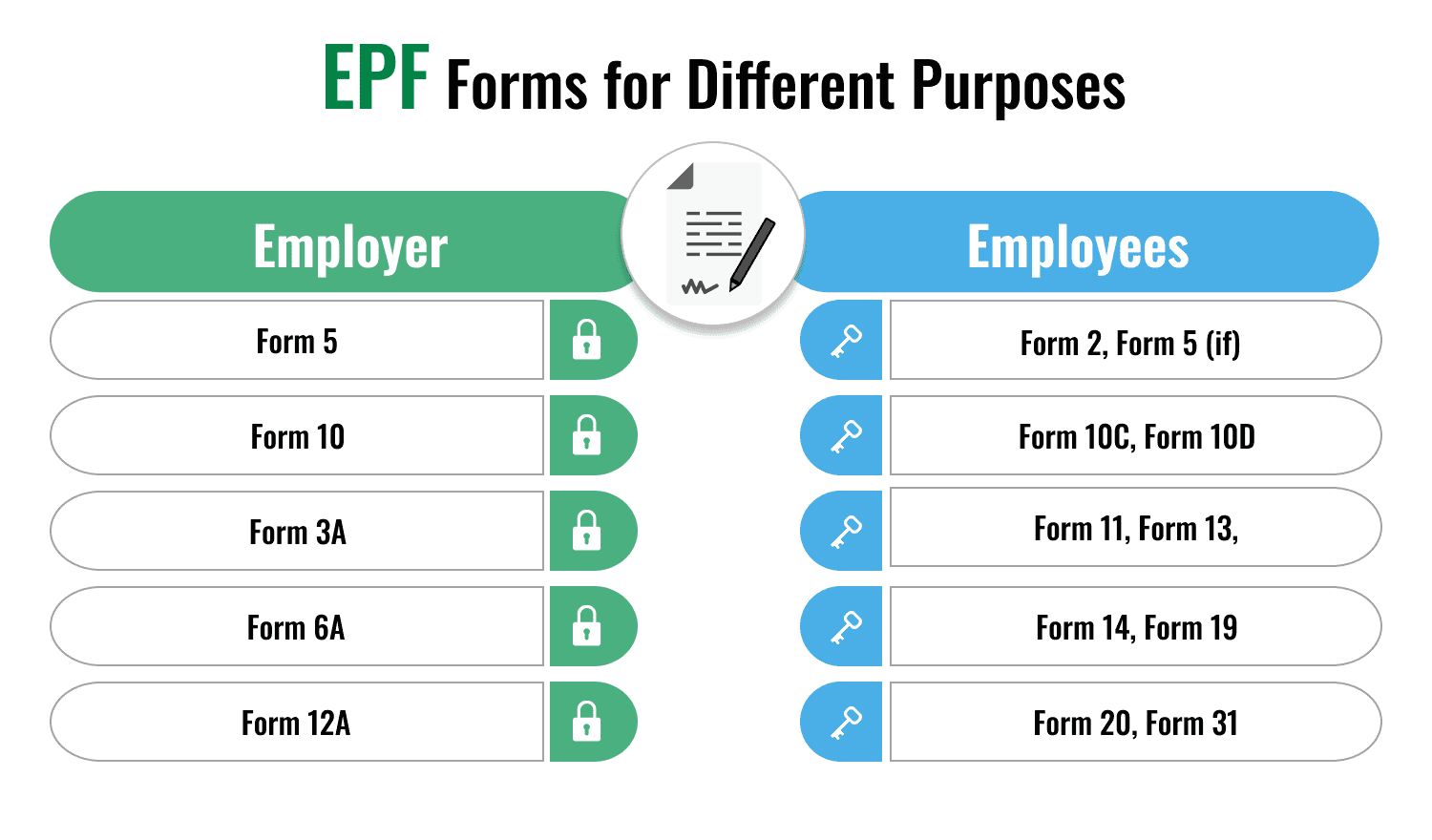

EPF Forms for Different Purposes

Last Updated : June 5, 2025, 3:25 p.m.

