When Should You Check Your Credit Score?

Last Updated : Jan. 8, 2025, 1:46 p.m.

It is a good idea to check your credit score and credit report regularly. Only when you check your credit report periodically, you can identify errors that bring down the credit score. Then, you can dispute these errors with the respective credit bureau and get them rectified. Also, it is important to check your credit score and review your credit report before applying for credit or making a major financial decision. Let us now understand the scenarios when you should check your credit score.

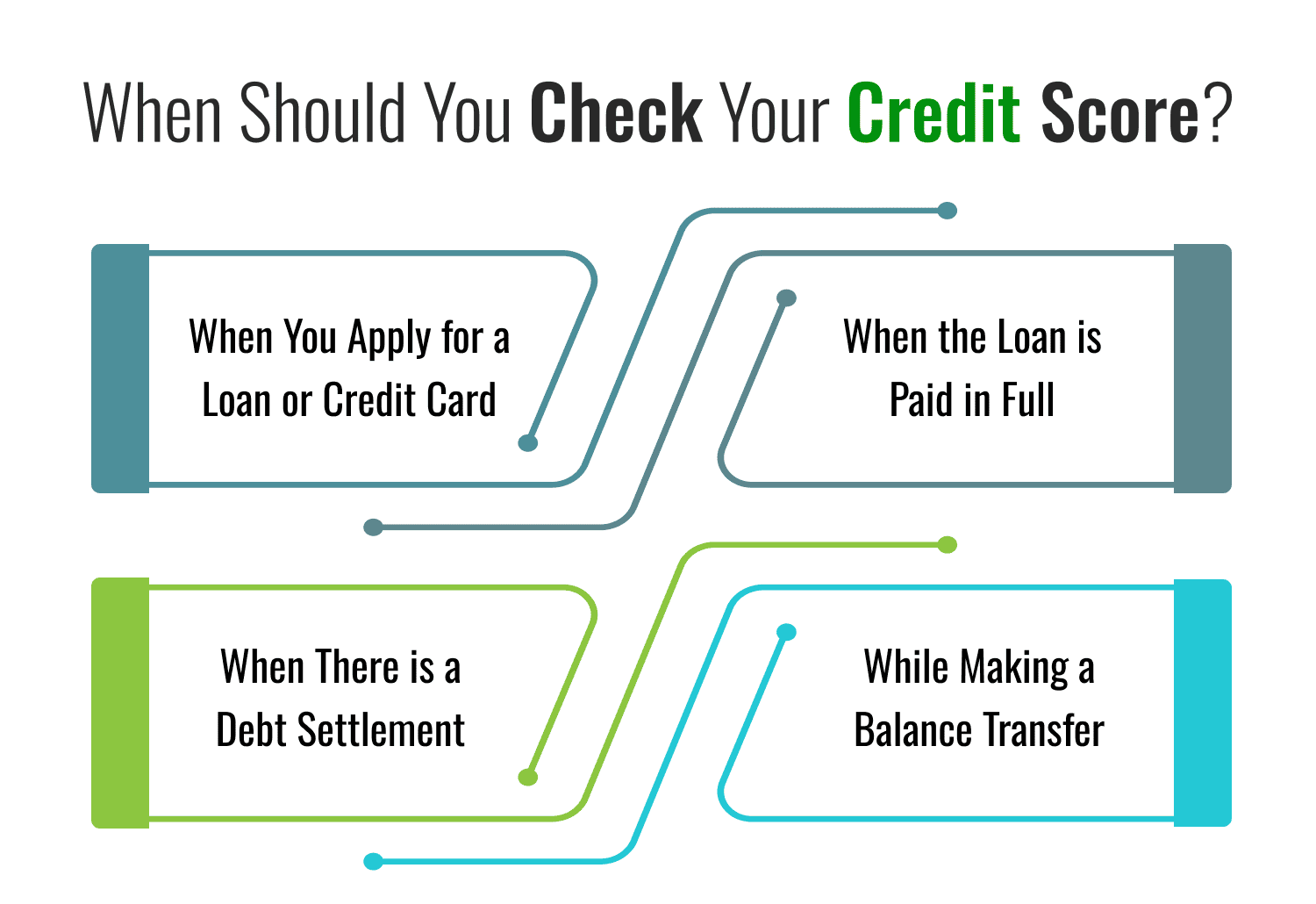

When Should You Check Your Credit Score?

You can check your credit score in the following instances:

When you apply for a loan or credit card: You must check your credit score and credit report before you apply for a loan or credit card. If your credit score is low, then, you must take steps to improve it and then apply for the credit card. Otherwise, you may face rejection of your application. A hard inquiry is placed on your credit record each time you apply for a loan . If the lender rejects the application, each hard inquiry has the potential to damage the credit score. A credit score of 750 and above is regarded as excellent. All lenders will be ready to lend, and your application may get approved quickly. You can also negotiate to get preferential interest rates.

When the loan is paid in full: Paying off a loan in full and closing the account can impact your credit score either positively or negatively based on various factors like the mix of account types, account balances, and other factors. If the loan is the only one on your credit report, then paying it off will reduce your credit score even though you are relieved from debt repayment. So, check your credit score to know what the impact is.

When there is a debt settlement: When you are not able to pay your loan in full due to some reasons, then you can negotiate with the lender to pay a portion of the debt owed. Debt settlement can hurt your credit score drastically depending on your credit history. So, check your credit score after debt settlement.

While making a balance transfer: Check the credit score before transferring the current loan to a different lender with a reduced rate. If you have a good credit score, you may be able to negotiate a lower interest rate. After you’ve made the transfer, double-check your credit score to see if it’s changed.

CIBIL Score Rating and its Significance

The table below shows the various ranges of CIBIL scores and their meanings.

CIBIL Score Range | Meaning |

|---|---|

NA/NH (-1 to 5) | This indicates that it is either “not relevant” or “has never happened before”. You will have no credit history if you have never used a credit card or taken out a loan. |

350 – 549 | This CIBIL score is regarded as being below average. It indicates that you have not made your credit card or loan EMI payments on time. With this CIBIL score, you will have a difficult time obtaining a loan or a credit card because you are at a high risk of default. |

550 – 649 | A CIBIL score in this range is considered fair. It indicates that you are having difficulty paying your bills on time. The loan's interest rate could be greater. |

650 to 750 | If you have a CIBIL score in this range, you're in a good position. Lenders will review your credit application before making you an offer. You may, however, lack the negotiating power to secure the best loan interest rate. |

750 – 900 | This is a fantastic CIBIL score. It signifies you've paid credit payments on time and have an excellent payment history. Banks will also lend you money and provide you with credit cards if they believe you have a low risk of failure. |

Check Credit Score at Wishfin?

There are majorly 4 credit bureaus in India, and they are TransUnion CIBIL, Experian, Equifax, and CRIF High Mark. Out of these, CIBIL is the most popular credit bureau. This is because amongst other credit bureaus, it has arguably the largest collection of loan and credit card data off any other credit bureau in the country. Wishfin, the official partner of TransUnion CIBIL, offers a free CIBIL score check . Just follow the instructions below to check your CIBIL score on Wishfin.

Specify the credentials such as your name, email, ID, and phone number.

Enter your PAN information.

Accept the terms and conditions by choosing the gender.

Click the ‘Submit’ button.

Following that, you can see your CIBIL score on the screen.

Good Credit Score Offer a lot of Advantages

Lower interest rates: You are eligible for a low interest rate when your credit score is good. A good credit score makes you a low risk borrower and lenders give you credit with confidence.

Attractive Credit Card Specials: If your credit score is high, lenders will offer credit cards loaded with incentives like significant cashback, discounts on online and offline transactions, appealing dining offers, and travel privileges.

A Quick Approval: Loans and credit cards are authorized speedily when the credit score is good.

Easy Negotiation: If your credit score is good, you may be able to negotiate with your lender to extend your loan limit or lower your interest rate.

Frequently Asked Questions (FAQs)