Useful Tips & Tricks to Maintain a Good CIBIL Score

Last Updated : Jan. 23, 2025, 12:26 p.m.

It takes a lot of time, patience, and efforts to create a good CIBIL score. A CIBIL score is a very crucial parameter if you have applied for a credit card or loan. All lenders look at your CIBIL score to see if you are eligible for the loan. A good CIBIL score implies quick approval of your application, preferential interest rates, higher loan amounts and credit card limits, and better loan terms. People who have a good CIBIL score get swift approval for loans even for rented or leased properties like homes, commercial complexes, or apartments. They also get exclusive credit card offers from banks, special discounts, and rewards. Hence, it is important to maintain a good CIBIL score. Let us now read about some useful tips and tricks to maintain a good CIBIL score.

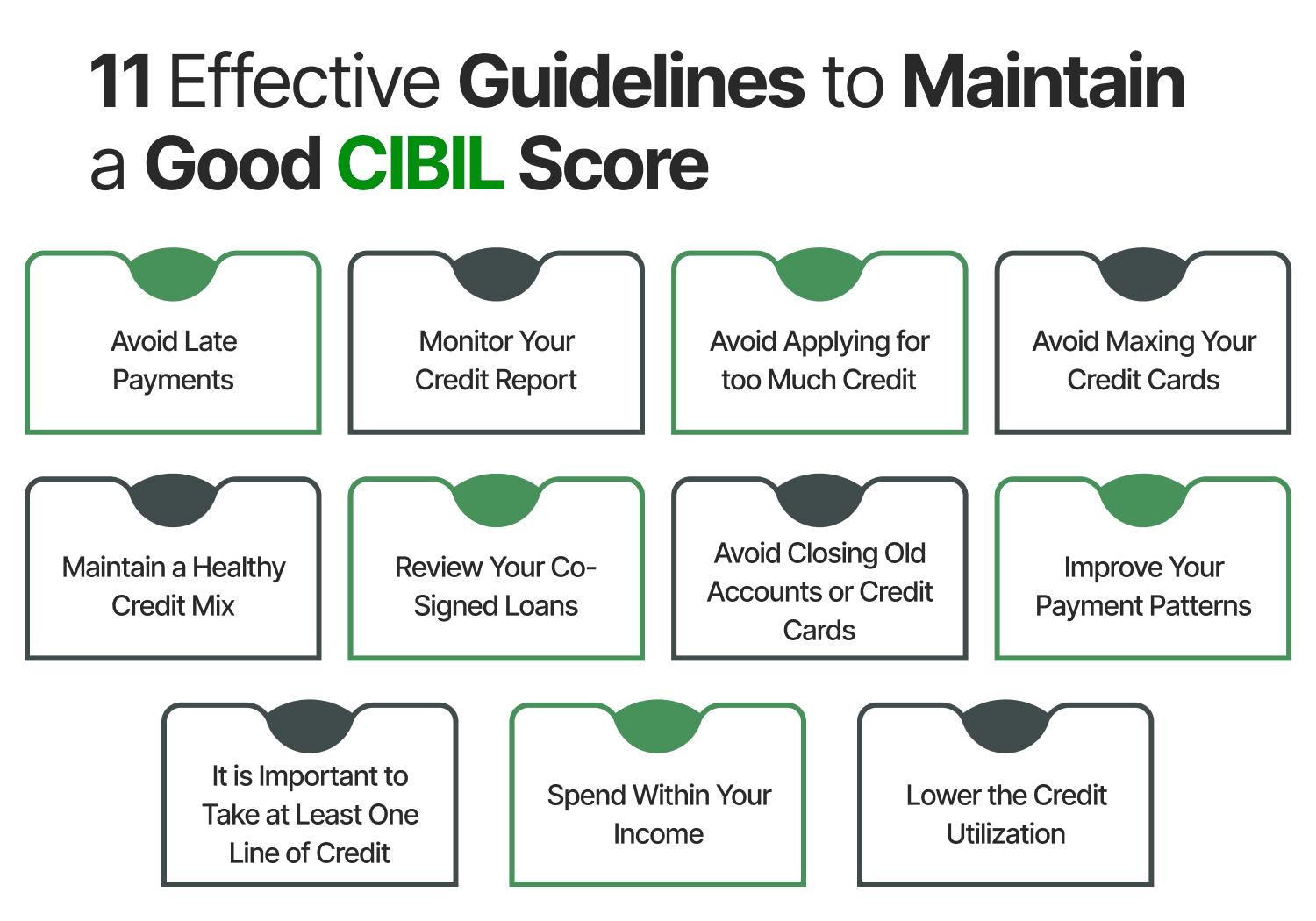

11 Effective Guidelines to Maintain a Good CIBIL Score

Here are some important guidelines to maintain your CIBIL score after building a good one.

1. Avoid Late Payments

Late payments impact your CIBIL score. So avoid late payments at any cost. Set up auto payments or payment alerts and make monthly task sheets to avoid late payments.

2. Monitor Your Credit Report

Regularly check and monitor your CIBIL report to identify any errors and ensure that the information is accurate. If you find any discrepancies, you can get them rectified immediately by raising a dispute with CIBIL. Checking your own CIBIL score is a good practice and is considered a soft inquiry. It will not affect your CIBIL score.

3. Avoid Applying for too Much Credit

Applying for too much credit in a short duration can impact your CIBIL score negatively. Each time you apply for credit, a hard inquiry is triggered on your CIBIL report by the lender. Multiple hard inquiries will impact your CIBIL score negatively. Hence, analyze if you really need additional credit before applying and research to find the best options available for you.

4. Avoid Maxing Your Credit Cards

Maxing your credit cards will impact your credit score negatively. It can affect your future credit prospects. So do not max out your credit cards or exhaust the credit limit.

5. Maintain a Healthy Credit Mix

Unsecured loans like personal loans , education loans, and business loans reduce credit scores. These loans carry risk as they are granted without collateral. The risk involved is much greater when compared to home loans or auto loans. To maintain a good credit score, go in for a credit mix as this will show you as a low risk borrower who can handle all types of credit. Keep a balance between secured and unsecured loans.

6. Review Your Co-Signed Loans

Sometimes, people go in for co-signed ventures. In such ventures, the co-signed borrower may be unable to repay the loan amount due to some financial emergencies. You may not be aware of this. Hence, there is a negative impact not only on his credit score but also yours. Hence, keep track of the loans you have co-signed.

7. Avoid Closing Old Accounts or Credit Cards

Closing your old accounts or credit cards with a good standing is not a good decision as it shows your long term association with the lenders. It shows your good credit history. Closing your old credit cards or accounts removes this good credit history and your robust long term association with lenders. It reduces the overall credit limit and hurts your credit score. Thus, do not close old accounts or credit cards.

8. Improve Your Payment Patterns

Ensure that all your outstanding balances are paid in full by opting for the automatic due deductions from your account. Via this method, you can improve your CIBIL credit score .

9. It is Important to Take at Least One Line of Credit

It is tough to get future credit with nil credit history also. Even if individuals get the loan or the credit card sanctioned, the interest rates will be higher. They will not get the desired loan amount or the desired credit limit. Loan terms will be poor. Hence, it is always advisable to take one line of credit like say a personal loan or a credit card and make payments on time. This is a good way to build your credit score and credit history.

10.Spend Within Your Income

Whenever you apply for a credit, you have to decide whether you will be able to afford it or not. One should always spend within their income as it will help them from overspending. Over a period of time, it will help you to maintain a solid or good CIBIL score and history.

11. Lower the Credit Utilization

Experts recommend a credit utilization ratio of 30% of the total available credit limit. By lowering your CUR, you will be building and maintaining a good credit score. Try not to go beyond a CUR of more than 80%, as it shows your credit-hungry behaviour and will result in the rejection of your credit application.

Frequently Asked Questions (FAQs)