Having confusion about certain EPF forms and their purposes? Both you and your employer contribute to your provident fund. Every month, your employer deducts 12% of your basic salary and dearness allowance and marks it as your contribution to the salary slip. An equitable contribution is also made by the employer. Both the employee and the employer contribute 12% of the employee’s base salary and dearness allowance to the EPF.

An important social security program, EPF, was created to give financial support to the workers after retirement. A part of each employee's pay is contributed to the EPF account by both the business and the employee. A certain amount of pay has been contributed by the employer and the employee both to the EPF account.

The contributions also earn you interest at a rate decided by the government of India. The current interest rate on EPF deposits is 8.50 percent per annum. Yes, you can withdraw from your EPF account for various purposes such as marriage, education, home purchase, etc. To do so, you need to fill certain forms. We, in this post, have explained EPF forms for both employee and employer. You should have a look and read and know what these forms are for.

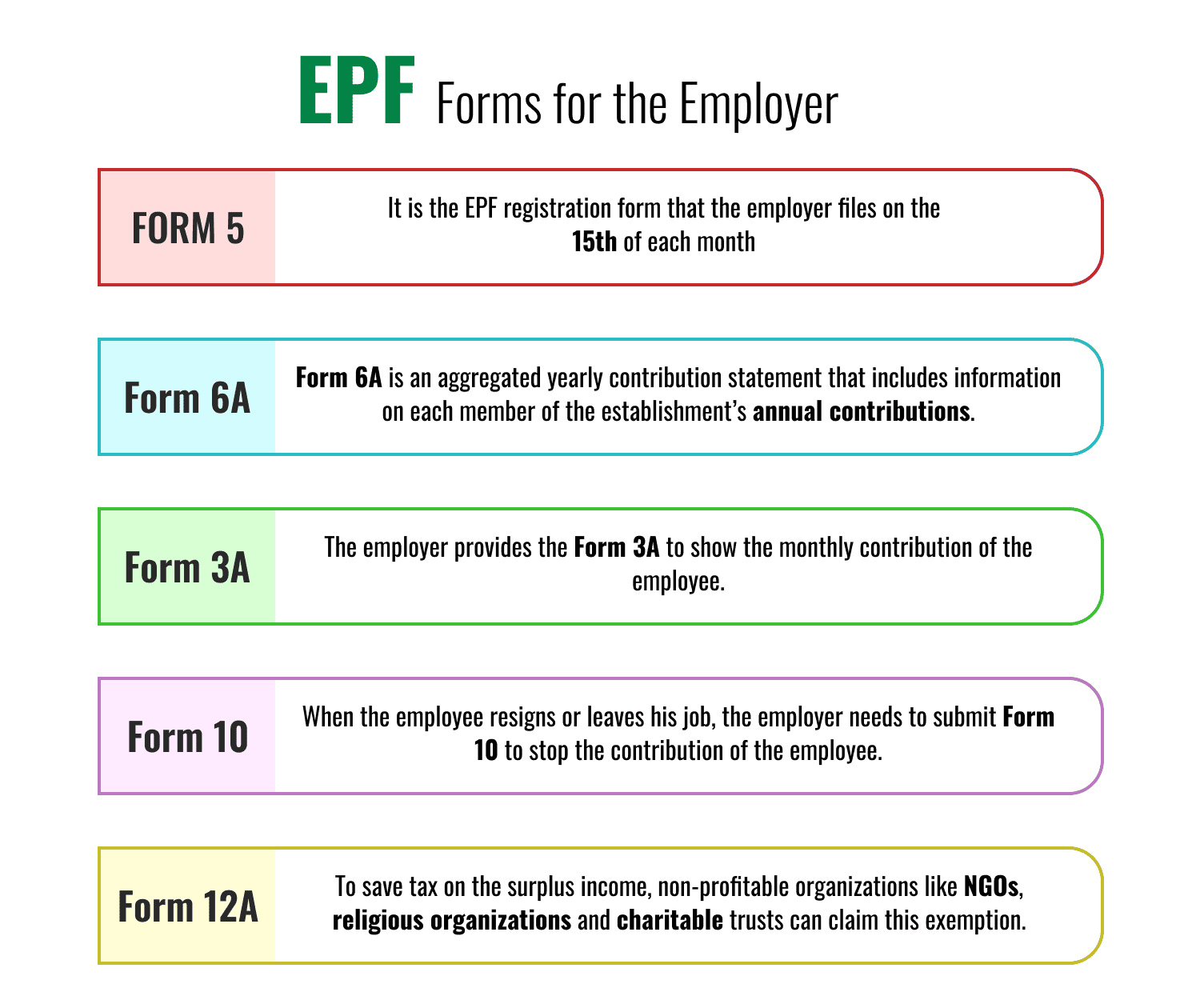

EPF Forms for the Employer Explanation

The organization or company in which you are working has to allow you to get the benefit under the EPF scheme if your salary is less than INR 15,000. Any business with more than 20 employees is required to register with the Employees’ Provident Fund Organisation of India. Companies with less than 20 employees can voluntarily join the Employees’ Provident Fund. EPF benefits are available to all salaried employees. Examine the forms listed below, which are required by the company in order to enroll the employee.

