How to Get a Good Credit Score?

Last Updated : Jan. 14, 2025, 12:45 p.m.

Your credit score is a very important parameter for lenders when they want to sanction a loan for you. The credit score is a 3 digit number between 300 and 900 provided by credit bureaus in India. (The 4 major credit bureaus in India are Equifax, TransUnion CIBIL, Experian, and CRIF High Mark). It is a summary of your creditworthiness. If you have a good credit score, then you will easily get your loan application approved with ease. A pool of lenders will be available and you can negotiate for preferential interest rates and high loan amounts. You can then select the lender from whom you want to obtain the loan. A credit score of 750 and above is regarded as excellent. Let us now read on to find out how to get a good credit score. Before that, let us understand the ratings given for various ranges of credit scores.

Credit Score Ranges and Their Meanings

| Credit Score Range | Credit Rating |

|---|---|

NA/NH or -1 to 5 | "Not applicable" or "never happened before." If you have never used a credit card or taken out a loan, you will have no credit history. |

350 to 549 | A CIBIL score in this range is considered below average. This means that you have defaulted on your EMIs or credit card bills. Obtaining a loan or a credit card with this CIBIL score will be difficult because you are in high danger of defaulting. |

550 to 649 | A CIBIL score falling in this range is regarded as fair. It means you're having trouble paying your bills and EMIs on time. The interest rates on the loan could be higher. |

650 to 750 | A CIBIL score lying in this range is considered good. Before giving you an offer, lenders will analyze your credit application. However, you may lack the negotiating strength to obtain the best loan interest rate. |

750 to 900 | This is an excellent CIBIL score. It means that you have made your credit payments on time and have an excellent payment history. You can also negotiate with lenders for favorable interest rates and better loan terms |

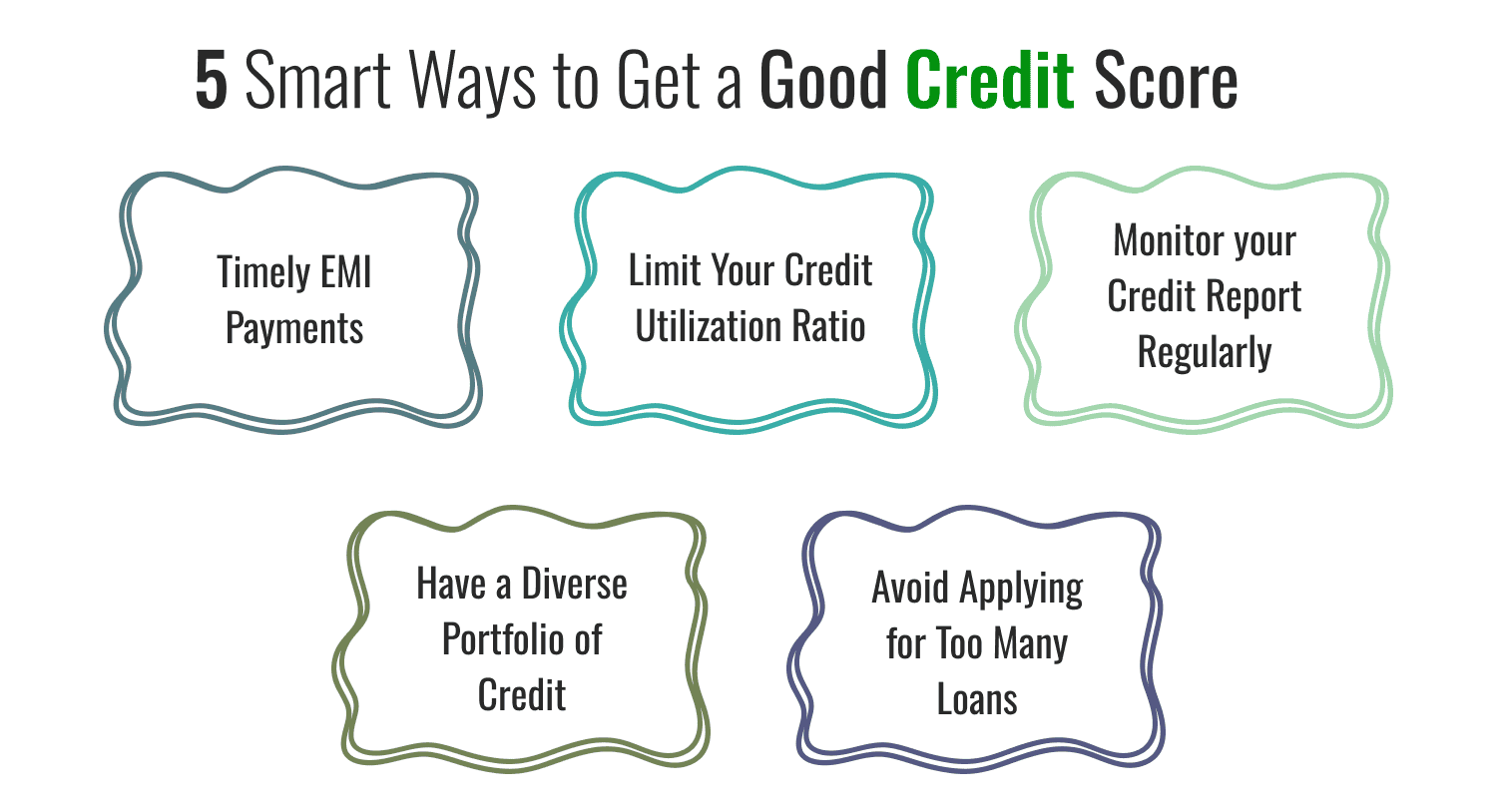

5 Smart Ways to Get a Good Credit Score

Here are 5 ways in which you can get a good credit score:

Timely EMI Payments

An important factor in improving your credit score is making timely payments of your EMIs and credit card bills. Defaulting on your loans or credit card bills will reduce your credit score. So, choose a loan that fits with your budget and offers a flexible duration. This will enable you to pay your EMIs and credit card bills on time.

Limit Your Credit Utilization Ratio

Your credit utilization ratio is computed as a percentage of the available credit limit that you are using. Experts recommend a CUR within 30% to 40%. This will help in getting a good credit score. A high CUR will create a negative impact on your credit score.

Monitor your Credit Report Regularly

Checking your credit report regularly will help you identify the errors in your report. These errors could be bringing down your credit score. Once you identify the errors in your report, you can raise a dispute with the credit bureau from which the score came. You can then rectify the error.

Have a diverse portfolio of credit

Maintaining a healthy credit mix of various types of loans like instalment loans, revolving credit, and mortgages encourages the lender to provide you financing. They will know that you are capable of handling different types of credit simultaneously. Also, maintaining a healthy mix of secured and unsecured loans with a short and long repayment tenure will show your capability to handle a diverse range of credit. This will help you get a good credit score since credit mix accounts for up to 10% in credit score computation.

Avoid Applying for Too Many Loans

Whenever you apply for a loan , lenders will conduct a hard credit pull on your credit report to analyze your past and current financial behavior such as payment history, balances on loans and credit cards, etc. A few hard inquiries may not have a great impact on your credit score. But, multiple hard inquiries will bring down your credit score drastically. Not only this, you will be seen as credit hungry and lenders may consider you as a risky borrower whose financial status is not stable. Hence, it is proposed to apply for one loan at a time and make successful repayments to enhance your credit score.

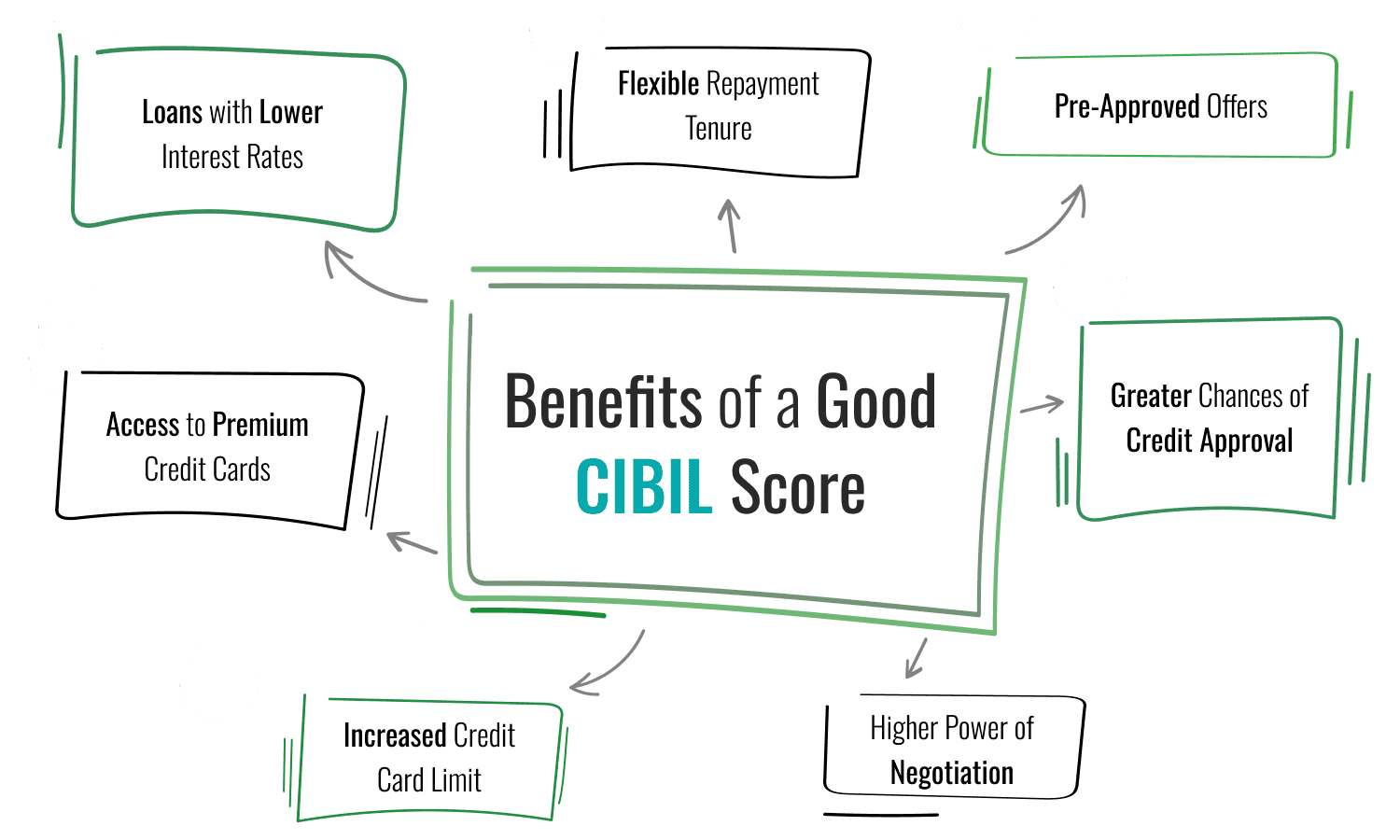

Benefits of a good CIBIL Score

Having a good CIBIL score has the following advantages:

- Loans with Lower Interest Rates: When you have a good CIBIL score, you can negotiate with lenders for lower interest rates and favorable loan terms.

- Flexible Repayment Tenure: When you have a good CIBIL score, you will have the advantage of getting a flexible repayment tenure. A longer loan tenure will help you in making successful repayments within the duration of the loan.

- Greater Chances of Credit Approval: A good CIBIL score gives you a greater chance of credit approval. This is because lenders are confident of your repayment abilities. You can get the best loan terms and a seamless loan application process.

- Pre-Approved Offers: A good CIBIL score makes you eligible for pre-approved loans and credit cards. For a pre-approved credit offer, you do not have to do extensive paperwork.

- Increased Credit Card Limit: When you have achieved a high credit score, you will be sanctioned a high credit limit. This is because a high credit score reflects your responsible credit behavior and timely repayments.

- Access to Premium Credit Cards: A good credit score gives you access to premium credit cards from top credit card companies. This is because credit card issuers are confident of your repaying abilities due to your high credit score.

- Higher Power of Negotiation: A higher CIBIL score gives you a higher negotiation power. You can negotiate for preferential interest rates and a higher sanction amount from your lender. You can also get better loan terms.

Frequently Asked Questions (FAQs)