Difference Between Hard and Soft Credit Check

Last Updated : Jan. 7, 2025, 3:11 p.m.

A credit check is a query made by you or by the potential lenders/employers/creditors/landlords to monitor your credit report for understanding your financial behavior. Sometimes, these inquiries are referred to as “Credit Pulls” because you or any financial institution is pulling information about you from the credit bureau files (Experian, Equifax, TransUnion - These are the three major credit bureaus from which the creditor or lenders request for the borrower’s credit report). Credit checks are of two types - Hard and soft credit checks. Let us now understand the difference between both.

Difference Between the Two Types of Credit Checks

Credit inquiries are of two types - Hard inquiry and soft inquiry.

Soft Credit Check or Soft Credit Pull

A soft credit inquiry is performed for informational purposes. It shows what accounts you have opened, payment history, etc.

A soft credit check occurs in the following cases:

When you check your own credit

Your bank or credit card company gives you a credit score

When you are applying for a job and the employer performs a credit check

When you are applying for a new apartment, and the landlord requires a background and credit check.

Insurance companies can do a soft check to see if the person qualifies for pre-approved offers.

It can be initiated by companies making a promotional offer of credit

When your lender conducts a periodic evaluation of your existing credit accounts.

Soft credit pulls get recorded on your credit report, but they do not impact your credit score. You can see all the soft inquiries on your report. However, lenders cannot see all the inquiries and can view only related ones. For example: A home loan lender can see only home loan inquiries and a personal loan lender can see only the information regarding personal loans .

Hard Credit Check or Hard Credit Pull

Lenders usually conduct a hard credit inquiry when you apply for new credit. Hard credit checks require your authorization, and the lender needs your permission to review your credit reports. A hard credit pull occurs in the following scenarios:

When you apply for a new credit card or loan

When you fund a new car at a dealer

When you refinance your student loans

When you request an increase in credit limit.

Submitting applications for utility services.

Completing rental application for apartments.

Collection agencies conducting skip tracing.

A hard inquiry can lower your credit score by up to 10 points, but it is mostly five. If you have a strong credit history, a single hard inquiry may only lead to a minor decrease in credit score. However, if your credit history is less favorable, a hard inquiry can have a more significant negative impact. Also, seeing too many hard inquiries on your report can make creditors feel cautious about lending to you even when you have a high credit score.

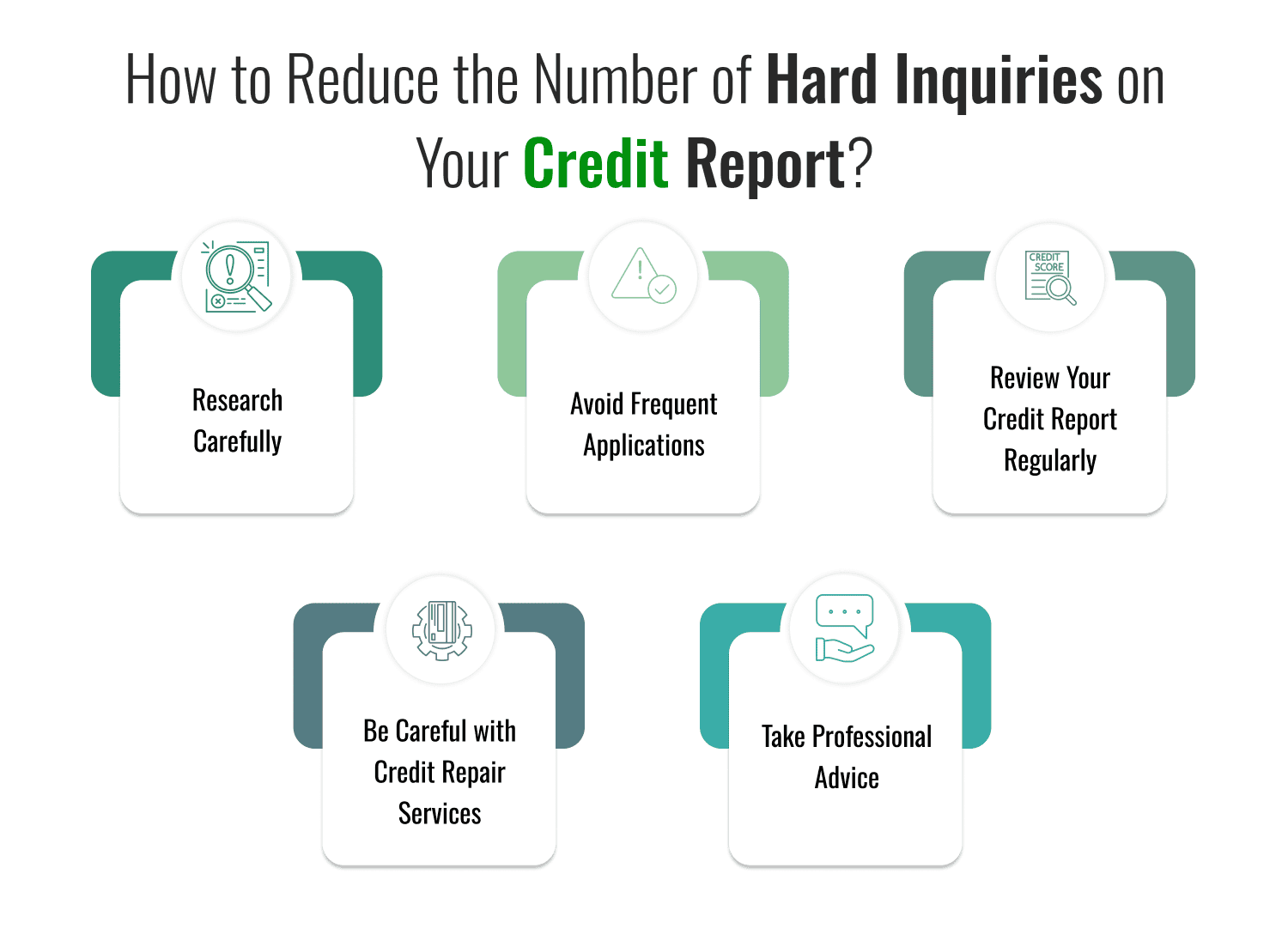

How to Reduce the Number of Hard Inquiries on Your Credit Report?

To reduce the number of hard inquiries on your credit report, you can take the following initiatives:

Research carefully: Before applying for loans or credit cards, research carefully to find out if it is possible for your credit applications to be approved without hard inquiries.

Avoid frequent applications: Avoid submitting multiple credit applications within a short timeframe. This will make lenders feel that you are credit hungry and financially unstable.

Review your credit report regularly: Regularly monitor your credit report. If you find any inaccuracies in your credit report, dispute it with the credit bureau and get your errors removed. When you maintain an accurate credit history, the impact of occasional hard credit checks can be reduced.

Be careful with credit repair services: Avoid hiring credit repair companies that ensure to delete hard credit checks or negative details. Legal and proper credit repair takes time and you have to work in collaboration with credit bureaus and creditors for the same.

Take professional advice: If you still have concerns about managing your credit checks or improving your credit score, seek advice from a certified credit counselor or financial advisor.

What Hard and Soft Credit Check Shows

The soft check shows detailed information about individual credit report like credit inquiries, loans, collection account, payment history. But these details are only visible to the borrower when they go for soft check for their credit report and not visible to the others.

Whereas in Hard check with the consent of borrower the potential lenders, creditors, employers or landlord can see each and every detail like loan history, repayment history, collection account, inquiries from which they get to know whether the borrower will be able to repay them on time, whether they should provide the credit requested by the borrower or not.

How Many Points Does an Inquiry Affect Credit Score

In soft check, every search is recorded in the credit report the very moment you made it, but it does not affect credit score as the inquires are only seen by the person himself and same is not visible to any financial institution or potential lenders. So there is no drop in points when the soft check is performed.

Whereas, As per Experian, on an average in Hard Check with every enquiry the credit score drop down with 5-10 points, but if borrower maintains proper credit report with no other issues than it may drop down with even fewer points.

Many Hard inquiries in a short period of time hit your credit score, and if the points in each inquiry made drop to 10 points the individual CIBIL score go down from good credit score to fair/poor credit score with five or more inquiries. This effect the decision of potential creditor or lender and affect negatively in the lending decision for borrower credit request, because poor credit report shows that borrower credit history is not good enough and giving any credit will lead to high risk of not getting repaid. Below is the credit score range which shows that what is the poor to excellent credit score report.

| Credit Score Range | What does it mean? |

|---|---|

| 300 – 549 | Poor |

| 550 – 649 | Fair |

| 650 – 749 | Good |

| 750 – 900 | Excellent |

Frequently Asked Questions (FAQs)