| EPF Forms | Uses |

|---|---|

| Form 5 | For registering of new employees under EPF & EPS |

| Form 10 | For resignation of an employee |

| Form 3A | For monthly contribution of an employee |

| Form 6A | For annual contribution of an employee |

| Form 12A | For one-time tax exemption to non-profitable companies |

Form 5: It is the EPF registration form that the employer files on the 15th of each month. This form is filled by the employer if there are new employees hired who will be registered for the first time under the EPF scheme. If no new employees are hired or no new employees are employed, it is reported as NIL.

Form 10: When the employee resigns or leaves his job, the employer needs to submit Form 10 to stop the contribution of the employee. It is also needed to be submitted every 15th of the month.

Form 3A: The employer provides the Form 3A to show the monthly contribution of the employee. PF Form 3A is an Employee-by-Employee Annual Report for the Amounts Deducted/Contributed to the EPF, VPF, and EPS Accounts by the Employee and the Employer. Form 3A, also known as a member’s annual contribution card, shows the subscriber’s/and member’s employer’s monthly contributions to the E.P.F. and Pension Fund in a given year.

Form 6A: Form 6A is an aggregated yearly contribution statement that includes information on each member of the establishment’s annual contributions. It includes your annual salary, which is deducted from your EPF contribution. As a result, the business can highlight each employee’s overall contribution.

Form 12A: To save tax on the surplus income, non-profitable organizations like NGOs, religious organizations and charitable trusts can claim this exemption. This form gives a one-time tax exemption to all the non-profitable trustees.

