When Does Your Credit Score Decrease?

Last Updated : Feb. 7, 2025, 5:25 p.m.

Your credit score is the most important parameter lenders look into when approving your credit card or loan application. If you have a high credit score, lenders will approve your application quickly. You will be able to negotiate for lower interest rates and better loan terms. You will also be able to get the desired loan amount and credit limit. However, if your credit score is low, then your loan or credit card application may get rejected. Even if they get approved, you will have to pay high interest rates and may not get the desired loan amount or credit limit. So, when does your credit score decrease? Let us now read about the factors that cause your credit score or CIBIL score to reduce.

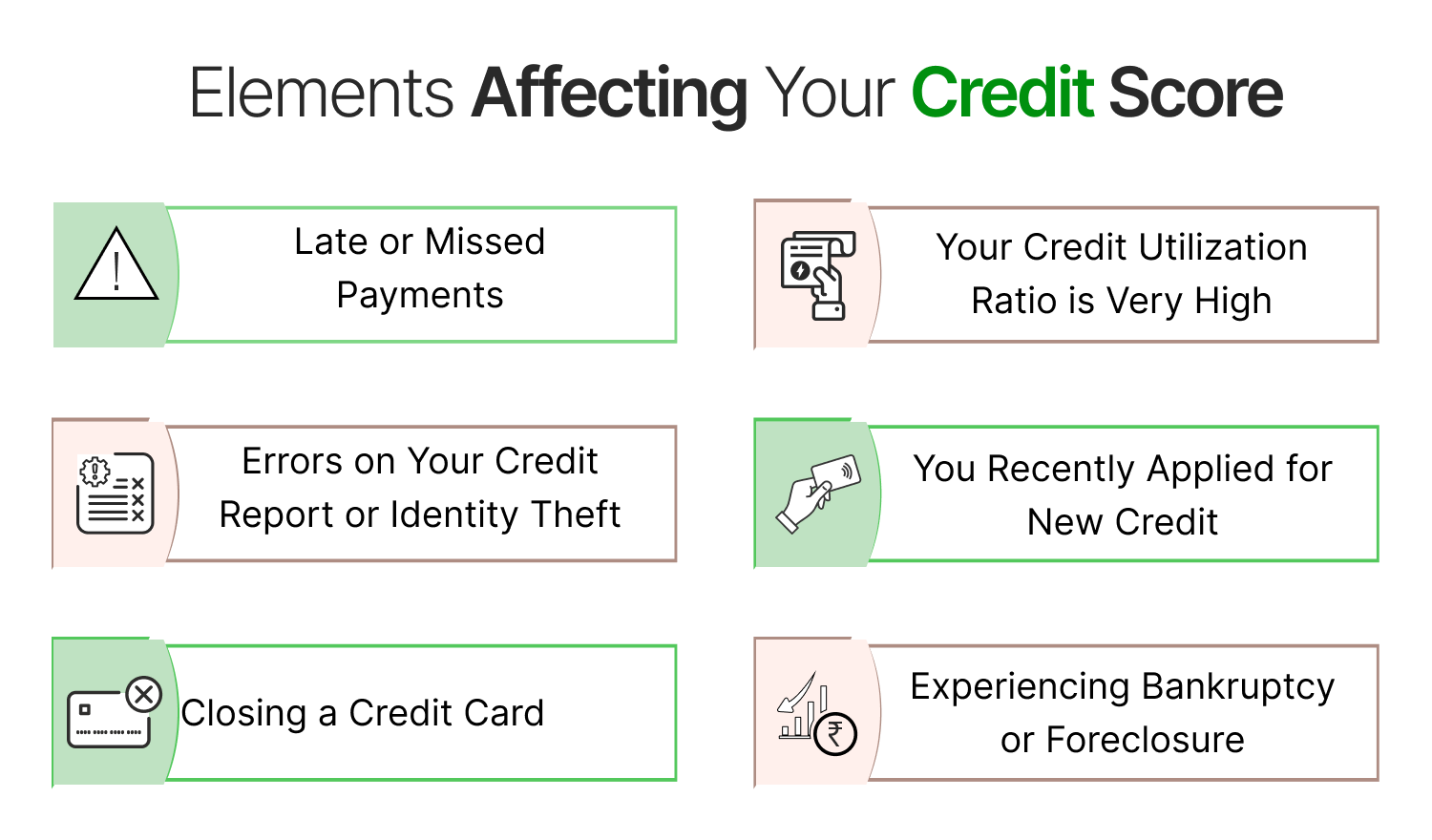

Elements Affecting Your Credit Score

Here are some common reasons that bring about a dip in your credit score.

Late or Missed Payments

The payment history is the most important parameter that affects your credit score. It accounts for 35% of your credit score, and even a single missed or late payment can have a negative impact on your credit score. Hence, it is important to ensure that you make all your payments on time. Payments that are delayed by 30 days or more are highly detrimental to your score. Moreover, late payments stay on your credit report for more than 5 to 7 years. You can refurbish your credit score by making a couple of payments on time, but the recovery will take time especially if your credit utilization ratio is high. So, the best thing you can do is to pay on time. Set up auto payment alerts, which will cause loan EMI and credit card bill payments to be deducted automatically from your account. You can also set up payment alerts so that you do not miss payments.

Your Credit Utilization Ratio is Very High

If you have a high credit utilization ratio, then it can cause a drop in your credit score. Check the usage of your credit limit. Credit utilization ratio is defined as the percentage of credit used out of the total available credit. A credit utilization of 30% or below is ideal. If you do not want a drop in your credit score, then depending on the credit limit, do not simply make large purchases or increase your balance significantly. Then your CUR will shoot up to a high causing your credit score to drop sharply. A CUR as high as 80% or above will hurt your credit score severely.

Errors on Your Credit Report or Identity Theft

There could be errors on your credit report like inaccurate information listed on your credit history, incorrect account details, past due payments that are not yours, or a wrong address which can have a negative impact on your credit score. Identity theft can also lower your credit score. This means that a fraudster has opened an account in your name or make purchases in your name. This will lead to fraudulent activity, which will reflect on your credit report.

You Recently Applied for New Credit

Whenever you apply for a new line of credit, lenders will request for a copy of your credit report to check your credit history and credit score. They evaluate parameters like your repayment history, types of accounts you currently hold, and the credit usage. Depending on these, they decide whether to lend to you or not. They can do so only with your authorization. This type of inquiry is called a hard inquiry and it goes down into your credit report. It can affect your credit score slightly. However, if you apply for several lines of credit in a short duration, then it will be detrimental to your credit score.

Closing a Credit Card

Closing a credit card can damage your credit score when closing it results in an increase in your credit utilization ratio. When you cancel a credit card account, the amount of revolving credit is decreased, and your credit utilization ratio soars up as a result. This is especially if you have high balances on your credit cards. Closing a credit card with a good credit history and which has been for quite some time can also lead to a decrease in the average length of credit. The age of credit is an important factor that impacts your credit score. It accounts for up to 15% of your credit score. The longer your credit history, the greater your score. Unless the card has a high annual fee or attracts you to overspend, you should not close it in order to maintain your credit limit and credit history length.

Experiencing Bankruptcy or Foreclosure

Late payments often lead to bankruptcy or foreclosure. This will harm your credit score. Bankruptcy is a major legal event triggered by borrowers who are looking to get relief from the burden of debts. It can cause severe harm to your credit score. The amount of time a bankruptcy remains on your credit report is in accordance with its type.

Foreclosure happens when a mortgager takes possession of your house due to at least four consecutive months of missed payments. This also seriously damages your credit.

Debt settlement is an agreement between the lender and borrower where the latter agrees to pay a reduced sum to the former. When that happens, the lender marks it as ‘Debt Settled’ against the credit account of the borrower while submitting its report to the credit bureaus. It may or may not reduce the credit score, but will most likely make borrowers ineligible for unsecured debts in the future.

How Will a Poor Credit Score Impact Your Financial Life?

As already discussed, a poor credit score can lead to the rejection of loans and credit cards. But, what is called a poor score? Well, a score below 580 is poor and will most likely lead to rejections of loans.

Even if some lenders agree to offer a loan, the interest rate will be much higher. Of late, lenders have been offering home loan interest rates based on the credit score . The same applies to credit cards as well. Your credit card applications are likely to face rejection. Even if approved, you will be sanctioned a very low credit limit. As far as home loans and other secured loans are concerned, the lender won’t deny but will charge a greater rate of interest.

Conclusion

Now that you know the credit behaviour which could decrease your credit score and make you face the complications that follow, you should avoid displaying it. If you pay your loan or credit card dues on time, maintain an effective credit mix and keep your credit card debt under control, you will benefit yourself only with a good score, which could further result in impressive credit offers for you.

Frequently Asked Questions (FAQs)