Top 5 Reasons that your CIBIL Score Goes Down

Last Updated : Feb. 5, 2025, 6:12 p.m.

The CIBIL score is a 3 digit number between 300 to 900. It is a summary of your creditworthiness. The CIBIL score is a really important parameter that lenders look into when they approve your loan or credit card applications. Higher the CIBIL score, easier the approval for loan or credit card applications. You will also get preferential interest rates, higher credit limits, desired loan amounts, and better loan terms. So, it is really essential to have a good CIBIL score. In order to maintain a good score, you must understand the reasons for why your CIBIL score goes down. Let us read on to understand the top 5 reasons why your CIBIL score is going down.

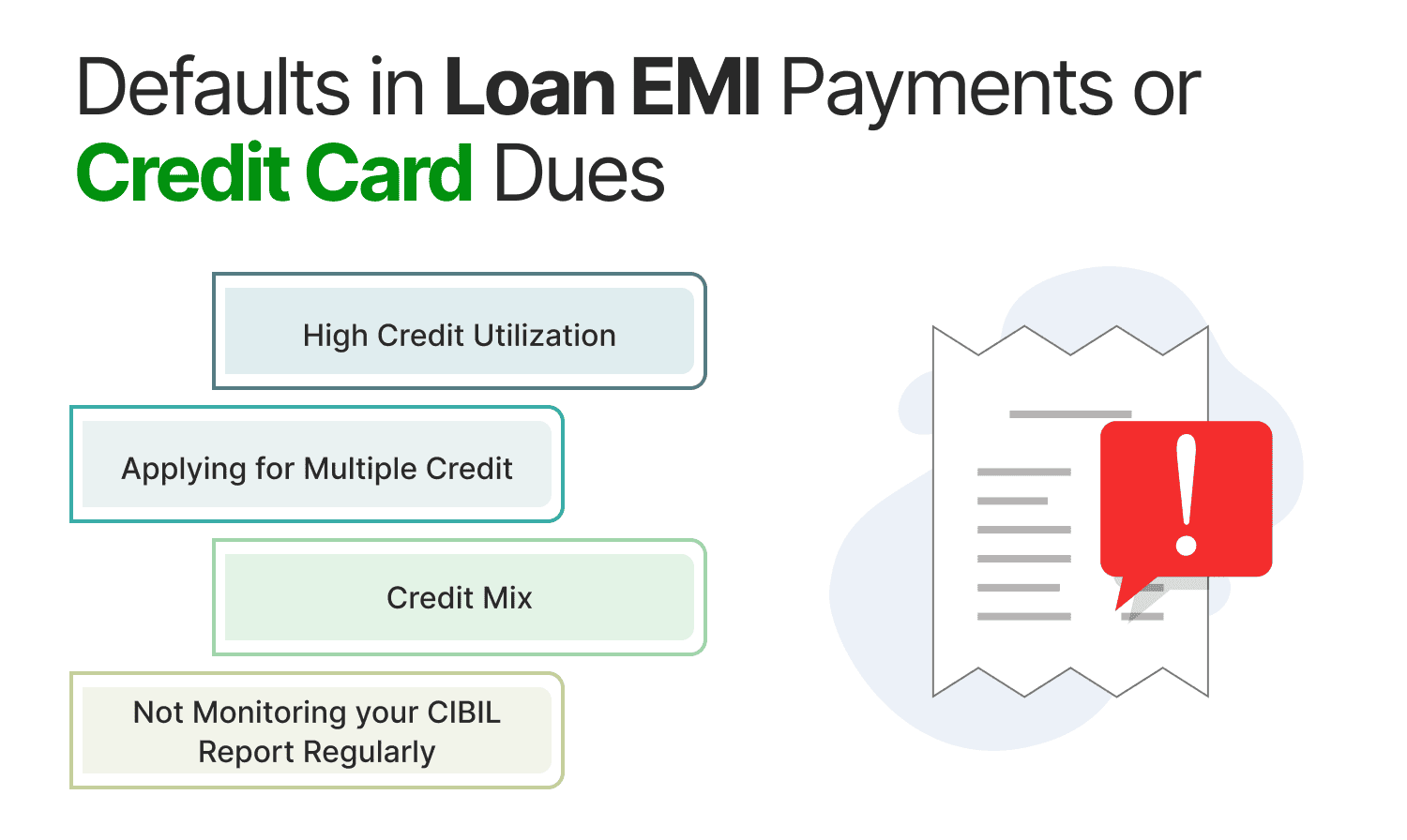

Defaults in Loan EMI Payments or Credit Card Dues

Not paying your credit card dues and loan EMIs will affect your CIBIL score drastically. It is one of the key factors that have an impact on your CIBIL score. Even one or two delayed or non payments will impact your credit score drastically. Frequent delays or non payments will decrease your score significantly. If your report shows DPD (Days Past Due) with numbers on your CIBIL report , then it means that you have defaulted on payments that will lead to a dip in your credit score. Accumulated unpaid dues of small amounts for over a period of time leads to a dip in your CIBIL score drastically.

High Credit Utilization

A high CUR impacts your CIBIL score negatively. It can also give the impression to lenders that you are over-dependent on credit and are overspending. This will impact your future prospects for potential credit.

Applying for Multiple Credit

Avoid applying for multiple credit simultaneously. Each time you apply for credit, a hard inquiry is triggered on your CIBIL report. If your CIBIL score is already good, then one or two hard inquiries will not impact your score. On the other hand, if you have a mediocre CIBIL score, even a few hard inquiries will cause your score to fall by a few points. Typically, multiple hard inquiries will have a drastic negative impact on your CIBIL score. Several hard inquiries also display your credit hungry behavior. Also, multiple lines of credit will be difficult to manage and repay, ultimately leading to huge accumulation of debt and a debt trap. Rejection of your loan or credit card application also reduces your CIBIL score significantly.

Not Monitoring your CIBIL Report Regularly

Your CIBIL report may contain errors such as duplicate accounts, active accounts which were not opened by you due to identity theft or incorrect entry, incorrect personal details, incorrect loan balance, errors in outstanding balance, errors in reported active loans or credit, etc. may affect your CIBIL score negatively. When you do not check your report regularly, these errors will go unidentified. You cannot rectify them and they will continue to impact your CIBIL score.

