Weightage of Different Repayment Aspects to Your Credit Score

Last Updated : Jan. 31, 2025, 12:49 p.m.

There is an often-repeated financial term that you must have heard innumerable times from the people around you. This term is the Credit Score. Observe around yourself and you will notice people saying things like – “My Credit Score is pretty low”, “Why is my credit score going so low in such a short period of time?”, “ How can I increase my Credit Score ?”, etc. The main reason why people have so many questions about it is that they don’t really understand the credit score and aspects that are given weightage in it.

The credit score or the CIBIL score is a 3 digit number between 300 and 900. It is a measure of your creditworthiness. It is derived from your credit report. Let’s understand this via an example. Consider your credit report as the scorecard you used to get in your school, and your credit score as the rank. However, this is your financial report card consisting of all your financial transactions such as your debt, repayments, utility bills, etc. To understand your credit score better , you must know the different aspects that carry weightage in your credit score. Let us now read on to find out the varied aspects used to compute your credit score.

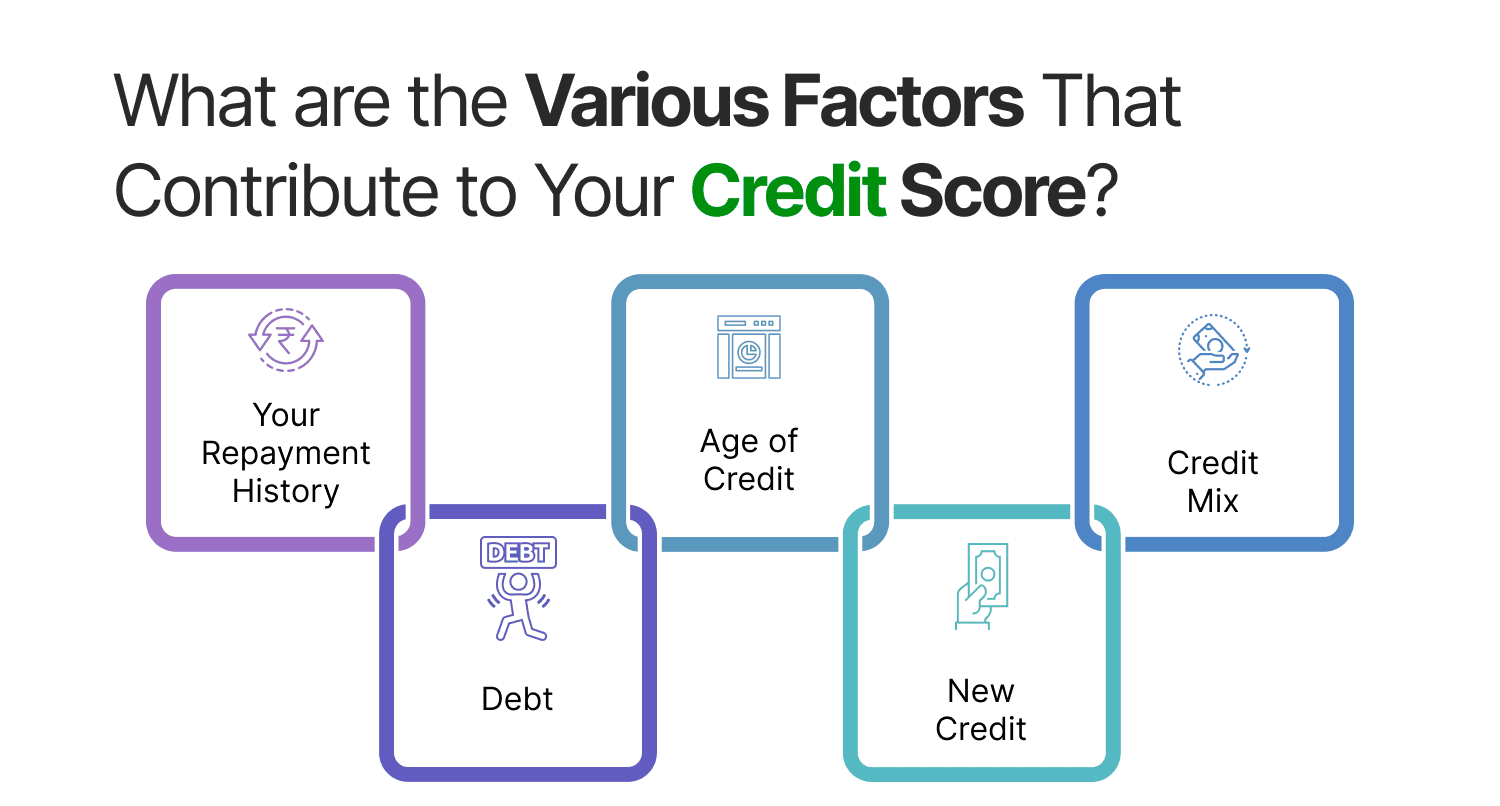

What are the Various Factors That Contribute to Your Credit Score?

A credit score is made up after taking several parameters into consideration. These aspects are your repayment history, total amount owed by borrowers, number of years servicing the debt, number and amount of recent loans availed or applied for, and the credit mix. Each of these aspects are assigned a different weightage in your credit score and contribute towards building your credit score accordingly. There are several credit bureaus approved by RBI which will maintain the record of all your financial transactions. Some of the leading credit bureaus are TransUnion CIBIL, Equifax, Experian and CRIF Highmark. These bureaus keep track of all your parameters and then assign a credit score to you. The table below shows all the parameters and their individual weightage in your credit score.

In the below table, we are showing you all the aspects and their individual weightage to your credit score. Check it out!

| Parameter | Weightage |

|---|---|

Repayment history | 35% |

Debt | 30% |

Age of credit | 15% |

New credit | 10% |

Credit mix | 10% |

Now, we will explain each of these aspects so that you can understand them better.

Your Repayment History

Your Repayment History carries the maximum weightage to your credit score, contributing up to 35%. When you always pay your credit card bills and Loan EMIs on or before the due date, your repayment history will have a positive impact. And it will help you in building a good credit score gradually. Even one payment default can affect your score negatively. Your credit report has all the details related to the payments you made on time and the ones you made after the due date. Higher the percentage of on-time payments, higher your credit score will be.

Debt

The second most important factor - debt or amount owed contributes to 30% of your credit score. It looks into the following:

- Credit utilization ratio or CUR: The credit utilization ratio is the percentage of credit you have used from the total credit limit available. If you have a higher credit utilization ratio, lenders will get the impression that you will not be able to pay your dues on time.

- Amount owed on specific types of accounts: How much you owe on specific types of accounts such as credit cards , home loans, installment loans, auto loans, etc will be seen. Your credit score is enhanced by a diverse portfolio of credit.

- The amount owed by you compared to the credit limit particular accounts: For instance, if you have a balance of Rs. 50 on a credit card with a limit of Rs. 500, you will be seen as managing your finances more responsibly compared to someone who owes Rs. 8000 on a credit card with a limit of Rs. 10,000.

Age of Credit

An individual with a longer credit history has a greater probability of having a higher credit score as compared to someone with several new loan accounts or credit cards. This parameter helps lenders in understanding the fact that the borrower has substantial past experience in handling debt and he or she can handle it pretty well without any trouble if trusted with a new debt.

There are various factors related to the credit history that can contribute towards your credit score. Some of them are mentioned below:

- The age of your oldest account

- The age of your newest account

- The average age of all your debt accounts

- Whether you have used a debt account recently

Among all the factors mentioned above, the most crucial factor is the age of your oldest account. This helps in boosting the average age of all of your debt accounts. A lot of individuals tend to close their oldest credit cards when they have more than one credit card and want to opt for a new one. This affects both credit utilization ratio and your average age of credit history. That’s why it is advisable not to close your oldest credit card accounts. Also, you should opt for new loans and credit cards only when you are in need of it. Otherwise, it reduces your average credit history, and subsequently, it can affect your credit score negatively. So, do not open several new accounts at once.

New Credit

Whenever you apply for a loan, the lender checks your credit report to see your repayment behavior and then decides whether it is good to lend you the money. This inquiry by the lender is known as a hard credit pull. On the other hand, when you check your credit score by yourself or if it is checked for informational purposes like background verification etc., it is called a soft inquiry. Hard inquiries will show up on your credit report. They can cause a temporary drop in your credit score. This is because, if you have opened many accounts recently and the percentage of these accounts is high compared to the total number, then you represent a great risk as a borrower. Why so? Because people resort to applying for credit frequently only when they are experiencing financial problems.

Credit Mix

It is ideal to have different kinds of credit in your portfolio, such as home loans , installment loans, revolving credit like credit cards, etc. When lenders see a diverse portfolio in your credit report, they are impressed by the fact that you can handle different kinds of credit simultaneously. Credit mix is a low impacting factor but should not be overlooked. For example: Let’s assume you currently have a credit card and a personal loan and are in urgent need of funds. Then, you could opt for a secured loan such as gold loan , loan against securities, loan against property, etc. rather than going in for another unsecured loan. This will add variety to your credit portfolio and create a credit mix. A credit mix results in a higher credit score, however, you should pay all your dues on or before time, failing which your credit score will go down sharply.

Frequently Asked Questions (FAQs)