Is CIBIL Score Required for Gold Loan?

Last Updated : Jan. 9, 2025, 3:19 p.m.

A gold loan is a secured loan that can be obtained from a bank or financial institution by pledging gold jewelry as collateral. In case the borrower fails to repay the gold loan, then the lender can recover the loan through the gold pledged as security. As gold loans are obtained against a collateral, they do not require a minimum CIBIL score in India . However, the CIBIL score does have an impact on gold loans and vice versa. Let us now read on to understand the same.

Importance of CIBIL Score in Gold Loans and Vice Versa

Although the CIBIL score does not impact the approval of a gold loan directly, a good CIBIL score equips you with the power to negotiate for better interest rates and terms with the lender.

If you do not pay your gold loan on time, it could bring down your CIBIL score just like any other loan. It is therefore advisable to avail a gold loan only if you can pay on time. A default or late payment can reduce your credit score.

Just like any other loans, repaying a gold loan on time will impact your CIBIL score positively. It will enhance your credit history. The history of timely repayment will impact your credit score positively. It will be reported to CIBIL and improve your overall creditworthiness.

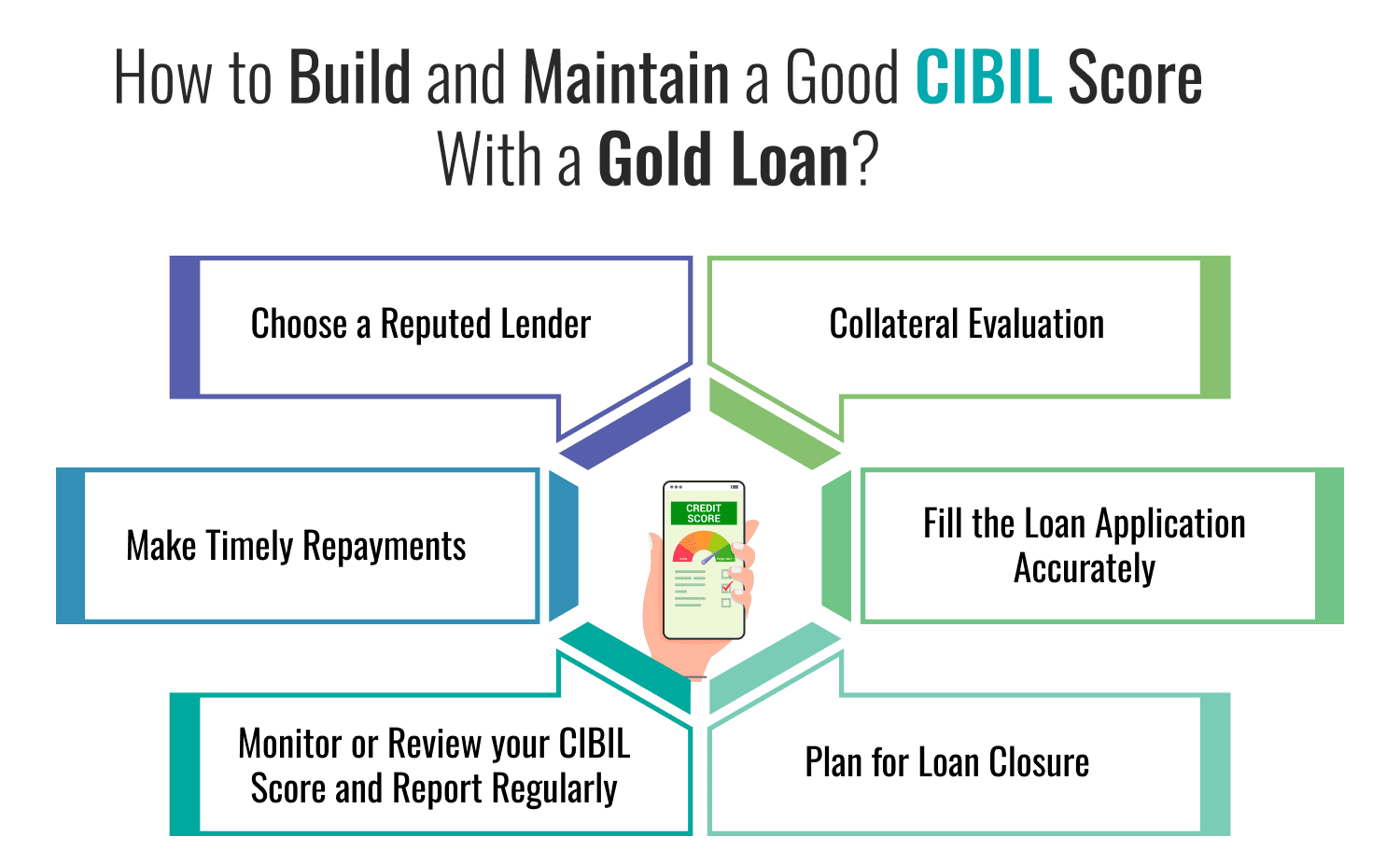

How to Build and Maintain a Good CIBIL Score With a Gold Loan?

Here are some tips on how you can build and maintain a good CIBIL score with a gold loan.

Choose a Reputed Lender: Research different lenders offering gold loans and compare their interest rates, loan terms, and customer reviews. Choose a credible lender who is reputed and employs fair practices.

Make Timely Repayments: Timely repayments for gold loans impacts your credit score positively. The behavior is reported to TransUnion CIBIL by lenders and this enhances your score. So, ensure that payments are made before the due date or on time. Set up auto pay or reminder alerts to prevent missing due dates.

Monitor or Review your CIBIL Score and Report Regularly: Monitoring your CIBIL report regularly helps you identify discrepancies that are bringing down the score. You can then dispute them with CIBIL and get them rectified. Check CIBIL report from Wishfin to keep track of your credit score and credit activity.

Collateral Evaluation: Before applying for a gold loan, it is important to evaluate the value of the gold ornaments. The loan amount is determined depending on a percentage of the evaluated value of the gold.

Fill the Loan Application Accurately: Complete and submit the application accurately. Also, submit all the required documents correctly. Submitting correct details about you will help you repay your loan on time without defaulting. This will help you maintain your CIBIL score without impacting it.

Plan for Loan Closure: Have a plan to repay your gold loan either in EMIs or as a one time payment. Having a well laid out strategy will help you manage your loan more effectively.

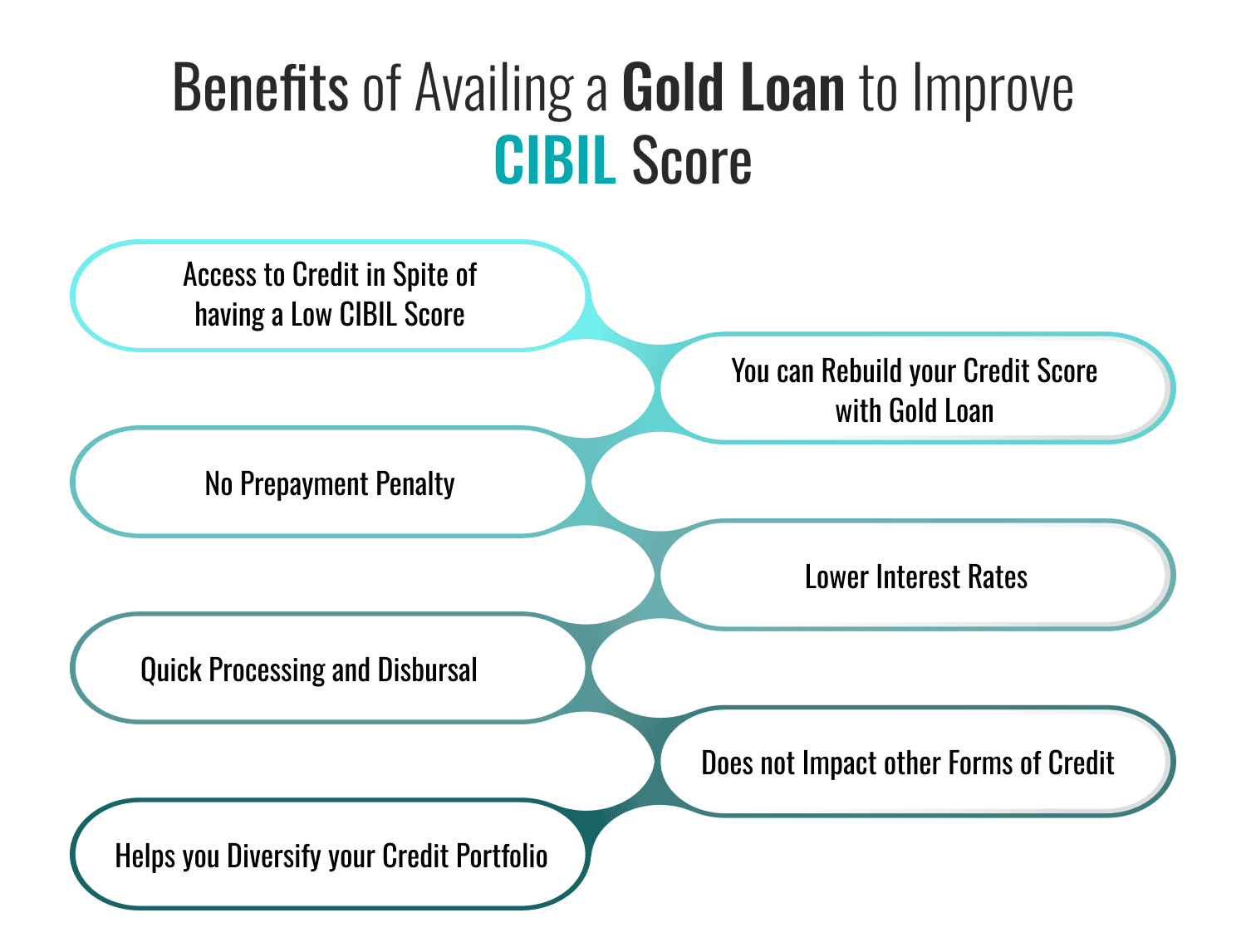

Benefits of Availing a Gold Loan to Improve CIBIL Score

Here are some advantages of taking a gold loan to improve your CIBIL score.

Access to Credit in Spite of Having a Low CIBIL Score: When your CIBIL score is low, you will have great difficulties in getting unsecured loans, creating a challenging situation for you. However, you can easily get a gold loan since it is backed by gold jewelry as collateral.

You can Rebuild your Credit Score with Gold Loan: Taking a gold loan and repaying it on time can help you rebuild your fallen credit score. Your responsible gold loan management behavior will be reported to credit bureaus. This will enhance your credit score and report. Each successful repayment contributes to building a positive credit score and credit history.

No Prepayment Penalty : Gold loans do not have any prepayment penalties. So, this feature is beneficial when closing the loan before the original tenure. Also, by repaying the loan early you are displaying your financial stability. This will impact your credit score positively. Further, repaying the loan before the loan tenure gets over lifts the loan burden from your head and helps you save potentially on interest.

Lower Interest Rates: Gold loans usually have lower interest rates compared to other unsecured loans. This helps you with easy repayment of the loan. By taking a gold loan and repaying on time, you can raise your credit score and also reduce potential interest that has to be paid over the loan tenure.

Quick Processing and Disbursal: When faced with emergencies, gold loans are very easy to procure due to their swift and quick approval and disbursal process. This speedy process helps you to procure funds during financial crisis and maintain your CIBIL score.

Does not Impact other Forms of Credit: Getting a gold loan will not impact other forms of credit taken by you unlike other loan forms which may affect existing credit lines or credit card limits. Since it is a secured loan, your current credit limits will remain intact allowing you to use other forms of credit parallelly.

Helps you Diversify Your Credit Portfolio: Maintaining a credit mix will impact the credit score positively. So, taking out a gold loan will add diversity to your credit profile impacting your credit score positively.

Tenure of a Gold Loan

The tenure of the gold loan depends on lender to lender as they have different policies. Gold loan is basically taken when you are in immediate need of money and can afford to pay it back in shorter period of time. Hence you are looking for a shorter-term obligation.

Fees on the Gold Loan

Generally, every lender has different policies and fees attached to the gold loan. The fees is usually a percentage of the value of the loan and depends on the lender at the same time. Some lenders charge processing fees and there is also a fee charged while undertaking the valuation of gold.

Other fees and charges include pre-closure charges if you close your loan amount before the due date. Late payment charges in the cases when you are not able to make the payments on time then an additional penal rate is charged over and above the existing rate. A renewal fees can be charged if the loan is renewed beyond the original period and other statutory government duties and charges that need to be paid.

How to Apply for Gold Loan

It’s very easy to apply for a gold loan. There are two ways of applying for gold loan.

- Online Process: You can apply online through NBFCs and banks through their online process. You just need to visit their website, and follow the process.

- Offline Process: But if you want to apply in a very conventional way you can just walk into the branch of the bank with your jewellery. But make sure that has gold loan facility available. Benefit of doing this way is you can get the process done in person.

But you need to make sure that the branch you are entering can provide you the gold loan, as not every branch has the gold loan facility.

Repayment of Gold Loan

Prepayment or Partial payment: Lenders have different policies for pre-payment or partial payment of loan. Many lenders charge some fees when you close the loan before the due date. Some can provide you a option of partial payment and take back the equivalent value of the pledged gold. You will only have to the interest amount on the balance principal loan amount. Some lenders will only release your gold on full repayment only

In case you are unable to make payment, then lenders have different default policies. You will be charged interest on the time overdue. This interest will be higher than the existing rate of the loan. Bank will send you a notice, stating that how much time is left in clearing their obligations. Before they will put your gold for auction to recover the payment.

Renewal of Gold Loan

If a customer wants to renew his loan amount, he can do the by simply visiting the branch of lender from where you have taken the loan. Every lender has a time capping that after paying certain number of EMIs only, you can apply for renewal. You can only renew the amount that you has taken earlier, but if you want to go for a higher amount then it will be considered as a new loan amount and the complete documentation process will be done.

Bank or NBFCs will provide you an authority letter mentioning your loan amount and extended tenure for the gold loan. It’s that easy.

You need to be very careful while approaching any lender for Gold Loan. Below are some important points you need to keep in mind while applying –

- Do market research about the lenders available in the market.

- Have sufficient knowledge of their security systems that will keep your gold safe.

- There may be lenders who can offer you a gold loan, but may not be financially sound to carry on. Hence, there is a possibility of them shutting down, taking your jewellery with them.

- We suggest you to apply with nationalized banks or reputed private banks and NBFCs. Who have robust security system in place to keep your gold loan safe. Some of them are specialized only in Gold Loan, you can also refer them.

You run a risk of losing your jewellery with no hope of recovery, if your lender ditches you. Gold has always emotional and social angle attached to it as it is associated with family jewellery. So, it is always best to your research thoroughly and stick to the banks or NBFCs who are reliable and well reputed.

Frequently Asked Questions (FAQs)