SBI Balance Check Number

Last Updated : Dec. 6, 2024, 12:59 p.m.

Millions of customers in India have their savings accounts with the State Bank of India, which offers a variety of services including credit cards, savings accounts, loans, and many others. Many individuals want to keep an eye on their account balances, and SBI provides several methods to check your balance. Here, we'll explore various techniques to find out the available balance in your SBI savings account. These methods include net banking, a toll-free number, as well as SMS and missed call services. Let’s take a look at all the SBI balance check numbers you can use to check the balance in your savings account.

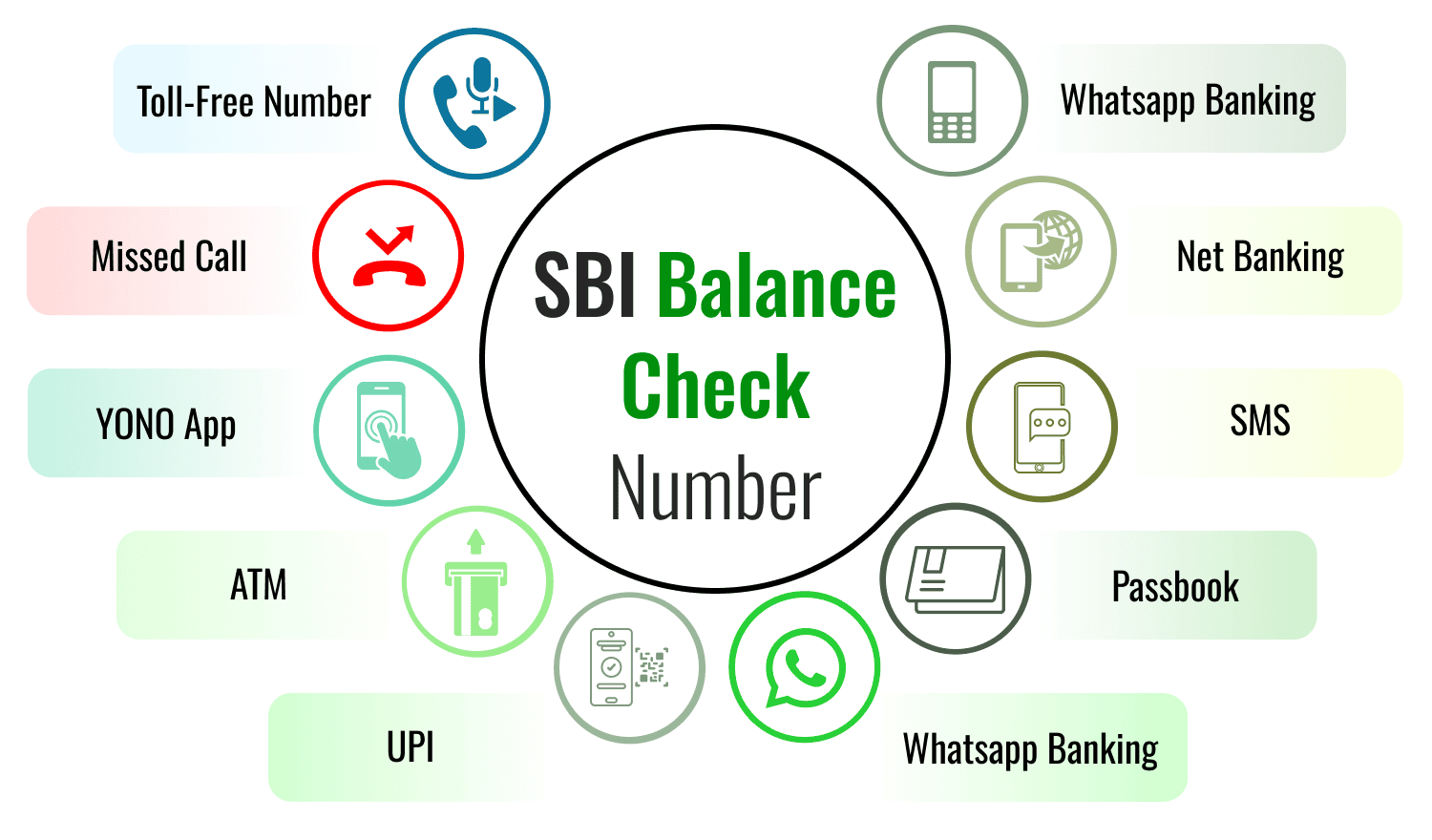

Methods to Check SBI Savings Account Balance

Here are some simple methods to check the available balance in your account using the SBI balance check numbers:

SBI Bank Balance Check Using NetBanking

SBI account holders registered for net banking can check their account balance by logging into the SBI Online Banking website at https://www.onlinesbi.sbi/ using their SBI net banking ID and password. Once logged in, they should navigate to the 'My Accounts' section and click on 'View Account Balance' to see their balance.

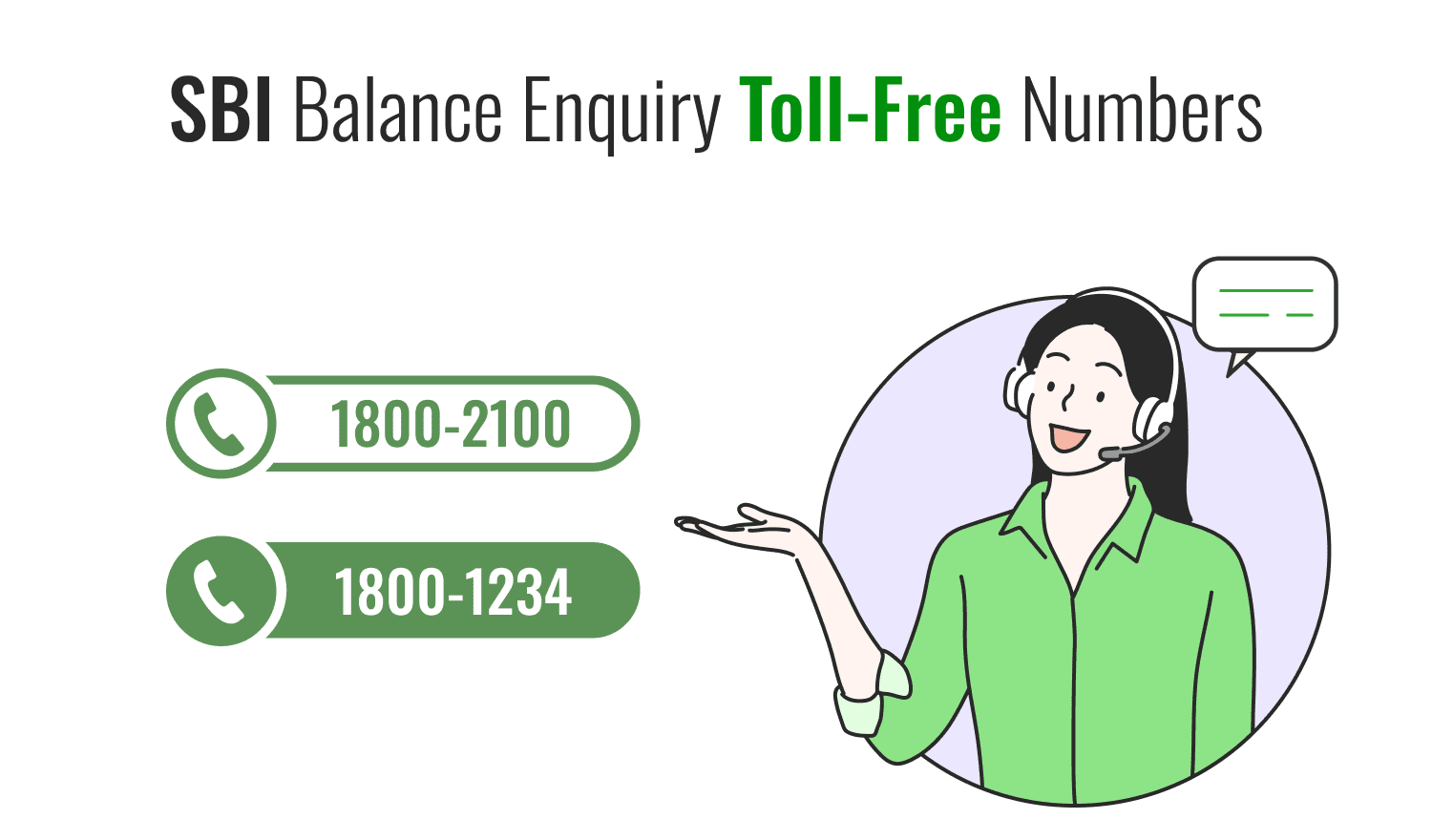

SBI Balance Enquiry through Toll-Free Number

You can check your SBI account balance by calling any of the below SBI toll-free numbers:

- 18001234

- 18002100

- 1800112211

- 18004253800

1. Make a call on the SBI balance check numbers given above.

2. Follow the instructions to know your balance in the savings account.

3. Make sure that you call from the mobile number registered with the State Bank of India.

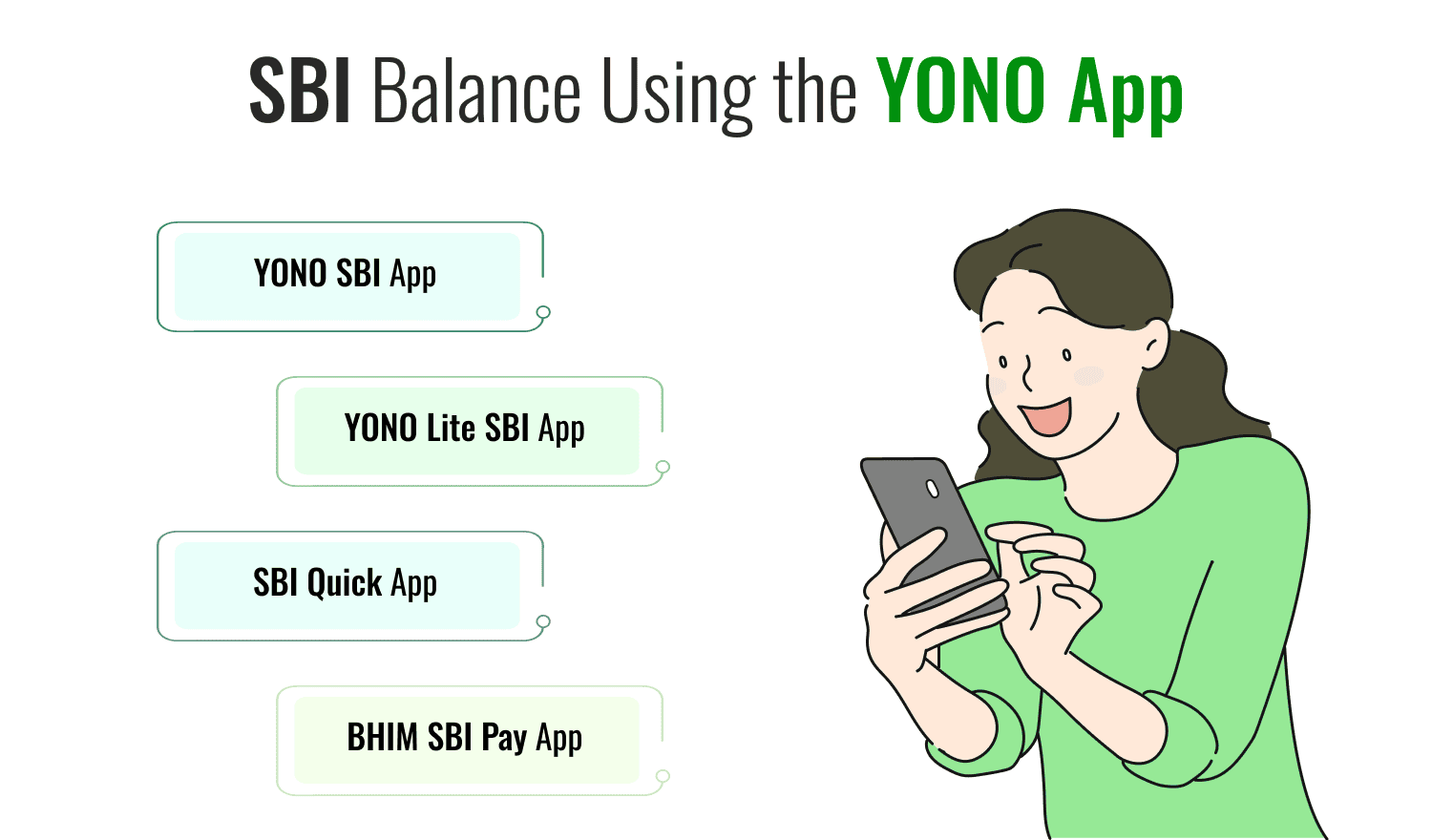

SBI Balance Check by Using the YONO App

SBI provides its customers with several mobile apps for easy banking, including YONO SBI, YONO Lite SBI, SBI Quick, and BHIM SBI Pay. Here's how you can check your SBI account balance using these apps on your smartphone:

YONO SBI App

- Download and install the YONO SBI app on your Android or iOS device.

- Log in with your mobile banking credentials.

- Access various services such as balance checks, account statements, and fund transfers.

YONO Lite SBI App

- Log into the YONO Lite SBI app using your username and password or by using your fingerprint.

- Tap “View Balance” on the home screen to see the balance of your default account.

- To check the balance of other accounts, select the specific account.

- View detailed transactions in the mPassbook section for each account.

SBI Quick App

- Open the SBI Quick app on your phone.

- Without logging in, go to “Account Services” under the “Without Login” tab.

- Tap the call or message icon next to the Balance Enquiry option to get your account balance instantly.

BHIM SBI Pay App

- Open the BHIM SBI Pay app and enter your 6-digit app PIN to log in.

- Select “View Balance” below your default account to see the balance.

- To check the balance of other linked accounts, choose the account you want and tap on View Balance.

Check SBI Account Bank Balance By Visiting an ATM

Customers with an SBI account can check their balance using their ATM/debit card. Just visit any State Bank of India ATM and follow these steps:

- Visit the nearest ATM Machine.

- Insert your Debit Card and follow the instructions to go to the Banking Services.

- Then in the Banking option, choose the Balance Enquiry option.

- The ATM will display the balance available in your SBI account.

SBI account holders can also check their last 10 transactions by choosing the “Mini Statement” option at the ATM. The SBI ATM will print a receipt containing the details of the last 10 account transactions.

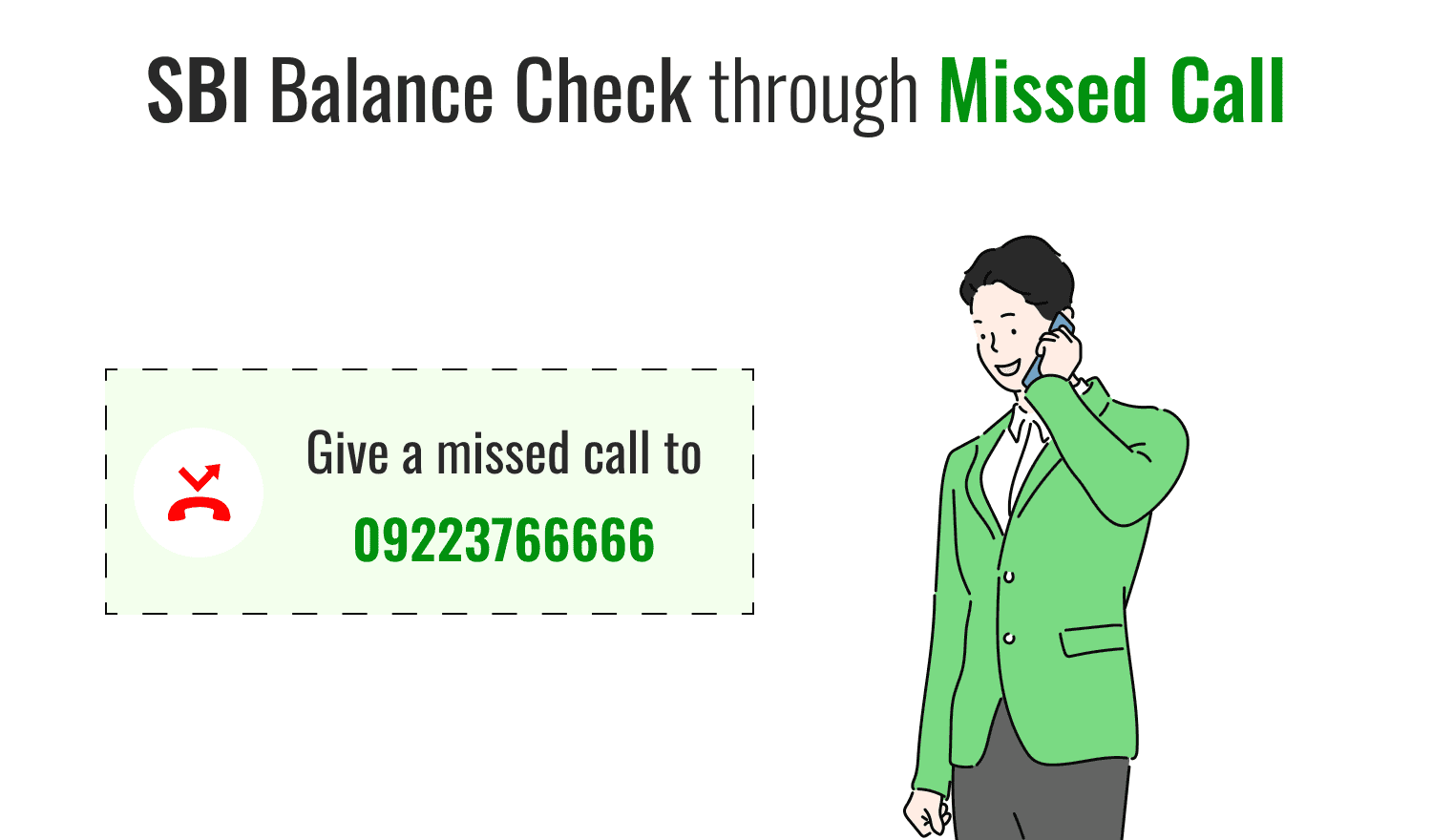

SBI Balance Check through Missed Call

You can also check your balance with the SBI balance check number for missed call, but you must first register for this service. Send an SMS with the text 'REG Account Number' (without quotation marks) to 9223488888. After sending this SMS, you will receive a confirmation message indicating that your account has been activated for the service. After registration you can missed call on 09223766666 for your balance enquiry.

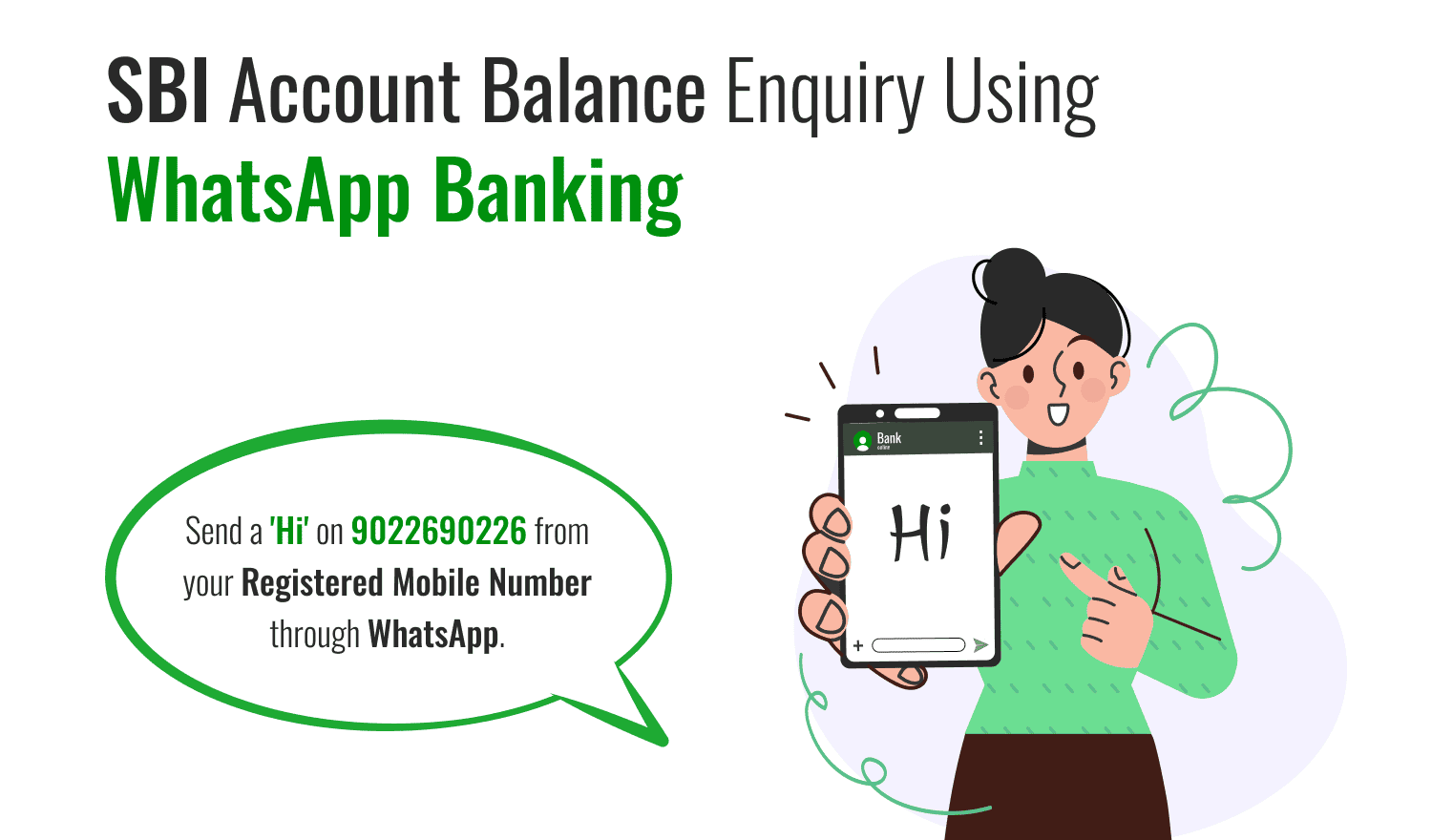

SBI Account Balance Enquiry Using WhatsApp Banking

To use WhatsApp Banking for SBI, simply send a 'Hi' from your registered mobile number to the SBI balance check number +91-9022690226 and follow the instructions provided.

Alternatively, you can register for this service by sending an SMS in the format 'WAREG ACCOUNT NUMBER' to 7208933148 from the mobile number you have registered with SBI.

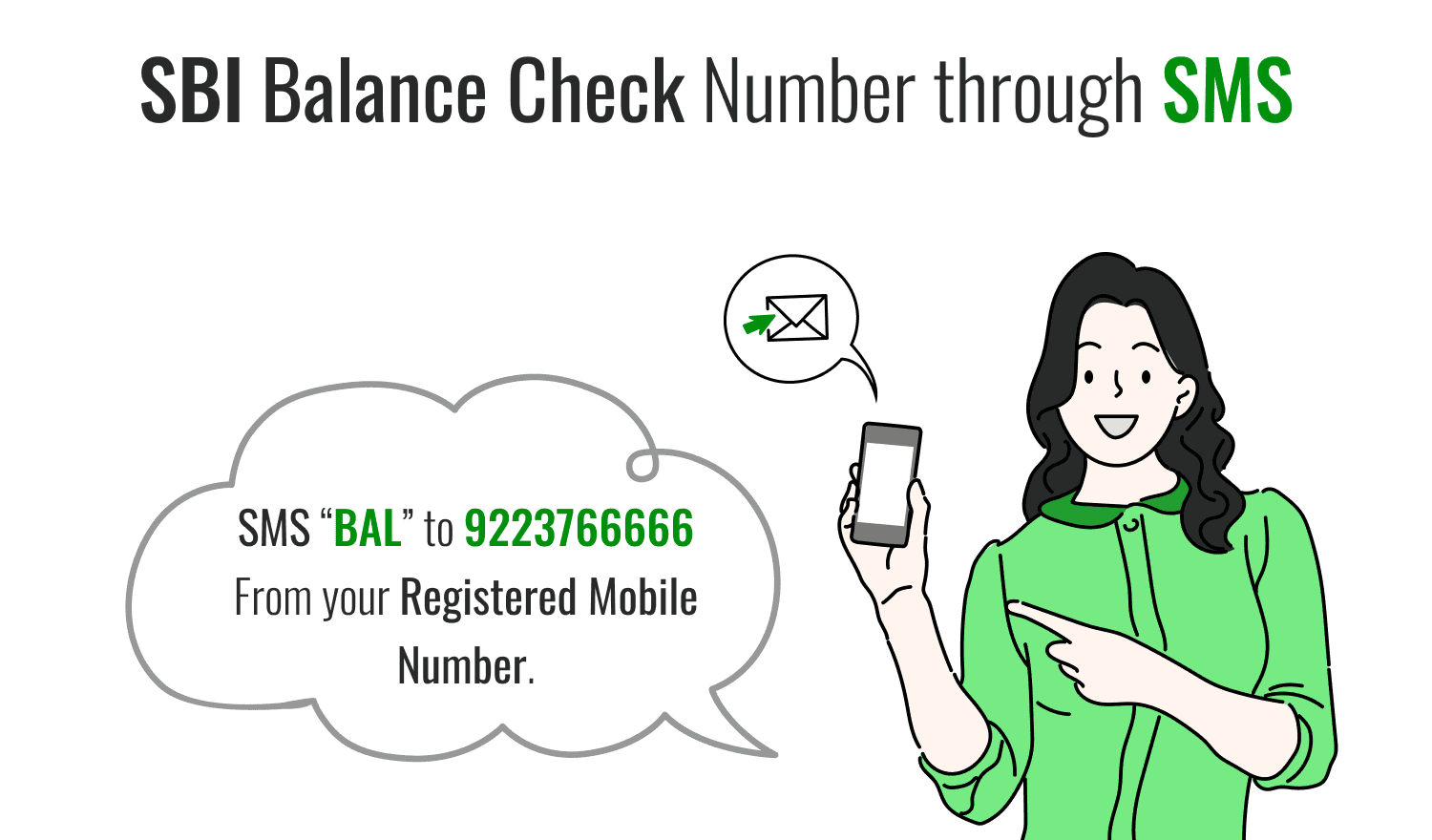

SBI Balance Check via SMS

You can also have an SBI Balance Check Enquiry through an SMS. You will have to send an SMS “BAL” (without inverted commas) to 9223766666. Make sure that you send this SMS with your registered mobile number that is registered with the bank. For registration, send the text in the format mentioned below:

REG

Check Your SBI Account Balance Using a Passbook

State Bank of India provides a passbook to every customer when they open an account. It’s important to keep this passbook updated to reflect all recent transactions. Here’s how you can use your passbook to check your account balance:

- Update Your Passbook : Visit your nearest SBI branch to get your passbook updated regularly. This ensures it records all your latest transactions.

- Check Your Balance : Simply open your updated passbook to see your current balance along with a detailed list of transactions, both money coming in (credits) and going out (debits).

Check SBI Bank Account Balance Via UPI

Here's how to check your bank balance using a UPI app on your smartphone:

- Open your UPI app.

- Log in using your security code.

- Select the account you want to check.

- Tap on 'Check Balance.'

- Enter your passcode to confirm.

- Once verified, your balance will be displayed on the screen.

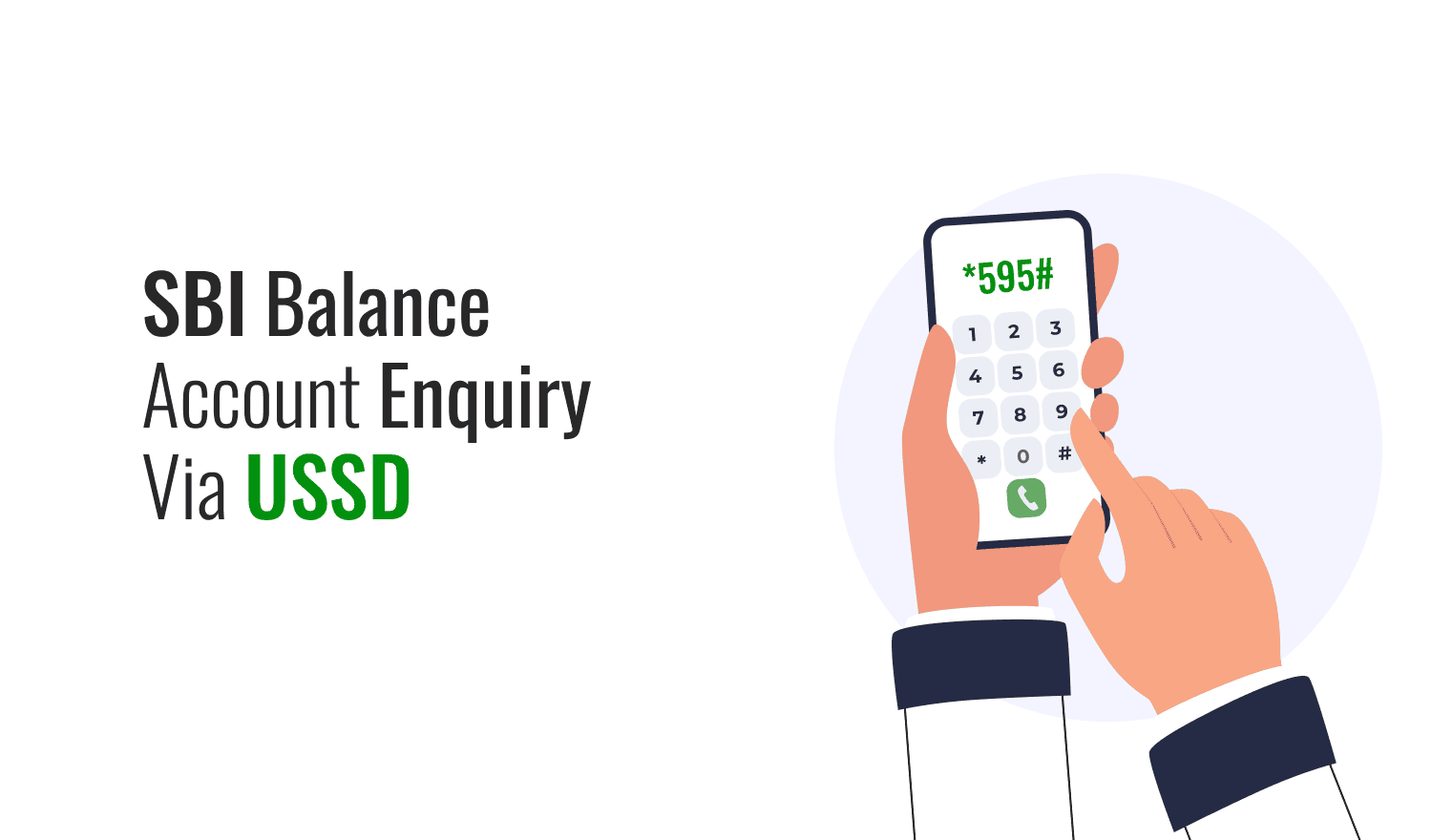

SBI Balance Account Enquiry Via USSD

Unstructured Supplementary Service Data (USSD) is a communication protocol used in GSM mobiles to send information between a phone and network application software. SBI customers with current or savings accounts can use this service to check their balances. Here’s how to do it:

- Dial *595# to enter your User ID.

- Select 'Option 1' from the 'Answer' menu.

- Choose either 'Balance inquiry' or ‘Mini statement'.

- Enter your MPIN and press ‘Enter’ to submit.

How to Register for SBI Balance Enquiry Using USSD?

To register for SBI Balance Enquiry using USSD, follow these simple steps:

- Send an SMS to register: Type

and send it to either 9223440000 or 567676. - Receive User ID and MPIN : You'll get a User ID and a default MPIN via SMS.

- Change Your MPIN :

- Dial *595#.

- Enter ‘4’ and send.

- Agree to the terms and conditions.

- Press ‘Answer’, enter ‘1’, then submit your old MPIN.

- Enter a new MPIN and send it.

You must change your MPIN to complete your registration, which you can finalize at an SBI ATM or branch.

To activate at an ATM :

- Insert your debit card and select ‘Mobile Registration’.

- Enter your ATM PIN and choose ‘Mobile Banking’.

- Select ‘Registration’, enter your mobile number, and confirm.

- A message on the ATM screen will confirm that your mobile registration is successful.

Conclusion

Here are various methods for checking your balance using SBI balance check numbers. You can accurately know your balance in your SBI savings account using the techniques mentioned above. You can also download the SBI Mini Statement after logging into Internet banking. These services are available 24/7, allowing you to check your balance at any time. Additionally, you can manage your credit cards through the SBI Credit Card Login . These methods offer a convenient way to monitor your available balance.

Frequently Asked Questions (FAQs)

What is the SBI balance enquiry number?

Can I use USSD to check my SBI account balance?

How do I check my SBI account balance using SMS banking?

Is there a charge for using the SBI balance check number?

Can I use the toll-free service to check the balance of my SBI zero balance account?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement