Short Term Personal Loan

Last Updated : June 16, 2025, 6:18 p.m.

Meeting small financial needs like vacations, weddings, or purchasing a second-hand two-wheeler can often be challenging. Borrowing money from friends or relatives may seem like an option but can strain relationships in the long run. At the same time, opting for a large personal loan to cover minor expenses isn't always practical. That’s where a Short Term Personal Loan becomes the ideal solution. As the name suggests, this type of loan is borrowed for a tenure of less than one year. The loan amount is typically modest, and the repayment is swift, making it suitable for immediate financial needs. Below, you'll find a list of trusted apps in India that offer short-term loans to help you manage such expenses with ease.

You can also explore our curated guide on the Best Personal Loan Apps in India to find the most suitable option based on your needs and profile.

Short Term Personal Loan Applications

Here, you can go through the table containing short-term loan interest rates, loan amounts ,tenure, and some features and benefits with all the applications that give you such loans -

| Short Term Loan Apps | Loan Amount | Interest Rate | Tenure | Features and Benefits |

|---|---|---|---|---|

₹1 Lakh to ₹50 Lakh | Starting at 9.99% | 12-84 months |

| |

Starting from 5K to 10 Lakh | Starting 1.16% per month and 10% per annum | 3 Months to 60 Months | - Get the loan from Money View within 24 hours. - You can know your loan eligibility in just 2 minutes with MoneyView. - With fast disbursal, get the approved loan credited to your bank account within minutes. - To apply anytime, from anywhere—no paperwork or branch visits needed, 100% digitalised process. | |

Up to INR 5,00,000 | Starting from 18% per annum | From 6- 36 Months | - Receive the loan amount directly in your bank account within 10 minutes of approval. - Flexible amounts that you can borrow as a short-term personal loan. - There is no need to fill out lengthy forms to get instant cash. - Repay your existing loan anytime without any pre-closure charges and instantly become eligible for the next loan. | |

Up to INR 5,00,000 | 13% onwards per annum | From 3 to 36 Months | - There will be no contractor and no guarantor. - Get the Instant Short Term Loan up to Rs. 20,000 anytime for small expenses. - With Money Tap, you can instantly transfer your money. - Enjoy safe, secure, and lifetime access to credit from MoneyTap. | |

INR 5,000 to INR 5,00,000 | 1.4% - 2.3% per month | 3 Months to 60 Months | - Quick approvals and affordable EMI options. - Apply for the short-term loan without CIBIL. - The loan disbursal process will be paperless. - Even if you've never taken a loan before, you're still eligible. Paysense ensures a smooth experience with easy payment management. | |

IIFL Personal Loan | INR 5,000 to INR 5,00,000 | 12.75% - 44% p.a. Per annum | Up to 3.5 years (42 months) | - You will not need any collateral to take this loan. 100% unsecured loan - Get the short-term personal loan within 24 hours. -Make part payments anytime to reduce your outstanding balance and interest, at your convenience. - You can borrow an amount as low as INR 5000 as a personal loan for the short term. |

From Rs. 45,000 Up to 3 lakhs | 2.5% onwards per month | 9 Months to 1.5 years | -Cashe has the fastest loan approval process. Complete the entire loan application in just 15 to 20 minutes. - All the disbursal processes will be 100% digital. -Apply for CASHe’s instant small loans without pledging any assets or security. - Enjoy a seamless loan application experience with a tech-driven, intuitive platform. | |

Mobikwik | From Rs. 10,000 to INR 5,00,000 | From 17.99% to 35.99% p.a. | From 3 months to 24 Months | - There is no need for any collateral to apply for the Mobikwik Loan. - Receive funds directly in your bank account with a fully digital, paperless process in 30 minutes. - Shop with Zero repayment and without any upfront cost, or lower your EMI by up to 50% with a down payment option. |

StashFin | Up to INR 5,00,000 | 12% onwards per annum | 12 Months to 36 Months | -Borrow now and repay within 30 days without any interest charges—perfect for managing short-term cash needs with zero cost. - You can upload your documents digitally, and there is no need to visit the branch. - The platform uses an AI-powered system that operates 24/7 to ensure quick loan approvals within minutes. |

Lazy Pay | From Rs. 3,000 to INR 5 lakhs | 18% to 25% per annum | 3 Months to 24 Months | - Get an Instant small loan online without visiting the branch. - No collateral or security is needed to get the loan. - Apply for a loan through the LazyPay app with minimal documentation and a fully digital process—no paperwork required. - Once approved, the personal loan amount is credited directly to your bank account without delay. |

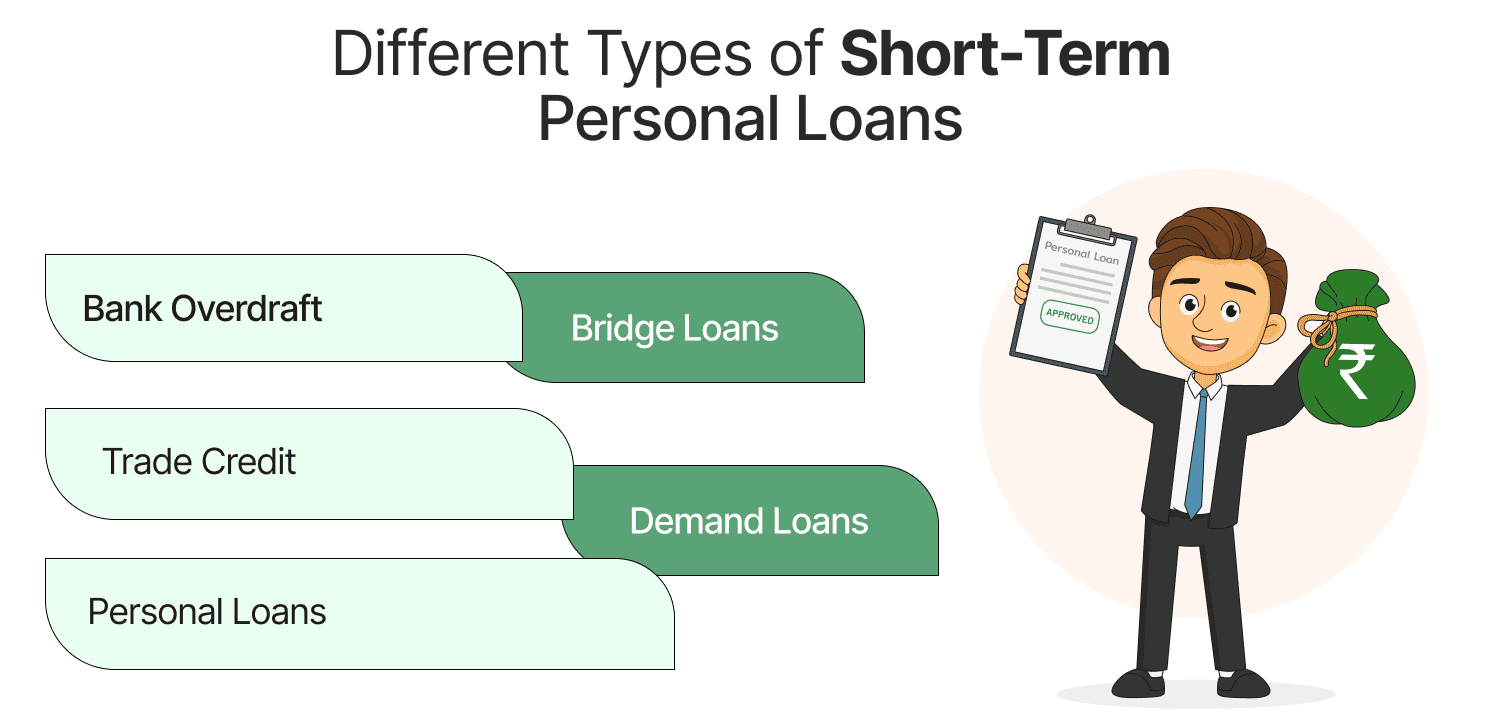

Different Types of Short-Term Personal Loans

Below mentioned are the types of short-term personal loans that could be beneficial to you. Make sure to go through them and their benefits before applying for them.

Bank Overdraft - Allows you to withdraw more than your account balance up to a set limit. Interest applies only to the amount overdrawn.

Benefits:

- Pay interest only on what you use

- Immediate access to funds

- Suitable for short-term cash needs

Trade Credit - An interest-free credit facility that businesses use to make urgent purchases, usually repayable within 30 days. Tenure extensions may be requested for better cash flow management.

Benefits:

- No interest cost

- Flexible repayment terms

- Helps maintain cash flow

Bridge Loans - Short-term loans used to bridge a financial gap until a larger loan is secured. Commonly used in property deals when funds from a long-term loan are delayed.

Benefits:

- Fast disbursal

- Temporary financial support

- Useful for real estate transactions

Personal Loans - Unsecured loans are ideal for personal needs like weddings, education, or emergencies. Offers higher loan amounts and repayment terms of up to 36 months.

Benefits:

- No collateral needed

- High loan limits

- Flexible repayment tenure

Demand Loans

Loans can be availed against savings instruments such as insurance policies or National Savings Certificates (NSCs). The eligible loan amount is determined based on the maturity value of the underlying asset.

Benefits:

- Quick funding using savings

- No need to liquidate investments

- Adjustable loan amounts

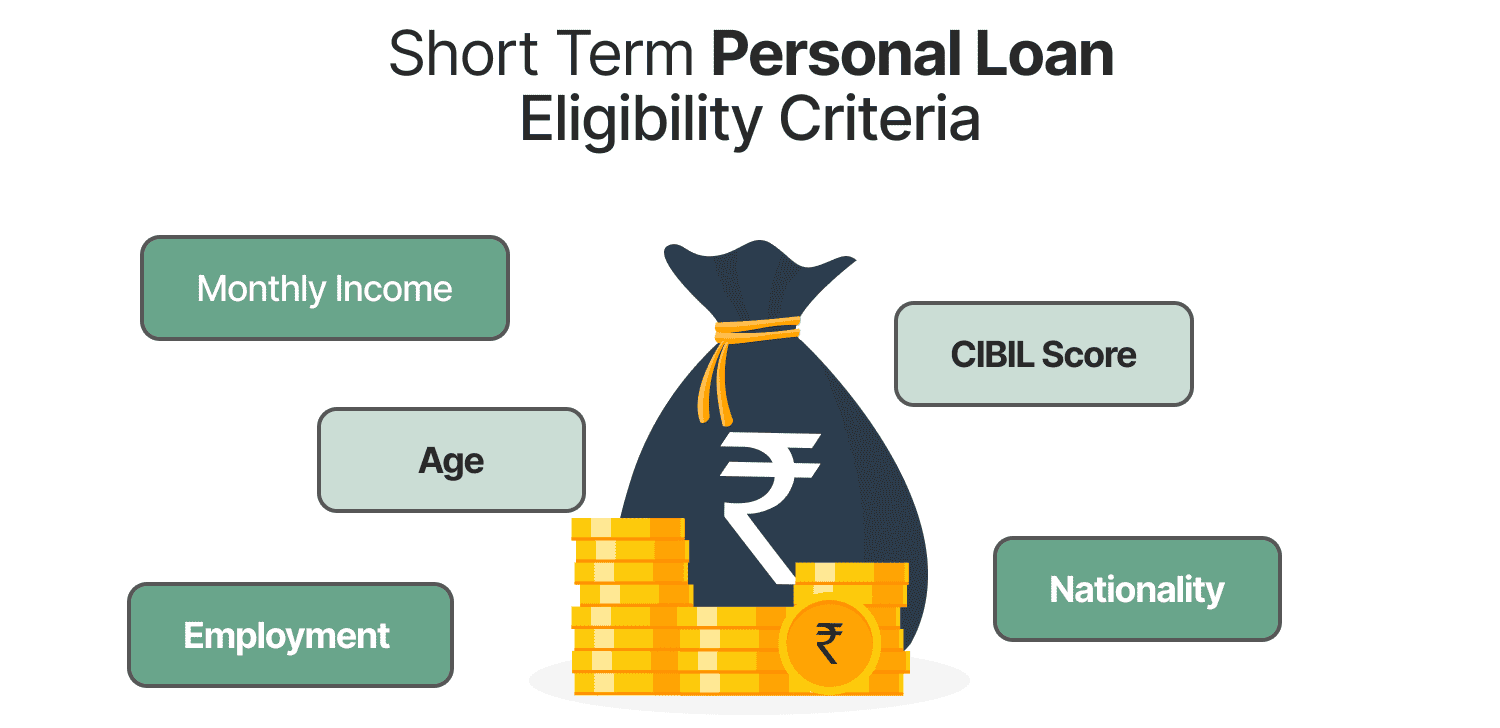

Short Term Personal Loan Eligibility Criteria

You will have to be eligible to take a short term personal loan. If you aren’t eligible, then you cannot borrow short-term loans. Therefore, you must go through the eligibility criteria that you will have to fulfill before you apply for short-term personal loans.

- Age - The Age of the borrower should be between 21 years to 80 years.

- Employment - Salaried and self-employed or borrowers working with an MNC, a public or private company.

- Nationality - Indian citizen with a stable residence (permanent or rented)

- Monthly Income - Minimum ₹15,000–₹25,000 (may vary by lender and city)

- CIBIL Score - Your minimum CIBIL score should be 600 and above.

Documents Required for Short Term Personal Loan

If you are using the Short Term Personal Loan Application to get a loan, then you should know that you will have to submit all the documents digitally. You will have to scan the documents first and then upload them to the app from which you are borrowing the loan.

When applying for a short-term personal loan online, keep the following documents handy for a smooth digital process:

- Identity Proof - Voter ID, Passport, Aadhaar Card, or Driving Licence

- Address Proof - Utility bill, Rent Agreement, or Aadhaar Card with current address

- Income Proof - Latest salary slips, Bank statements (last 3–6 months), ITR, or Form 16

- Employment Proof (for salaried applicants) - Offer letter, Appointment letter, or Employee ID card

- Business Proof (for self-employed applicants) - GST Certificate, Business registration, or Partnership deed

- PAN Card- Required by most lenders as a crucial document for processing the loan application.

- Credit Score (Soft Pull or CIBIL Check) – Though not a document you need to upload, maintaining a strong credit score is vital for loan approval.

How to Apply for Short Term Loans?

With the help of the lender’s application you can easily apply for the short term personal loans. You can see the process to apply :-

- Step 1: Search for the Instant Loan App and download the application.

- Step 2: Tap "Apply Now." - Click on the “Apply Now” button to begin your application process.

- Step 3: Fill in Your Details - Provide your birth date, PAN details, monthly earnings, KYC credentials, and current address information.

- Step 5: Upload Documents Submit the required documents to speed up the approval process.

Once your details are verified, the approved loan amount will be instantly credited to your bank account.

Why a Short Term Loan and not a Credit Card?

Many individuals consider credit cards as a solution for emergency financial needs. However, missing a payment can result in high interest charges. Moreover, if your monthly income is below ₹20,000, your credit limit may be too low to cover larger expenses. In such cases, a short-term personal loan proves to be a better option—it allows you to borrow a higher amount with flexible repayment terms. Additionally, unlike credit card cash withdrawals that come with extra fees, converting your short-term loan amount into cash doesn’t involve such charges.

Tips to Prepare Documents for a Short-Term Personal Loan

- Organize in Advance : Prepare a checklist and keep all necessary documents ready before applying for the loan.

- Check Validity : Make sure your ID and address proofs are current and not expired.

- Ensure Clarity : All documents should be clear, legible, and free from errors or overwriting.

- Get Expert Guidance : If unsure about any document, consult a loan officer or financial advisor for clarity.

Conclusion

Short-term personal loans are an effective solution for meeting urgent financial needs like medical expenses, education fees, travel, or emergency repairs. With quick approval, minimal documentation, and flexible repayment options, they provide fast access to funds without long-term debt burdens. Whether you're salaried or self-employed, choosing a reliable lender and understanding the loan terms can help you manage expenses wisely and maintain financial stability. You can also explore our curated guide on the Best Personal Loan Apps in India to find the most suitable option based on your needs and profile.

Frequently Asked Questions (FAQs)

Which loan is best for the short term?

Who all are eligible or can apply for a Short Term Personal Loan?

What is a short-term personal loan?

Does short-term debt affect credit score?

What is an example of a short-term loan?

Why do people get short-term loans?

What is the highest loan amount available under a Short Term Personal Loan?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

Personal Loan

- Personal Loan

- Personal Loan Eligibility Calculator

- Personal Loan EMI Calculator

- Personal Loan Interest Rates

- Pre-approved Personal Loan in India

- Personal Loan Top Up in India

- Personal Loan Balance Transfer

- Apply Personal Loan on WhatsApp

- Personal Loan for Unemployed

- Personal Loan for Government Employees

- Personal Loan Without CIBIL Score

- Minimum CIBIL Score for Home Loan

Personal Loan Calculator by Top Banks

- HDFC Personal Loan EMI Calculator

- ICICI Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- IndusInd Bank Personal Loan EMI Calculator

- RBL Bank Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- IDFC First Bank Personal Loan EMI Calculator

- Tata Capital Personal Loan EMI Calculator

- SMFG India Credit Personal Loan EMI Calculator

- Standard Chartered Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- Axis Bank Personal Loan EMI Calculator