Five Credit Score Myths Busted

Last Updated : Jan. 27, 2025, 2:46 p.m.

A credit score is a 3 digit number between 300 and 900 that serves as a summary of your creditworthiness. The higher your score, the higher your creditworthiness. You can negotiate for lower interest rates, better loan terms, higher credit limits, and higher amounts. By managing your credit score well, you will have better financial opportunities. There are some common misconceptions about credit score which make it difficult to understand how credit scores work. Let us now read and understand the common credit score myths.

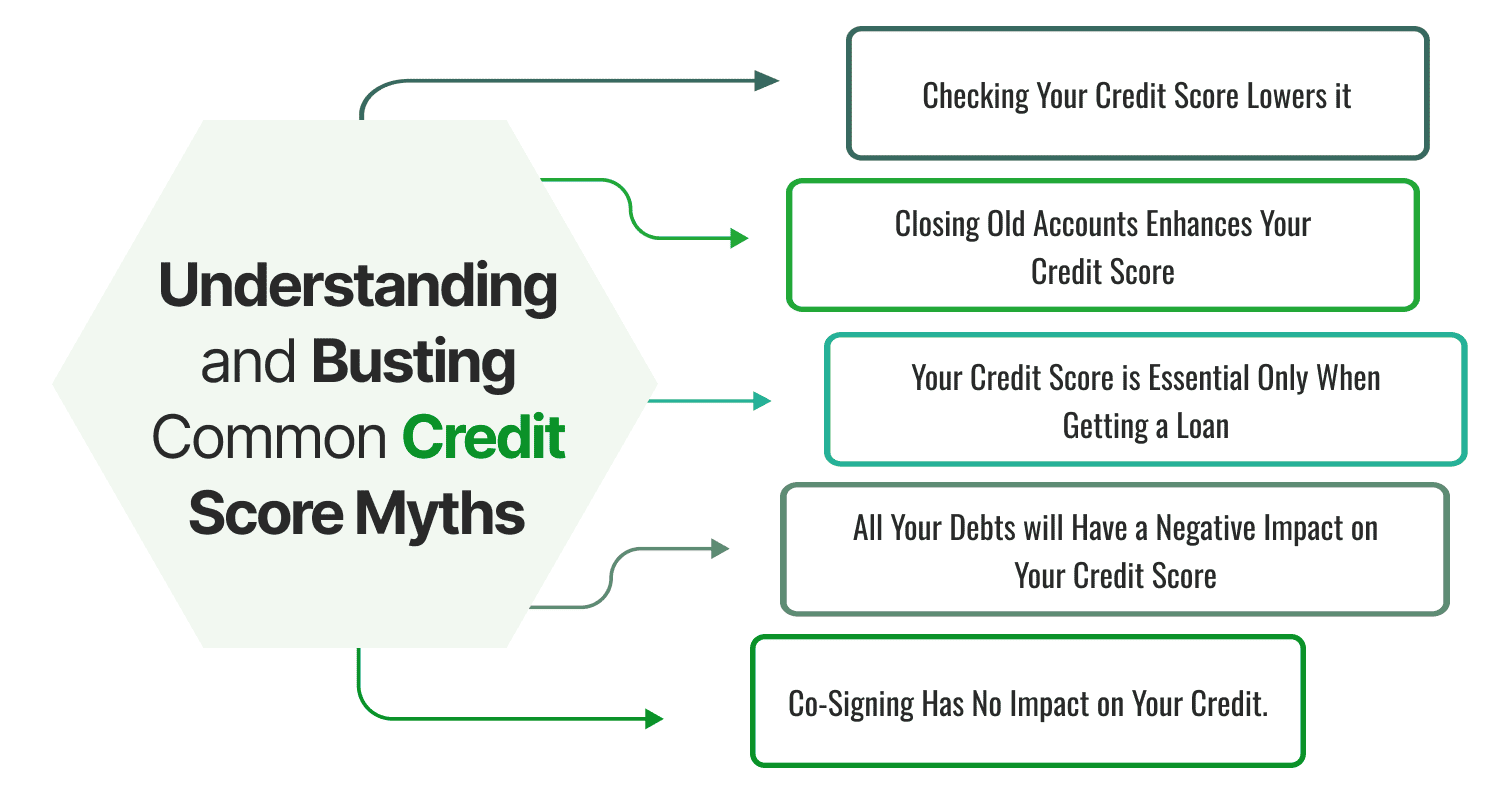

Understanding and Busting Common Credit Score Myths

.Here are some common credit score myths.

Myth 1: Checking Your Credit Score Lowers it

There is a common misunderstanding that checking your credit score can hurt it. This is wrong. Verifying the credit score by yourself is called a soft inquiry. It does not affect your score in any way. It is in fact important to check your credit score and credit report periodically to identify any errors and rectify them. Only hard inquiries conducted by lenders affect the credit score.

Myth 2: Closing Old Accounts Enhances Your Credit Score

There is a common misconception that closing old accounts may enhance your credit score. However, closing old accounts is not ideal. Your old accounts may have a great standing and a great credit history. Closing old accounts may lead to a decrease in the overall available credit limit, which will increase the credit utilization ratio. It will also shorten the age of your credit history and may also affect the diversity of your credit portfolio. All these in turn will hurt your credit score contrary to the fact that it will be enhanced.

Myth 3: Your Credit Score is Essential Only When Getting a Loan

Credit scores play an important role in getting loans. However, this is not its only use. Landlords, employers, and insurance companies may use your credit score to assess your financial responsibility. Thus, having a good credit score can influence various aspects of your life like renting a house, getting a higher credit limit for your credit cards , getting your insurance application approved, and in employment (Although it is not widely practiced for employment in India).

Myth 4: All Your Debts will Have a Negative Impact on Your Credit Score

Myths about debt demotivate people from taking on a variety of debts. Having various types of credit - A diverse credit portfolio can only impact your credit score positively. A good mix of credit includes installment loans , mortgages, revolving credit like credit cards etc. While managing the various types of credit in your credit mix, ensure to make timely repayments, maintain a good credit utilization ratio, and keep a low debt to income ratio. This helps in enhancing your credit score.

Myth 5: Co-Signing Has No Impact on Your Credit

Co-signing a loan with your borrower will affect your credit score. If the borrower defaults or misses on his payments, then your credit score will also get impacted negatively. On the other hand, if the borrower makes all his payments on time and manages his finances responsibly, then it will have a positive impact on your credit score.

Frequently Asked Questions (FAQs)