What is the pattern of IFSC Code?

Last Updated : July 29, 2024, 3:13 p.m.

The Indian Financial System Code (IFSC) is a critical element in India’s banking infrastructure It is designed to streamline electronic payments across the country. This unique 11-character code identifies each bank branch involved in the fund transfer, ensuring transactions are routed accurately and efficiently.

Here, we’ll explore the specific pattern of the IFSC code, breaking down its structure to understand how it functions within the network of electronic financial transactions.

Meaning of IFSC code

IFSC stands for the Indian Financial System Code, which is an 11-character alphanumeric code used to uniquely identify bank branches in India that participate in electronic fund transfer systems, such as NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

This code is essential for facilitating online transactions and ensuring the funds are transferred to the correct bank branch.

Indian Financial System Code (IFSC) Alphanumeric code for fund transfer in India | |

|---|---|

Format | 11-character code; first four alphabetic for bank name, last six for branch |

Usage | Identifies bank branches in NEFT, RTGS, and IMPS systems in India |

Role | Routing messages to destination banks/branches for electronic funds transfer |

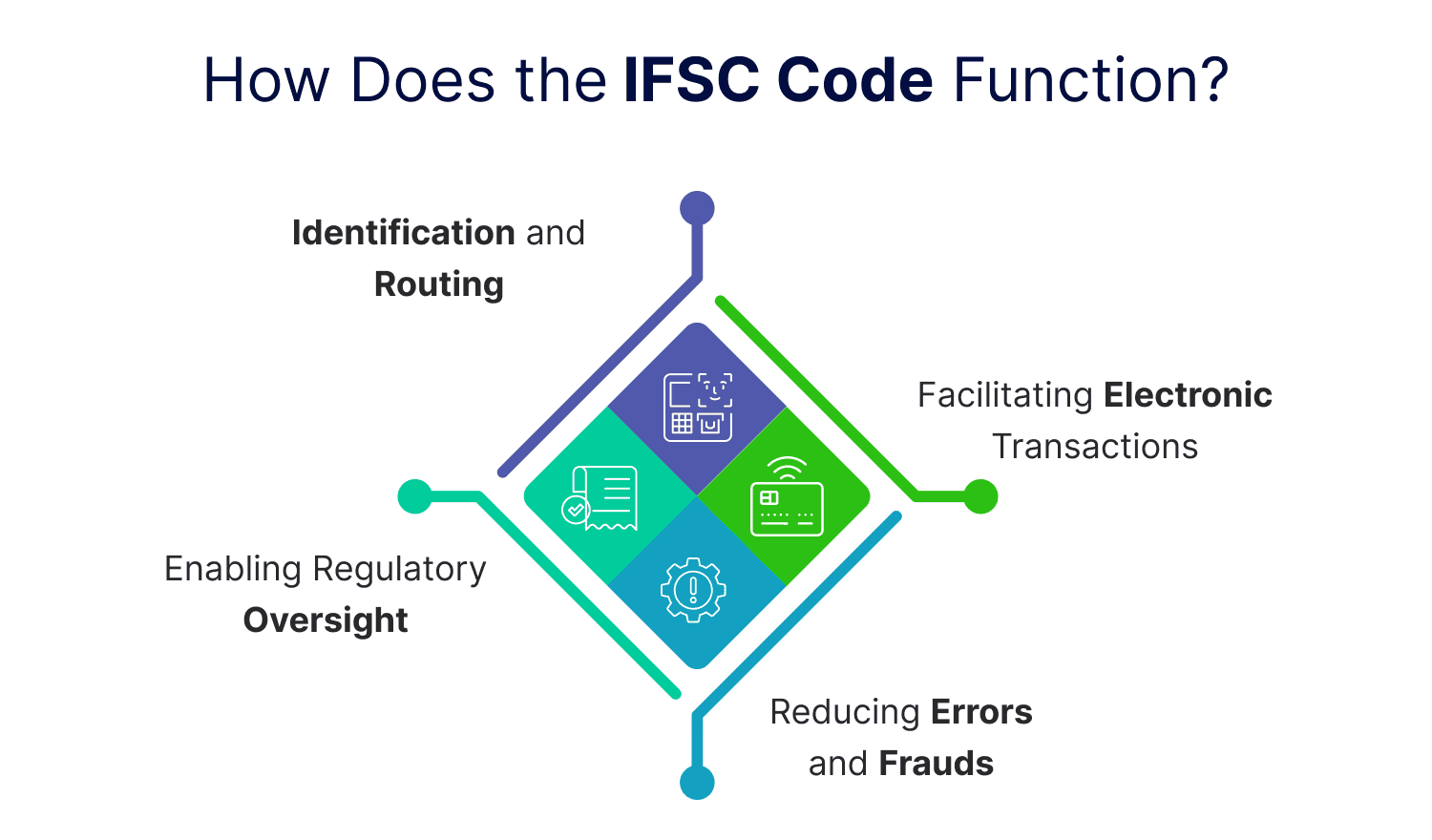

How does the IFSC code function?

The IFSC code functions as a crucial identifier for electronic fund transfer systems in India, such as NEFT, RTGS, and IMPS. Here’s how it works:

- Identification and routing: The IFSC code helps in identifying source and destination bank branches for electronic transactions. When a customer initiates a fund transfer, the IFSC code ensures that the money reaches the correct bank branch.

- Facilitating electronic transactions: This code is mandatory for online fund transfers through NEFT, RTGS, or IMPS. It ensures the funds are credited to the right account by providing the necessary information about the bank and branch involved in the transaction.

- Reducing errors and frauds: By using the IFSC code, the system reduces the chances of errors in fund transfers. It also adds a layer of security, making it difficult for fraudulent transactions to occur.

- Enabling regulatory oversight: The Reserve Bank of India (RBI) uses IFSC codes to monitor and regulate electronic banking transactions. This promotes transparency and accountability in the banking sector and protects consumer interests.

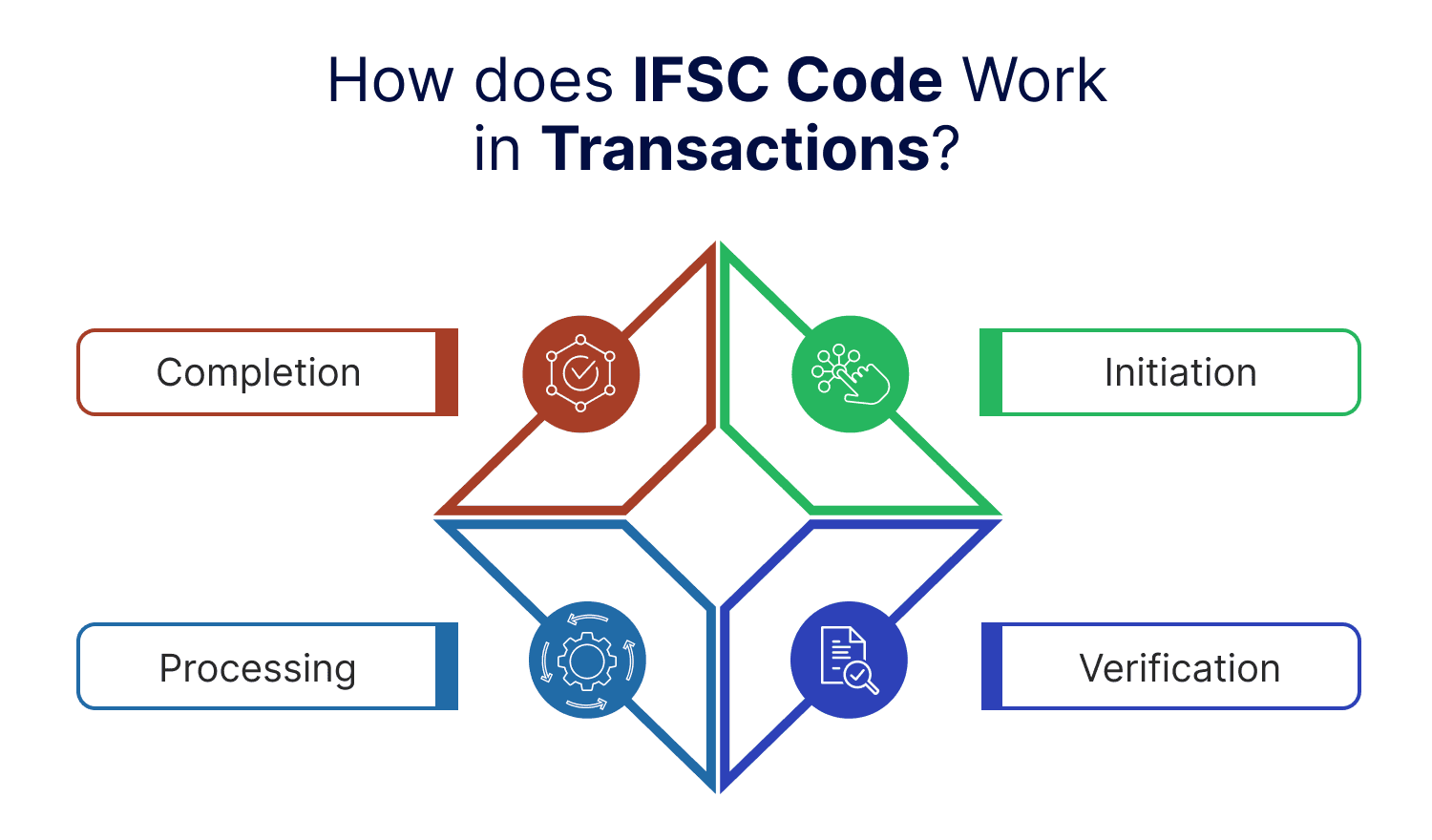

How does IFSC Code Work in Transactions?

The IFSC code is essential for guiding electronic transactions to the right bank branch. It uniquely identifies the branch where the recipient's account is based, ensuring transactions are processed accurately and efficiently.

Here’s how the code works in transactions:

- Initiation: When a customer wants to transfer money, they need to provide the recipient's bank account number and the IFSC code of the recipient's bank branch.

- Verification: The initiating bank verifies the IFSC code and the account details to ensure the correct transfer of funds. This step helps in confirming that the transaction details are accurate.

- Processing: The transaction request is processed through the electronic funds transfer system (NEFT, RTGS, or IMPS). The IFSC code helps in routing the transaction to the correct bank branch.

- Completion: The recipient's bank receives the transaction request, verifies the details, and credits the money to the correct account. The initiating bank updates the customer's account to reflect the transfer.

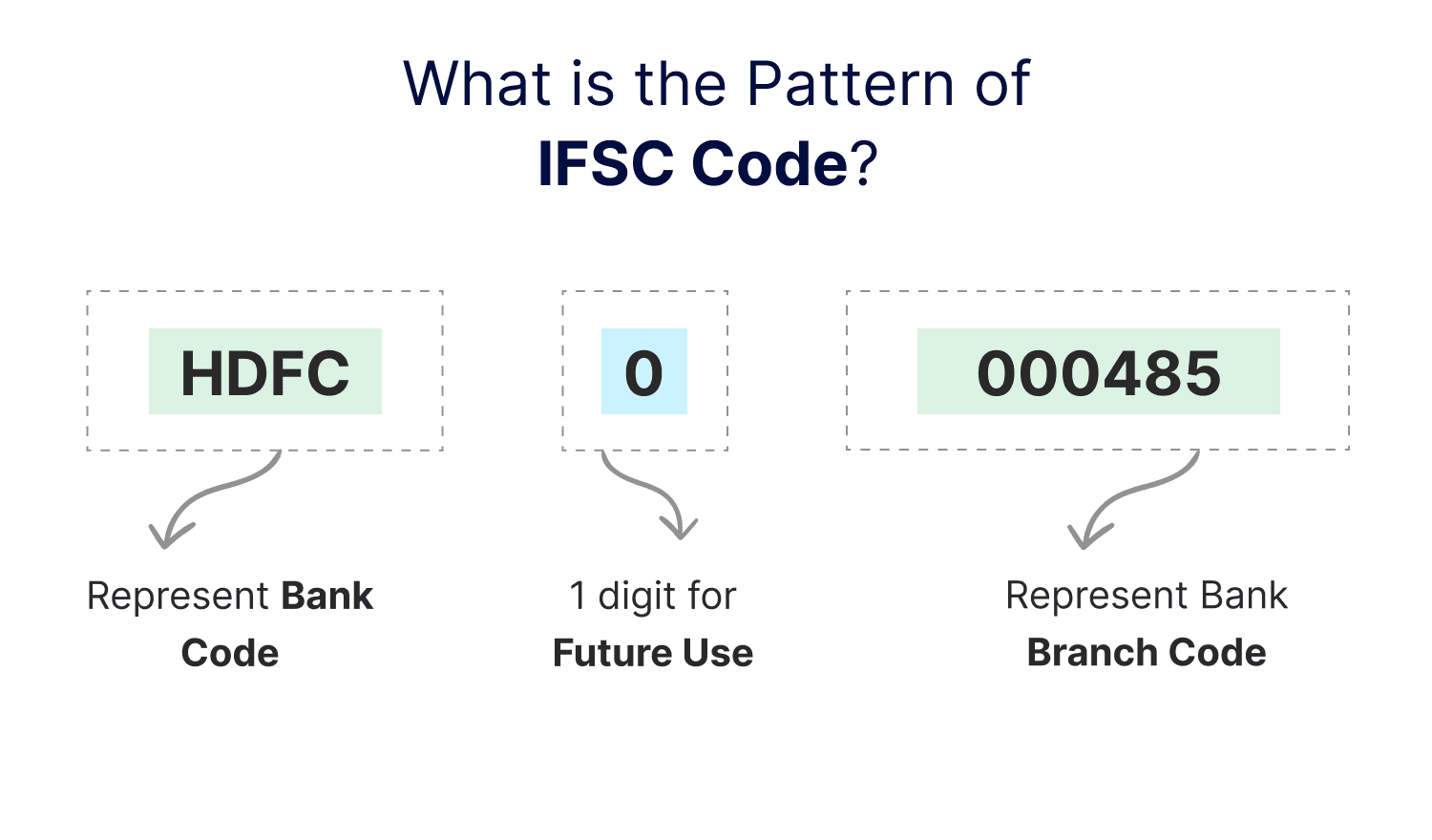

IFSC Code Structure

The IFSC code is structured as follows:

- First four characters: These are alphabetic and represent the bank's name. For example, "ICICI" for ICICI Bank.

- Fifth character: This is always '0' (zero) and is reserved for future use.

- Last six characters: These can be numeric or alphabetic and represent the specific branch of the bank.

For example, in the IFSC code "ICIC0000206":

- "ICIC" represents ICICI Bank.

- "0" is the fifth character reserved for future use.

- "000206" identifies the specific branch of ICICI Bank.

Frequently Asked Questions (FAQs)