NAVIGATING ROUGH WATERS – FINANCIAL CRISIS-IMPACT, IMPLICATION & RECOMMENDATION

Last Updated : March 25, 2020, 12:56 p.m.

BLOOD ON DALAL STREET!!

SENSEX HAS ITS WORST FALL IN THE HISTORY!!

FINANCIAL MARKETS COLLAPSE!!

FEAR GRIPS STOCK MARKETS!!

These have been the headlines for the last couple of weeks echoing what’s happening in the stock markets There is fear, panic, anxiety, portfolios are bleeding and there seems to be no light at the end of the tunnel.

GREED AND FEAR

Human beings have two emotional states-greed and fear. Sensational news headlines like these heighten fear in these times. When we are driven emotionally, rationality and objectivity take a back seat. And when emotion overrules logic the outcome is bad decision making. Best decisions are made with a calm mind and looking beyond the news.

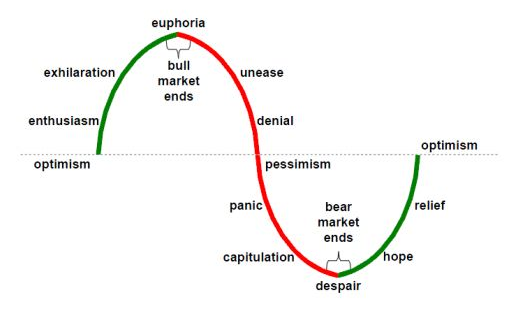

In stock market parlance, bull markets(phase where stock markets give positive returns) and bear markets(phase where stock markets give negative returns) are a result of greed and fear.

The picture above describes the emotions and its impact on bull & bear markets. Currently we are in the panic phase which could be followed by capitulation leading to an end in the bear markets. Let’s understand the impact of the current crisis on global and Indian stock markets.

CORONOVIRUS & CRISIS IN THE GLOBAL FINANCIAL MARKETS

Every crisis in the financial markets is because of a significant event, this time it is the coronavirus which has led to the same. The first case was detected in December in Wuhan, China but no one thought that it could turn out to be a global problem of this scale. As we write,3.82 lakh cases have been detected worldwide with around 16,000 deaths. Many countries have gone on a complete lockdown thereby bringing economic activity to halt. Markets are pre-empting a major disruption to economic activity and discounting next 2-3 quarters of slow economic growth globally. The same is reflected in the falling stock prices, these are the returns of the major stock indices around the world since the outbreak:

| Country | Stock market Index | Returns |

|---|---|---|

| India | Nifty | -38% |

| South Korea | Kospi | -36% |

| Germany | DAX | -36% |

| France | CAC | -35% |

| Singapore | Straits Times | -33% |

| United Kingdom | FTSE | -33% |

| United States Of America | NASDAQ | -32% |

| Japan | NIKKEI | -30% |

| Hong Kong | Hang Seng | -28% |

| China | Shanghai | -19% |

Source-Bloomberg

As we see this crisis has affected every global market and India is no exception let’s focus on the Indian stock markets and understand the impact.

IMPACT ON INDIAN FINANCIAL MARKETS

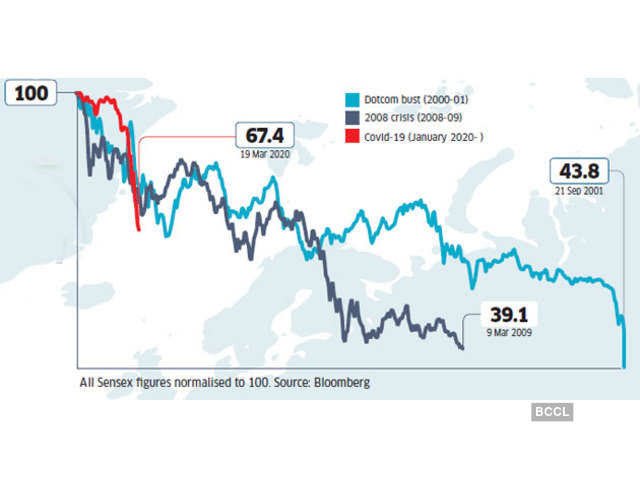

Source-Economic Times

As we see the Sensex and nifty have fallen sharply, what’s been more astounding is the speed of the correction in the markets. We compared this with the last two major stock market crashes-Dot com burst in 2000 and the global financial crisis of 2008:

The fall in 2000 and 2008 was gradual over several months but in this crisis we have fallen 38% in a month itself, this can be attributed to these reasons:

- Trading in stock markets today is largely done using algorithms so the speed of decision making has quickened, machines give a buy or sell signal immediately on hitting threshold levels.

- The speed of information thanks to social media is much faster than 2000 or 2008, there was no social media in 2000 and 2008 it was just starting.

- Before the corona virus issue the Indian stock markets were trading in high valuations-the PE(Price to Earnings) ratio had touched 28 which is expensive so a correction was on the anvil.

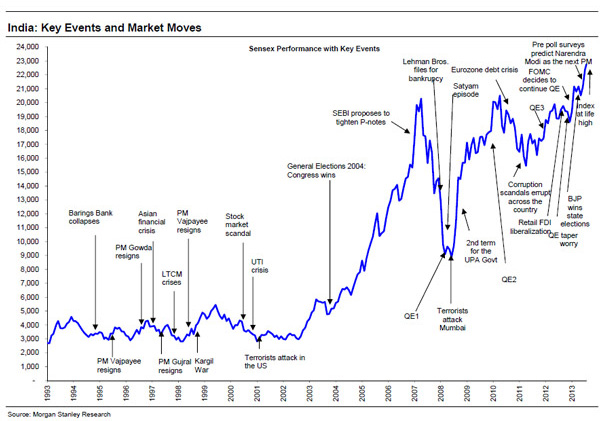

However stock markets don’t remain in a single zone forever, there are bad & good times but it is important to remain invested over a long period of time, in fact times like these are the best to invest since fear is at the highest thereby giving an opportunity to buy stocks or mutual funds at a discount. We analysed the last 25 years data of the sensex to look at all major events in the Indian economic and political history to see what markets did during and after these events. From being at 3000 levels in 1993 to peaking at 42,000 recently the stock markets have seen it all and bounced back from every fall. The same is depicted in the graph below:

IMPACT ON MUTUAL FUND RETURNS

Mutual fund returns, especially equity fund returns are dependent on how the stock markets perform since mutual funds invest into stocks listed on the Indian stock exchange. Let’s look at how different categories of equity mutual funds have performed in this market fall.

MUTUAL FUND CATEGORY RETURNS(IN %)

| Fund Category | 1 Week (in %) | 1 Month (in %) |

|---|---|---|

| Large Cap Funds | -16.35 | -35.36 |

| Large & Midcap Funds | -18.49 | -36.18 |

| Multi Cap Funds | -17.81 | -35.44 |

| Midcap Funds | -18.62 | -35.49 |

| Small Cap Funds | -19.81 | -37.40 |

| ELSS (Tax Saver Funds) | -17.64 | -33.64 |

Source-Value Research

We can draw the following conclusions from this:

- Most of the funds have fallen in line with the fall in stock markets

- This has been the case since there has been broad based selling across large, mid and small cap stocks

- Large cap funds as a category have fallen the least.

- Small cap funds have fallen the most in this market correction

- There would be funds which will be outliers with significant divergence from these returns-both positive and negative.

DO’S AND DON’T’S FOR MUTUAL FUND INVESTORS

- Don’t stop your SIP now, SIP’s work best when markets are volatile. Please read this to understand better: https://www.wishfin.com/mutual-fund/should-mutual-fund-investors-fear-stock-market-volatility/

- If you have cash, this is a great time to invest but stagger your investments over the next month or so, invest in a liquid fund and do an STP(systematic transfer plan)

- Don’t redeem your investments just because markets have fallen, in case you need money for some other purpose you may do so.

- Be patient and disciplined, this is not the first market fall nor the last.

- Embrace volatility and don’t be fearful, investments made in bad times yield the best returns.

- Don’t look at your mutual fund portfolio daily-it will make emotions override rational.

- Consult your advisor and re-balance your portfolio if required.

- Don’t get swayed to invest your emergency funds or take a loan to invest, no one knows the bottom

RECOMMENDATION:

- If you are looking to invest in equity mutual funds, its prudent to invest in large cap funds since they will bounce back first before any other category of funds.

- Recommended large-cap funds are:

- Axis Blue chip

- ICICI Prudential Blue chip

- SBI Blue chip

- For beginners it is a good time to start investing, you should see good returns over the next 3-5 years, start your SIP today in any of the above large cap funds.

- People who have the ability to take higher risk at these levels and are willing to stay for the next 5 years, small and mid-cap funds present a good opportunity since they have corrected the most and valuations are cheap. The recommended funds in these categories are:

- DSP Midcap

- Kotak Emerging Equity

- HDFC Small Cap

- Franklin India Smaller Companies Fund

We are going through turbulent times, no one can predict the exact bottom of the stock markets, they could fall even more from here. But history and valuations both suggest that such times are best to make outsized returns. Many who wouldn’t invest now would look at this as a missed opportunity couple of years down the line but the investment has to be done prudently. This is a black swan event and once in a decade opportunity to build portfolios. For the sake of humanity a quick solution to the virus is imperative and we hope there is one soon.

We would leave you with a powerful quote from the great investor-Warren Buffet.

“We simply attempt to be fearful when others are greedy and to be greedy when others are fearful”