How to Improve Your Credit Score with a Gold Loan?

Last Updated : Jan. 24, 2025, 5:40 p.m.

A gold loan is a secured loan taken by pledging gold. So, a credit score or a credit history is not crucial to obtain a gold loan unlike unsecured loans. However, obtaining a gold loan and repaying on time will help you to improve your credit score . Let us now understand how to improve your credit score with a gold loan.

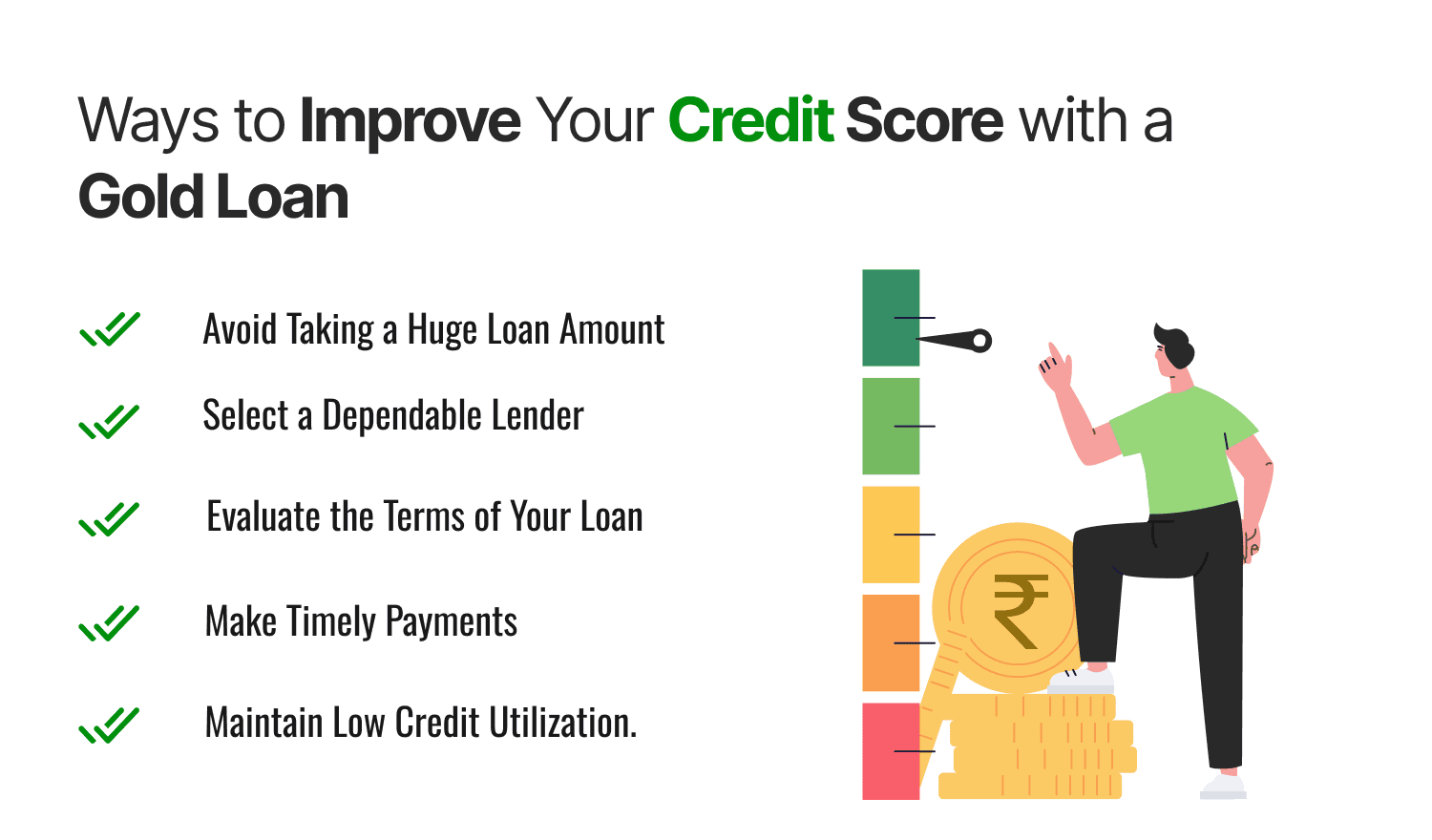

Ways to Improve Your Credit Score with a Gold Loan

Here are some tips on how to improve your credit score with a gold loan:

Make Timely Payments

Making timely payments of your gold loan that too in full helps in improving your credit score. This reflects to the lender that you are handling credit responsibly. This impacts your credit score positively.

Select a Dependable Lender

Check the credibility of the lender before you choose him. He should be trustworthy as borrowers have to entrust their precious jewels to him. It is not just enough if he gives you low interest rates.

Evaluate the Terms of Your Loan

Read and comprehend the terms and conditions of the gold loan. Analyze whether you will be able to repay the loan within the specified period. Make a repayment schedule plan and see if you could align to it. Check the interest rate and be aware of the potential overall interest amount you have to pay during the tenure of the loan. Do an overall evaluation before signing the loan acceptance.

Avoid Taking a Huge Loan Amount

Although you may feel attracted to keeping all the gold that you have as collateral to secure a huge loan amount, it is wise to avoid over pledging. It is wise to keep some of your gold with you unpledged for future emergencies. Always keep in mind that although you may have obtained a huge loan amount by offering all your gold as security, you may face challenges in repaying your EMIs. Loan defaults bring down your credit score. Multiple defaults will lead to a debt trap and you may lose your gold. The lender will sell your gold and recover the loan amount if you are unable to repay. Taking a loan amount you will be able to repay enables you to make timely payments and thus improve your credit score.

Monitor Your Credit Report and Rectify the Errors

When you repay your gold loan, check your credit report. Sometimes your repayments may not get reflected in your credit report. If this is the case, you must report the same to the credit bureau and get them to be shown on your report.

After understanding in what ways we can improve our credit scores by taking a gold loan, let us understand the benefits of taking a gold loan for improving the credit score.