Credit Mix

It is ideal to have a mix of various types of credit in your portfolio. You can have a mix of installment loans, revolving credit like credit cards, and mortgages. The ability to handle different types of credit simultaneously works favorably for you during the approval of loan and credit card applications. There must also be a balanced ratio between secured and unsecured credit.

Useful Guidelines to Improve your CIBIL Score

From the above, we can derive some useful guidelines to improve your CIBIL score . They are as follows:

- Make timely payments: Pay your EMIs and credit card bills on time. This will help you maintain your CIBIL score and will give you an impressive credit history.

- Check your credit report regularly: By checking your CIBIL report regularly, you can identify errors, duplicate accounts, and open accounts which are not owned by you. You can then raise a dispute with CIBIL and get these corrected.

- Do not apply for several lines of credit: Before you apply for further credit, analyze if you require that additional line of credit. This will help you avoid hard inquiries and the burden of managing multiple debts.

- Have a low credit utilization ratio: The credit utilization ratio is defined as the percentage of the total available credit that you are using currently. Experts recommend a credit utilization ratio within 30% or 40%. A CUR higher than this may result in lowering your CIBIL score. A CUR as high as 80% is highly detrimental to your CIBIL score. So, keep your CUR within the required limit.

- Have a good credit mix: Have a mix of credit in your credit portfolio. This will give a favorable impression to lenders that you are capable of handling different types of credit simultaneously. Versatile credit management works in your favor while approving loan and credit card applications while also enhancing your credit score.

CIBIL Score is very important for banks to determine your credit worthiness. One has to try to maintain a CIBIL score of 700-900, as it considered a good one.

It is advised that to maintain a good credit history and avoid low CIBIL Score. You will have to pay your dues on time, maintain your expenses as per your credit limit, and monitor your account on a timely basis. This will improve your CIBIL Score.

You can keep a track of your CIBIL Score and review your CIR (Credit information report). This will help you to know which financial activity is pulling your credit score down.

Frequently Asked Questions (FAQs)