Best Overdraft Facility Accounts for Salaried

Last Updated : Sept. 23, 2024, 12:46 p.m.

A financial emergency can strike unexpectedly, leaving little time to arrange funds. To handle such situations, many banks offer an overdraft facility against assets like property, fixed deposits, mutual funds, and insurance. Additionally, several reputable banks provide the best overdraft facility for salaried accounts, allowing individuals to withdraw more than the balance in their salary accounts when needed.

To access this overdraft loan facility for the salaried, account holders must apply separately and pay a one-time processing fee. The overdraft limit is usually 2-3 times the account holder's monthly salary, though this varies by bank. If you're a salaried individual seeking the best overdraft loan options and overdraft loan eligibility, we're here to help you. Below is a table of the top banks offering the best overdraft facilities for salaried individuals. Let’s get started.

Top Banks with Overdraft Facility Accounts for Salaried

Here is the list of top banks with the best overdraft facilities for salaried individuals. Have a look-

Bank Name | Name of Overdraft Facility | Interest Rates | Loan Amount (in ₹) | Tenure | Processing Fee |

|---|---|---|---|---|---|

SBI Maxgain Xpress Credit Personal Loan | 8.70% – 9.85% p.a. 11.00% - 14.00% | Minimum: 20 lakhs Loan up to 35 Lakhs | Up to 30 Years Up to 5 Years | 0.35% of the loan amount plus GST to a maximum ₹10,000 plus GST 1.50% of the loan amount, with a minimum of Rs. 1,000 + GST and a maximum of Rs. 15,000 + GST. | |

Xpress Flexi Scheme | Starts from 11.45% p.a. | Minimum - ₹1 Lakhs to ₹25 lakhs | Maximum - 6 years | 0.25% higher than 11.45% - 12.95% | |

Smartdraft (Only for those maintaining salary accounts with HDFC) | 15% to18% p.a. (interest on utilisation) | ₹ 25,000 to ₹ 1.25 lakhs | 12 months, but can be renewed with the fees of Rs.250 + govt. Levises and taxes. | Up to Rs 1999/- and 24% will be charged on the amount utilised above the overdraft facility. | |

Dukandar Overdraft (OD) Facility | NIL, but the interest rate of 24% per annum will be applied to the amount used beyond the operating limit of the overdraft facility. | Up to ₹10 Lakh. | As per the bank | A 2% processing fee is charged upon limited utilization. | |

ICICI Bank Home Overdraft Salary Overdraft (Only for those maintaining salary account with ICICI) | 8.75%* p.a. As applicable by the bank | Up to 5 Crore Up to 4 Lakh | As applicable by the bank As applicable by the bank | As applicable by the bank As applicable by the bank | |

FlexiCash: Overdraft against salary | 12.35% p.a. to 14.10% p.a. | Up to 2-3 times but it may vary from bank to bank. | 12 months can be renewed if it meets the bank's norms. | ₹1,999+ GST up to ₹2,999+ GST | |

Overdraft Facility Against Property | Starting from 12.0% | 5 Lakh-5 Crore | As applicable by the bank | 1% of the loan or Rs.10,000 whichever is higher | |

24x7 FlexiCredit | From 16%- 19% | Up to 5 Lakhs | 12 months and could be renewable | Pf is up to 1% of the loan amount or ₹10,000, whichever is higher, plus GST. | |

Personal Loan Overdraft | 13.50% onwards | Rs. 1 Lakhs to Rs. 35 Lakhs | Up to 60 months | Up to 3% + taxes of the final loan amount (one-time) | |

Overdraft Loan | from 14.75%* onwards | Up to ₹ 35 Lakh | Up to 84 months | up to 5.5% of the loan amount + GST | |

Salary Booster Account | 3% | Need to visit the branch | - | ₹500 | |

Online Overdraft Facility Against Fixed Deposit | At par with interest on the deposit. 1% above the interest rate | Advance up to Rs. 10 lacs Advance above Rs. 10 lacs - allowed on deposit. | 3 years or residual period whichever is less. |

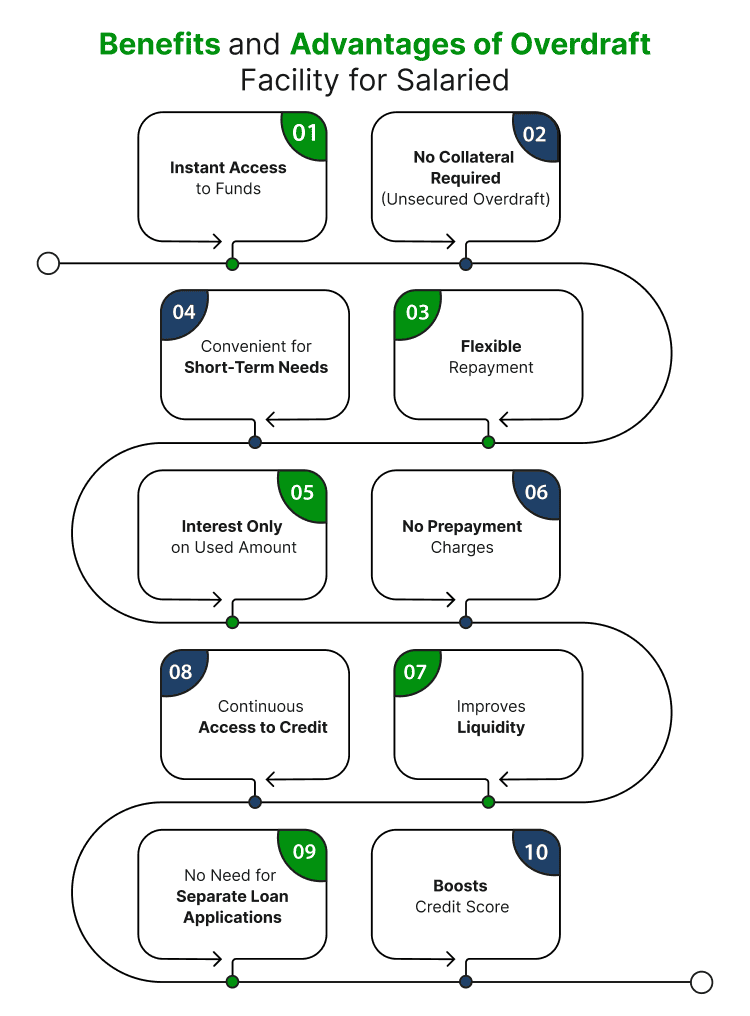

Benefits and Advantages of Overdraft Facility for Salaried

Every other bank provides or has this overdraft facility for Salaried Individuals. Here are some of the benefits and advantages listed below:-

- Instant Access to Funds: The overdraft facility allows salaried individuals to access funds quickly in case of an emergency, even if their account balance is low or zero

- No Collateral Required (Unsecured Overdraft): In many cases, banks offer unsecured overdraft facilities for salaried account holders, meaning no need to pledge assets as security.

- Flexible Repayment: Overdrafts offer repayment flexibility. You only need to pay interest on the amount used, and there are no fixed EMIs like loans.

- Convenient for Short-Term Needs: It’s ideal for covering short-term expenses such as medical bills, home repairs, or urgent purchases without needing to apply for a formal loan.

- Interest Only on Used Amount: Interest is charged only on the amount utilized, not on the entire overdraft limit, helping you save on interest costs.

- No Prepayment Charges: You can repay the overdraft at any time without incurring prepayment penalties, making it more flexible than loans.

- Improves Liquidity: Salaried individuals can manage temporary cash flow issues without having to liquidate investments or apply for a new loan.

- Continuous Access to Credit: The facility remains available as long as it is within the sanctioned limit, allowing repeated use without re-approval.

- No Need for Separate Loan Applications: Once set up, there is no need to apply for a loan every time you need extra funds, simplifying the borrowing process.

- Boosts Credit Score: Responsible use of the overdraft facility can improve your credit score, as timely repayments reflect positively on your credit history.

This makes the overdraft facility a flexible and convenient financial tool for salaried individuals.

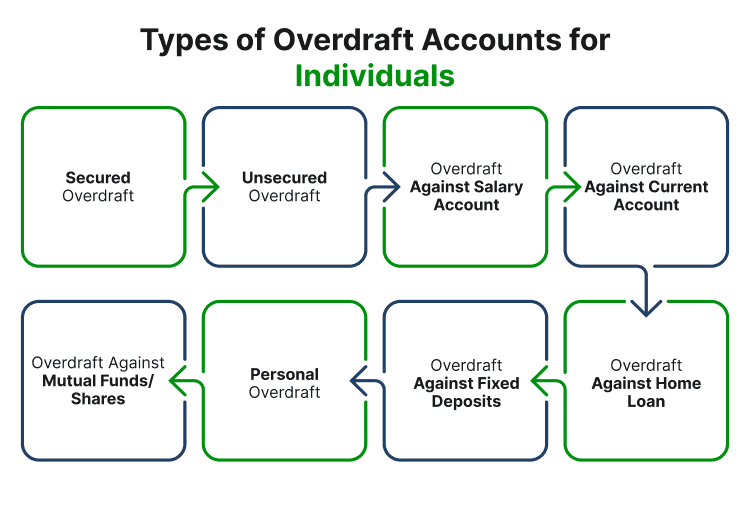

Types of Overdraft Accounts for Individuals

There are several types of overdraft facilities offered by banks, that are customised according to different needs and circumstances:

Secured Overdraft:

- Offered against assets like fixed deposits, property, or investments.

- Lower interest rates since it's backed by collateral.

Unsecured Overdraft:

- No collateral is required, given based on your creditworthiness and income.

- Higher interest rates as it's riskier for the bank.

Overdraft Against Salary Account:

- Available to salaried individuals with a salary account at the bank.

- Quick approval due to regular income tracking.

Overdraft Against Current Account:

- Meant for businesses with current accounts to manage cash flow.

- The limit depends on the business's financial standing.

Overdraft Against Home Loan:

- Linked to your home loan, where the principal repayment becomes the overdraft limit.

- Interest is only charged on the amount used.

Overdraft Against Fixed Deposits:

- Secured by your FD, allowing you to borrow up to 90-95% of the deposit.

- Lower interest rates, slightly above the FD rate.

Personal Overdraft:

- Unsecured, similar to a personal loan , based on your credit profile.

- Flexible repayment with interest only on the amount used.

Overdraft Against Mutual Funds/Shares:

- Pledge mutual funds or shares as collateral for the overdraft.

- The limit depends on the market value of your investments.

These overdraft types provide flexibility for individuals and businesses to meet their short-term financial needs.

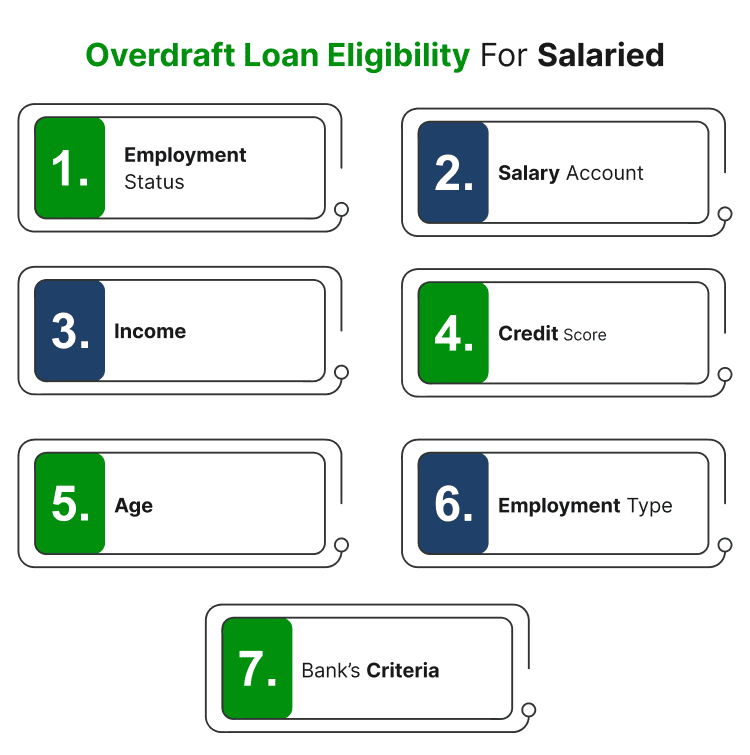

Overdraft Loan Eligibility For Individuals

Eligibility for an overdraft loan for salaried individuals generally includes the following criteria; however, different banks may have their specific requirements which could vary from the points listed:

- Employment Status: Must be employed with a reputed organization or a government entity. Some banks may require a minimum number of years with the current employer.

- Salary Account: Generally, the individual must have a salary account with the bank offering the overdraft facility.

- Income: The applicant’s salary should meet the minimum income requirements set by the bank. This amount can vary based on the bank’s policies.

- Credit Score: A good credit score is usually required to qualify for an overdraft loan. A higher credit score improves the chances of approval and favorable terms.

- Age: The applicant should be within the age limit set by the bank, typically between 21 and 60 years.

- Employment Type: Some banks may only offer overdraft facilities to individuals in permanent employment, as opposed to contract or temporary positions.

- Bank’s Criteria: Each bank may have additional specific criteria, such as minimum account balance requirements or length of banking relationship.

It’s advisable to check with individual banks for their specific eligibility requirements and terms.

How to Apply for an Overdraft Facility for Salaried Individuals?

To avail of this facility, salaried individuals or salary account holders need to apply separately at the concerned bank branch or can download the application form online. They can also apply for this facility when opening their account with the bank. Many banks charge a one-time processing fee, typically around 1% of the loan amount, though this fee can vary between banks.

Frequently Asked Questions (FAQs)