IDFC First Bank Mobile Banking

Last Updated : April 28, 2025, 6:59 p.m.

The IDFC FIRST Bank Mobile Banking App is a digital banking platform that allows customers to perform over 120+ banking transactions securely and conveniently from their smartphones. It caters to retail customers, MSMEs, and non-customers, offering a user-friendly interface for managing accounts, transferring funds, paying bills, investing, and accessing loans and credit card services.

The app is available for Android (Google Play Store) and iOS (App Store), with supplementary services like WhatsApp Banking, SMS Banking, Missed Call Banking, and USSD Banking for broader accessibility. Below is a detailed overview, including features, transaction limits, activation, and comparison with IndusInd Bank Mobile Banking (INDIE App), as both are relevant based on your query history.

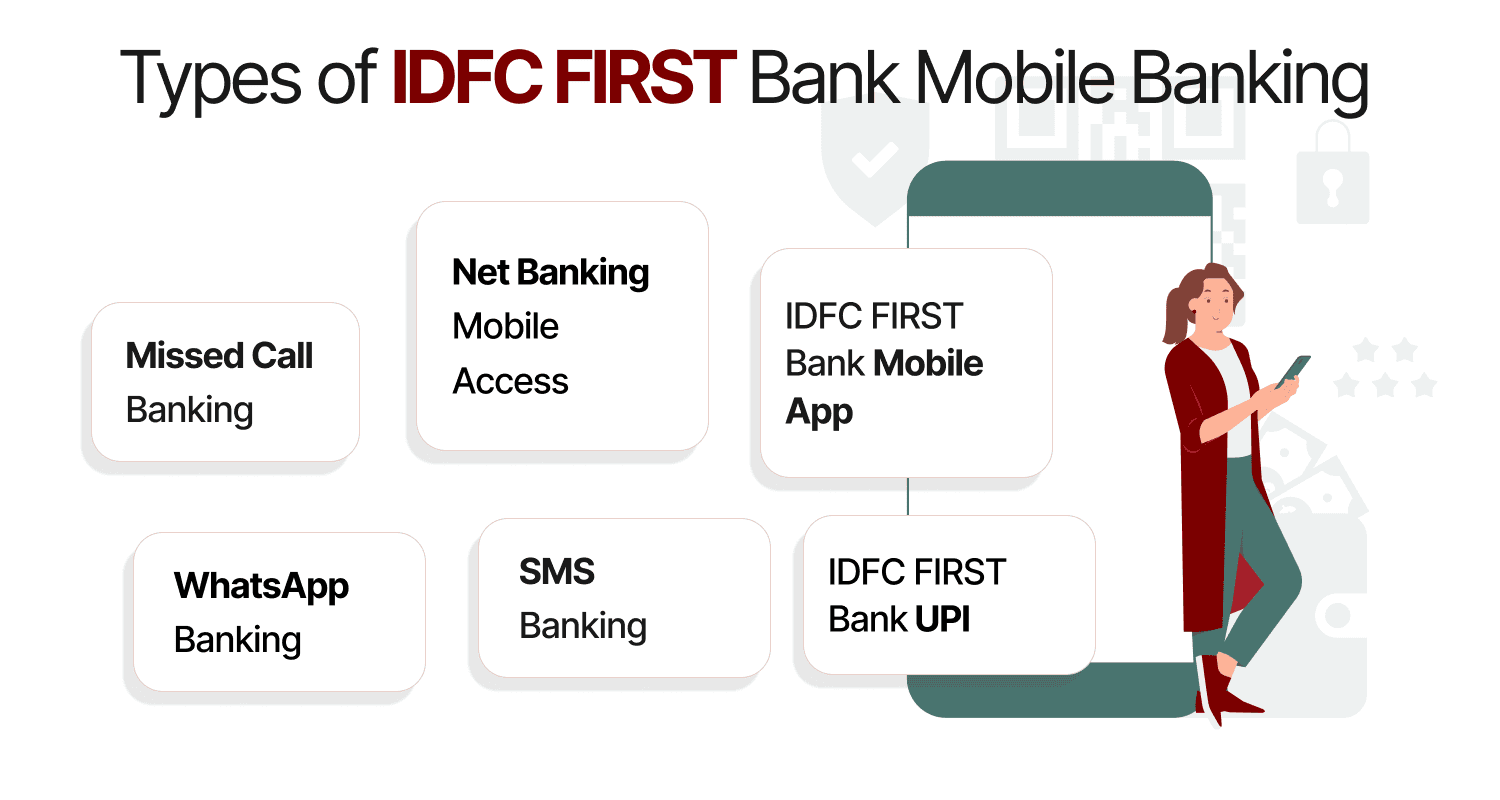

Types of IDFC FIRST Bank Mobile Banking

Below are some of the types of IDFC FIRST Bank mobile banking.

| Type of Service | Features | Access Method |

|---|---|---|

IDFC FIRST Bank Mobile App | Full banking (balance check, fund transfers, bill payments, investments) | IDFC FIRST Mobile App |

IDFC FIRST Bank UPI | Instant money transfer via UPI ID, mobile number, QR code | Mobile App or UPI Apps |

WhatsApp Banking | Balance inquiry, mini statements, chequebook request, loan info | Chat on WhatsApp |

SMS Banking | Balance enquiry, mini statement, cheque status via SMS keywords | SMS from the registered number |

Missed Call Banking | Instant balance check and mini statement via missed call | Missed a call from the registered number |

NetBanking Mobile Access | Access full Internet Banking via mobile browser | Browser on mobile device |

IDFC FIRST Bank Mobile Banking Registration

To register for IDFC First Bank mobile banking follow the steps below -

1. Download the IDFC FIRST Bank Mobile App

Register on the Mobile App

- Open the App: Launch the IDFC FIRST Bank Mobile Banking app on your device.

- Enter Customer ID: Input your Customer ID and registered mobile number.

- Authenticate: Choose one of the following for authentication:

- Account Number

- Debit Card Number

- Loan Account Number

- Account Number

- OTP Verification: Enter the OTP sent to your registered mobile number.

- Set Credentials: Create a Username and Password of your choice.

- Set MPIN: For quicker access, set a 4-digit MPIN.

- Enable Biometric Login: Optionally, activate fingerprint or face recognition for added security.

Register via SMS Banking

- Register Mobile Number: Ensure your mobile number is registered with IDFC FIRST Bank.

- Send SMS: From your registered mobile number, send an SMS with the appropriate transaction code to:

- 5676732 or 9289289960

- 5676732 or 9289289960

- Receive Confirmation: You'll receive a response confirming the requested service.

Register via Internet Banking

- Visit Website: Go to the IDFC FIRST Bank Net Banking portal.

- Create Username: Click on 'Login' and then select 'Create Username'.

- Enter Details: Provide your Customer ID and registered mobile number.

- Authenticate: Use your Account Number, Debit Card Number, or Loan Account Number for verification.

- OTP Verification: Enter the OTP sent to your registered mobile number.

- Set Credentials: Choose a Username and Password for your Net Banking account.

Process to Login IDFC FIRST Bank Mobile Banking App

Follow the steps below to log in -

- Download and Install the App

- Open the IDFC FIRST Bank App

- Enter Credentials

- Enable Biometric Authentication

- Access Your Account

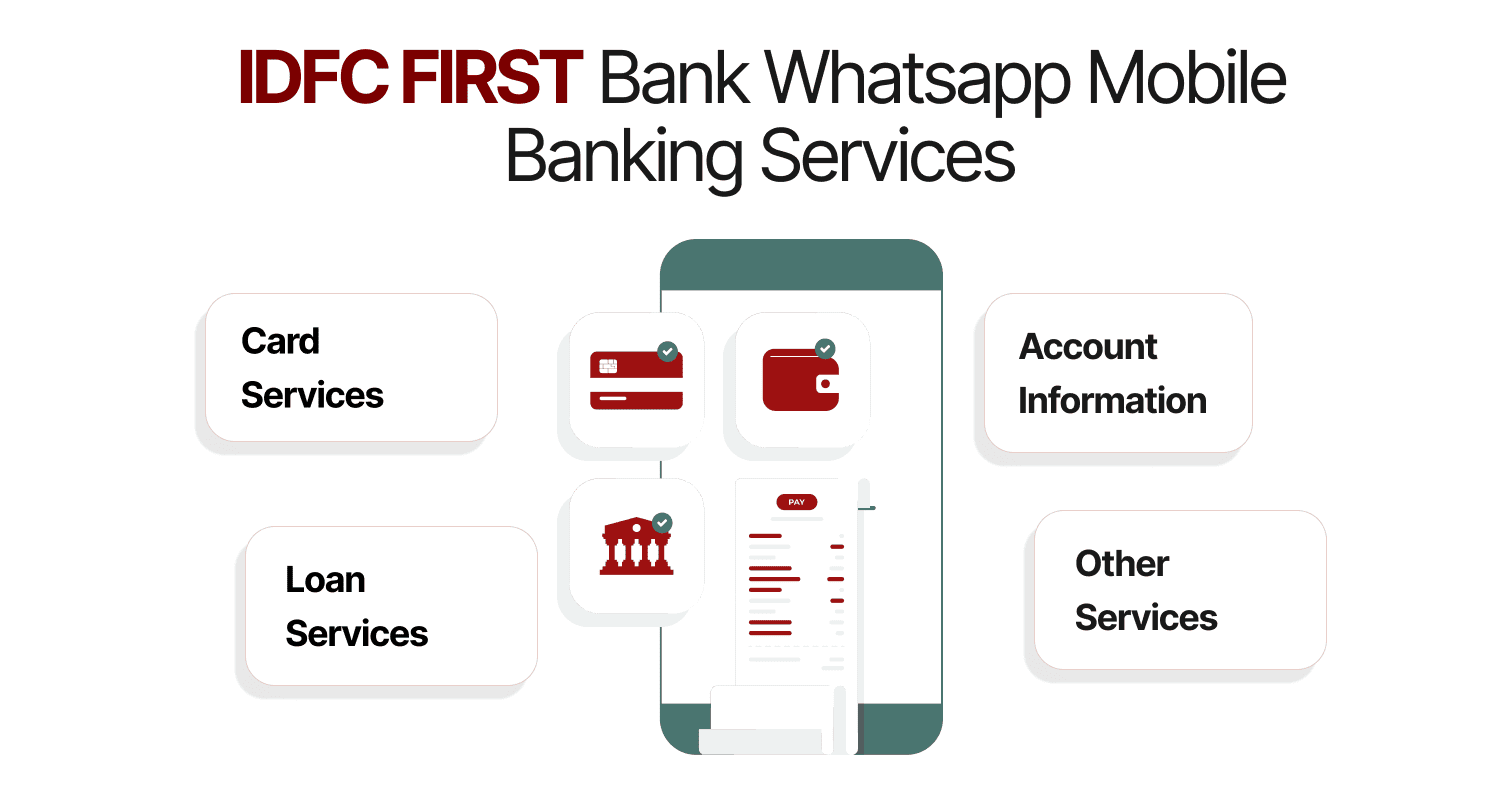

IDFC FIRST Bank Whatsapp Mobile Banking Service

IDFC First Bank services are Available via WhatsApp Banking -

Once registered, you can access a variety of services, including:

- Account Information:

- Check account balance

- View mini statements

- Download account statements

- Check account balance

- Card Services:

- Generate or reset debit card PIN

- Block lost or stolen cards

- View credit card details and outstanding balances

- Generate or reset debit card PIN

- Loan Services:

- Check loan account details

- View EMI schedules and due dates

- Make loan payments

- Check loan account details

- Other Services:

- Locate the nearest ATM or branch

- Access FASTag services

- Open a Demat account

- Apply for various banking products

- Locate the nearest ATM or branch

Benefits of IDFC FIRST Bank Mobile Banking

Below are some of the benefits of IDFC First Bank mobile banking.

| Benefit | Details |

|---|---|

Convenient 24x7 Access | Perform banking transactions anytime, anywhere through your smartphone. |

Wide Range of Services | Balance enquiry, fund transfer, bill payment, loan applications, investments, and more. |

Fast Fund Transfers | Instantly transfer funds via NEFT, IMPS, RTGS, and UPI from the app. |

UPI Integration | Send or receive money directly using mobile numbers, UPI IDs, or QR codes. |

Secure Transactions | Protected by MPIN, password, OTP, and biometric authentication (fingerprint/face ID). |

Bill Payment and Recharges | Pay utility bills, and recharge mobile/DTH easily without logging into multiple apps. |

Loan and Credit Card Services | Apply for loans, manage EMIs, view credit card details, and pay dues through the app. |

Customizable Dashboard | Personalize your app experience to show frequently used services first. |

Low Data Usage | The app is optimized for fast loading and minimal mobile data consumption. |

Paperless Banking | Open fixed deposits, apply for products and update details online without visiting a branch. |

WhatsApp Banking Integration | Use WhatsApp for quick banking like checking balances and mini-statements. |

Real-Time Alerts and Notifications | Get instant updates on transactions, offers, and security alerts. |

Uses of IDFC FIRST Bank Mobile Banking App

Some of the uses are IDFC First Bank mobie banking are -

- Check real-time account balances, view mini-statements, access transaction history with smart filters, and download Smart Statement + Digest for savings/current accounts.

- Perform instant UPI (3-click payments via Scan to Pay or Pay to Contact), IMPS, NEFT, and RTGS transfers with zero fees, including third-party transfers without adding beneficiaries.

- Pay utility bills (electricity, gas, water), mobile/DTH recharges, credit card bills, and FASTag top-ups, with options to schedule or auto-pay.

- Apply for free debit cards or chequebooks, block lost cards, update KYC (e.g., Aadhaar, PAN), request statements, or manage Forex cards.

- Book flights/hotels via Tripstacc (zero fees, 20 bonus points per INR 100 on hotels), pay for online shopping, or access dining/travel offers.

- Use expense tracking, Google-like transaction search, and in-app chat/video call support for real-time assistance and personalized alerts.

How to Reset the Password of IDFC FIRST Bank Mobile Banking?

To reset the password for IDFC First Bank mobile banking.

Reset through the IDFC FIRST Mobile App

- Open the App

- Launch the IDFC FIRST Bank Mobile Banking App on your smartphone.

- Launch the IDFC FIRST Bank Mobile Banking App on your smartphone.

- Click on "Forgot Password"

- On the login page, tap the "Forgot Password" option.

- On the login page, tap the "Forgot Password" option.

- Enter Customer ID

- Provide your Customer ID and Registered Mobile Number.

- Provide your Customer ID and Registered Mobile Number.

- Authenticate

- Choose to authenticate using:

- Account Number, or

- Debit Card Number, or

- Loan Account Number.

- Account Number, or

- Choose to authenticate using:

- OTP Verification

- An OTP (One Time Password) will be sent to your registered mobile number.

- Enter the OTP on the app.

- An OTP (One Time Password) will be sent to your registered mobile number.

- Set a New Password

- Create and confirm a new login password.

- Ensure it meets the bank’s password security guidelines (e.g., minimum characters, mix of letters, numbers, special characters).

- Create and confirm a new login password.

- Successful Reset

- After setting the new password, you can now log in with it.

Reset through NetBanking

- Visit the Official Website

- Go to IDFC FIRST Bank Net Banking portal.

- Go to IDFC FIRST Bank Net Banking portal.

- Click on "Forgot Password"

- On the login page, select "Forgot Password".

- On the login page, select "Forgot Password".

- Enter Required Details

- Input your Customer ID and registered mobile number.

- Input your Customer ID and registered mobile number.

- Complete Authentication & OTP Verification

- Set a New Password

- Login Using New Password

IDFC FIRST Bank Mobile Banking Transaction Limit

The transaction limits for IDFC First Bank mobile banking are -

| Transfer Method | Minimum Limit | Maximum Limit per Transaction | Maximum Daily Limit | Notes |

|---|---|---|---|---|

NEFT | ₹1 | ₹20,00,000 | ₹20,00,000 | Suitable for transfers below ₹2,00,000. |

RTGS | ₹2,00,000 | ₹20,00,000 | ₹20,00,000 | Ideal for high-value transactions above ₹2,00,000. |

IMPS | ₹1 | ₹2,00,000 | ₹20,00,000 | Instant transfers; per transaction limit is ₹2,00,000. |

UPI | ₹1 | ₹1,00,000 | ₹1,00,000 | Instant transfers; per transaction and daily limit is ₹1,00,000. |