Where can we use IFSC code for payment

Last Updated : July 29, 2024, 2:59 p.m.

The Indian Financial System Code, commonly known as IFSC, is a unique code assigned to each bank branch in India. This code is essential for facilitating electronic payments and ensuring that money reaches the correct destination. Let's explore the different scenarios where IFSC codes are necessary for making payments.

Is IFSC code only for India?

IFSC is an 11-digit alphanumeric code assigned by the Reserve Bank of India (RBI) to all bank branches participating in RTGS (Real-time Gross Settlement), NEFT (National Electronic Funds Transfer), and IMPS (Immediate Payment Service) systems. It can be used to conduct domestic transactions within India only. This code routes the funds to the correct bank account during the transaction process.

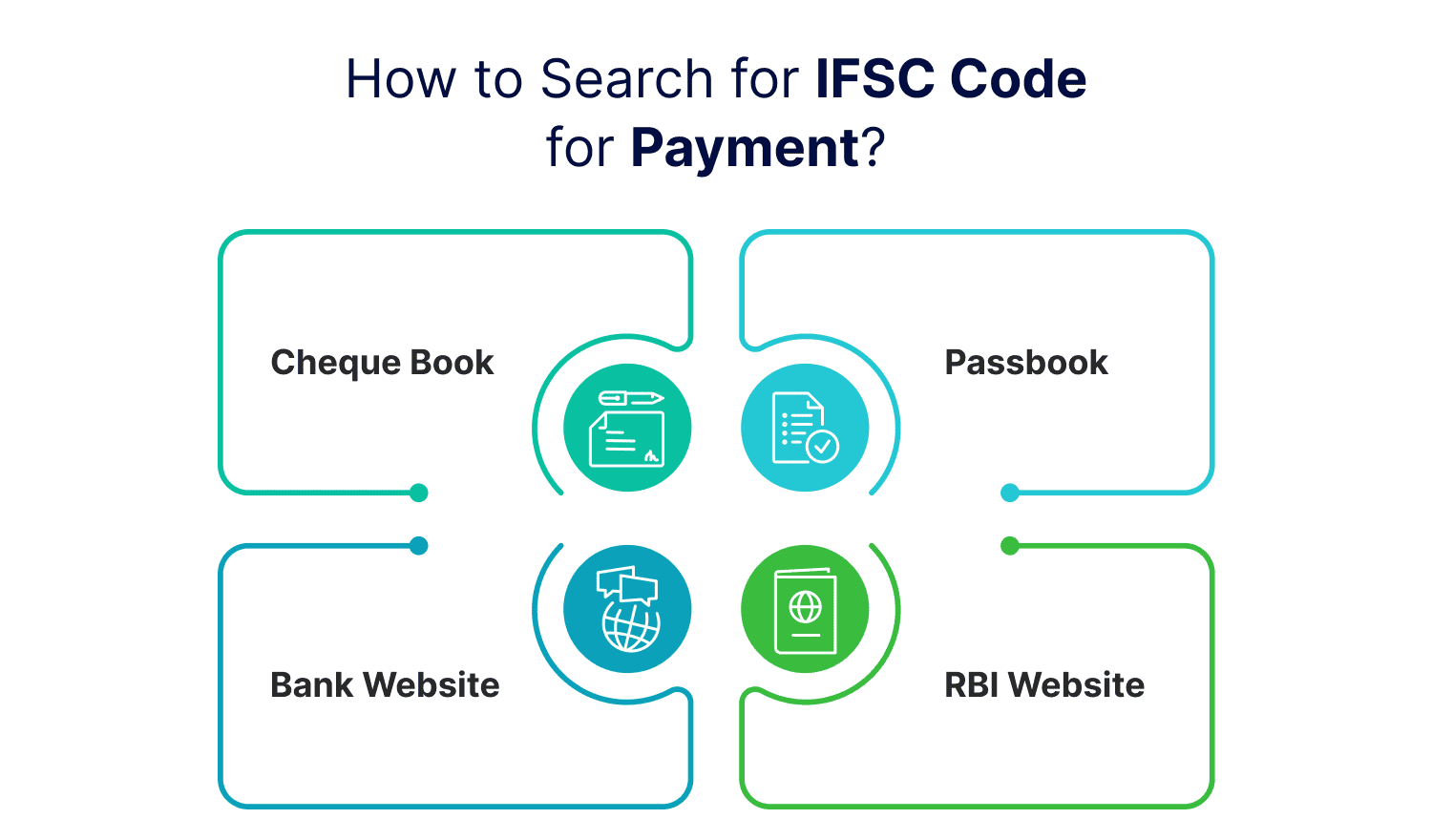

How to Search for IFSC Code for Payment?

If you are wondering how to find an IFSC code, below we have mentioned a few methods do so:

- Cheque book: To locate the IFSC code of your bank branch, check your cheque book. The branch's full address is typically found at the top left corner of each cheque, and the 11-digit IFSC code is listed at the end of this address.

- Passbook: Your passbook’s front page has account details along with the IFSC code mentioned on it.

- RBI website: You can also check the official website of the Reserve Bank of India (RBI). navigate to the 'IFSC codes' section. Here, you can select your bank from a drop-down menu and enter your branch's name to retrieve its IFSC code. If you are unsure of the branch name, just input your bank's name to get a complete list of branches and their respective IFSC codes.

- Bank website: Most banks provide a branch locator tool on their websites. Simply visit your bank's website, access this tool, and search for your branch to find its IFSC code.

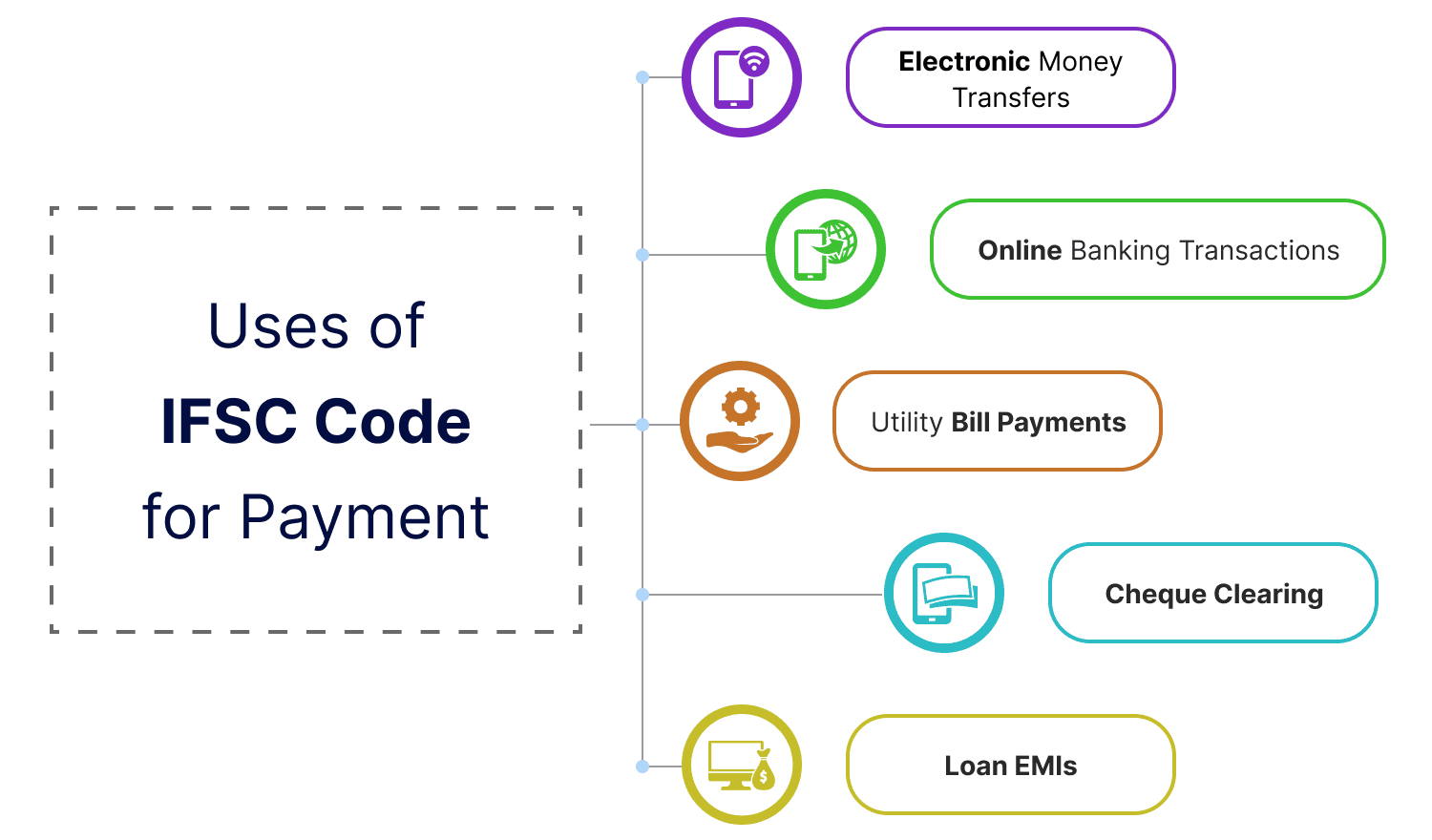

Uses of IFSC code for Payment

The IFSC code plays a major role in online money transfers in India and serves various purposes in banking transactions. Here are the key uses of IFSC code:

- Electronic money transfers: IFSC codes are integral for executing transactions via NEFT, RTGS, and IMPS, ensuring that money is accurately sent to the intended bank branch .

- Online banking transactions: Adding a new beneficiary for online transactions requires an IFSC code to ensure that transfers are directed to the correct account and branch.

- Utility bill payments: Many utility service providers in India ask for the IFSC code associated with the payer’s bank branch to facilitate bill payments via online banking.

- Cheque clearing: In the Electronic Clearing System (ECS), the IFSC code is used to pinpoint the banks involved in a transaction, facilitating a faster cheque clearing process.

- Loan EMIs: For setting up automatic debits or ECS for loan repayments, the IFSC code is necessary to link the bank accounts correctly.

Conclusion

In summary, IFSC codes are crucial for various financial transactions within India, including online banking, EMI payments, and more. By correctly using the IFSC, individuals and businesses can ensure that their transactions are processed swiftly and securely, enhancing the efficiency of digital payments across the country.

Frequently Asked Questions (FAQs)