What Makes a Good Credit History?

Last Updated : Jan. 8, 2025, 1:22 p.m.

Your credit history will determine whether or not your loan or credit card application is approved. Not only does your credit history reveal your credit score, but it also reveals your payback history. A credit score of 750 or more is considered good and nearly guarantees you the credit you desire. A credit score is a numerical score between 300 to 900 and it reflects your creditworthiness. So, handle your credit effectively and maintain a solid credit history to obtain credit quickly and with favourable conditions. Let us now read on to find out some tips for how to make a good credit history.

Factors Impacting Your Credit History

Credit bureaus use four main factors to establish credit score ratings - The number of credit inquiries, payback history, existing loan and credit use, loan tenure, and repayment history are the impacting factors. For a credit score, payment history, debts, and credit utilization always receive the greatest weightage.

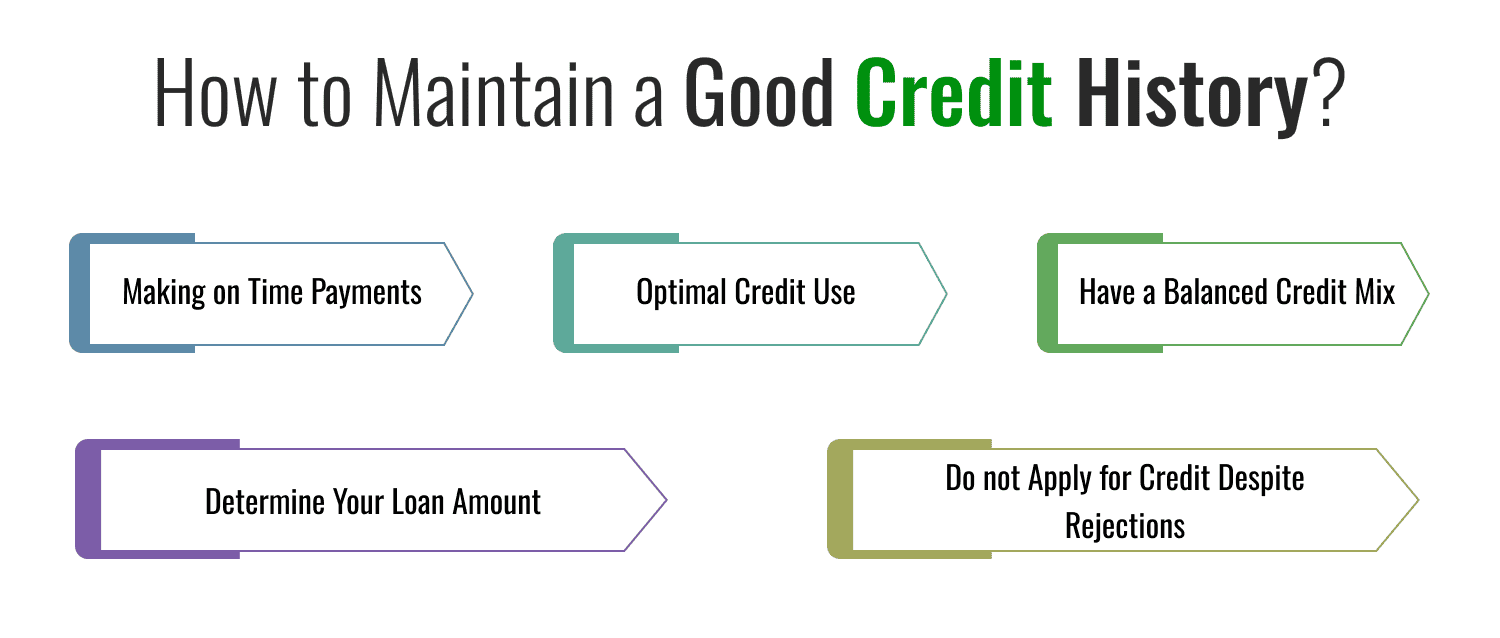

How to Maintain a Good Credit History?

Here are some tips to maintain a good credit history:

Making on Time Payments

- Making timely payments of your loan or credit card bills will help you get a very good credit history. So before you apply for credit, make a budget plan, analyze your spending habits, examine the already existing debts, and make sure that you have enough money to pay off your credit card bills and EMIs. Also, try to settle your existing debts one by one if there are too many. The settlement of debts equals approximately 30 percent of your credit score.

Optimal Credit Use

- Use credit optimally. A credit utilization ratio of 30% or within is recommended by experts. If your credit card limit is INR 2 lakhs, you must not use more than INR 60,000 in a month.

Do not Apply for Credit Despite Rejections

- In spite of facing rejections, do not seek credit in a hurry. When you apply for credit, lenders make a hard inquiry to pull out information from your CIBIL report. Although a few hard inquiries may not impact your credit score, making too many will bring it down drastically. It will impact your credit history negatively. So, before applying after facing a denial, find out why you faced the rejection. Work upon those impeding factors and apply again.

Have a Balanced Credit Mix

- Have a balance between unsecured credit and secured credit. Defaulting on unsecured loans will cause your credit score to fall drastically. However, both secured and unsecured loans have to be paid on time.

Determine Your Loan Amount

- When you are in need of a loan, determine how much loan you need. Do not apply for higher loan amounts than you required. For instance, during a medical emergency, determine how much you need based on your insurance and savings. This will reduce your financial burden, assist you in making timely payments, and help you maintain a positive credit history.

Advantages of a Good Credit Score

A consistent CIBIL score or credit score can assist you in saving money and simplifying your financial life.

If you have a good credit score, you will mostly be able to get the best interest rates. Of course, there are other factors such as income, age, etc. You can thus pay the least amount of financing costs on credit card balances and loans.

When you have an excellent credit score, your chances of acquiring credit improve. Thus you can apply for a loan or a credit card with confidence.

A high credit score leaves you with negotiating power with your lenders. You can negotiate for preferential interest rates and also get attractive and pre-approved credit offers.

Frequently Asked Questions (FAQs)