What is the IFSC code and its Importance?

Last Updated : July 30, 2024, 11:08 a.m.

The IFSC code is a crucial part of India's banking infrastructure. It plays a key role in processing electronic transactions securely and efficiently. This guide will explain what an IFSC code is, its structure, and its importance for banking operations. We will also explore how to find and use IFSC codes . These codes are necessary for different types of fund transfers like NEFT, RTGS, and IMPS. Let's begin.

What is an IFSC Code?

IFSC stands for the Indian Financial System Code, which is an 11-digit alphanumeric code unique to each bank branch in India. This code is used for online money transfers through NEFT, RTGS, or IMPS. It also helps identify the source and destination bank branches for transactions.

Format of IFSC Code

In an IFSC code:

- The first four alphabetic characters represent the bank name.

- The fifth character is always zero (0) and is reserved for future use.

- The last six characters (usually numeric but can be alphabetic) represent the bank branch.

For instance, in the IFSC code HDFC0001015, the four letters HDFC represent the bank name. The fifth digit ‘0’ is kept aside for future use.

The following six digits, ‘001015’ represent the bank branch. In this case, it is Dalhousie Branch, Kolkata, West Bengal.

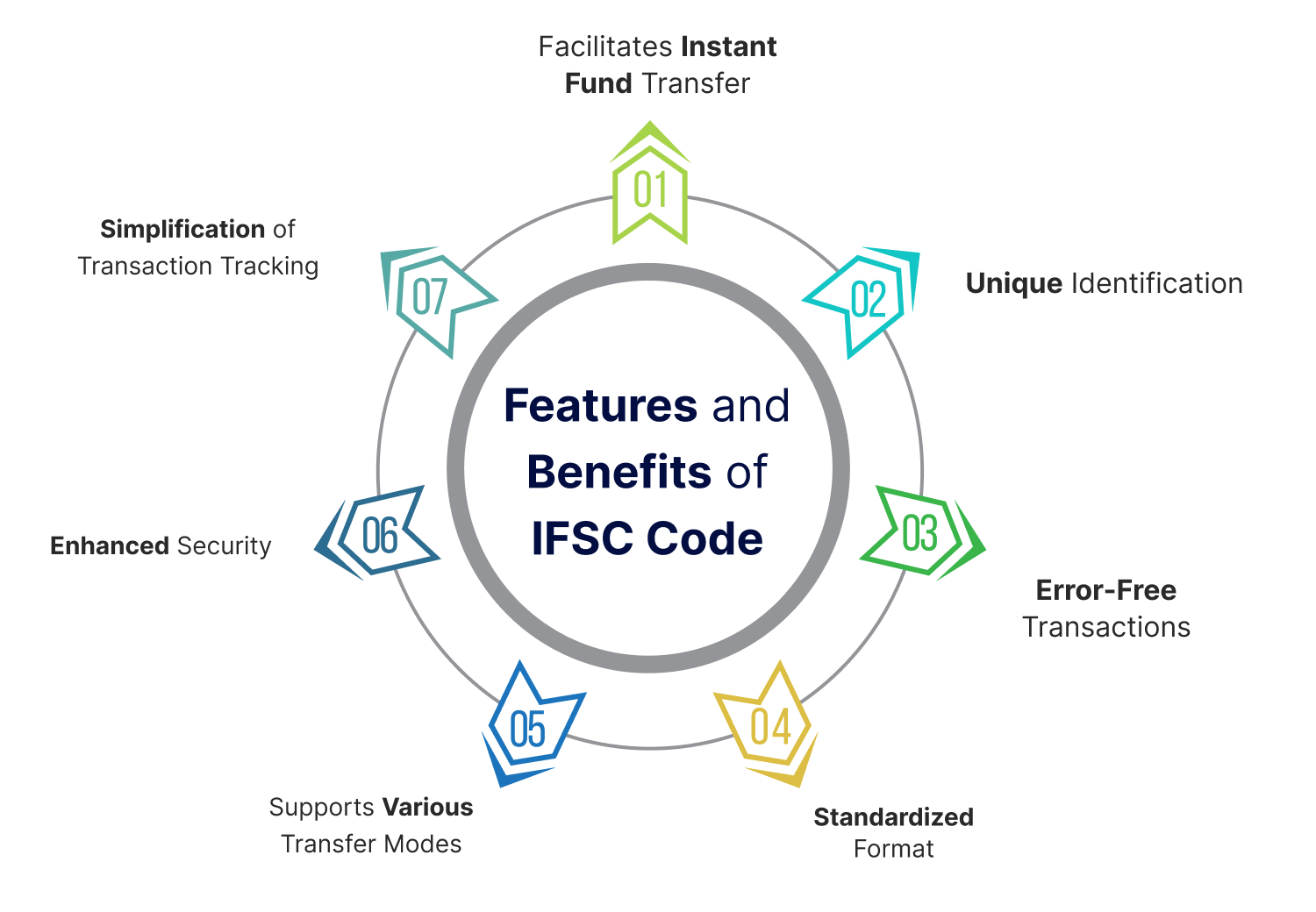

Features and Benefits of IFSC Code

The IFSC Code is super important for identifying each bank branch, making electronic transfers smooth and safe. Here's why it's useful:

Facilitates Instant Fund Transfer

IFSC code facilitates quick and efficient fund transfers between bank accounts, which is particularly useful for both domestic and international transactions. It can also be used for paying bills, insurance premiums, EMI payments, and more.

Unique identification

Each IFSC code is unique to a specific bank branch, which helps in accurately identifying and verifying the branch involved in a transaction.

Error-Free Transactions

When you use the IFSC code, it helps ensure that your online transfers go to the right bank branch. This reduces the chance of mistakes happening during transactions, making everything smoother and more reliable.

Standardized Format

The IFSC code is an 11-digit alphanumeric code that facilitates electronic banking transactions. It includes three parts: the first four characters are alphabetic and represent the bank’s name. The fifth character always being zero (reserved for future use), and the last six characters represent the branch code.

Supports Various Transfer Modes

IFSC codes are used across different electronic fund transfer systems, such as NEFT, RTGS, and IMPS, supporting a range of transaction types and sizes.

Enhanced Security

The requirement of an IFSC code enhances the security of financial transactions. It helps protect against fraud by ensuring money only moves between authenticated bank branches.

Simplification of Transaction Tracking

IFSC codes make it easier for customers and banks to track transactions. Each transaction can be precisely identified and traced back to its origin, thanks to the unique code that is recorded in the transaction details. This is particularly beneficial in maintaining clear and accurate financial records.

How Does the IFSC Code Work?

An IFSC code uniquely identifies each bank involved in electronic transfers like NEFT, IMPS, and RTGS. This 11-digit alphanumeric code ensures payments reach the correct bank branch. It facilitates accurate and secure electronic transactions.

To initiate a transfer, the sender needs the recipient’s bank name, account number, and IFSC code. This information helps the payment system locate the destination bank and branch. It ensures the funds go to the right account.

The IFSC code is crucial for all bank-to-bank electronic transfers. Without it, transactions cannot be completed. It allows the RBI to monitor and record all activities conducted via NEFT, RTGS, or IMPS.

Where to Find IFSC Codes in Passbooks and Cheque Leaves?

You can easily locate the IFSC code on the chequebook. The full address of the bank is mentioned at the top left corner of the cheque leaf. You will find the code at the end of the address.

You can also look for the IFSC code in the passbook of your bank. The front sheet of your passbook mentions your account details as well as branch details. You will find the IFSC code there.

Online Money Transfer Options Using IFSC Codes

The IFSC code is essential for transferring money through NEFT, IMPS, or RTGS. These systems enable easy transfers from one account to another.

They reduce transaction errors as transfers require correct details like account numbers and the specific IFSC.

- NEFT, or National Electronic Fund Transfer, allows fund transfers across banks. Transactions via NEFT are processed in batches and settled hourly. It is monitored by the RBI, ensuring a safe process.

- RTGS stands for Real Time Gross Settlement. It allows continuous, real-time settlement of fund transfers. Transactions are processed instantly, making it ideal for transferring large sums securely.

- IMPS, or Immediate Payment Service, facilitates instant interbank transfers. Available 24/7, it lets users send and receive money anytime, including holidays.

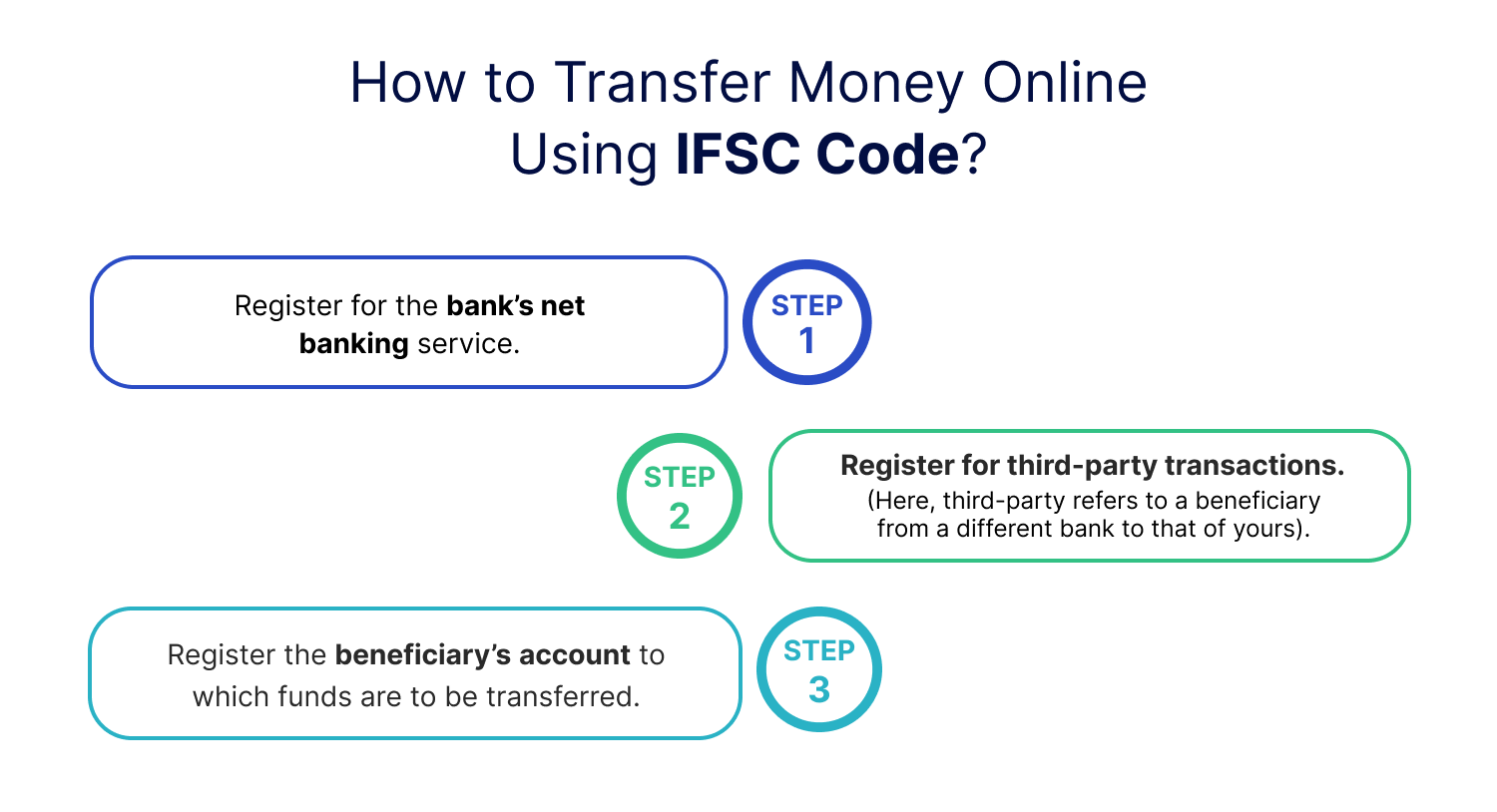

How to Transfer Money Online Using IFSC Code?

To transfer money online using NEFT, RTGS, or IMPS, you need to meet the below-mentioned requirements:

Step 1: Register for the bank’s net banking service.

Step 2: Register for third-party transactions. (Here, third-party refers to a beneficiary from a different bank to that of yours).

Step 3: Register the beneficiary’s account to which funds are to be transferred.

How to Register a Beneficiary's Account?

To add a beneficiary for online transfers, you must provide several details. These include the beneficiary's name, account number, and the IFSC code of their bank. You also need to provide the name of their bank branch.

Once you submit these details, the beneficiary registration is complete.

However, the activation time for the beneficiary varies by bank. For instance, at HDFC Bank, it takes 12 hours to activate a beneficiary after registration. This allows you to start transferring money.

Final Words!

The IFSC code is crucial for secure and precise online bank transfers. It uniquely identifies each bank branch. This ensures that electronically transferred money reaches the correct destination. Consequently, transactions remain smooth and reliable across India's banking network.

Frequently Asked Questions (FAQs)