Best Education Loans for Admission to Top Management Institutes in India

Last Updated : Sept. 25, 2024, 6:10 p.m.

Pursuing an MBA or management degree from a top institute in India is a dream for many aspiring professionals. However, the high cost of education at premier institutions can be a significant financial challenge. The best education loans in India for admission to top management institutes provide an ideal solution, offering financial support to cover tuition fees, living expenses, and other associated costs. These loans come with competitive interest rates, flexible repayment options, and tailored benefits, allowing students to concentrate on their academic goals without financial stress.

Fee Structure of Top MBA Colleges in India

Here is the table of Top MBA Colleges with their fee structure -

College/Education Institute | Total Cost |

|---|---|

IIM Ahmedabad | INR 28 Lakh |

IIM Bangalore | INR 23 Lakh |

IIM Calcutta | INR 27 Lakh |

IIM Lucknow | INR 13,55,000 |

IIM Kozhikode | INR 9,50,000 |

XLRI Jamshedpur (MBA/PGDM) *9 Courses* | INR 4 L - 58.84L |

MDI Gurgaon (MBA/PGDM) *5 Courses* | INR 1.87 L - 26 L |

IIFT Delhi (MBA) *2 Courses* | INR 17.17 L - 21.77 L |

SPJIMR Mumbai (MBA/PGDM) *6 Courses* | INR 9.5 L - 24 L |

Top Banks Offering the Best Education Loans in India for MBA Admissions

The table below shows the education loan interest rates with the maximum loan amount by top banks of various top-level MBA Institutes in India. Have a look -

Banks | Loan Amount | Interest Rate (In Per Annum) |

|---|---|---|

Rs.125.00 lakh | BRLLR+0.25 % | |

Loans up to 50 Lakhs | 8.10% - 9.65% | |

Up to INR 50 Lakhs (depending on the institutes) | 6.90% - 9.55% | |

Up to 4 Lakhs to 7.5 Lakhs | 13.70%-15.20% | |

Up to 150 Lakhs | 8.10% to 10.00% | |

INR 30-50 Lakh | 7.40% - 9.40% | |

INR 10-30 Lakh | 6.85% - 9.00% | |

INR 10-20 Lakh | 9.05% - 9.85% |

Margin Money on Education Loans

Understanding the meaning of loan margin can help you navigate the education loan process more effectively and plan accordingly. Knowing what margin in a bank loan entails is crucial as it allows you to manage your financial planning more efficiently.

Margin money, often referred to as the loan margin, is the amount that the borrower must contribute from their funds. It represents the proportion of the total loan amount that the borrower needs to pay out of pocket, while the bank provides the remaining amount. Essentially, it is the difference between the total cost and the amount approved by the bank. In a bank loan, the margin is the portion of the total cost that you must cover yourself, with the bank financing the rest.

Will Banks Ask for Collateral?

Yes, banks often ask for collateral when providing the best education loans in India, especially for higher loan amounts or certain types of loans. Collateral is an asset pledged by the borrower to secure the loan, which the bank can seize and sell if the borrower fails to repay the loan otherwise would be consumed in arranging the collateral and waiting for the nod of the lender.

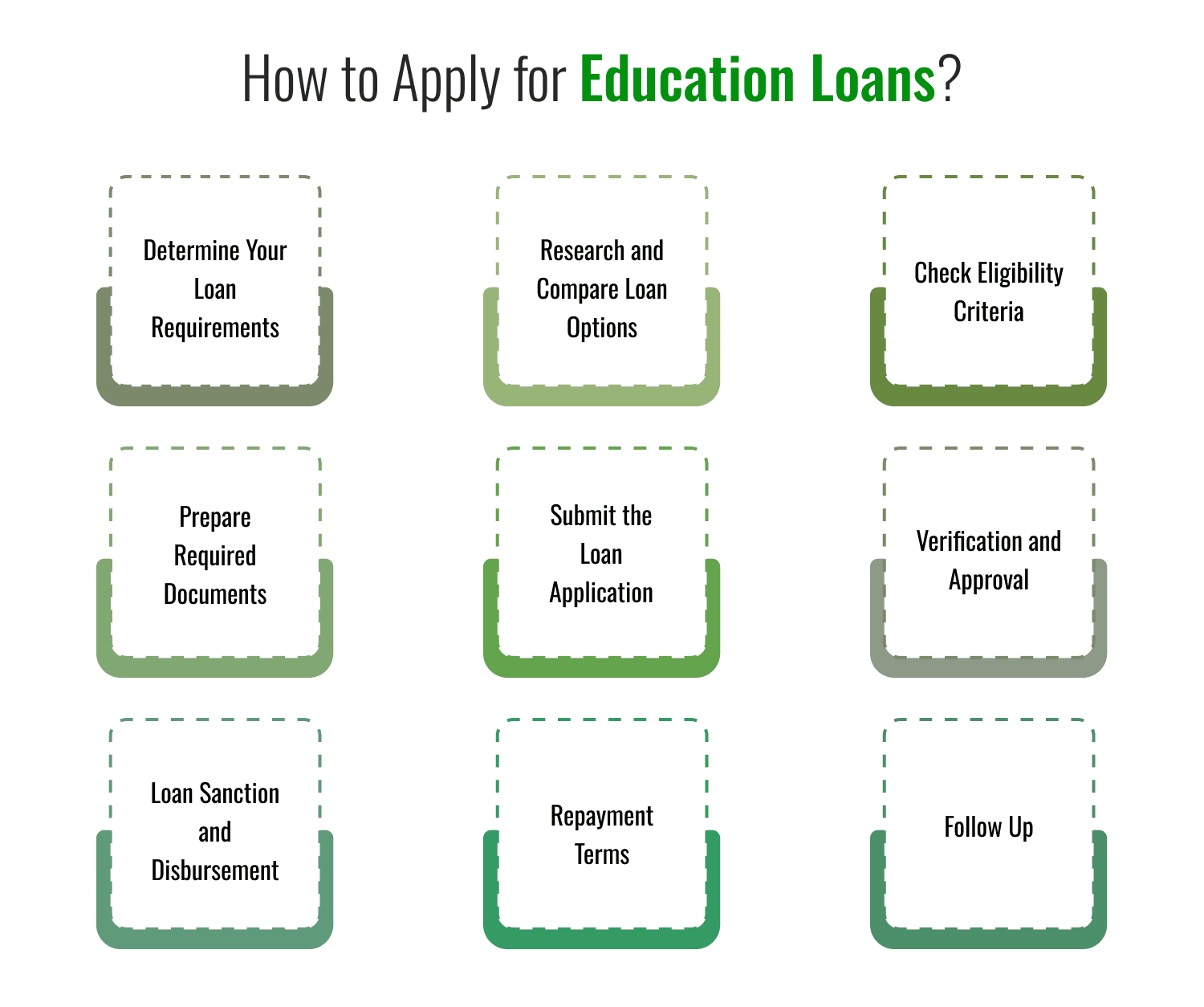

How to Apply for Education Loans?

Applying for an education loan involves several steps to ensure you meet the bank’s education loan eligibility and provide the required documentation. Here’s a step-by-step guide on how to apply for an education loan:

1. Determine Your Loan Requirements:

- Calculate the Total Cost: Include tuition fees, accommodation, travel expenses, and other costs.

- Assess Your Contribution: Check how much you can pay yourself, as banks typically ask for a margin amount.

2. Research and Compare Loan Options:

- Compare: Compare different banks' loan offerings, including interest rates, loan tenure, processing fees, and repayment options.

- Look for the Schemes: Look for government schemes like the Central Sector Interest Subsidy Scheme (CSIS) for eligible students.

3. Check Eligibility Criteria:

- Course & Institution: The course should be recognized, and the institution should be on the bank's list of approved institutions.

- Co-applicant Requirement: A co-applicant (parent, guardian, or spouse) is usually required for education loans .

4. Prepare Required Documents:

- Personal Documents: ID proof, address proof, and photographs.

- Academic Documents: Mark sheets, certificates, and admission letters.

- Loan Application Form: Complete the bank’s education loan application form.

- Financial Documents: Income proof of the co-applicant, bank statements, and IT returns.

- Collateral Documents: If applicable, documents of the collateral property, fixed deposits, or other assets.

5. Submit the Loan Application:

- Visit the bank’s branch or apply online, if available.

- Submit the filled application form along with the required documents.

6. Verification and Approval:

- The bank will verify your documents and may conduct a personal discussion.

- If the loan amount is high, they may also inspect the collateral offered.

7. Loan Sanction and Disbursement:

- Once approved, you will receive a loan sanction letter detailing the loan amount, interest rate, and other terms.

- The loan amount is usually disbursed directly to the educational institution as per the fee schedule.

8. Repayment Terms:

- Understand the repayment terms, including the moratorium period (the period when you do not have to make payments) and the repayment schedule after course completion.

9. Follow Up:

- Keep track of your loan account and communicate with the bank in case of any issues or required adjustments.

What are the Eligibility Criteria for Education Loans?

Education loan eligibility depends on various factors, including the type of course, the institution, and the borrower's and co-applicant's financial standing which directly or indirectly affects the education loan interest rate. Here's a detailed guide to the typical eligibility criteria for education loans in India:

1. Academic Qualifications:

- Admission Requirement: The applicant must have secured admission to a recognized course in India.

- Courses Eligible: Loans are available for professional, technical, and vocational courses at undergraduate and postgraduate levels.

2. Age Criteria:

- There is no specific minimum age, but generally, the applicant should be 18 years or older. If the applicant is a minor, the loan can be taken in the name of a co-applicant (usually a parent or guardian).

- The maximum age limit varies from bank to bank, typically ranging from 35 to 45 years at the time of course completion.

3. Co-applicant Requirement:

- A co-applicant (parent, guardian, or spouse) is mandatory for most education loans.

- The co-applicant should have a stable income and a good credit history, as this affects the loan approval process.

4. Income Criteria:

- Some banks may have minimum income criteria for the co-applicant, especially for high loan amounts.

- Banks may ask for proof of income (salary slips, IT returns) and employment details of the co-applicant.

5. Eligible Institutions:

- The institution should be recognized by the bank, such as a university, college, or professional body.

6. Collateral Requirements:

- No Collateral Required: For loans up to ₹4 lakh.

- Collateral May Be Required: For loans above ₹7.5 lakh. Collateral can include property, fixed deposits, or life insurance policies for most of the banks.

7. Repayment Capacity:

- Banks assess the repayment capacity of the applicant and co-applicant. This is based on the future earning potential of the student, especially for professional courses.

8. Credit Score:

- A good credit score of the co-applicant improves the chances of loan approval.

- Some banks may also check the student’s credit history, if applicable.

9. Nationality:

- The applicant should be an Indian citizen.

*These criteria may vary slightly from one bank to another, so it's advisable to check with the specific bank for their detailed requirements.*

Frequently Asked Questions (FAQs)