EPFO Employer Login

Last Updated : June 6, 2025, 2:35 p.m.

EPFO is the Employees’ Provident Fund Organization where an employee and an employer make equal contributions. 12% of the basic salary of the employee is contributed by both parties. The employer makes a contribution of 8.33% to the Employee Pension Scheme and the rest of the amount is contributed to the PF account. But an employer needs an EPFO Employer Login to make contributions and create an account for the employee. So, if you aren’t aware of the login process then you are at the right place. Here you can see the various steps involved to make an employer login to the EPFO website. By accessing the employer’s account online you can come across various advantages.

What is the EPFO Employer Portal?

The EPFO Employer Portal is a dedicated online platform for establishments registered with the EPFO. It enables employers to manage PF-related activities, ensuring compliance with the Employees’ Provident Fund and Miscellaneous Provisions Act, of 1952. Employers use the portal to submit employee contributions, update KYC details, approve claims, and generate reports, streamlining administrative processes.

The procedure of Employer’s EPFO Login

In order to login into the employer portal, you will always need a UAN. UAN is the universal account number that has to be activated before any login. After creating the UAN, you can easily log in. You can also change the password as per your needs. So, you can see the various steps involved if you are logging in to the employer portal of the EPFO website.

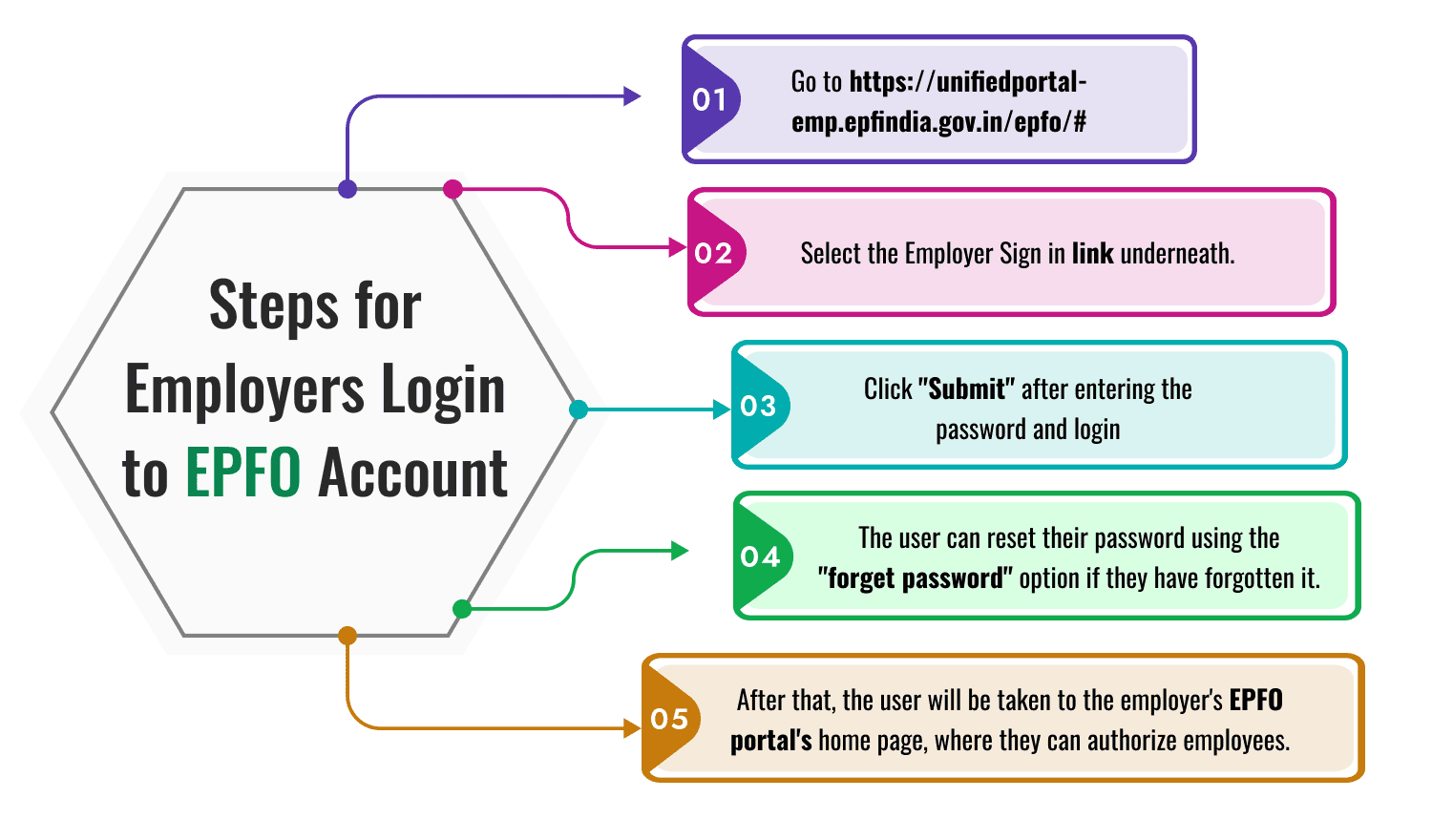

Steps for Employer’s Login to EPFO Account

Step1: Go to https://unifiedportal-emp.epfindia.gov.in/epfo/# .

Step 2: Select the Employer Sign in link underneath.

Step 3: Click "Submit" after entering the password and login.

Step 4: The user can reset their password using the "forget password" option if they have forgotten it.

Step 5: After that, the user will be taken to the employer's EPFO portal's home page, where they can authorize employee.

- In the unlikely event that you can't remember your password, click the Forgot Password link and proceed with the full recovery procedure.

- You can utilize the Unlock Account link to retrieve your account if it gets locked repeatedly because of incorrect password entries.

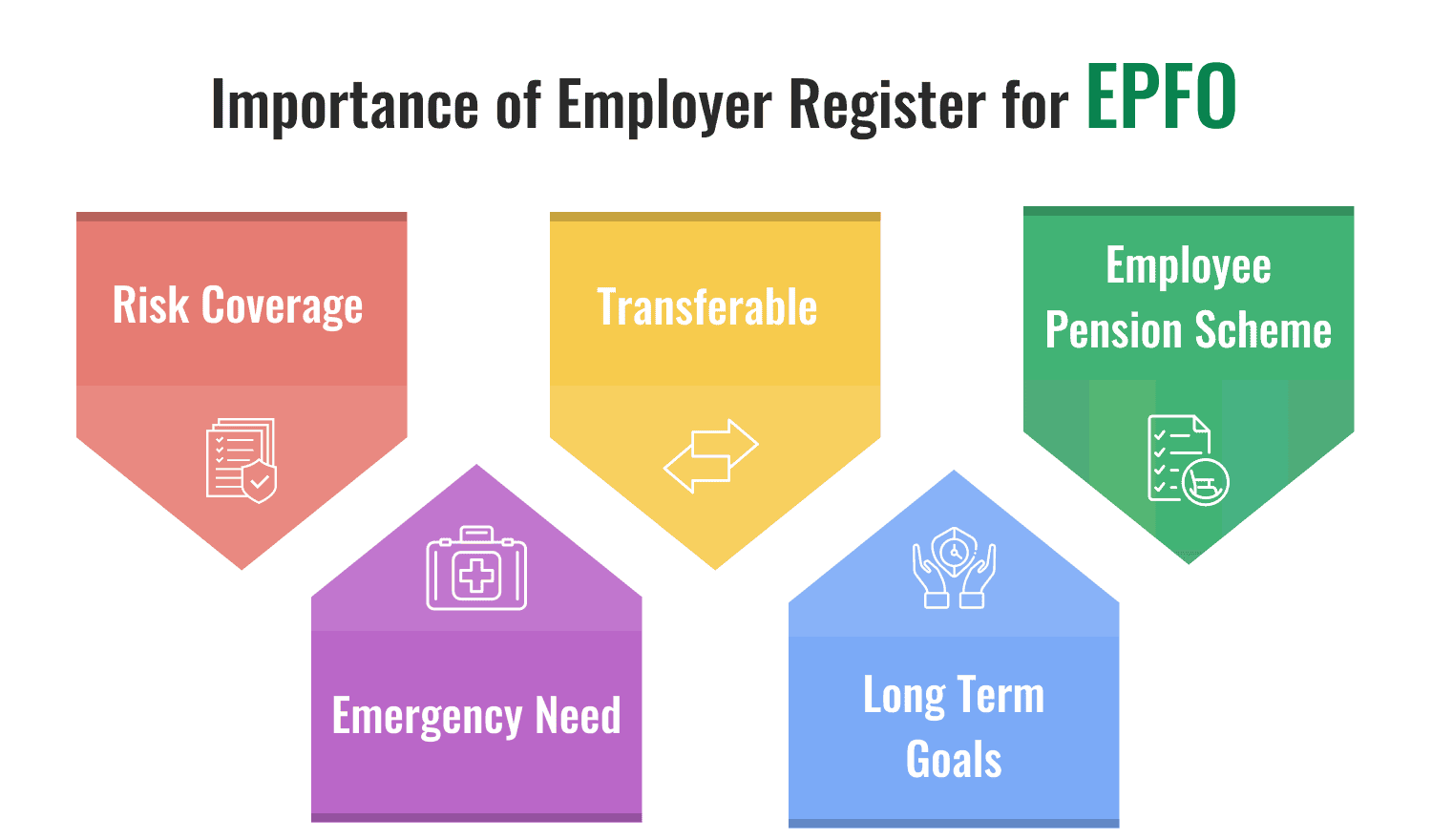

Importance of Employer Register for EPFO

Employers must complete the EPF registration process since TDS is subtracted from employee wages. Additionally, they would have to handle remittances only once the employer generated a challan via the EPFO portal.

- Risk Coverage: The main goal is to insure against the financial risks that workers may incur due to disease, death, and retirement.

- Transferable: The account is transferable to any other location you want to work and it is unique.

- Employee Pension Scheme: All Pension holders are covered by EPF. An 8.33% interest rate on employer’s contribution up to 15000/- would be paid as a monthly pension after 58 years of service.

- Emergency Needs : You can use the money that has accrued in the PF corpus for emergencies.

- Long Term Goals: EPF money can be used to finance a number of long-term objectives, such as getting married , going to college , or buying a house.

Advantages of EPFO Employer Login

- New Establishments registration can be done through the employer login portal.

- ECR Challan payment can also be done by the employer.

- Once you have access to the employer's site, you can create EPF accounts for your new hires.

- Approval of EPF Claims is also permitted for numerous additional services.

- Additionally, the employer has the option to contribute their share of the PF account online.

- You can even use the EPFO Login Portal for Employers to view your contribution or balance.

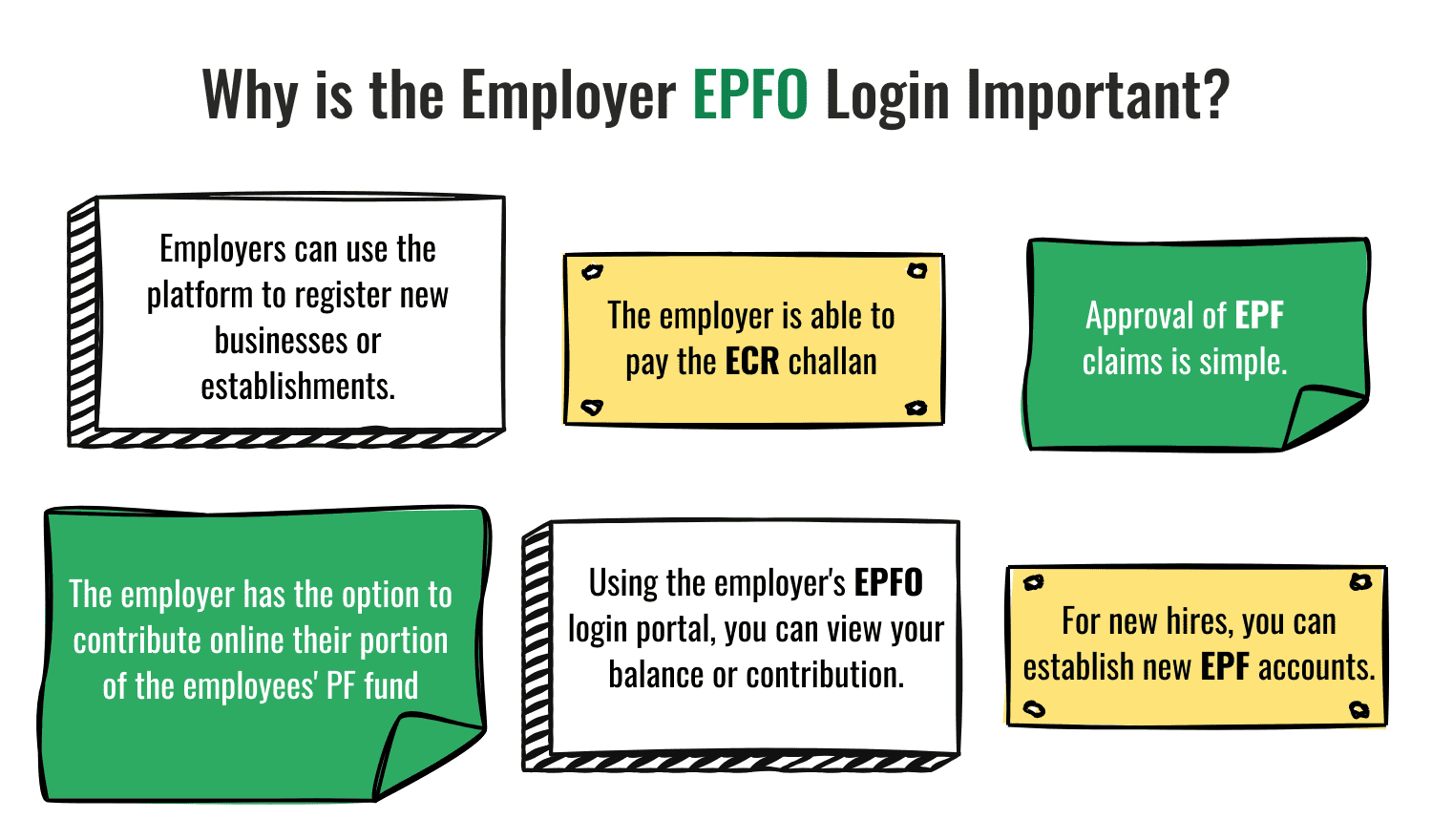

Why is the Employer EPFO Login Important?

- Employers can use the platform to register new businesses or establishments.

- The employer is able to pay the ECR challan.

- For new hires, you can establish new EPF accounts.

- Approval of EPF claims is simple.

- The employer has the option to contribute online their portion of the employees' PF fund.

- Using the employer's EPFO login portal, you can view your balance or contribution.

Best EPFO Practices for Employers

- Regularly Update KYC : Ensure the establishment’s and employees’ KYC details are updated to avoid claim rejections.

- Timely ECR Filing : Submit monthly contributions by the 15th of the following month to avoid penalties (1–2% interest per month for delays).

- Secure DSC : Store Digital Signature Certificates securely and renew them before expiry.

- Monitor Employee Claims : Promptly approve or reject employee claims to prevent delays in disbursements.

- Train HR Staff : Ensure HR personnel are trained to use the portal and understand compliance requirements.

- Use Secure Networks : Access the portal on trusted devices and avoid public Wi-Fi to protect sensitive data.

- Backup Records : Maintain digital or physical copies of challans, returns, and approvals for audits.

Conclusion

Well, you can do a lot of things through the EPFO Employer Login. All you need is to first create or activate the Universal Account Number and then through UAN, you can make a hassle-free login. The EPFO Employer Portal allows you to manage your accounts and view the balance. You can also EPF Balance check and Pension balance through the employer portal.

Indeed, there are numerous functions available with the EPFO Employer Login. To ensure a hassle-free login, all you need to do is generate or activate your Universal Account Number (UAN). You can check the balance and manage your accounts through the EPFO Employer Portal. Through the employer site, you may also check your pension balance and EPF balance.

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates