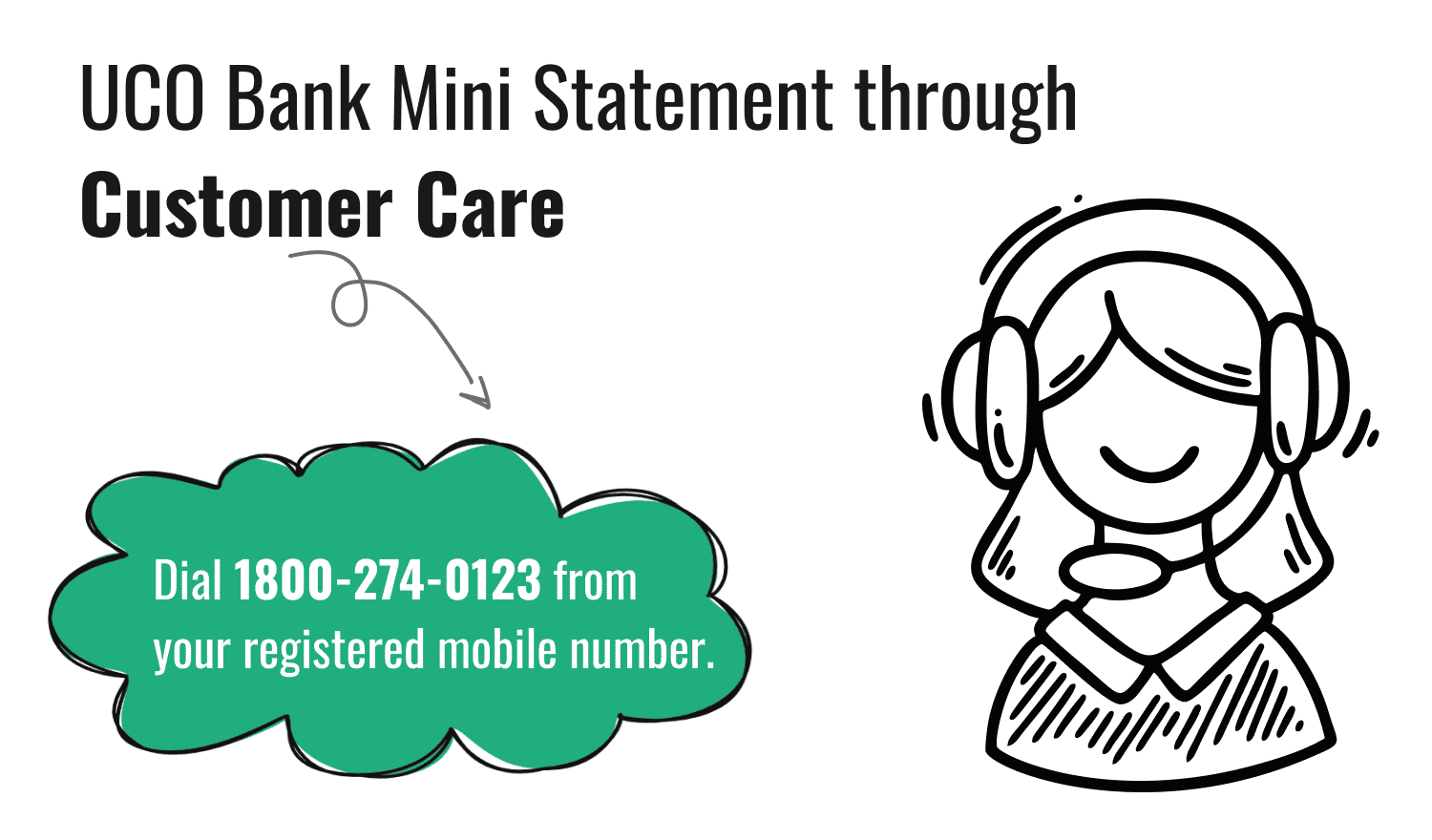

UCO Bank Mini Statement via Toll-Free Number

If you prefer speaking to a representative, you can call UCO Bank’s toll-free number:

- Dial 1800-274-0123 from your registered mobile number.

- Follow the Interactive Voice Response (IVR) instructions to request your mini statement.

- The details of your last 5 transactions will be sent via SMS.

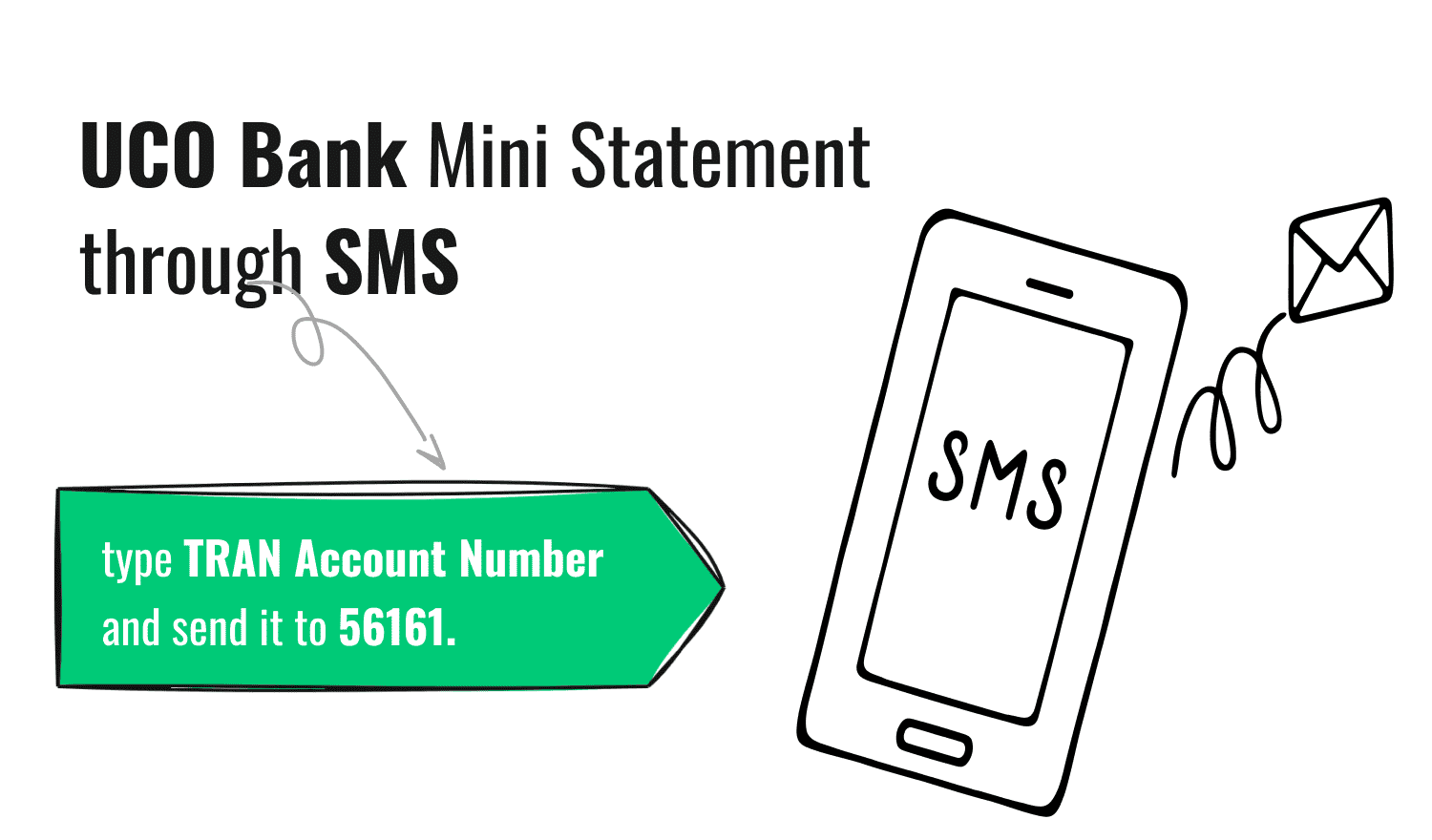

UCO Bank Mini Statement via SMS

To get your mini statement via SMS, you need to send a message from your registered mobile number. Follow these steps:

- Open your messaging app.

- Type TRAN [Account Number] [mPin]

- Send the SMS to 56161.

- You will receive an SMS with details of your last 5 transactions.

UCO Bank Mini Statement through Missed Call Number

UCO Bank provides a dedicated missed call service for quick access to your mini statement:

- Dial 1800 274 0123 from your registered mobile number.

- The call will disconnect automatically after a ring.

- You will receive an SMS with details of your last 5 transactions.

UCO Bank Mini Statement via Net Banking

For those who prefer online banking, UCO Bank’s internet banking portal is a secure option:

- Visit the official UCO Bank net banking portal (https://www.ucoebanking.in/).

- Log in using your User ID and password.

- Navigate to the “My Accounts” section and click on “Mini Statement.”

- View the last 5 to 10 transactions on your screen.

UCO Bank Mini Statement by using Mobile Banking

The UCO mBanking Plus app and UCO mPassbook app are excellent tools for accessing your mini statement:

- Download the App : Install the UCO mBanking Plus or UCO mPassbook app from the Google Play Store or Apple App Store.

- Log In : Use your 4-digit mPIN and the OTP sent to your registered mobile number.

- Navigate : Go to the “Banking” or “Account Statement” section and select “Mini Statement.”

- View/Download : Your mini statement, showing recent transactions, will be displayed. You can save it for future reference.

UCO Bank Mini Statement by Visiting ATM

You can also access your mini statement at any UCO Bank ATM:

- Insert your UCO Bank debit card into the ATM.

- Enter your 4-digit ATM PIN.

- Select the “Mini Statement” option from the menu.

- View the last 10 transactions on the screen or print a physical copy for your records.

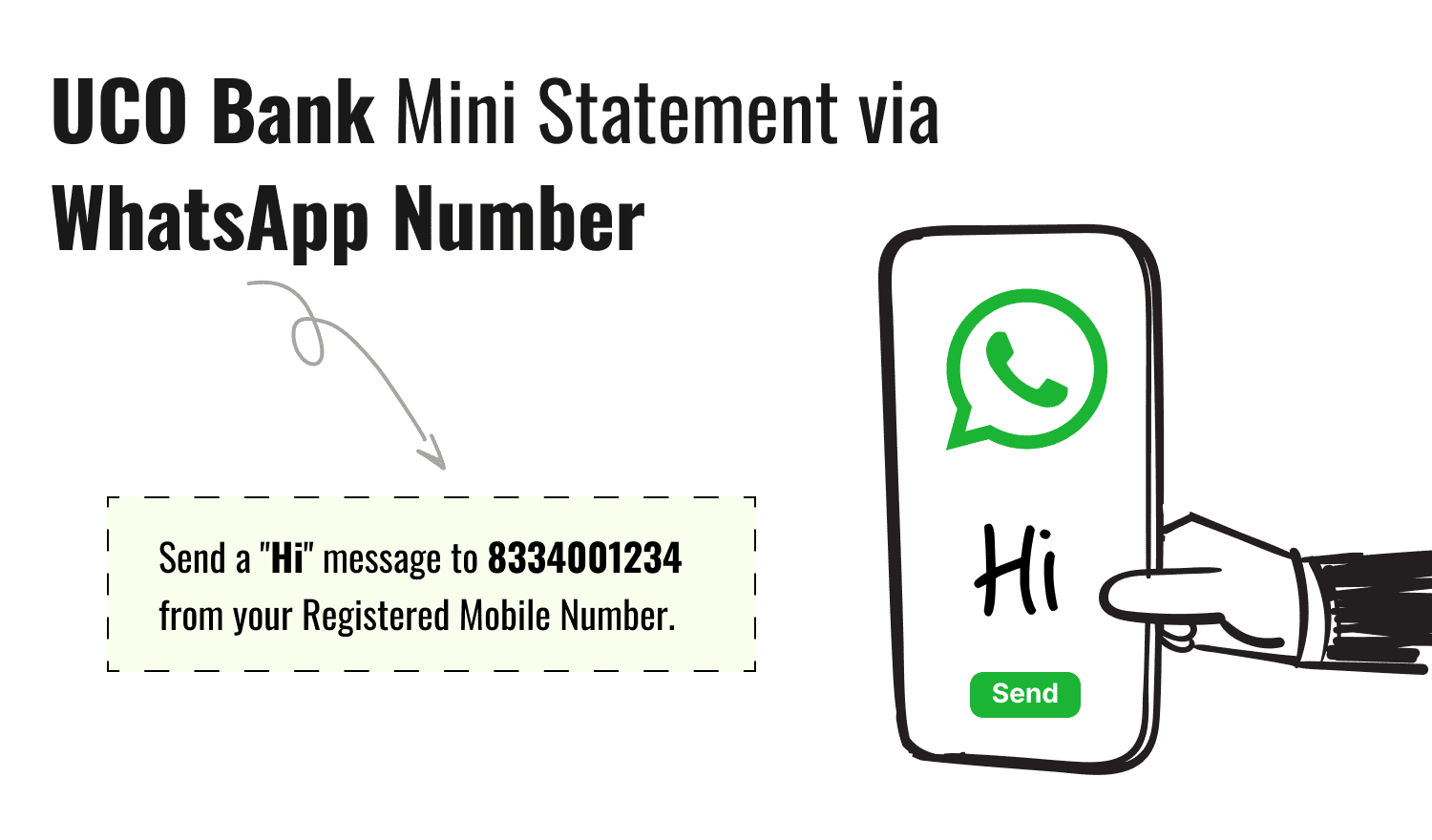

UCO Bank Mini Statement via WhatsApp Number

UCO Bank also offers WhatsApp banking for added convenience:

- Save the UCO Bank WhatsApp number 8334001234 in your contacts.

- Open WhatsApp and send “Hi” to initiate a chat.

- Select your preferred language and choose “Banking Services.”

- Click “Mini Statement” to view your recent transactions.

Why Use the UCO Bank Mini Statement Number?

The UCO Bank mini statement number allows account holders to check their transaction history on the go. Here are some key benefits:

- Convenience : Access your transaction history anytime, anywhere.

- Financial Planning : Monitor your spending and account balance to make informed financial decisions.

- Security : Quickly identify and report any unauthorized transactions.

- Free Service : UCO Bank does not charge for mini statement services, though standard SMS charges may apply.

Conclusion

Accessing your UCO Bank mini statement is simple and convenient with options like SMS, missed call number, mobile apps, net banking, ATMs, and WhatsApp banking. These methods allow you to stay on top of your finances without visiting a branch. Whether you’re a tech-savvy user or prefer traditional methods, UCO Bank ensures seamless access to your transaction history.

Frequently Asked Questions (FAQs)

How can I check my Uco Bank mini statement?

How can I get a Uco Bank mini statement on mobile?

How can I get a mini statement from Uco Bank Online?

Do you have to pay any charges for availing Uco Bank mini statement service?

How can I check my last 5 transactions in Uco Bank?

How can I check my last 10 transactions in Uco Bank?

How can I download my 3 month bank statement from Uco Bank?

How can I check my mini statement in Uco Bank ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement