Standard Chartered Bank Credit Card Online Payment

Last Updated : April 24, 2025, 1:06 p.m.

Paying your credit card bills on time is essential to protect your credit score and prevent additional fees. For cardholders in India, Standard Chartered Bank provides a variety of convenient payment solutions through both digital and traditional channels. This detailed guide explores each available Standard Chartered credit card payment method, highlights any associated charges, and offers practical advice to help you select the payment option that best fits your specific requirements and preferences.

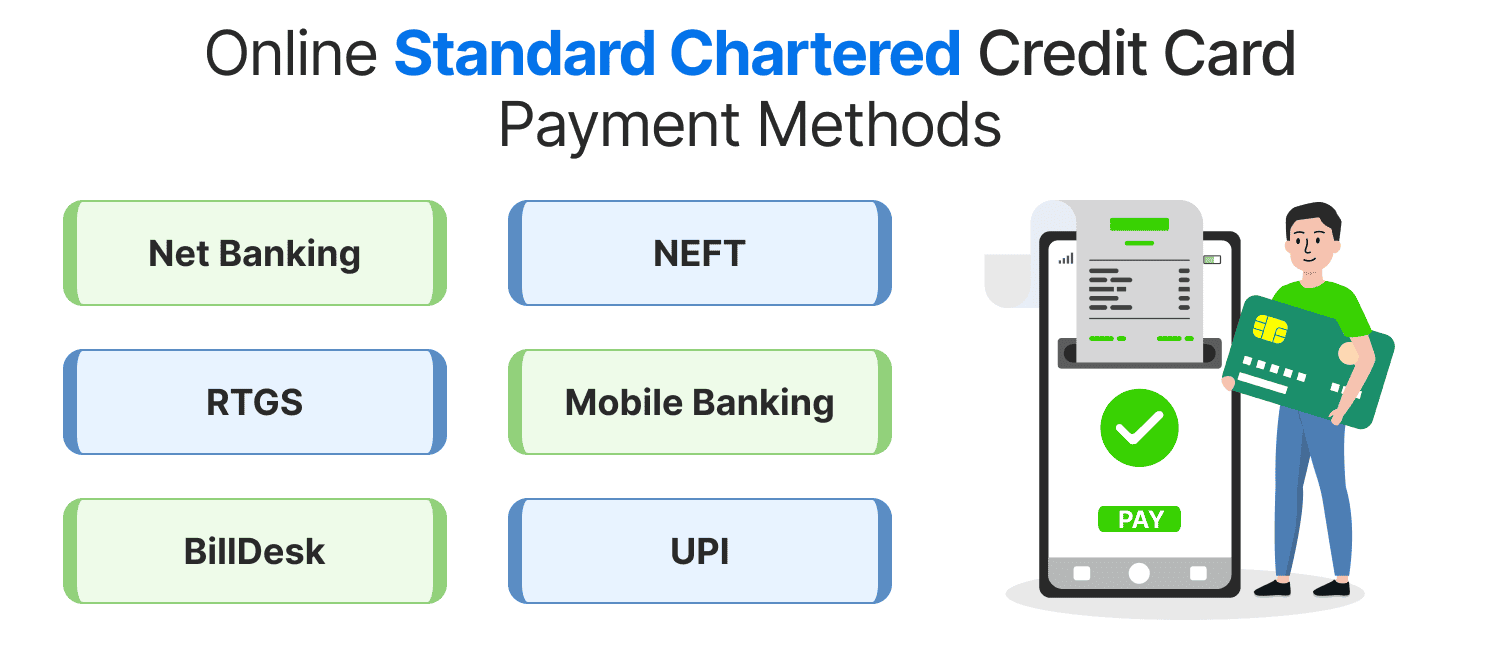

Online Standard Chartered Credit Card Payment Methods

1. Standard Chartered Bank Credit Card Payment via Net Banking

This is one of the most convenient ways to make credit card bill payments if you have a Standard Chartered Bank account.

Process:

- Access your account through Standard Chartered's Online Banking portal.

- Navigate to the credit card payment section

- The payment options include the minimum balance due, the complete outstanding amount, or a personalized payment sum of your determination.

- Confirm the payment

Advantages:

- Instant transfer of funds

- No additional charges

- Available 24/7

- Ability to schedule payments in advance.

2. Standard Chartered Credit Card Payment via NEFT (National Electronic Funds Transfer)

NEFT allows you to transfer funds from any bank account to your Standard Chartered credit card .

Process:

- Log in to your bank’s net banking portal

- Add your Standard Chartered credit card as a beneficiary with these details:

- Beneficiary Name: Standard Chartered Bank

- Account Number: Your 16-digit credit card number

- Bank Name: Standard Chartered Bank

- IFSC Code: SCBL0036001

- Branch Address: MG Road, Mumbai

- Select NEFT as the fund transfer mode

- Enter the payment amount and complete the transaction

Advantages:

- Convenient for payments from other bank accounts

- Widely accessible

- Secure transfer method

Note: Payments should be made at least one working day before the due date to ensure timely credit.

3. Standard Chartered Bank Credit Card Payment through RTGS (Real Time Gross Settlement)

RTGS is suitable for transferring large amounts (Rs. 2 lakh and above) to your credit card.

