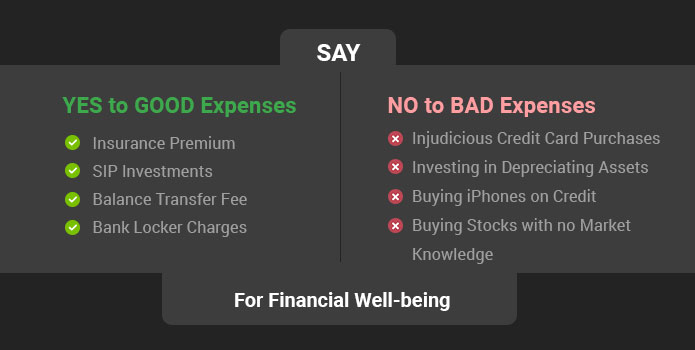

The Sooner You Understand the Difference Between Good and Bad Expenses The Better Your Financial Management Will be

Last Updated : July 2, 2020, 1:21 p.m.

As money doesn’t come easy to us, its proper utilization is of paramount importance to our survival and prosperity. But keeping the money idle and not investing in the right avenue doesn’t help you either. The inflation only increases with time, so your money should yield to help you sustain through the challenging times. At the same time, you could come across situations wherein you have to take a loan to meet your needs. But choosing a bad loan option will only make you curse your choice. To put our finances on track, it’s important we know what are good and bad expenses. In this post, we will differentiate between the two so that you can manage your finances efficiently. So, let’s begin!.

Let’s Start with Good Expenses

Insurance Premium

Getting yourself and your family insured at the face of any unforeseen contingencies in the future should be your top priority. So paying the premium to get that protective cover should not bother you one bit. However, you should compare the insurance policies and see which offers you the maximum cover at least premium. For the unaware, life insurance gives cover to the family members in the eventuality of the death of the insured during the policy period. Whereas, health insurance helps you and yourself undergo expensive medical treatments.

Paying for Your Future

A secured future is what we all want, but only some of us get it in the end. The fact that some incur good costs on paying the monthly SIP amount in mutual funds diligently without worrying about the market fluctuation puts their future on track. But they don’t stop there and go for incremental investments in SIPs every year to heighten the possibilities of an enhanced corpus, helping them deal with the times like an extended period of unemployment or the retirement days when the active income becomes virtually NIL.

Distributing the Cost According to Risk-appetite

Investing in an instrument that doesn’t go in sync with your risk appetite will put you nowhere. While this holds true, investing entirely in one nest deprives you of the benefit of diversification. Therefore, your assets must get distributed across financial instruments. The only thing you need to do is choose instruments based on what returns they have delivered to the investors and distribute them according to your risk appetite. If you have a high-risk appetite, around 75%-80% of your investment portfolio should be in equities, be it in the form of direct stocks or mutual funds, and the rest in debt funds, fixed deposits and small saving schemes. Individuals with low-risk appetite must distribute the other way round.

Paying a Balance Transfer Fee

If you have to pay about INR 10,000 or so to save around INR 2 lakh and more with a home loan balance transfer, will you hesitate to do the same? As a home loan is a long-term loan that spans for upto 30 years, you get multiple opportunities for a balance transfer. The key, however, is to choose and time it better. If you find a lender that allows you to switch your existing loan balance to it at an interest rate lower than the existing one by at least 0.25%-0.50%, grab the deal before it goes out of your hand. We have already discussed how to maximize home loan balance transfer in our previous post. Click on this https://www.wishfin.com/home-loans/when-to-shift-your-home-loan-to-new-lender/ to know the same.

Buying Gold

The yellow metal gold occupies a special place in our life. Not only it helps us make jewellery for grand occasions like marriage, but it also reaps returns for us over time. The reason being the value of gold grows over time, maybe with leaps and bounds. If media reports are to be believed, gold has provided an average return of around 8%-9% to its investors over the last 10 years. The return you see is higher than the fixed deposits of banks. You can even get a loan against gold to meet your emergency needs. Such a loan won’t require you to submit any income proof. Plus, the lender won’t check your credit history before approving the loan, which can be disbursed at a lower rate than a personal loan. So, the penny spent in gold doesn’t go down as waste, instead, it helps you in more ways than one.

Paying for the Bank Locker

Keeping jewellery and other expensive items at home can make you restless because of the possibility of thefts. In that case, you can approach the bank for a locker. Yes, you need to pay a one-time fee and annual maintenance charges for the service. For instance, if you talk about SBI, it takes a one-time fee and annual rent of INR 500-1,000 +GST and INR 1,500-9,000 +GST, respectively. But the safety provided by the locker to your precious belongings far outweighs the money you pay for getting such services. That does not mean you choose any offer just for the sake of it. Do compare the locker charges of banks and other terms & conditions carefully before signing the agreement.

Say No to These Bad Expenses

Spending Injudiciously on Credit Cards

Credit cards have raised infinite possibilities for you. From helping you book travel & movie tickets to reserve your table at a restaurant of your choice, credit cards have added a greater degree of convenience. But shopping with credit cards remains good till the time you do it properly. The moment you start spending injudiciously, the resulting bill could be way too high for you to pay on time. What happens then is a series of defaults, which go on to sink you in a severe debt trap and lower your credit score drastically, potentially shutting the door on you for any loans in the future.

Investing in a Depreciating Asset

There’s no point putting your hard-earned money in assets such as a car, whose value comes down sharply over time, if you don’t need it. More so when you do it via a loan as the interest you pay to the bank will be much more than what you could get on selling the vehicle. If a car is indeed your need, ensure you pick a vehicle with maximum resale value. Doing so will help you recover quite a bit of your loan cost.

Putting Money Directly in Stocks Without Any Knowledge

Stocks are heavens for those who understand the dynamics of the capital market, which is driven greatly by investment sentiments. While a rally in the stock market indices will see your investments outnumber the returns of other instruments, a sustained plunge there could erode the gains sharply and mount losses for you. Those who know this aspect can make smart moves to propel their investments through the market fluctuation. But if you don’t know the same, look to invest in stocks via mutual funds that are under the constant supervision of a fund manager. The years of expertise in dealing with complex market situations help fund managers choose those quality stocks in the portfolio to safeguard your returns or reduce the rate of fall when the market goes through a lull period. All you need to do is choose a mutual fund that has performed for long and sailed through varied market situations.

Buying iPhones on Credit

Buying expensive iPhones on credits is fast becoming a fashion statement among the youth in India. People love to flaunt and share the news of buying iPhones on several social platforms, just to show the importance of it in one’s life. Like cars, iPhones are also depreciating in nature. The interest you will pay on a loan taken to buy an iPhone could be more than the proceeds you will get on selling the phone. Click on this https://www.wishfin.com/banks/the-pitfalls-of-buying-a-costly-cellphone-on-emi/ to understand the perils of buying an iPhone on credit. If you want to buy an iPhone, do it from your savings.