What is a Credit Report and Why is it Important?

Last Updated : Jan. 4, 2025, 4:58 p.m.

A credit report is a detailed document about your credit history. One can determine your financial reliability from the report. The report contains details about your credit activity and current credit situation such as loan payment history and the status of your credit accounts. Most people have more than one credit report. Let us now understand why a credit report is important, what it contains, and how it is created.

Why is a Credit Report Important?

Credit reporting companies, also called as credit bureaus or consumer reporting agencies collect and store financial data about you, submitted by creditors (Lenders, credit card companies, and other financial companies) in a credit report. This report is important for the following reasons:

Before approving your loan or credit card application, lenders usually check these reports. They then decide whether they can give you a loan and the terms you get for the loan (For instance, the interest rate charged by the lender).

Lenders use your credit report to determine whether you continue to meet the terms of an existing credit account.

Insurance companies may use the information to decide whether you can get insurance and to set the rates you will have to pay.

Employers may use your credit report to decide whether to hire you or not.

Telephone and utility companies may use the information in your credit report to decide whether to provide services to you.

Landlords may utilize this information to decide whether to rent an apartment to you.

What is the Information Required to Generate a Credit Report?

The following details are used to create a credit report:

Personal details:

Applicant’s full name

Other alternate names used in the past for credit applications.

Date of birth

Applicant’s address associated with the credit accounts

Contact information associated with the credit account of the applicant.

Details about the current and previous employers.

Account details:

Credit account details

Creditor’s or lender’s name

Account opening and closing date

Status of the credit payment

Credit limit for both loans and credit cards

Total balance in the account

Payment history

Utility accounts or rental leases

Inquiries:

Total number of hard inquiries and soft inquiries.

How is the Credit Report Created?

Credit bureaus collect financial information about individuals and businesses in order to create credit reports. They get the information from banks, financial institutions, and credit card companies and create a detailed record of an individual’s or business’s credit history. All the transactions that the borrower does are updated in the credit report. Referring to the credit report at any point of time reflects the borrower’s true credit status. However, access to credit reports is restricted and is provided only to certain individuals or parties. The people who can access a person’s credit report are as follows:

The current or prospective employer of the borrower

Lenders from whom the borrower wants to get a loan.

Insurance companies which have issued or will issue an insurance policy to the borrower

Utility or telephone companies to evaluate the creditworthiness of the borrower

Government agencies which are interested in reviewing the borrower’s financial status.

If the borrower makes a written request, the credit report can be shared with third parties. Further, if required by a court order, credit bureaus may provide a borrower’s credit report.

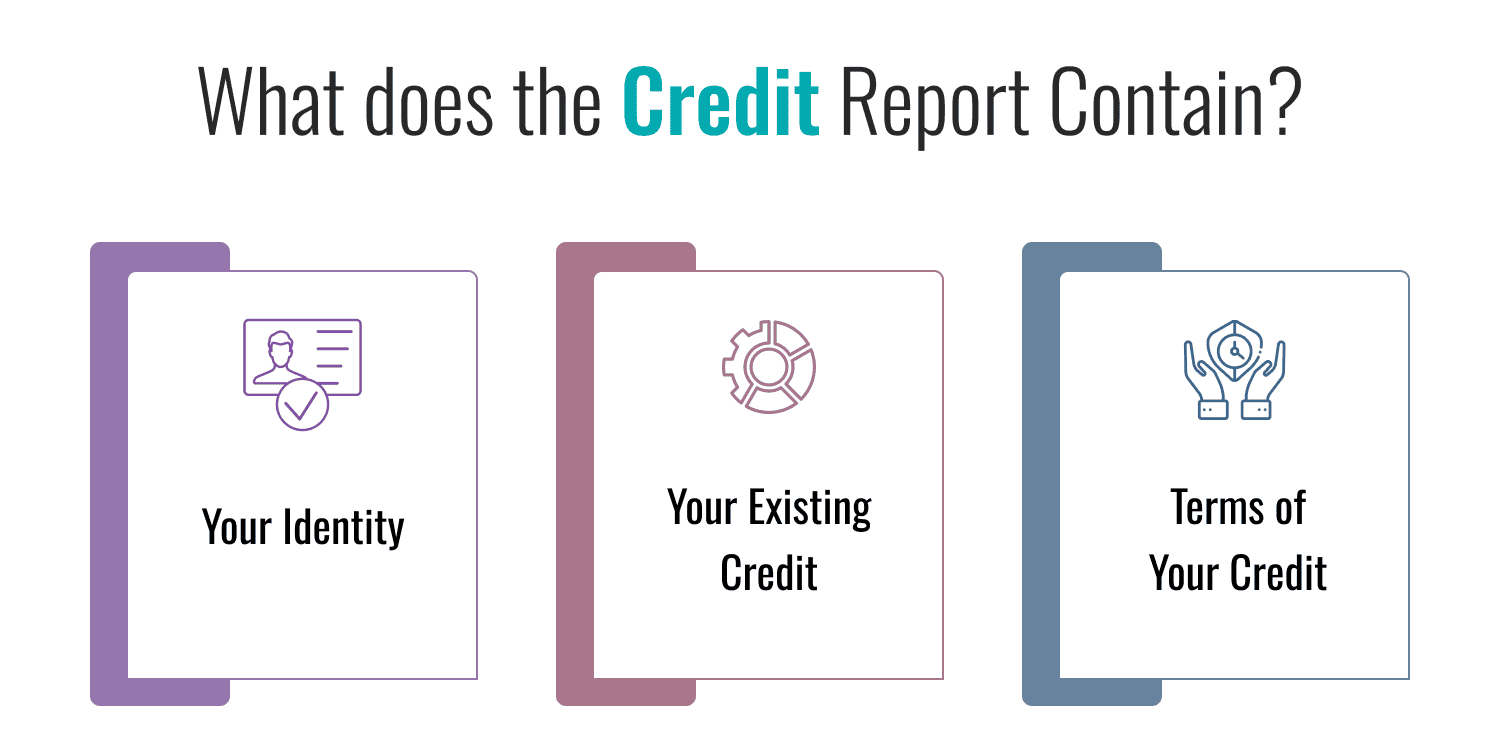

What does the Credit Report Contain?

A credit report is a detailed record of your credit history that contains information about:

Your identity: Your name, address, date of birth, full or partial social security number, and possibly employment information.

Your existing credit: The credit report may contain details of existing credit such as the present credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe to your creditors, and your history of making payments.

Terms of your credit: The credit report includes the terms of your credit, how much you are in debt for creditors, and the history of making payments.

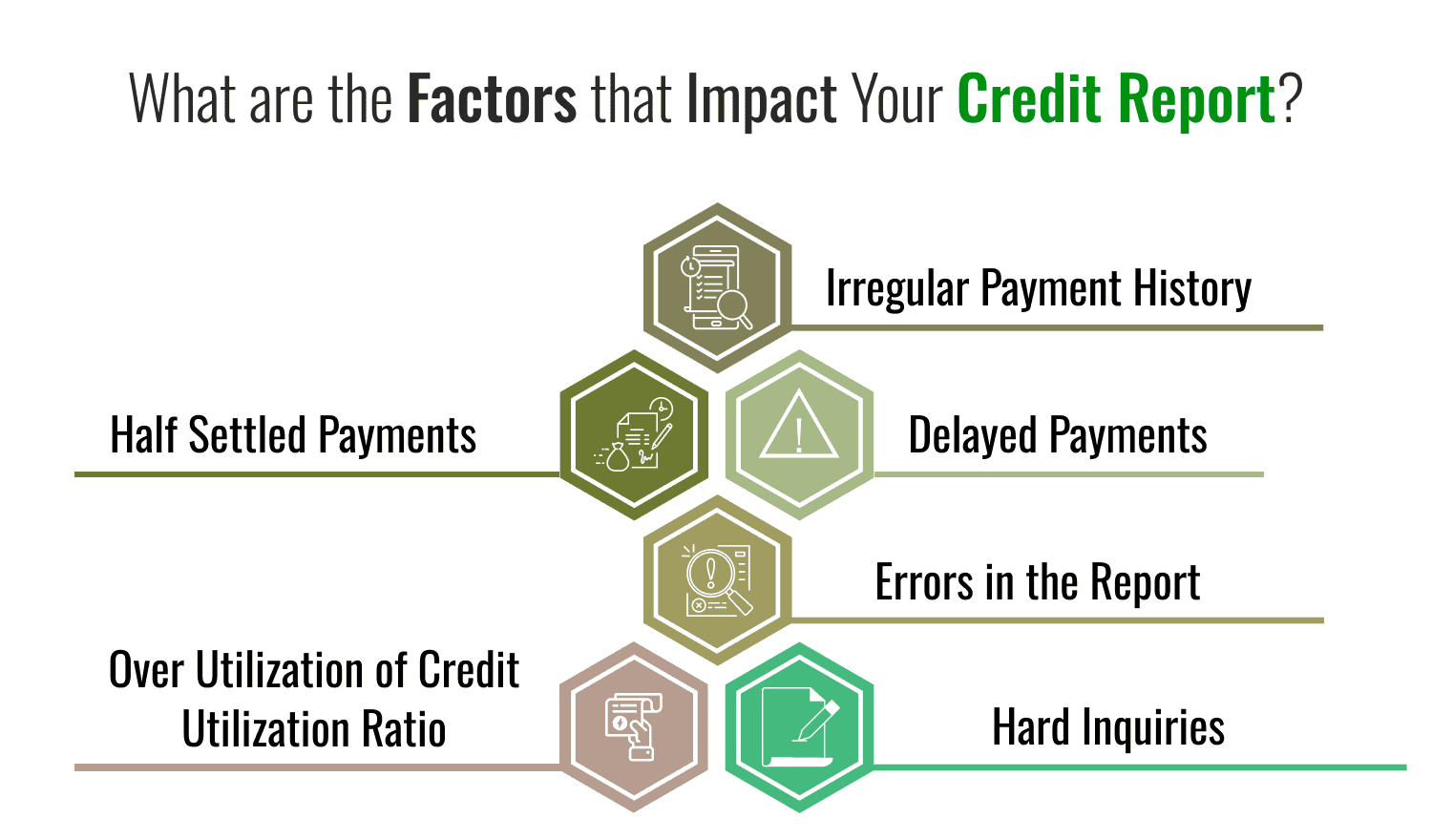

What are the Factors that Impact Your Credit Report?

The factors impacting your credit report are as follows:

Irregular payment history

Delayed payments

Half settled payments

Errors in the report

Hard inquiries

Over utilization of credit utilization ratio

How to Get a Free Credit Report?

You can get your credit score by going to the credit bureau’s portal. The following are the steps:

Step 1: Go to the portal of the credit bureau

Step 2: Register to log into your account

Step 3: Fill the form with your personal details such as name, email ID, ID, and date of birth

Step 4: Submit the form

Frequently Asked Questions (FAQs)