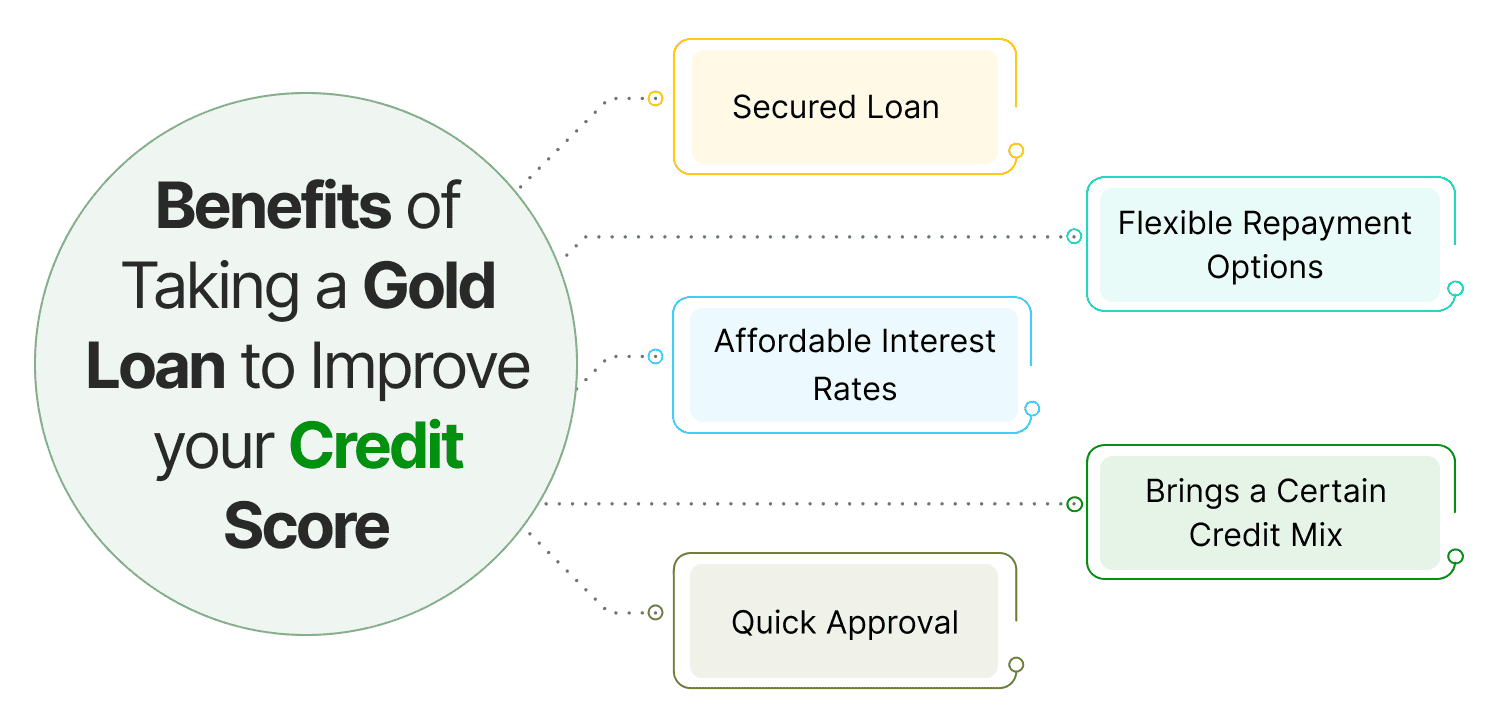

Benefits of Taking a Gold Loan to Improve your Credit Score

Here are some benefits of taking a gold loan to enhance your credit score.

Secured Loan

Gold loan is a secured loan since it is obtained by pledging a collateral (Gold). So, the lender will offer you a loan even if your credit score is not good. Since he can always recover the loan by seizing the collateral, you are seen as a low risk borrower.

Flexible Repayment Options

Gold loans come with flexible repayment options. You can choose the payment option most suitable for you. This helps you to repay easily in time.

Affordable Interest Rates

Gold loans have a lower interest rate compared to other unsecured loans like personal loans and business loans. Repayments can be made easily without creating a strain on your finances. Timely repayments will help you improve your credit score.

Quick Approval

Gold loans can be approved quickly and easily since it is collateral based. So you can procure the loan fast.

Gold Loan Brings a Certain Credit Mix

Having a credit mix helps in improving your credit score. The weightage given to the credit mix in the computation of credit score is 10%. A credit mix should be a combination of both secured and unsecured loans. A gold loan is a secured loan and diversifies your credit portfolio. Suppose you already have a credit card (Unsecured credit) on your name and you need immediate funds. Then it would be better for you to opt for a gold loan instead of a personal loan, which is an unsecured loan.

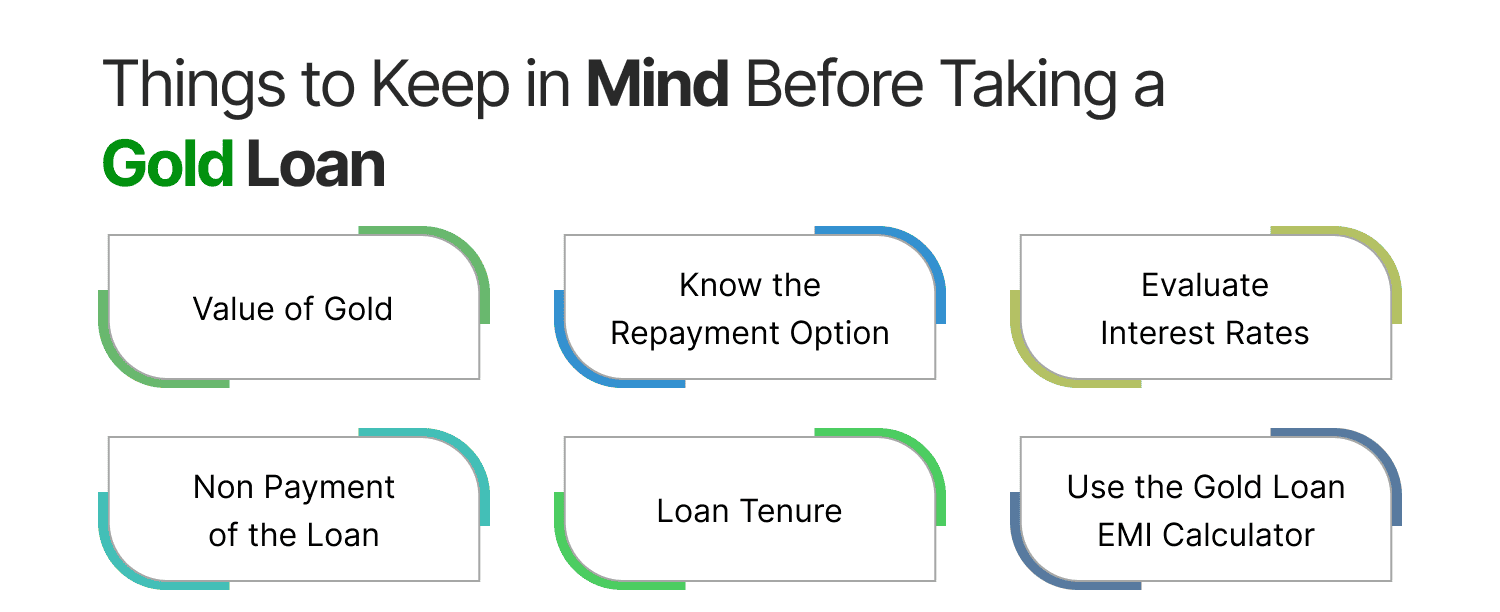

Things to Keep in Mind Before Taking a Gold Loan

Here are some things to consider before taking a gold loan:

Value of Gold

The value of gold is an important factor in determining the gold loan amount. If you have stones or any additional materials on your gold, it will not be considered for the amount. It is important to note that you will not get 100% of the value of the gold as your loan amount. Also, the ratio of the loan amount varies across lenders.

Loan Tenure

A gold loan is a short term loan. So, get a tenure most suitable to you so that you can repay your loan easily.

Know the Repayment Option

There are many options to repay your gold loan such as EMIs, partial payments, and bullet payments. So, choose the option that will align with your income. The repayment option must not put a strain on your finances.

Evaluate Interest Rates

Interest rates may vary across lenders. However, you may get a lower interest rate if your credit score is good. Before you apply for a gold loan, research and create a pool of lenders. Then, choose the lender giving an interest rate which aligns with your repayment abilities.

Use the Gold Loan EMI Calculator to Estimate Your EMI Amount

Have an early estimate of the EMI amount to know whether it is within your repayment capacity. This can be done using the Gold Loan EMI Calculator . It will show you the EMI according to your loan amount, gold loan interest rate, and tenure. When you know your EMIs, you can manage your finances better. Chances of paying the EMI on time are higher.

Non Payment of the Loan

If you fail to repay the loan, the lender can auction it. Further, if the price of gold comes down due to market conditions, then you may have to pledge more gold or pay for the additional price. So, this is one of the major factors that you must consider while taking a gold loan. Taking a gold loan and not repaying it will hurt your credit score drastically.

Frequently Asked Questions (FAQs)