SBI Mini Statement

Last Updated : July 8, 2025, 3:54 p.m.

The SBI Mini Statement is a convenient service offered by the State Bank of India, allowing account holders to quickly access details of their last five transactions. Whether you're tracking recent debit or credit activities, the SBI Mini Statement provides a snapshot of your account activity without the need to visit a bank branch. This article explores the various methods to access your SBI Mini Statement, the importance of the SBI mini statement number, and answers frequently asked questions to help you manage your finances efficiently.

What is an SBI Mini Statement?

An SBI Mini Statement is a concise summary of the most recent five transactions (deposits, withdrawals, or transfers) in your SBI savings account. It includes details of transactions made via payment methods like UPI, IMPS, NEFT, RTGS, and more. This service is especially useful for account holders who need quick updates without the hassle of obtaining a full bank statement. To access this service, your mobile number must be registered with your SBI account.

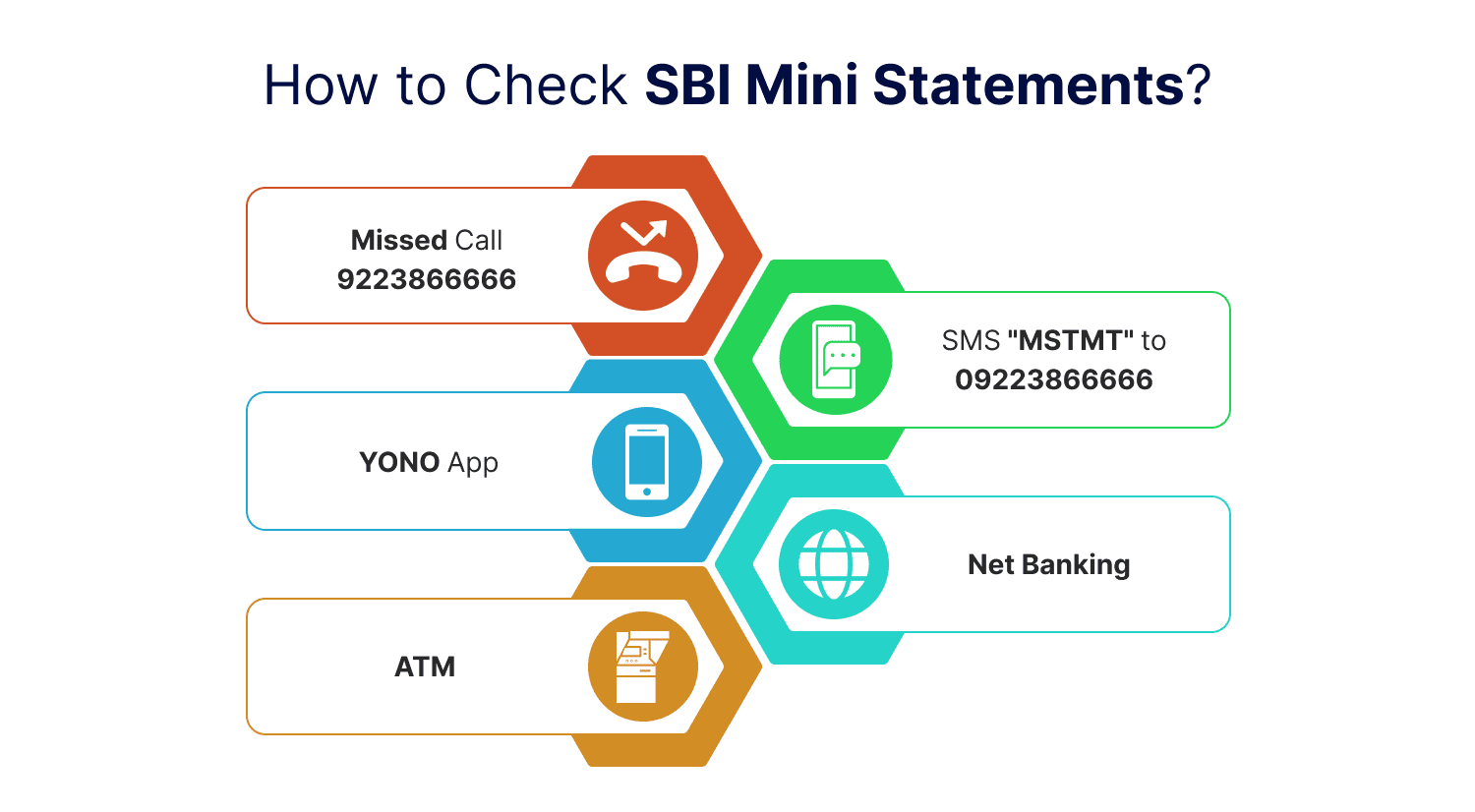

How to Access Your SBI Mini Statement?

The State Bank of India offers multiple methods to check your SBI Mini Statement, catering to both online and offline preferences. Below are the most popular ways to retrieve your mini statement:

SBI Mini Statement via Missed Call Number

One of the easiest ways to get your SBI Mini Statement is through the missed call service. Simply dial the SBI mini statement number 9223866666 from your registered mobile number. The call will disconnect after two rings, and you’ll receive an SMS with details of your last five transactions. This method is ideal for those without internet access and is available 24/7 at no cost.

Steps :

- Ensure your mobile number is registered with your SBI account.

- Dial 9223866666 from your registered number.

- Wait for the call to disconnect automatically.

- Receive an SMS with your SBI Mini Statement.

SBI Mini Statement via SMS

For those who prefer text-based services, SBI offers an SMS banking option. Send ‘MSTMT’ to the SBI mini statement number 9223866666 from your registered mobile number. You’ll receive an SMS containing the last five transactions. This method is quick, free, and doesn’t require an internet connection.

Steps :

- Open your SMS app.

- Type MSTMT and send it to 9223866666.

- Check the SMS for your SBI Mini Statement.

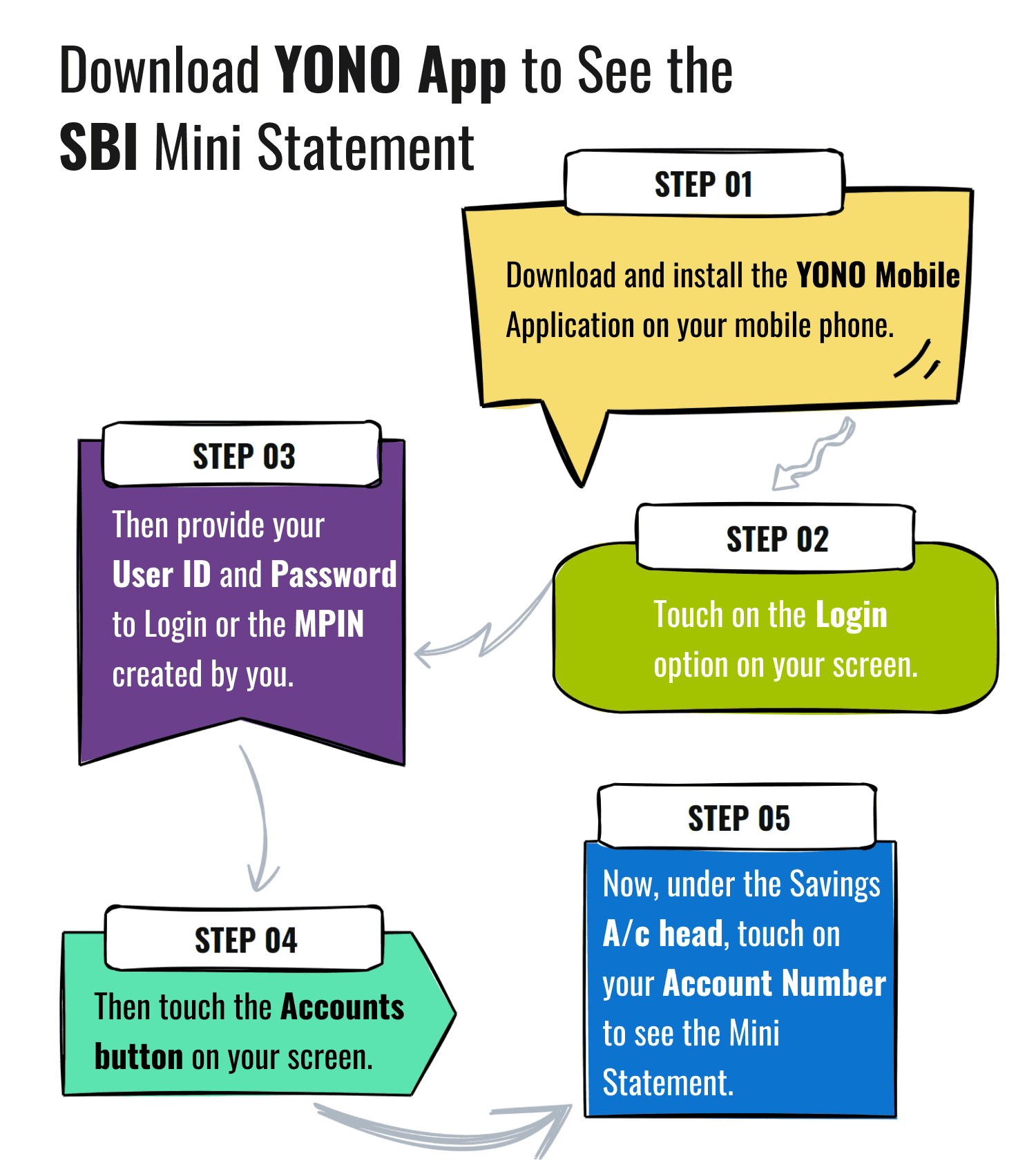

Download YONO App to See the SBI Mini Statement

The SBI YONO app is a modern solution for tech-savvy customers. It allows you to access your SBI Mini Statement and other banking services on your smartphone.

- Download and install the YONO Mobile Application on your mobile phone.

- Touch on the Login option on your screen.

- Then provide your User ID and Password to Login or the MPIN created by you.

- Then touch the Accounts button on your screen.

- Now, under the Savings A/c head, touch on your Account Number to see the Mini Statement.

See SBI Mini Statement through Net Banking

SBI’s internet banking portal is another secure way to access your SBI Mini Statement. This method is ideal for those who prefer managing their accounts online.

Steps :

- Visit the official SBI website (www.onlinesbi.sbi).

- Log in to your net banking account using your username and password.

- Go to the ‘Account Details’ or ‘Account Summary’ section.

- Select your account to view or download the SBI Mini Statement.

SBI Mini Statement via ATM

You can easily obtain your mini-statement by visiting the closest SBI ATM if your SBI account has a debit card. To obtain your SBI mini statement after visiting the ATM counter, take the following actions:

Step 1: Place your debit card inside the ATM.

Step 2: From the list of available languages, pick your favourite and then select 'Mini Statement'.

Step 3: Input the four-digit PIN for your ATM.

Step 4: The ATM will print a receipt for the recent transactions that you made.

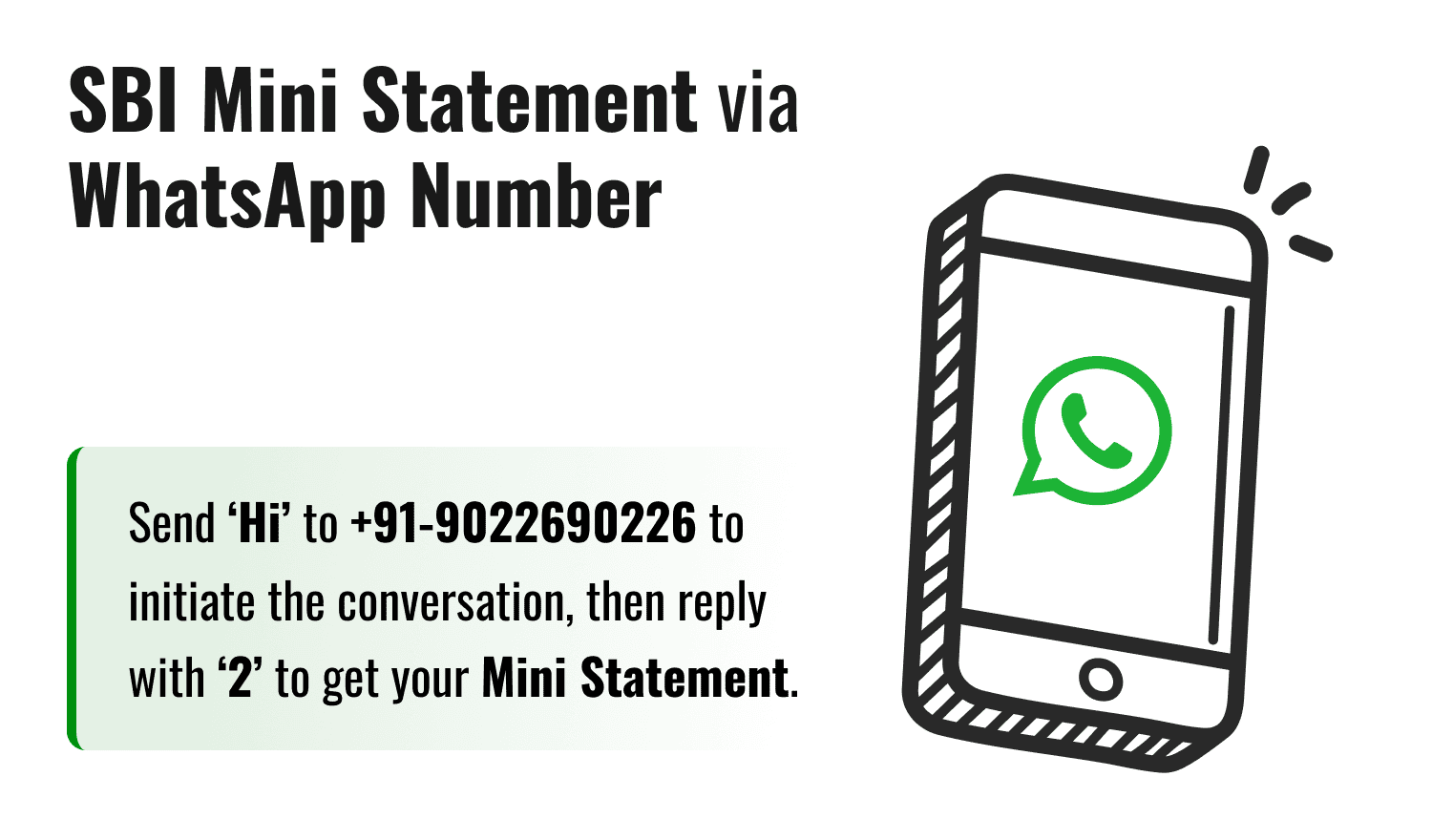

SBI Mini Statement via WhatsApp Number

SBI’s WhatsApp banking service offers a modern, interactive way to access your SBI Mini Statement.

Steps :

- Save the SBI WhatsApp banking number +919022690226 in your contacts.

- Open WhatsApp and send ‘Hi’ to initiate the conversation.

- Reply with ‘2’ to request the mini statement.

- Receive the details of your last five transactions via WhatsApp.

How to Register Your Mobile Number for SBI Mini Statement?

To use services like missed call or SMS banking, your mobile number must be linked to your SBI account. If it’s not already registered, follow these steps:

- Open your SMS app.

- Type REG Account Number (e.g., REG 12345678901).

- Send the SMS to 09223488888.

- Your mobile number will be registered, enabling access to SBI Mini Statement services.

If you have multiple SBI accounts, note that only one account can be registered for SBI Quick services at a time. To switch accounts, deregister the current account and register the new one using the same process.

Benefits of SBI Mini Statement

The SBI Mini Statement service makes banking super simple and convenient:

- Anytime, Anywhere : Check your recent transactions without stepping into a bank.

- Works Without Internet : Use a missed call or SMS even in low-network areas.

- Totally Free : Most options, like missed calls and SMS, cost nothing (only standard SMS charges may apply, depending on your phone plan).

- Saves Time : Skip the long bank queues and get updates fast.

- Stay Secure : Quickly review your last five transactions to catch any unusual activity.

- Pick Your Way : Choose from missed call, SMS, ATM, online banking, YONO app, or WhatsApp—whatever suits you best!

Conclusion

Summarising the above information, we can say that there are various methods to see the SBI Statement. You are free to choose any method at your convenience and by making an SBI Credit Card Login you can get your credit card’s mini statement. If you want a physical copy of the mini statement or have an SBI Balance Check then it can only be printed from the SBI ATMs. However, if you want a virtual copy of the mini statement, then as discussed above, you can use SMS Services, Missed Call Services, Internet Banking, or SBI YONO App as per your ease.

Frequently Asked Questions (FAQs)

What is the SBI mini statement number?

How many transactions are shown in an SBI Mini Statement?

Is there a charge for accessing the SBI Mini Statement?

Can I access the SBI Mini Statement without a registered mobile number?

How do I deregister an account for SBI Quick services?

Can I access the SBI Mini Statement if I have multiple SBI accounts?

Is an internet connection required to check the SBI Mini Statement?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement