What Does NH Mean in CIBIL Score?

Last Updated : Feb. 1, 2025, 4:05 p.m.

Credit information Bureau of India Limited (CIBIL) TransUnion is one of the 4 credit bureaus that gives credit scores to customers. The CIBIL score ranges from 300 to 900 in India. The closer your score is to 900, the higher is your creditworthiness. Apart from a score in this range, there is a CIBIL score called ‘NH’ or ‘No History’. Read the post and know how to get a loan with no credit history in India from a bank or NBFC.

What does ‘NH’ or ‘No History’ Mean in CIBIL Score?

The CIBIL score ‘NH’ means a credit report with no credit history. It means that the credit bureaus do not have any information using which they can evaluate your credit history or credit behavior. This happens when you are new to credit and have never taken out a loan or credit card. Then, your score may show up as ‘Not Available’ or ‘No History’.

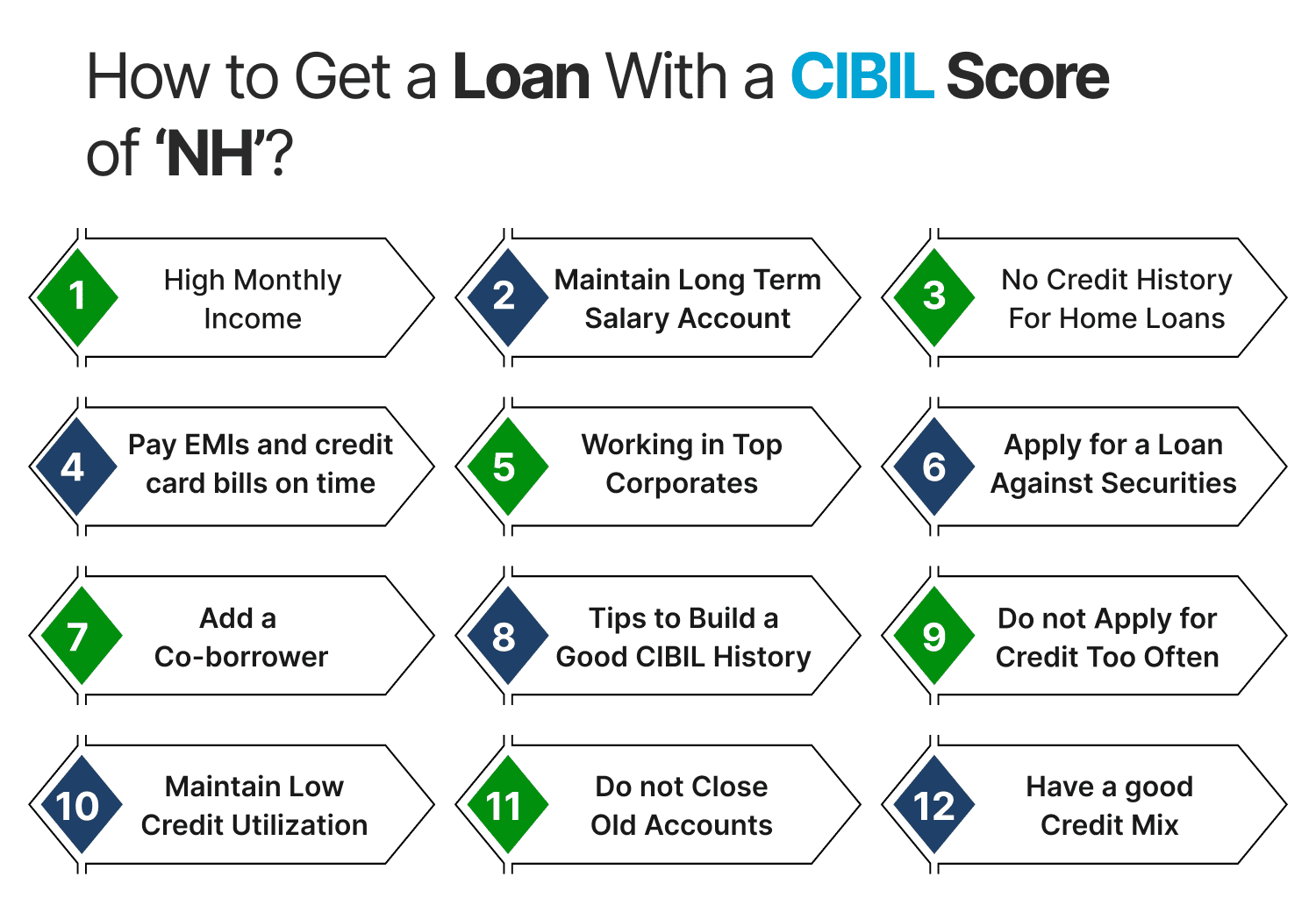

How to Get a Loan With a CIBIL Score of ‘NH’?

Here are some tips to get a loan with a CIBIL score of ‘NH’.

High Monthly Income

When your credit history is ‘NH’, the bank or NBFC will not approve your loan request that easily. You will have to convince the lender that you are creditworthy for the loan amount. You can prove this by furnishing your income proofs such as salary slip, bank statement, ITR report, or Form 16. Based on the income details, the lender will set your loan limit, and you can borrow the loan by completing the application form and paying the necessary charges for it.

Maintaining a Salary Account for a Long Time

When you maintain long term salary accounts with financial institutions, you can benefit from pre-approved personal loan and credit card offers. Lenders will send you those offers based on your income and long term relationship you have with them.

Working in Top Corporates

Personal loans and credit cards are approved with ease for individuals working in top corporates even if they don’t have a credit history. Working in reputed organizations makes lenders feel confident about your stable income and repayment capacity.

Apply for a Loan Against Securities

Individuals with an ‘NH’ CIBIL score can apply for a loan against securities against a collateral. Collateral can be your fixed deposit, insurance policy, property, land, manual fund units, shares, bonds, etc. Although you do not have a credit history, the lender has an asset to claim in case of non payment. So, the lender will give you a loan.

Credit History Not Mandatory for Home Loans

When you apply for a home loan , the lender will check your credit score or credit report to decide on the interest rate. However, an ‘NH’ or ‘No History’ CIBIL score will not lead to the rejection of your home loan application. There are other factors which the lender will consider primarily like the income, property value, down payment amount, etc. to sanction you a home loan. If you are planning to renovate, construct, or purchase a house, you can apply for a home loan without worrying about the CIBIL score.

Add a Co-borrower

If you do not have any credit history, you can borrow an unsecured loan along with a co-borrower. The inclusion of a co-borrower makes you eligible, and the chances of loan approval become higher. However, the borrower should have a good credit score.

Tips to Build a Good CIBIL History

Although there are ways to get a loan without a CIBIL history, it is important to build a good CIBIL history. Let us now look at some important tips to build a good CIBIL history.

Pay Loan EMIs and Credit Card Bills on Time

Make sure to pay your loan EMIs or credit card bills on time, so that it reflects well in your CIBIL report and helps you build a good CIBIL history over time. You can use payment methods such as ECS, NACH, or PDCs. Using these payment services, your EMI amount will be deducted from your bank account on or before the due date every month. This ensures that credit is built gradually as the repayment proceeds.

Do not Apply for Credit Too Often

Handling debts efficiently helps you build a good credit history and in turn a good credit score . But applying for credit frequently can work against you. More applications will mean frequent hard credit enquiries. Multiple hard inquiries impact your CIBIL score negatively.

Keep Your Credit Utilization Ratio Low

Try not to use the credit card for every single purchase . It is ideal to have a credit utilization ratio of 30% or less. Having a high credit utilization ratio lowers your CIBIL score and also gives the impression to lenders that you are over spending.

Do not Close Old Accounts

When it comes to CIBIL score, the length of CIBIL history is very important. There may be old accounts in your CIBIL report which may have a great CIBIL history and demonstrate a good and long relationship with lenders. These accounts should not be closed when no longer in use. This will reduce the length of CIBIL history.

Have a good Credit Mix

Having a diverse portfolio is very important for a good CIBIL score. You must have a good mix of various types of credit like instalment loans, revolving credit like credit cards, mortgages, etc. Also, there must be an equal balance between secured and unsecured loans. Having a higher proportion of unsecured loans in your credit report will lower your credit score.

Frequently Asked Questions (FAQs)