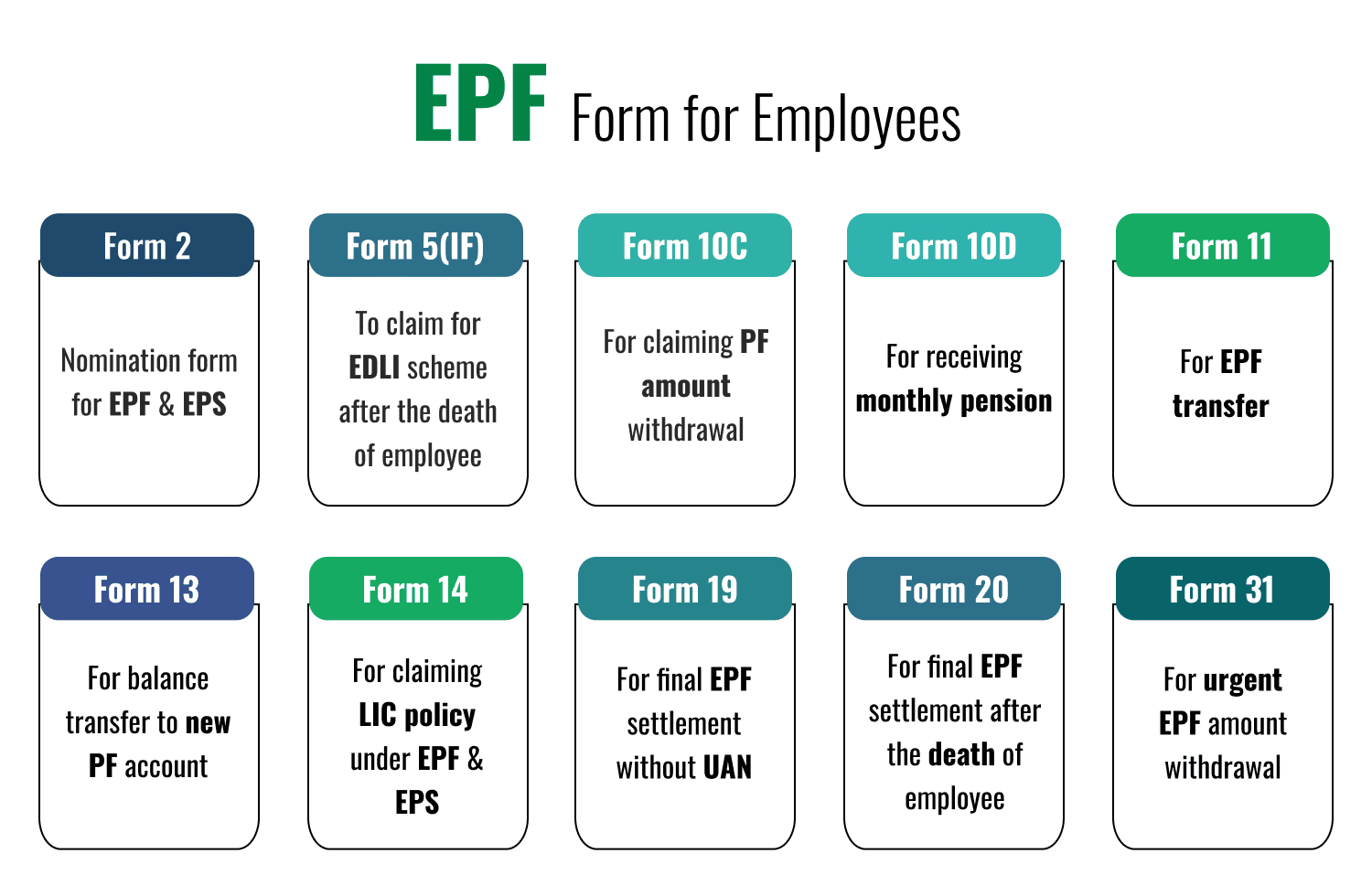

EPF Form for Employees Explanation

Employees can fill the following forms for specific purposes.

| EPF Forms | Uses |

|---|---|

| Form 2 | Nomination form for EPF & EPS |

| Form 5(IF) | To claim for EDLI scheme after the death of employee |

| Form 10C | For claiming PF amount withdrawal |

| Form 10D | For receiving monthly pension |

| Form 11 | For EPF transfer |

| Form 13 | For balance transfer to new PF account |

| Form 14 | For claiming LIC policy under EPF & EPS |

| Form 19 | For final EPF settlement without UAN |

| Form 20 | For final EPF settlement after the death of employee |

| Form 31 | For urgent EPF amount withdrawal |

Form 2: It is basically a nomination and declaration form. To add a nominee to your EPF account, it is necessary to submit Form 2 which you can do either online or offline. Why is it important? In this form the employee nominates his or her family members and nominates them, who are liable to receive the EPF balance in the case of the employee’s demise. It is necessary to secure the family member of the employee in case of the latter’s unfortunate death. You can change your nominee anytime and it is mandatory after the marriage.

Form 5(IF): After the death of the employee and to claim the Employee Deposit Linked Insurance (EDLI) you can fill Form 5 (IF). You need to provide an attested form by the employer to claim this benefit. If the form is not attested by the employer due to any reason, the gazetted officer can do so. When the beneficiary of the insurance is minor, its legal guardian can fill the form.

Form 10C: You can submit this form online or offline for the withdrawal of the pension amount from the EPS scheme. But, before doing so, you should look at the essentials.

- The withdrawal from EPS can be made if you have worked for 10 years

- Your age must be below 50 years

In case the employee is above 50 years old but below 58 years at the time of pension withdrawal, the employee can receive a reduced pension amount after filling the Form 10D. In both cases, the employee is set to receive a scheme certificate.

Form 10D: A member must complete EPF Form 10D in order to receive pension benefits. After completing ten years of service in the formal sector, the member is eligible for a pension. When a pensioner retires, he or she fills out this form.

Form 11: When an employee swaps his job, he needs to submit Form 11. When a member changes jobs, he must file EPF Form 11 to transfer the EPF money from the prior account to the new account. The UAN will stay the same, but the Member ID and PF account number will be different.

Form 13: To transfer the balance of your old EPF account to a new PF account just after the job change, you can fill form 13. Remember the UAN remains the same wherever you go. The thing that changes with a job change is the provident fund account number. It is included in the composite claim form for a quick transfer.

Form 14: For paying the Life Insurance Corporation (LIC) policy from the PF account, you need to fill this form, do a self-attestation and submit it to the employer, which will submit it to the EPF commissioner.

Form 19: If you don’t have the Universal Account Number (UAN), you can still make withdrawals using Form 19 . Only the PF contribution and interest can be withdrawn using this form. The form does not apply to the withdrawal of pension contributions. When a member wants to close out his or her PF account, PF Form 19 must be completed. It only applies to employees who don’t have a UAN (Universal Account Number). This form will be used to request a PF account final settlement or to request pension withdrawal benefits.

Form 20: The nominee can claim for the settlement by filling and submitting the Form 20 after the death of the employee. If the nominee was a minor or disabled individual. The legal guardian can fill-up the form and submit it on his/her behalf. The PF amount would be disbursed to the bank account directly or via money order.

Form 31: To meet your urgent financial needs when you require funds, you can submit Form 31 and make a partial withdrawal from the PF account. This form applies to withdrawal for marriage, education, home & plot purchase, home loan repayment, etc.

Key EPF Forms and Their Purposes

Below is a comprehensive list of the most commonly used EPF forms, their purposes, and the scenarios in which they are required.

1. Form 19: Final PF Settlement

- Purpose : Used to withdraw the entire EPF balance when an employee retires, resigns, or leaves employment.

- When to Use :

- Retirement after attaining the age of 55.

- Leaving a job and not joining another EPF-covered establishment for 2 months.

- In case of the member’s demise (by nominees/legal heirs).

- Key Requirements :

- Universal Account Number (UAN) must be activated.

- Aadhaar, PAN, and bank account details must be linked and verified.

- Submit through the employer or directly via the EPFO Unified Portal for composite claims.

- Process :

- Log in to the EPFO Unified Member Portal (https://unifiedportal-mem.epfindia.gov.in/).

- Submit Form 19 under the “Online Services” tab for final settlement.

- Authenticate using Aadhaar-based OTP.

2. Form 10C: Pension Withdrawal

- Purpose : Used to claim benefits under the Employees’ Pension Scheme (EPS), such as pension withdrawal or scheme certificate.

- When to Use :

- Withdrawing pension contributions if service is less than 10 years.

- Obtaining a scheme certificate for pension eligibility after 10 years of service.

- By nominees in case of the member’s demise.

- Key Requirements :

- UAN linked with Aadhaar and bank details.

- Composite Claim Form (Aadhaar/Non-Aadhaar) for simplified processing.

- Process :

- Submit online via the EPFO portal or through the employer.

- Select “Pension Withdrawal” under the “Online Services” tab.

3. Form 31: EPF Advance/Partial Withdrawal

- Purpose : Allows partial withdrawal from the EPF account for specific purposes like marriage, education, medical treatment, or home purchase.

- When to Use :

- Medical emergencies (self/family).

- Marriage or education of self/children (after 7 years of membership).

- Purchase or construction of a house/flat.

- Repayment of a home loan.

- Key Requirements :

- Minimum balance and service period criteria (e.g., 5 years for housing, 7 years for marriage).

- Supporting documents (e.g., medical certificate, marriage invitation).

- Process :

- Apply online via the EPFO portal under “Online Services” > “Claim (Form-31, 19, 10C & 10D)”.

- Verify with Aadhaar OTP or submit through the employer.

4. Form 11: Declaration Form

- Purpose : Used for automatic transfer of EPF balance when switching jobs or for updating member details.

- When to Use :

- Joining a new employer covered under EPF.

- Declaring previous PF account details for seamless transfer.

- Updating KYC details like Aadhaar, PAN, or bank account.

- Key Requirements :

- UAN and previous PF account details.

- Employer verification for new employees.

- Process :

- Submit through the new employer or online via the EPFO portal.

- Ensures continuity of EPF benefits without manual transfer.

5. Form 13: PF Account Transfer

- Purpose : Transfers the EPF balance from a previous employer’s PF account to the current employer’s account.

- When to Use :

- When changing jobs, the new employer is under the EPF scheme.

- To consolidate multiple PF accounts into one.

- Key Requirements :

- UAN must be active and linked to Aadhaar.

- Previous and current employer details.

- Process :

- Apply online via the EPFO portal under “Online Services” > “One Member – One EPF Account (Transfer Request)”.

- Authenticate using Aadhaar OTP.

6. Composite Claim Form (Aadhaar/Non-Aadhaar)

- Purpose : A single form replacing Forms 19, 10C, and 31 for simplified claims.

- When to Use :

- Final settlement (Form 19 equivalent).

- Pension withdrawal (Form 10C equivalent).

- Partial withdrawal/advance (Form 31 equivalent).

- Key Requirements :

- Aadhaar-linked UAN for online submission.

- Non-Aadhaar form requires employer attestation.

- Process :

- Download from the EPFO website or access via the Unified Portal.

- Submit online for Aadhaar-based claims or physically through the employer for non-Aadhaar claims.

7. Form 2: Nomination and Declaration

- Purpose : Used to nominate beneficiaries for EPF and EPS benefits.

- When to Use :

- When opening a new EPF account.

- Updating or changing nominees (e.g., after marriage or family changes).

- Key Requirements :

- Nominee’s Aadhaar, name, relationship, and address.

- Photograph of nominee(s) for e-nomination.

- Process :

- File e-nomination online via the EPFO portal under “Manage” > “E-Nomination”.

- Authenticate using Aadhaar-based OTP.

8. Form 5: New Employee Registration

- Purpose : Registers new employees under the EPF scheme.

- When to Use :

- When an employee joins an organization covered under EPF.

- Key Requirements :

- Employee details (name, Aadhaar, bank account, etc.).

- Employer submits on behalf of the employee.

- Process :

- The employer submits Form 5 to the EPFO along with Form 2 (nomination).

9. Form 10D: Monthly Pension Claim

- Purpose : Used to claim a monthly pension under the EPS after retirement or by dependents.

- When to Use :

- Retirement after 58 years with at least 10 years of service.

- By spouse/children in case of member’s demise.

- Disability pension claims.

- Key Requirements :

- UAN linked with Aadhaar.

- Bank account details for pension disbursal.

- Process :

- Submit online via the EPFO portal or through the employer.

- Attach supporting documents like a pension certificate.

How to Submit EPF Forms?

Most EPF forms can now be submitted online through the Unified Member Portal (https://unifiedportal-mem.epfindia.gov.in/) for faster processing. Here’s a general process:

- Log in to the Portal :

- Use your UAN, password, and CAPTCHA to sign in.

- Ensure your KYC (Aadhaar, PAN, bank account) is updated and verified.

- Select the Appropriate Service :

- Navigate to “Online Services” or “Manage” to access forms like e-nomination, transfer, or claims.

- Fill and Authenticate :

- Enter required details, upload documents, and authenticate using Aadhaar-based OTP.

- Track Status :

- Monitor the status of your request under the “Track Claim Status” tab.

For offline submissions, forms must be attested by the employer and submitted to the regional EPFO office.

Conclusion

This article will help to know about the different types of Forms under EPF scheme , that can be beneficial in your working as well after working life, i.e after retirement. It’s very important to know about the schemes of the EPF and usage so that employee and employer both can manage their money and to be disbursed and how much to be needed. This can be beneficial which can ensure their financial stability.

Frequently Asked Questions (FAQs)

Without the employer’s attestation can a PF Member submit his or her claim settlement?

Total how many types of forms are there in PF ?

How many different types of PF (Provident Funds) exist ?

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates