Which Lender Offers the Best Personal Loan Part Prepayment?

Last Updated : Sept. 24, 2024, 2:51 p.m.

Personal loans can significantly increase your financial obligations if you don’t carefully choose the interest rate. This could substantially raise your monthly installments (EMIs), and you might notice that interest makes up a large portion of your EMI. However, you can manage this by using the personal loan prepayment facility.

Prepayment involves paying off the outstanding loan balance, either partially or in full. This reduces your overall interest burden. While making a full prepayment might not be feasible during times of inflation, planning and executing a partial prepayment is very possible!

If you’re considering taking out a loan, you should review the partial prepayment policies of various lenders and choose one that charges minimal or no fees for this transaction. Existing borrowers should do the same. If the terms are not flexible, consider a personal loan balance transfer to reduce your debt burden. Although this effectively closes your loan account with the current lender and opens a new one with another, it serves as a form of prepayment. However, since our focus here is on the partial prepayment facility, let’s explore that further. Let’s get started!

How Should You Go About Doing a Personal Loan Part Prepayment?

Knowing the right time for a personal loan prepayment (part payment) is half the job done for you! The sooner you do, the more you will save, and vice versa. So, if your personal loan is for 5 years, look to part-pay it within 2-3 years of the loan. The reason is that the interest payment is likely to be much more in the initial years as opposed to when the loan is a year or a few months away from completing its term.

And last, but not least, check the personal loan part payment charges of different lenders before choosing the best lender. Also, the charges vary based on the time of prepayment. This particular line should also interest the borrowers who are already paying a personal loan.

Let’s Read the Personal Loan Part Prepayment Norms of Different Lenders

Each bank sets its own rules for paying off a loan early. These rules can make a big difference in how easily and affordably you can handle your loan.

Below, we've listed some of the top banks along with their rules and processes for making part payments on personal loans.

Bank Name | Part Payment Charges | Additional Notes |

|---|---|---|

4% (13-24 months), 3% (25-36 months), 2% (after 36 months) | Part payment allowed after 12 EMIs; up to 25% once a year, twice during loan tenure. | |

2% (after 36 months) | Part payment allowed after 12 EMIs; up to 20% (13-36 months) and 25% (37-60 months); once a year. | |

2% of the part payment amount | Part payment allowed after 3 EMIs; up to 40% of principal. Only for Smart Personal Loan. | |

3% of the part payment amount | Part payment allowed after 12 EMIs; charges waived for defense customers. | |

INR 500 plus taxes | Part payment allowed after 12 months; up to 20% once a year. | |

Charges vary at bank's discretion | GST applies; charges determined by the bank. | |

2% (within 6 months), NIL (after 6 months) | Up to 10% of remaining balance; minimum Rs. 10,000; up to three times a year. | |

No charges | Part payment allowed after 12 EMIs; up to 25% once a year, twice during loan period. | |

2% of the part payment amount | Part payment allowed after 12 EMIs. | |

2.5% on amounts over 25% of principal | Part payment allowed once a year; minimum gap of 6 months; no payments in the first 12 months. |

HDFC Bank

HDFC Bank allows you a personal loan part prepayment facility only when you have paid your 12 EMIs successfully. Further, it allows part payment of up to 25% of the principal outstanding, and that too, only once in a financial year and twice during the loan tenure. When you do a personal loan part prepayment within the 13-24th month of the loan, the bank will charge 4% of the part payment amount. If you do a part payment from the 25-36th month, the charge will come down to 3% and 2% after 36 months.

YES BANK Personal Loan Part Payment?

Like HDFC Bank, YES BANK allows part prepayment only after the successful payment of the first 12 EMIs. YES BANK’s personal loan part prepayment norms vary depending on the stage of the loan. If the loan is within the 13th to 24th month, the bank allows you to make a part prepayment of up to 20% of the principal outstanding.

As the loan progresses beyond this period and remains up to 36 months, you can still make a part prepayment of up to 20% of the principal outstanding. The permissible part payment amount increases to up to 25% when the loan is within the 37th to 48th months and 49th to 60th months. Additionally, you will need to pay a charge of 2% on the part payment amount. You can do a personal loan part prepayment once in a financial year.

As per the prepayment clause, YES BANK will subtract the part payment amount from the principal outstanding, but the EMI won’t change. However, it is a blessing in disguise for you! The same EMI post the personal loan part prepayment will reduce the interest payment even more.

IDFC FIRST Bank

IDFC First Bank has a Smart Loan Facility feature for personal loan borrowers wherein it allows part payment of up to 40% of the principal outstanding as soon as you pay the first three EMIs. For this, the bank charges 2% of the part payment amount. Part-payment is allowed from the customer’s own funds. This option is only available for customers who have chosen the Smart Personal Loan. It's not available for those with the Simple Personal Loan.

SBI

The country’s largest lender i.e. State Bank of India (SBI) levies a charge of 3% on the part payment of personal loans. It will be allowed only after paying the first 12 EMIs successfully. No part payment charges apply if the account is closed using funds from a new loan account under the same scheme. For defense customers, prepayment and foreclosure charges are completely waived, regardless of the loan duration.

Kotak Mahindra

Kotak Mahindra Bank has specific conditions for part payments on personal loans. For loans disbursed on or before February 1, 2020, part prepayment is not permitted. However, for loans issued after this date, customers can make a part prepayment of up to 20% of the outstanding principal amount once they have completed the first 12 months of the loan term. This option is available once a year, and each instance of part payment incurs a charge of INR 500 plus applicable taxes.

Axis Bank

For Axis Bank personal loans , there are charges for making part prepayments, and these charges are determined at the bank's discretion. This means if you decide to pay off a portion of your loan early, you'll need to pay extra fees on that amount, and the exact fee can vary. Additionally, Goods and Services Tax (GST) will also apply to these charges. It’s important to consider these potential costs when planning any early payments.

IDBI Bank

With IDBI Bank, if you make a part payment within six months of getting the loan, you'll be charged 2% of the remaining loan amount. If you make a part payment after six months, there's no charge. You can pay up to 10% of your remaining loan balance, but the part payment must be at least Rs. 10,000. You can make part payments up to three times in a year, but there must be at least 90 days between each payment.

Bandhan Bank

For Bandhan Bank personal loans , part payments are allowed after you've made the first 12 months of EMI payments. You can pay up to 25% of the outstanding principal once a year, but only twice during the entire loan period. There are no charges for making these part payments.

Bajaj Finserv

Bajaj Finserv personal loan part prepayment charges are calculated at 2% of the amount paid. Most likely, the lender will allow part prepayment once you pay the first 12 EMIs of the loan spotlessly.

Tata Capital

Part prepayment is allowed once a year, with a minimum gap of six months between two part prepayments. You can prepay up to 50% of the outstanding principal in a single year. However, a charge of 2.5% will apply on any amount over 25% of the principal outstanding, up to the maximum limit of 50%. Additionally, no part payment is permitted during the first 12 months due to a lock-in period. The minimum amount for part prepayment must be equal to at least two months of EMI.

Let’s Check the Mathematics of Personal Loan Part Payment

The reduction in interest payments is evident with a personal loan part payment. But how much will the reduction be? Maybe an example below will give us a clue! Take a look.

Example – You take a personal loan worth INR 8.50 lakh at 13% per annum for 5 years. If you wish to make a part payment of INR 3 lakh at the end of 2 years, how much will you save eventually?

| Repayment Aspects | Amount (In INR) |

|---|---|

| EMI Payable at 13% | 19,340 |

| Interest Payable Over 5 Years at 13% | 3,10,407 |

| Interest Payable for 2 Years | 1,88,157 |

| Outstanding Loan Balance at the End of 2 Years | 5,73,993 |

| Part Payment Amount | 3,00,000 |

| Outstanding Loan Balance Post Part Payment | 2,73,993 |

| EMI Payable for the Next 3 Years | 9,232 |

| Interest Payable for the Next 3 Years | 58,356 |

| Interest Payable for 2 Years + Interest Payable for the Next 3 Years | 2,46,513 |

| Savings | 63,894 (3,10,407-2,46,513) |

If you continue to pay the same EMI after part payment, the interest outgo will then amount to around INR 25,000 for the remaining time. So, your overall interest outgo (Before & After Part Payment) equals INR 2,13,157, raising your savings to INR 97,250.

What are the Main Benefits of Personal Loan Part Payment?

Making part payments on a personal loan can offer several benefits:

- Cut Costs on Interest: If you repay some of the capital ahead of schedule, precisely the total interest cost over your loan's lifetime will be less because interest is calculated on the remaining balance.

- Shorter Time to Repay Your Loan: By making extra payments, you can shorten the overall length of your loan, and so find yourself paying off your debts sooner.

- Boost Your Credit Score: Regular part payments indicate a good habit of managing money, which not only pays off in financial savings over time but can also help one's credit score rise.

- Get Flexible Repayments: Make a part payment on your loan when there is spare money, but do not wipe out the entire debt.

- Total Cost of Loan Savings: Lower interest payments together with a shorter term for the loan mean that the total cost of borrowing is substantially lower.

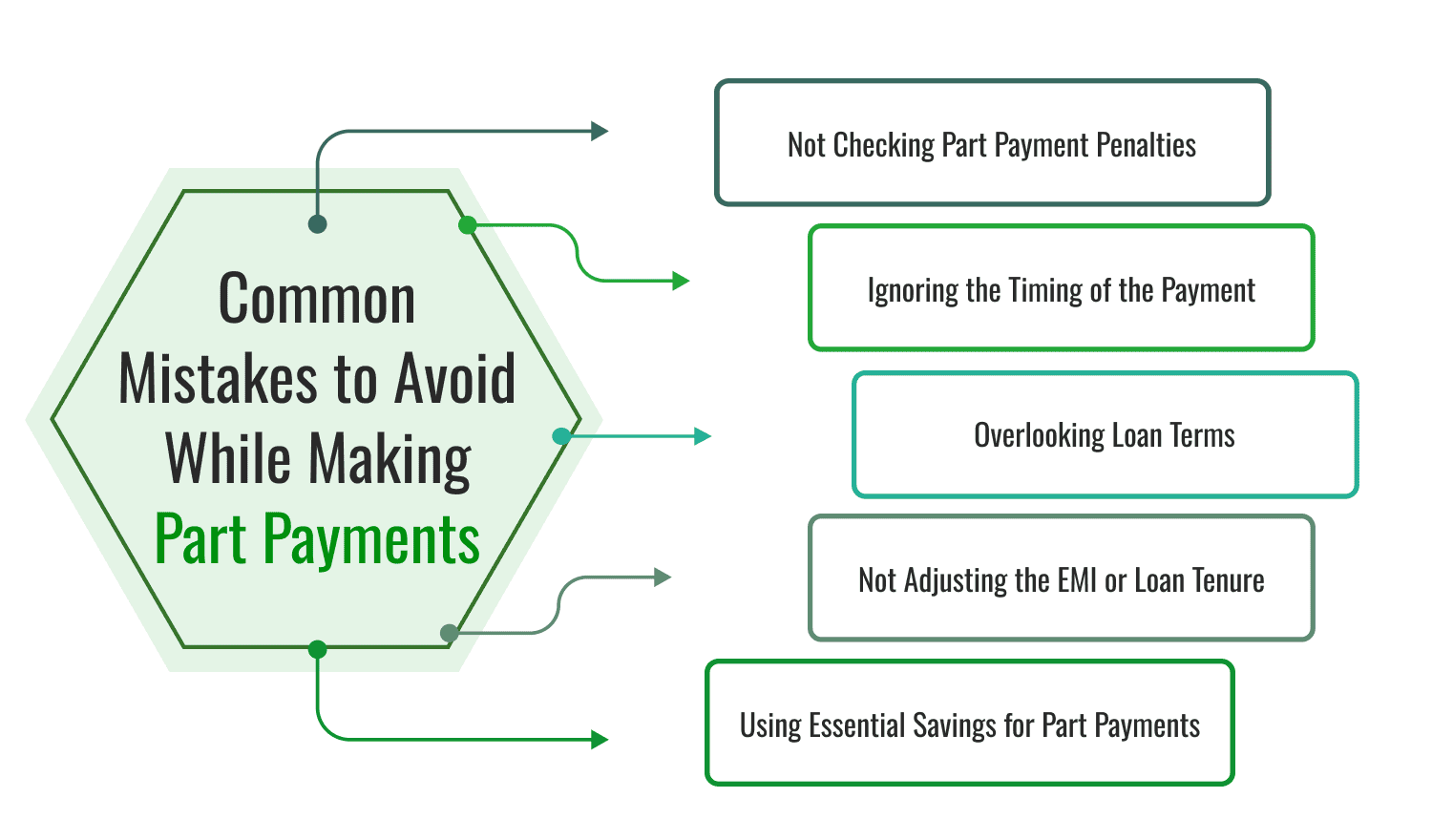

Common Mistakes to Avoid While Making Part Payments

When making part payments on personal loans, borrowers can sometimes overlook certain aspects or make errors that negate the benefits of part payments. Here are some common mistakes to avoid:

- Not Checking Part Payment Penalties : Before making a part payment, it’s crucial to understand if there are any penalties or fees involved. Some banks charge a fee if you make a part payment within a certain period of the loan tenure. Always review your loan agreement for any part payment penalties and weigh the cost against the benefits.

- Ignoring the Timing of the Payment : The impact of a part payment on interest savings is greater when done earlier in the loan tenure because early payments reduce the principal amount on which subsequent interests are calculated. Making part payments later in the tenure might not be as beneficial since you would have already paid a significant amount of interest.

- Overlooking Loan Terms : Some loan agreements only allow part payments under specific conditions or during certain times of the year. Ensure you are aware of these terms to avoid unnecessary charges or the rejection of your part payment.

- Not Adjusting the EMI or Loan Tenure : After making a significant part payment, you might have the option to reduce either your EMI or loan tenure. Failing to adjust these can result in less significant financial relief. Discuss with your lender whether it's more beneficial to decrease the monthly payment or shorten the loan period.

- Using Essential Savings for Part Payments : While reducing debt is important, using emergency savings or funds allocated for other crucial financial goals can put you in a precarious situation if unexpected expenses arise. Always ensure that making a part payment does not compromise your financial security.

Frequently Asked Questions (FAQs)

How does part payment benefit me?

Can I make part payments on my personal loan anytime?

Are there any charges for making part payments on a personal loan?

How often can I make part payments on my personal loan?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

Personal Loan

- Personal Loan

- Personal Loan Eligibility Calculator

- Personal Loan EMI Calculator

- Personal Loan Interest Rates

- Pre-approved Personal Loan in India

- Personal Loan Top Up in India

- Personal Loan Balance Transfer

- Apply Personal Loan on WhatsApp

- Personal Loan for Unemployed

- Personal Loan for Government Employees

- Personal Loan Without CIBIL Score

- Minimum CIBIL Score for Home Loan

Personal Loan Calculator by Top Banks

- HDFC Personal Loan EMI Calculator

- ICICI Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- IndusInd Bank Personal Loan EMI Calculator

- RBL Bank Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- IDFC First Bank Personal Loan EMI Calculator

- Tata Capital Personal Loan EMI Calculator

- SMFG India Credit Personal Loan EMI Calculator

- Standard Chartered Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- Axis Bank Personal Loan EMI Calculator