SIP returns negative in the last year – should you worry?

Last Updated : March 16, 2019, 5:42 p.m.

Three friends Sachin, Saurav & Mitali met after a long time and started discussing their lives, career and finances. The discussion on finances revolved around investments and mutual funds came up for discussion.

Sachin : My friend told me an year back about mutual funds and I invested but my portfolio returns are negative. Don’t know what to do, I think I made a mistake.

Mitali : Same here Sachin, I saw the Mutual Fund Sahi Hai advertisement and started an SIP but thinking of stopping it now.

Saurav : Friends, I am in the same boat, based on my financial advisor’s recommendation I invested in equity mutual funds an year back but my capital has eroded. So, now I am thinking of taking out the entire money.

From cafes to drawing rooms to offices such discussions have picked up steam and people are thinking of the next step-should I stay invested or should I call it quits and take my money out?

Mutual Funds, particularly SIP has been the buzzword in the last three four years and have caught the fancy of many . There has been a slew of first time investors who have flocked to mutual funds.

There are a lot of people who share the same sentiment and are witnessing negative returns in their mutual fund portfolios, there are some investments which are down by 5%-20% or even more. This has led to a state of flux & confusion .

Kya Mutual Fund sach mein sahi hai?

So are you also confused and don’t know what to do now?

Should you withdraw your investments or stay invested?

Should you cancel your SIP ?

Before these questions are answered lets rewind and ask ourselves that were our investment decision based on these fundamental aspects of investing:

1)Time Horizon – When investing in equity mutual funds one needs to have a long-term time horizon but how does one define long-term. Well historical data & facts suggest that investments kept for 10 years and above yield the desired results. However a minimum of 5 years is what one should have in mind while investing. Investing is like playing a test match, one has to wait for 5 days to get the result and patience is supreme. One should not treat it like a T20 game and expect result overnight.

2)Risk Appetite -Before investing understanding the risk associated with one’s investment is extremely important because your risk appetite should be one of the key determining factors of which mutual fund scheme to invest in. If you get worked up and have sleepless nights by a 20% fall in your portfolio then equity is not for you. You are better of investing in debt funds and be contend with a 6-7% return. However if you are aiming for a higher return then be ready to bear with the volatility and ride it out like facing a good bowler on a difficult pitch against whom defending is better than attacking.

3)Investment objective – Have you invested to achieve a long-term goal(10 years and beyond) like your child’s marriage ,education, retirement, buying a house or wealth creation. Or have you invested for buying that dream car or a dream vacation in the next three years. If you have invested to achieve a long-term goal then why get perturbed over negative returns in the short term, treat this as a part of the game and just stay put. However if you have invested in a equity mutual fund scheme to achieve a short-term goal then it’s high time you review your portfolio and make suitable changes.

4)Asset Allocation – “Never put all your eggs in one basket”. This phrase is most relevant when it comes to investments. It is important to diversify among different asset classes-equity, debt, deposits , gold, real estate etc. Now the question arises how much should be allocated to which asset class.

We need to be also clear on the return expectation from an equity investment. Equity is a volatile asset class and returns are not linear. A reasonable expectation from an equity mutual fund scheme should be a 12-15% annualized return(in line with economic & corporate growth in the country) in the long-term. But this 12-15% doesn’t come very straightforward i.e. you won’t get 12-15% fixed every year. Returns will vary every year and there will be ups and downs.

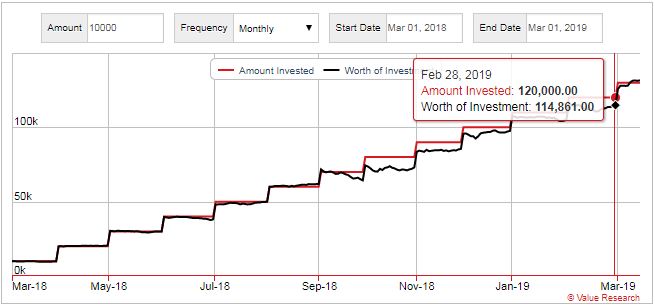

Let’s look at one of the oldest equity funds-Franklin India Prima fund which has recently completed 25 years in existence. If someone would have started an SIP of ₹ 10,000 in this fund an year back(1st March,18) let’s see the returns:

The value of Rs 1,20,000 invested is 1,14,861(as on 28th February,19) , looking at these figures would cause disappointment but should this be the basis of stopping an SIP in this fund(the outcome of most other equity funds is quite similar).

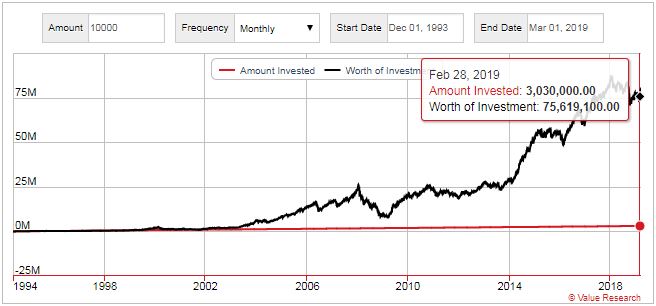

Now let’s go through the entire journey of this fund and see what’s been the performance like:

This fund was launched on 1st Dec,93 and a ₹ 10,000 SIP per month since then would have accumulated to ₹ 7.56crs(as on 28th February,19) against an investment of ₹ 30.30 lakhs(10,000 p.m. for 304 months). It’s a staggering figure which is unimaginable for many but that’s the kind of wealth equity SIP’s can generate over the long-term. However there have been some one year periods like above when the fund has generated negative return and if one would have not got swayed by those negative periods he would have created massive wealth. You could turn around and say that not all funds would have been as successful as this one. Well, there is somewhat variation in returns but the broad outcome or message is the same.

So to answer the questions:

- If your investment is for long-term, your asset allocation is right don’t pull out you money-stay invested!!

- Don’t stop your SIP’s now, SIP’s work best in volatile markets. You are getting more units for your investment and when the tide turns units bought at these levels will give positive returns.

- If you have invested for a short period of time to make a quick buck in equity,it isn’t the smartest move. One should review our portfolio and make necessary changes.

Don’t worry, apna time aayega!!!

The author of this post is Mr Pradeep Bhasin, Business Head-Mutual Funds at Wishfin. He has done Bachelors in Commerce from Delhi University and completed PGDM from Narsee Monjee Institute of Management Studies, Mumbai specializing in Marketing & Finance. Pradeep has 16 years of experience in the wealth management and mutual fund industry. In his previous roles he has worked with HDFC Asset management Company, ABN Amro Bank, ICICI Bank ,Standard Chartered Asset Management Company Limited and Sundaram Asset Management Company Limited

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Information contained in this article is not a complete representation of every material fact and is for informational purposes only. The recipient is advised to consult its advisor/ tax consultant prior to arriving at any investment decision.