Process:

- Similar to the NEFT process

- Use IFSC Code: SCBL0036001

- Select RTGS as the transfer mode

Advantages:

- Real-time transfer for large amounts

- Same-day processing

- Ideal for high-value transactions.

4. Standard Chartered Credit Card Payment through Mobile Banking

Pay your credit card bills through the Standard Chartered mobile banking app.

Process:

- Log in to the SC Mobile app

- Navigate to the credit card payment section

- Select the card and payment amount

- Confirm the payment

Advantages:

- Convenient on-the-go payments

- User-friendly interface

- No additional charges

- Available 24/7

5. Standard Chartered Credit Card Payment via BillDesk

This third-party payment platform allows you to pay your credit card bill from any bank account.

Process:

- Visit the Standard Chartered website and select the BillDesk payment option

- Enter the details pertaining to your credit card and the amount to be paid

- Select your bank from the options provided

- You’ll be taken to your bank’s payment interface. Verify and complete the transaction

Advantages:

- Pay from any bank account

- Secure payment gateway

- Available 24/7

6. Standard Chartered Bank Credit Card Payment via UPI (Unified Payments Interface)

Make quick payments using any UPI-enabled application.

Process:

- Open your UPI app (Google Pay, PhonePe, BHIM, etc.)

- Select UPI Money Transfer

- Enter the account number and IFSC code (SCBL0036001)

- Enter the payment amount and complete the transaction

Advantages:

- Quick and convenient

- No need to add beneficiary details each time

- Available 24/7

- Minimal transaction time

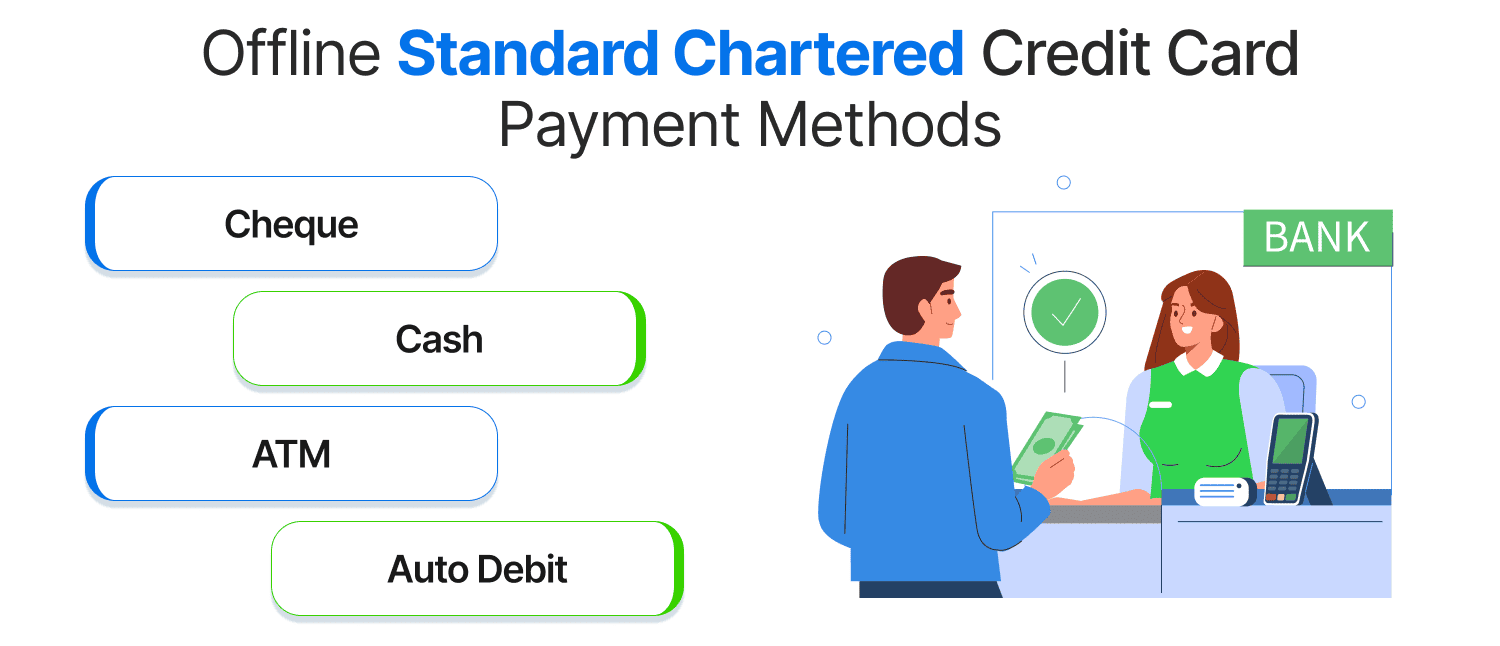

Offline Standard Chartered Credit Card Payment Methods

1. Standard Chartered Credit Card Payment via Cheque

Process:

- Write a cheque that can be paid to “Standard Chartered Bank Card No. XXXX XXXX XXXX XXXX” (your 16-digit card number)

- Ensure the cheque is properly filled and signed

- You can place it in a collection box at any Standard Chartered Bank branch

Important Points:

- Make payments at least 3 days prior to the due date

- Any alterations must be countersigned

- The bank’s website provides a list of cheque collection box locations.

2. Standard Chartered Credit Card Payment via Cash

Process:

- Go to any Standard Chartered Bank branch with a teller facility

- