Does Loan Rejection Affect CIBIL Score?

Last Updated : Jan. 31, 2025, 6:17 p.m.

The CIBIL score is a 3 digit number between 300 to 900 and is given by the credit bureau TransUnion CIBIL in India. It is a very crucial parameter that lenders look into when approving loans. So, before you apply for a loan, check your CIBIL score and see if you satisfy the eligibility criteria for credit score set down by the lender. Otherwise, you may face loan rejection, which will impact your CIBIL score negatively. For this purpose, Wishfin, a popular fintech partner of TransUnion CIBIL, enables individuals to do a free CIBIL score check on its portal. You can also view your CIBIL report for free and get deeper insights for credit. So, now let us read on to find out why loan rejection affects your CIBIL score negatively and how you can avoid it.

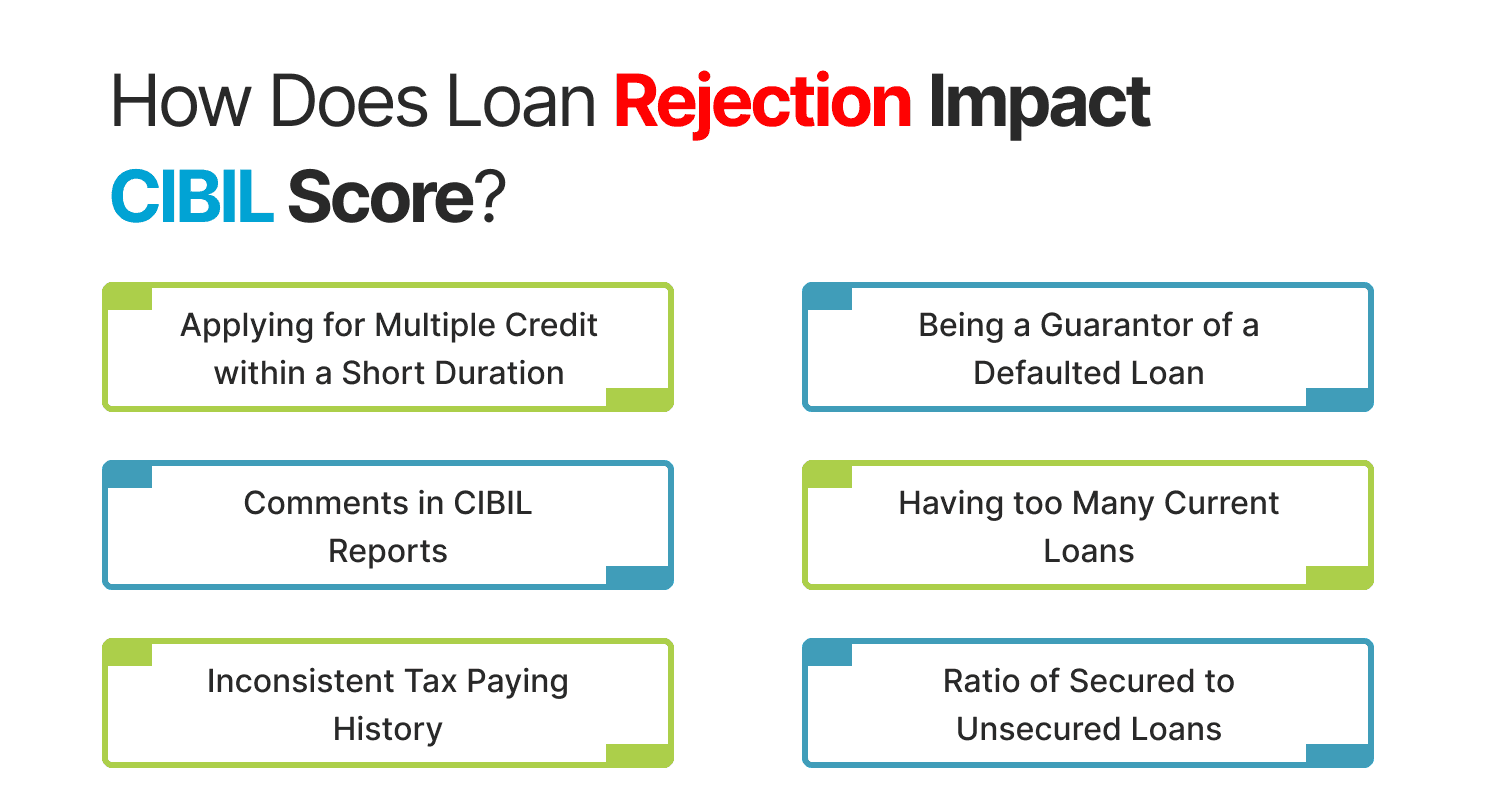

How Does Loan Rejection Impact CIBIL Score?

Loan rejection impacts the CIBIL score negatively. Each time your loan application is rejected, it can lower your credit score by a few points. Multiple rejections will thus lower your credit score drastically. So, before you apply for a loan, check the CIBIL score or credit score criteria set down by the lender. Also, do not apply for a loan immediately after your loan application is rejected. Take steps to improve your score and then re-apply for the loan.

Reasons for a Loan Rejection

1. Applying for Multiple Credit within a Short Duration

Taking too many loans within a short duration of time shows you as credit hungry. Banks will then hesitate to give you a loan as they will doubt whether you can repay your loan on time. Even if you have a great payment history, they will raise a concern as to whether you can manage multiple debts at once.

Solution: So, do not apply for multiple credit lines in a short duration. Apply for credit only when required and after thoroughly checking the eligibility criteria set down by the lender.

2. Being a Guarantor of a Defaulted Loan

Being a guarantor for a defaulted loan has a negative impact on your credit score and also your future credit prospects. A missed payment impacts not only the primary borrower negatively but also the guarantor.

Solution: As a guarantor, you are also equally responsible for ensuring that the borrower does not miss his payments. Payment defaults indicate that you are not able to manage your finances responsibly. It reflects poorly on your credit history.

3. Comments in CIBIL Reports

CIBIL reports contain comments by lenders such as about loan settlement, missing payments, making payments after the due date, unpaid debt, etc. This has a negative impact on the loan approval process and also on the CIBIL score. Banks then see you as a risky borrower and may reject your loan application.

Solution: Always make timely repayments. While loan settlement may seem like a viable option at the present and free you from debt, it will have negative consequences for future loan prospects. Banks may consider it as not honoring the loan agreement. So, as far as possible, avoid this option.

4. Having too Many Current Loans Compared to Your Declared Income - Overleveraging

When you are overleveraging or having too many existing loans to pay in proportion to your declared income, your debt to income ratio will be really high. That is, you will be allocating a good proportion of your salary to pay your debt. This will make banks wary about your repaying capacity. Hence, they may reject your loan application.

Solution: Before you apply for additional credit, think if you really need it. Analyze and check if you can repay. You also need to convince the lender that you will be able to repay by submitting proofs. For instance, you can submit documents about additional income sources, etc. In this way, you can avoid loan rejection

5. Inconsistent Tax Paying History

Banks prefer people who have filed their income tax actively for at least 2 years before applying for the loan. Filing your tax consistently is one of the parameters that reflect your creditworthiness. Lenders find it easier to evaluate your repayment capacity with documented evidence for tax paying.

Solution: Pay your tax consistently and do not forget to file your income tax returns. It only helps in easy approval of loan applications but provides other benefits like compensation for losses in business, quick via processing, ability to use your ITR as income proof, etc.

6. Ratio of Secured to Unsecured Loans

Having a favorable balance between secured and unsecured loans is important for loan approvals. Secured loans are backed by a collateral or a guarantor. Unsecured loans on the other hand do not require any security or collateral. When you have more unsecured loans, lenders will have an unfavorable impression about your creditworthiness. They will be wary of your repayment capacity and might reject your loan.

Solution: Try having a higher proportion of secured loans in your credit portfolio. This will reflect high financial responsibility. Lenders will be confident about your repaying capacity.

What to Do to Get CIBIL Score on Track?

To improve the CIBIL score , you need to make sure that you pay the debts and due payments of your loans or credit cards . First, you need to check the credit report and find the reason why your CIBIL is low. After that contact the credit bureau or bank to take help in CIBIL improvement. And when the CIBIL is improved, apply for the loan you need. See the pointers below to know what are the tips for CIBIL improvement.

Debt Payment: Make payments for your previous loans in Equated Monthly Installment (EMI). CIBIL improves gradually and takes time to improve your score as per your payments.

Credit Utilization: If you have a credit card, it is necessary to use it carefully, otherwise, it will affect your CIBIL negatively. You need to make sure that the credit utilization ratio won’t get above 30% of your credit limit.

Select a Suitable Loan Tenure: Opt for a suitable loan repayment period when you apply for a loan . Now the word ‘Suitable’ here means the tenure has to be optimized keeping in view the timely monthly payment while also ensuring the overall interest payout is controlled.

Pay Overdue: To improve the credit report post settlement, you can pay the due amount of your settlement. It removes the ‘settled’ remark from your report and you can borrow a loan whenever you want.

Avoid Taking Multiple Loans: When your credit score gets improved, try not to borrow more than one loan so that it will be easy for you to manage it without any due or default.

Borrow Mixed Loans: Maintain a healthy CIBIL score by borrowing different types of loans. Your credit report must contain secured and unsecured both types of loans so your credit profile attracts lenders to lend you money based on the creditworthiness.

Frequently Asked Questions (FAQs)