Should One Stop Investments in Mutual Fund SIPs in The Election Year?

Last Updated : March 7, 2020, 2:20 p.m.

Effect of Elections on SIP Returns

For a lot of investors, the Indian equity market has been quite unexpected. The September came with the bad news as there was an 11.5% drop in 50-share Nifty. Others who have invested in mutual funds through Systematic Investment Plans (SIPs) are considering withdrawing their money as soon as possible.

Moreover, with 2019 general elections approaching, everyone is having second thoughts about any money they have invested. So, to clear the fog, we have evaluated how SIPs perform during election years. Let’s have a clear look.

Benefits in Pre-Elections

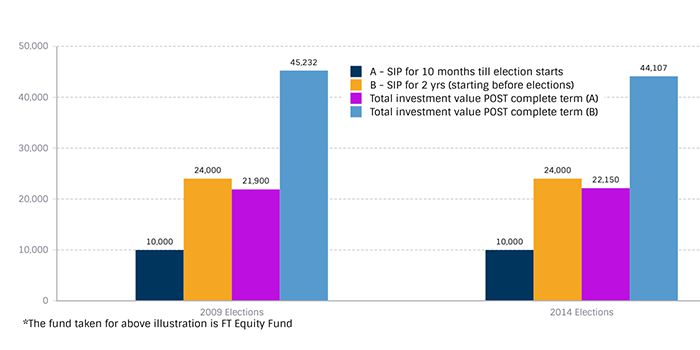

Many experts believe that investing 6-8 months before the general election year can give you considerable returns. However, this is keeping the fact in mind that SIPs are best when held for long-term. Hence, if you are investing your money or you already have, then keep it in SIP for at least 2 years.

In the year 2009, we all know the market position improved and investors earned even up to 50% gains around election time. At that time, the other factors were also in the favor. Comparing the position of the market in previous years such as 1998, 2004, 2009, and 2014, there is no prominent trend. But, investing pre-election holds high chances of you receiving great returns.

So, if you are planning to invest in the SIPs, now would be the right time for it.

Continue Your SIPs Even with Falling NAVs

If the market starts to drop, don’t panic or withdraw your SIP immediately. If you have placed your money in a stock with stable fundamentals and performance in relevance to other stocks, then you have no reason to worry.

When you invest in SIPs regularly, you have the benefit of rupee-cost averaging. When the market is high, you buy lesser units and vice versa. This leads to good returns if you keep the SIP for long-term.

It is a common practice for investors to drop out when the market falls. But, you should keep investing fixed sum to receive rupee-cost averaging benefits.

How SIPs Have Performed in Election Years

If we consider the tenure of UPA government in 2009-2014, there was a 67% Sensex return over 5 years. Investing during this tenure led to 30% annual return returns for mutual funds ’ owners. For instance, if you would have invested INR 10,000 during that tenure (Before 2009 election), you may have received approximately INR 35,000 in return.

Conclusion

The successful returns on your mutual fund’s investments depend on many factors, including global and national factors such as financial crisis. However, if you analyse the overall trend at the time of general elections, then the right time to invest your money is before the elections. There is absolutely no trend post-election.

Hence, if you are wondering when to invest your money and where, then invest in mutual fund SIPs now. SIPs further have an added advantage with the lower risk of market fluctuations. So, this fixed invest makes a perfect investment instrument presently.