SBI Credit Card Payment Online

Last Updated : April 18, 2025, 3:19 p.m.

Managing your SBI Credit Card payment has never been easier with multiple convenient options at your fingertips. Whether you prefer digital solutions or traditional methods, SBI Card offers a comprehensive range of payment channels to suit your needs. From instant online options like NEFT, Paynet, UPI, and the SBI YONO app to offline methods such as ATM payments and branch visits, you can choose what works best for your lifestyle. Most online payment methods reflect instantly in your account, helping you avoid late fees and maintain your credit score . The payments for your SBI Credit Cards will be processed in a safe and methodical way.

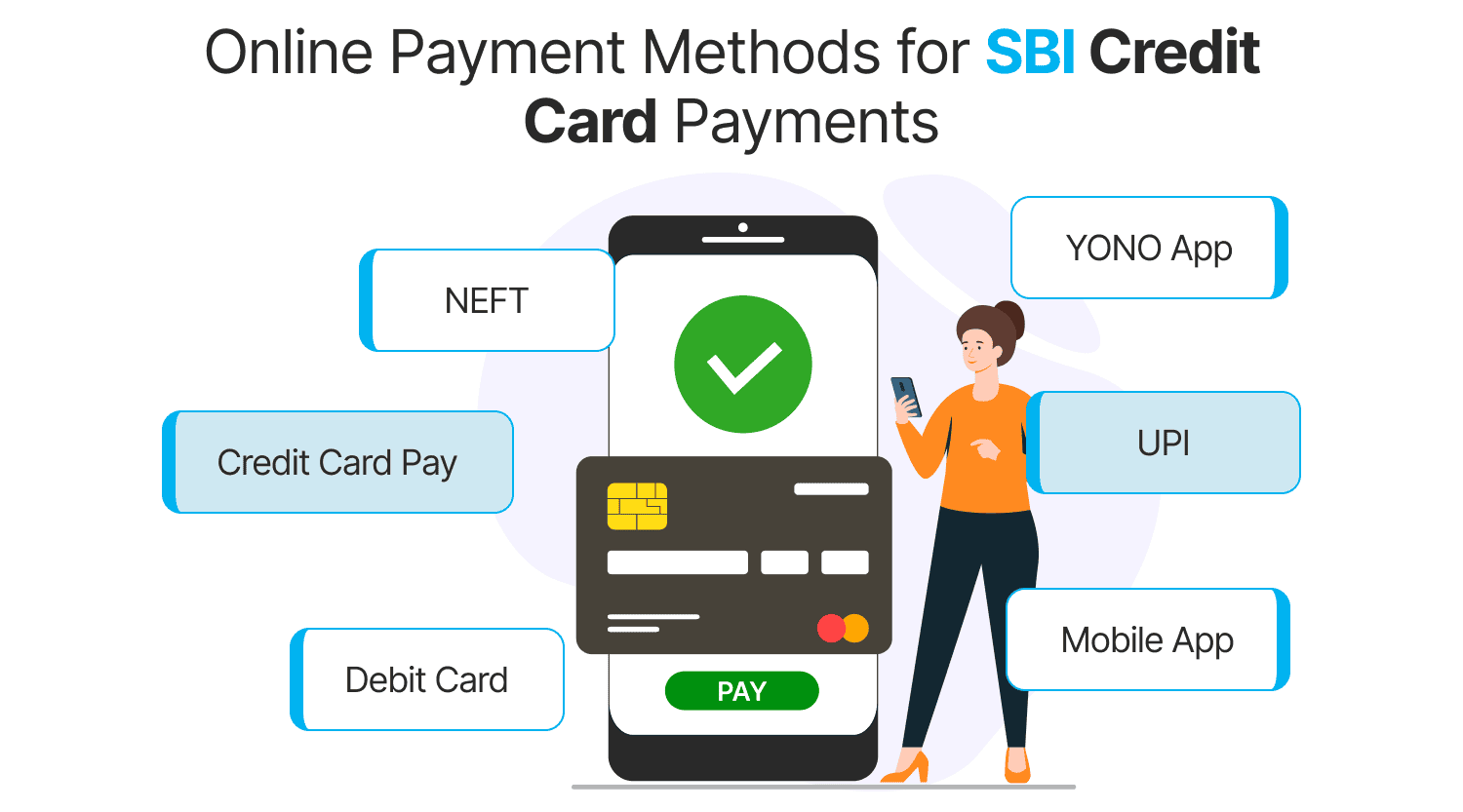

Online Payment Methods for SBI Credit Card Payments

Here are some simple and easy online methods provided by SBI to manage its credit card payments .

SBI Credit Card Payment Via Paynet - Pay Online

Paynet is SBI's online platform that allows instant credit card payments:

Step 1: Navigate to sbicard.com. Log into your account.

Step 2: Go to the dashboard and select 'Pay now'

Step 3: Select the amount to be paid

Step 4: Choose your preferred payment mode and confirm.

Step 5: You'll be forwarded to the payment interface of your bank to complete the transaction.

Step 6: Your account will get debited online and you will get a confirmation for the online transaction with a transaction reference number. This will be sent to your registered mobile no: and e-mail id.

SBI Credit Card Payment by using NEFT

National Electronic Funds Transfer is a secure way to pay your credit card bill:

Step 1: Log into your net banking portal and add SBI Card as a beneficiary under third party transfer.

Step 2: Enter the IFSC code SBIN00CARDS

Step 3: Use your 16-digit SBI card number as the account number.

Step 4: For Beneficiary account type, choose 'Credit Card Payment' or 'Savings Account'

Step 5: Enter "SBI CREDIT CARD - NEFT" as the name of the bank.

Step 6: Click ‘Submit’ to complete your registration process.

Step 7: The payment will show up instantly in your SBI Credit Card account.

SBI Credit Card Payment through Visa Credit Card Pay

You can transfer funds to any SBI Visa Credit Card 24/7, using the net banking facility provided by your bank. This method is a quick and safe way to pay your bills online.

Step 1: Log in to the net banking page of your bank with your user ID and password

Step 2 : Navigate to the ‘Third Party Funds Transfer’ section and choose ‘Visa Credit Card Pay’

Step 3 : Fill in the details pertaining to the sender and receiver to initiate the fund transfer.

Step 4: After entering the details, click ‘Confirm’ transaction.

Step 5: Once you confirm the transaction, the amount will be deducted from your account and the payment will be scheduled to your card.

Step 6: The Payment will show immediately in your SBI Credit Card account.

SBI Card Payment through Debit Card

Step 1: Make the outstanding payment for your SBI Card.

Step 2: Key in the SBI Credit Card number you wish to make the payment for. Also, enter the amount that has to be paid and your email ID.

Step 3: Click on debit cards as your chosen method of payment. Select the bank account that you wish to deduct from.

Step 4: You will be safely redirected to the payment interface of your chosen bank account.

Step 5: Confirm your payment amount to SBI Card. On confirming, your bank account will be debited online. SBI will send you an email and SMS acknowledgement for your transaction.

Step 5: Enter your debit card and card authentication details - The user ID, password, and PIN number.

SBI Credit Card Payment through Mobile App

Step 1: Download and register on the SBI Card app

Step 2: On the Account Summary page, click 'Pay Now'

Step 3: Enter your email ID and mobile number.

Step 4: Add the payment amount

Step 5: Choose the payment option and bank

Step 6: Confirm the details to complete the payment.

SBI Credit Card Payment via UPI

Step 1: Visit the Paynet channel on the SBI Card website or app

Step 2: Enter your credit card number and the amount that you have to pay

Step 3: Choose the UPI option

Step 4: Input your VPA or scan the QR code

Step 5: Authorize the payment through your UPI app

SBI Credit Card Payment by using YONO App

Manage your SBI Credit Card payments effortlessly through YONO, SBI's digital banking platform. Available as both a mobile app and website, YONO brings all SBI's services together in one convenient digital hub.

Why Choose YONO?

Experience simplified banking with YONO's user-friendly interface, intuitive navigation, and instant payment crediting to your account.

Getting Started with YONO

Registration Process

Step 1: Download YONO by SBI from Google Play Store or App Store

Step 2: Install the app on your device (Android/iOS) or access via SBI Online Portal

Step 3: Register using your internet banking credentials or debit card number

Step 4: Verify your identity with the OTP sent to your registered mobile number

Step 5: Create your secure MPIN to complete setup

Linking Your SBI Credit Card

Make sure to keep your registered mobile phone handy, then:

Step 1: Go to the Credit Card section in the YONO app

Step 2: Select "Link SBI Credit Card" option

Step 3: Enter your sbicard.com username and password

Step 4: Request and enter the OTP received on your registered mobile number

Step 5: Your SBI Credit Card(s) will now be successfully linked to your YONO account

Making Payments

Through the YONO Mobile App

Step 1: Log in using your MPIN or SBI Internet banking credentials

Step 2: Navigate to "My Relationships" and select "My Credit Cards"

Step 3: Choose the card you wish to pay for and view the card summary

Step 4: Tap "Pay Now" to continue to the payment screen

Step 5: Select your SBI account for the transaction

Step 6: Enter the payment amount and confirm by tapping "Pay Now"

Through the YONO Web Portal

Step 1: Access the YONO portal and log in with your SBI internet banking credentials

Step 2: Go to “My Relationships” and choose “My Credit Cards"

Step 3: Click “Pay” near your desired credit card.

Step 4: Select which SBI account to use for the payment

Step 5: Enter your payment amount and click "Pay Now" to complete the transaction.

SBI Credit Card Payment via Standing Instructions (SI)

On the payment due date, get your dues deducted directly from your bank account through NACH.

What is NACH?

National Automated Clearing House (NACH) is a convenient payment system that automatically deducts your SBI Card dues directly from your bank account each month. Once authorized, payments are automatically credited to your card account on the payment due date, eliminating manual intervention.

Key Benefits

- Timely Payments: Never miss a payment deadline again

- Worry-Free Experience: No need to remember due dates

- Paperless Process: Eliminate the hassle of writing and sending cheques

Quick Setup: Simple and immediate registration process.

Digital NACH Setup Process

Online Registration Steps:

Step 1: Access the portal: Visit the e-NACH enrollment form

Step 2: Navigate to NACH Settings: After logging in, go to ‘My Dashboard’ → ‘Services’ → ‘NACH’ tab

Step 3: Choose Payment Option: Select your preferred auto-debit type:

- Total Amount Due (TAD)

- Minimum Amount Due (MAD)

Step 4: Continue Registration: Click ‘Proceed’ to reach the registration page

Step 5: Verify Information: Confirm pre-populated data and enter your bank details

Step 6: Complete Authentication: Fill the e-Mandate form and authenticate via:

- Net-banking

- Debit card

Step 7: Confirmation: You’ll receive a reference number and registration confirmation instantly

Note: NACH activation takes approximately 4 working days to complete.

Physical Form Registration

Paper Form Submission Process:

Step 1: Download Form: Access the NACH form here.

Step 2: Complete the form: Fill in all the required details (Refer to the MITC document for guidance. Incomplete forms will not be processed).

Step 3: Select the payment option:

- Total Amount Due (TAD), as displayed on your statement

- Minimum Amount Due (MAD), as shown on your statement

- Note: Fixed amount option is not available with NACH mandate

Step 4: Submit Documentation: Send the completed form with a cancelled cheque (optional) to:

SBI Card and Payment Services Pvt. Ltd.

P.O. Bag No.28, GPO

New Delhi – 110001

Step 5: After verification of your form, your NACH setup will be activated, and payments will begin processing automatically on your due dates.

Note: Digital copies are acceptable only when sent from your registered email address.

Master Card Money Send

What Is MasterCard MoneySend?

MasterCard MoneySend is a versatile mobile payment solution that enables secure, convenient, and rapid money transfers through partner banks on a third party payment platform. This service offers a streamlined way to manage your SBI Credit Card payments digitally.

Key Advantage

The primary benefit of MasterCard MoneySend is the ability to pay your SBI Card bill instantly through mobile applications, eliminating the need for traditional payment methods.

How to make payments using Master Card Money Send?

Step 1: Access the platform: Download and install a third party payment application or use an existing platform that supports MasterCard MoneySend functionality.

Step 2: Card Setup: Connect your SBI Credit Card within the application to enable it for receiving payments.

Step 3: Select Payment Method: When making a payment, choose the MasterCard MoneySend option from the available payment methods in the application.

Step 4: Payment Authorization: Enter the desired payment amount and complete the authorization process according to the app’s security requirements.

Step 5: Transaction Processing: After successful processing, the specified amount will be:

- Debited from your linked bank account

- Instantly credited to your SBI Card account

Step 6: Confirmation: Upon finishing the transaction, you will get an SMS of confirmation from SBI Card verifying the successful payment.

Offline Methods for SBI Credit Card Payments

1. SBI ATM Payment

- Visit any SBI ATM with your SBI debit card

- Insert your card and select 'Services' followed by 'Bill Pay'

- Enter your SBI Credit Card number and the payment amount

2. Over the Counter Payment

You can visit any SBI branch to make your credit card payment directly at the counter.

3. Manual Drop Box

Deposit your payment through designated drop boxes at SBI branches.

Payment Processing Times

Different payment methods have varying processing times:

- Instant Credit: Paynet, Online SBI, UPI, SBI Debit card, Mobile Banking, YONO

- 2 Working Days: SBI ATM Payment, Over the Counter Payment

- 3 Working Days: Electronic bill payment, NEFT (3 banking hours), Paytm

- 4 Working Days: Electronic Drop Box, Manual Drop Box, Cheque Payment.

Tips for Timely SBI Credit Card Payments

- Set up reminders: Mark your payment due dates on your calendar or set up alerts on your phone.

- Consider auto-debit: Set up SBI Auto Debit for automatic payments on the due date.

- Pay before the due date: Account for processing times, especially when using offline methods.

- Use instant payment methods: When paying close to the due date, use methods that offer immediate credit.

- Check for confirmation: Always verify that your payment has been processed successfully.

Benefits of Making SBI Credit Card Payment on Time

Since you know all the online methods by which you can make the SBI Credit Card payment. But do you know when you pay your credit card bill on or before the due date, you can enjoy numerous benefits? No! Don’t worry, we will tell you the benefits you can enjoy if you make your SBI Credit Card payment on time. Please have a look at them!

Credit Score Improvement

Out of all the aspects of credit score, your repayment history carries most weightage (35%) of the overall weightage. Your repayment history depends on how you pay your credit card bills and EMIs. So, when you make your SBI Credit Card payment on or before the due date, your credit score will keep on rising with time. To pay your credit card bills on time, you should spend according to your repayment capacity and monthly income.

Pre-approved Personal Loans

Paying SBI credit card bills diligently and on time will help you get attractive pre-approved personal loan offers from the leading public sector bank. The best part about such offers is attractive interest rates and no documentation. All you need to do is give your consent and the loan amount will get credited in your account. You can choose the tenure according to your convenience.

Credit Card Upgrade

If you pay your SBI Credit Card bill on time, the public lender can extend your credit limit or upgrade your existing credit card. Let’s say your existing limit is INR 40,000. With this limit, you cannot purchase anything above INR 40,000. But if you keep on paying your credit card bills on time, SBI may offer you a higher credit limit. Apart from this, you can also get an upgrade on your current credit card. With an upgraded credit card, you can enjoy an extended range of cashback offers and reward points. Hence, you should pay your credit card bills on time and get rewarded later.

Save Late Payment Fees and other Charges

When an individual does not pay credit card bills on time, SBI charges late payment fees and interest on their outstanding credit card amount. So, when you pay your credit card bills on time, you can avoid all these unnecessary late payment fees and other charges.

Conclusion

SBI offers a wide range of payment options to suit different preferences and needs for SBI credit card payments. Online methods provide convenience and immediate credit, while offline methods can be helpful for those who prefer in-person transactions. Regardless of which method you choose, ensuring timely payments is crucial to maintain a good credit history and avoid additional charges. Remember that your credit utilization ratio and payment history significantly impact your credit score and future loan approval chances. Choose the payment method that works best for your situation and always aim to pay at least the minimum amount due before the deadline.

Frequently Asked Questions (FAQs)