Benefits of Personal Loan Prepayment

Last Updated : June 19, 2025, 3:43 p.m.

Personal loans are collateral-free, unsecured loans that are easily accessible and typically disbursed quickly. Personal Loan eligibility is typically based on your income level and credit score. However, these loans often come with higher interest rates—usually ranging from 10% to 20% per annum—compared to other types of loans. If you opt for a loan at a rate significantly above the market average, your total interest payout may be considerably higher.

One effective way to manage this is by using the personal loan prepayment option. Benefits of Personal Loan Pre-Payment include a reduction in the overall interest burden, faster loan closure, and improved creditworthiness. Prepaying allows you to settle your outstanding balance before the loan tenure ends, helping you save on future EMIs and interest payments.

Let’s read this article that tells the benefits of personal loan prepayment and how you should go about it.

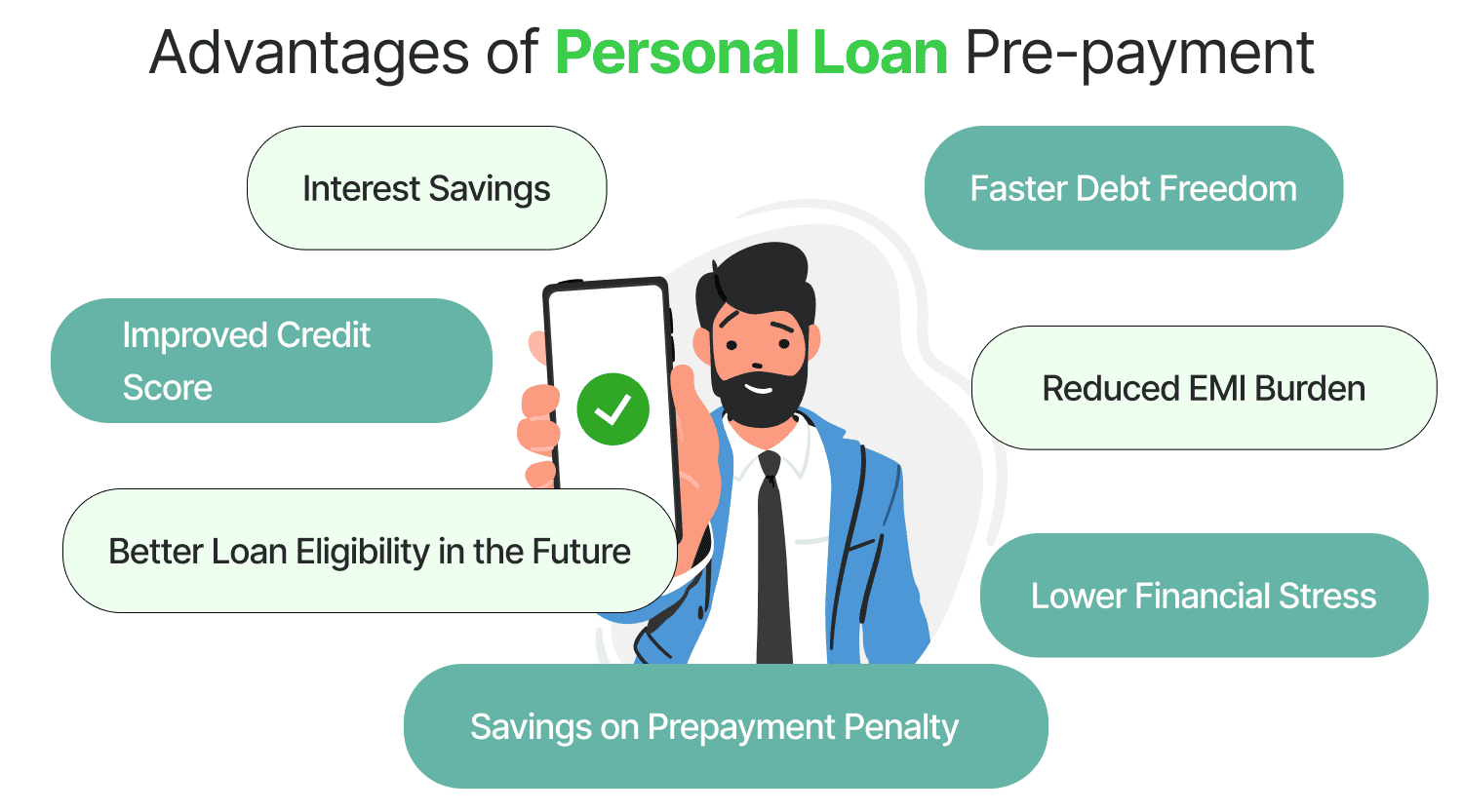

Advantages of Personal Loan Pre-payment

Here are the advantages of personal loan pre-payment presented as bullet points:

- Interest Savings: By pre-paying your loan, you reduce the outstanding principal, which directly lowers the total interest payable.

- Faster Debt Freedom: It helps you close the loan earlier than the original tenure, giving you peace of mind and financial freedom.

- Improved Credit Score: Timely pre-payments or early loan closure can positively impact your credit report and score. In India, credit scores typically range between 300 and 900. To achieve and maintain a good credit score , it's essential to build a strong credit history by consistently repaying your loans and credit card dues on time.

- Reduced EMI Burden: You can either lower your high interest rates on your loan payments or shorten your loan tenure, depending on the lender’s policy.

- Better Loan Eligibility in the Future: Reduced liabilities make you eligible for higher loan amounts in the future.

- Savings on Prepayment Penalty (in Some Cases): Many lenders waive off prepayment charges after a certain period (like 12 months), making it cost-effective.

- Lower Financial Stress: With one less loan to manage, your monthly budgeting becomes easier and less stressful.

How Can a Personal Loan Prepayment be Possible?

A personal loan prepayment is possible when a borrower pays off the loan amount—either in part or in full—before the scheduled end of the loan tenure. Here's how it can be done:

Here are the steps to prepay a personal loan:

Check the Loan Agreement

- Review your loan documents for prepayment terms, lock-in periods (if any), and charges.

Contact Your Lender

- Inform the lender of your intention to prepay. Ask for the exact outstanding amount and any prepayment charges.

Choose Between Part Prepayment or Full Prepayment

- Part Prepayment : Pay a lump sum to reduce the principal. EMIs may be reduced, or the tenure may be shortened.

- Full Prepayment : Pay the remaining loan balance in one go to close the loan account entirely.

Make the Payment

- Payments can typically be made via net banking, cheque, demand draft, or by visiting the branch.

Collect Prepayment Receipt

- Always collect an official receipt and updated loan statement from the lender.

Get a No Dues Certificate (NOC) (for full prepayment)

- This document confirms you’ve cleared all dues and is important for your credit history.

Also,

We suggest that you seek assistance from a personal loan EMI calculator. Why? Because it can help you estimate the outstanding balance of your borrowed loan amount at different points in time. Understand it better with the example below.

Let’s say you take a personal loan of ₹6 lakh at an annual interest rate of 13% for a tenure of 5 years. Before making a prepayment decision, you can use the Wishfin Personal Loan EMI Calculator to estimate your repayment schedule and outstanding balance. Refer to the table below for the calculator’s output.

| Tenure | Loan Amount | Interest Rate (EMIs) |

|---|---|---|

1 | Rs. 6,00,000 | ₹53,590.37 |

2 | Rs. 6,00,000 | ₹28,525.09 |

3 | Rs. 6,00,000 | ₹20,216.37 |

4 | Rs. 6,00,000 | ₹16,096.50 |

5 | Rs. 6,00,000 | ₹13,651.84 |

Prepayment Conditions to Keep in Mind

- Some lenders have a lock-in period (usually 6–12 months) before prepayment is allowed.

- There might be a prepayment penalty (1%–5%) depending on your lender’s policy.

- NBFCs and digital lenders may offer more flexible prepayment options compared to traditional banks.

What is Personal Loan Prepayment?

Personal loan prepayment means repaying your loan amount—either partially or fully—before the end of the scheduled loan tenure. It is a useful financial strategy to reduce your interest burden and clear debt sooner.

Types of Prepayment

Part Prepayment:

- You make an extra one-time payment along with your regular EMIs.

- Reduces the outstanding principal, which leads to lower future interest.

- You keep paying your EMIs, although the amount may decrease or the loan tenure might get reduced.

Full Prepayment (Foreclosure):

- You clear the full remaining loan balance with a single payment.

- The loan is settled in full before the original repayment period concludes.

Personal Loan Prepayment Fee

Personal loan prepayment refers to the process of repaying your loan—either partially or fully—before the end of the agreed loan tenure. While many lenders permit prepayment after you’ve completed the first 12 EMIs, some may charge a prepayment fee for early closure. To compensate for the interest amount, the bank charges a prepayment fee to the customer.

See the table below and know the prepayment fee charged by banks in India.

| Banks | Prepayment Fee |

|---|---|

| |

| |

| |

| |

| |

A fee of ₹500 + applicable taxes is charged for each part prepayment. | |

3% of the principal outstanding | |

NIL |

Conclusion

The benefits of personal loan pre-payment include saving significantly on interest, closing your loan early, and boosting your credit score. By reducing your outstanding loan balance ahead of schedule, you lower your EMI burden and improve your financial profile. If your lender permits it and charges are minimal, personal loan pre-payment is a smart move towards financial freedom.

Frequently Asked Questions (FAQs)

What are the benefits of prepayment of a personal loan?

Can prepaying a personal loan have any disadvantages?

What is personal loan pre-payment?

What is the best time to prepay a personal loan?

Does prepayment affect my loan eligibility in the future?

Which lenders offer zero prepayment charges?

Is there any lock-in period before I can prepay my personal loan?

What is the prepayment fee for an ICICI Bank personal loan?

Does Kotak Mahindra Bank charge a fee for prepaying a personal loan?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

Personal Loan

- Personal Loan

- Personal Loan Eligibility Calculator

- Personal Loan EMI Calculator

- Personal Loan Interest Rates

- Pre-approved Personal Loan in India

- Personal Loan Top Up in India

- Personal Loan Balance Transfer

- Apply Personal Loan on WhatsApp

- Personal Loan for Unemployed

- Personal Loan for Government Employees

- Personal Loan Without CIBIL Score

- Minimum CIBIL Score for Home Loan

Personal Loan Calculator by Top Banks

- HDFC Personal Loan EMI Calculator

- ICICI Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- IndusInd Bank Personal Loan EMI Calculator

- RBL Bank Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- IDFC First Bank Personal Loan EMI Calculator

- Tata Capital Personal Loan EMI Calculator

- SMFG India Credit Personal Loan EMI Calculator

- Standard Chartered Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- Axis Bank Personal Loan EMI Calculator