Why Credit Reports are Important? Understand all the Reasons Behind it

Last Updated : Feb. 5, 2025, 12:35 p.m.

A credit report is a detailed summary of an individual’s credit history. It contains essential information such as credit score, detailed credit account history, closed accounts, personal details, credit inquiries, and more. When you have applied for credit, financial institutions check your credit report to know about your financial status. If you have a good credit score and an excellent credit history, then your loan and credit card applications will be sanctioned with ease. On the other hand, if your financial history is shaky, then your credit application may get rejected. You have to necessarily view your credit report periodically at regular intervals. Let us now read about the importance of checking your credit reports regularly.

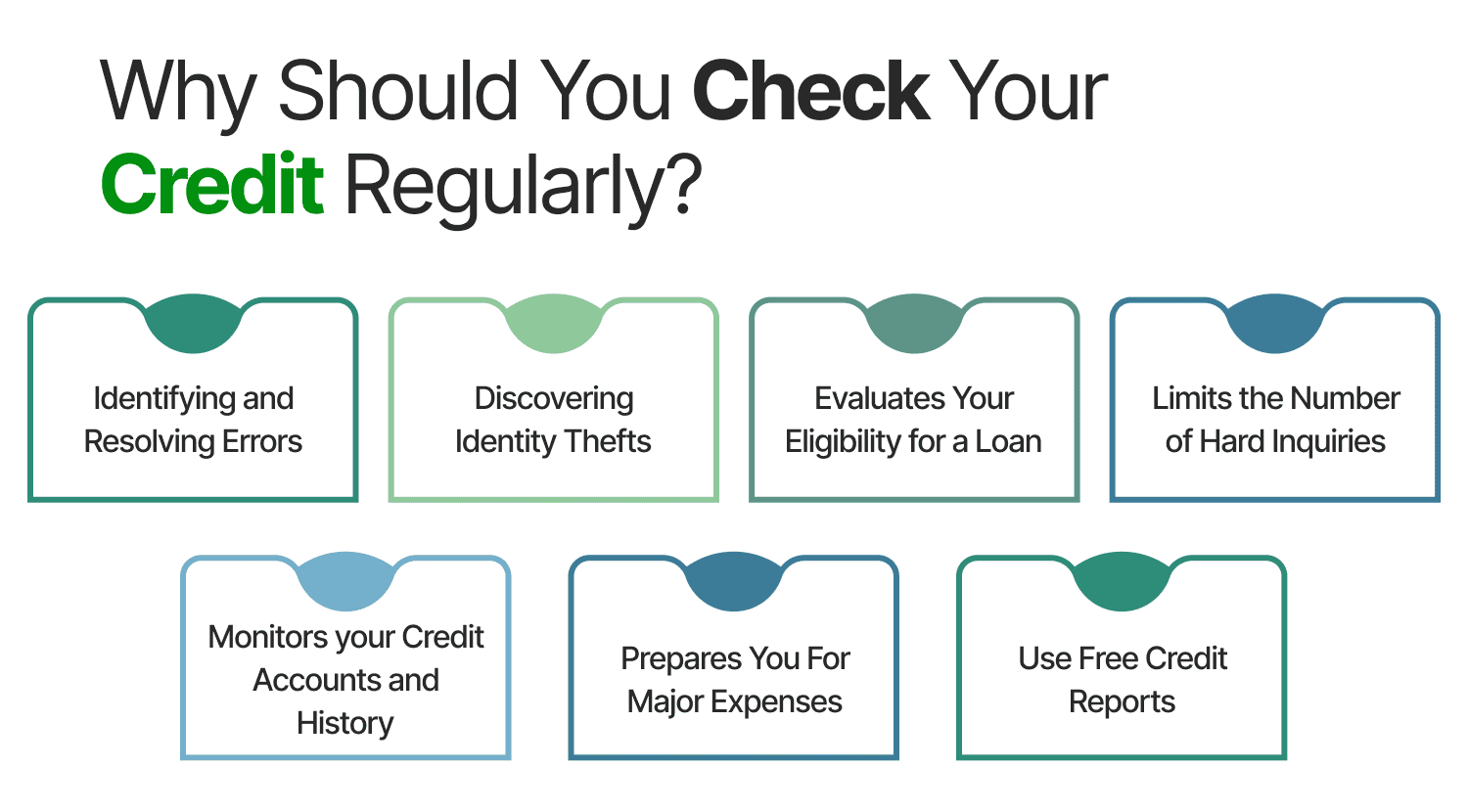

Why Should You Check Your Credit Regularly?

Here are some top reasons for checking your credit report regularly.

Identifying and Resolving Errors

Your credit report may contain discrepancies related to personal information such as name, address, mobile number, etc. Credit bureaus or lenders must have entered the details wrongly. It is important to review your report regularly and raise disputes with the respective credit bureau to rectify any inaccuracies. You can take vital steps to enhance your credit score and maintain good credit health. This encompasses making timely payments and avoiding other negative factors.

Discovering Identity Thefts

Verifying your credit report also helps to discover accounts that are not yours or any fraudulent activities. After detecting any potential cases of identity theft, it is important to inform the credit bureau and relevant authorities.

Evaluates Your Eligibility for a Loan

Before applying for a loan or a credit card, it is ideal to view your CIBIL report or credit report. This will help you assess if you are eligible for a loan or if there are areas in which you need to take action to enhance your credit score.

Limits the Number of Hard Inquiries

Each time you apply for credit, the lender conducts a hard inquiry on your credit report. Multiple hard inquiries within a short duration will bring down your credit score. However, if you verify your credit report before you apply for a loan , you can reduce the number of times lenders check your report and maintain your credit score.

Monitors your Credit Accounts and History

Checking your credit report regularly enables you to identify incorrect records, duplication of loans or credit card accounts, and mix ups with someone else’s details. Any errors in your credit accounts can be detrimental to your credit score. It will impact your chances of getting potential credit in the near future.

Prepares You For Major Expenses

Check your credit report online before making major purchases or planning a trip. It helps you to understand your present financial status. You can understand how your current financial situation will affect your loan approvals or credit limits for big ticket purchases like electronic devices or international trips.

Use Free Credit Reports

Since 2017, the RBI has made it compulsory for all credit bureaus in India to provide one free annual credit report to consumers. Make a request to one of the credit bureaus for a free credit report and ensure that the report covers all the details. Using these free reports enables you to stay updated on your financial status without paying any additional cost. You can also check your credit score and credit report for free from fintechs like Wishfin. Wishfin is the first official fintech partner of CIBIL, and gives you an accurate CIBIL score .

Conclusion

Now you know why credit reports are important and the reasons for generating a Cibil Report before you apply for any loan. On the other hand, it is also necessary for lenders to take a deep look at the Cibil Report of the applicant before giving any type of debt, loan, or credit card. Now you know the reasons for calculating a Cibil Score before borrowing any kind of debt.

Frequently Asked Questions (FAQs)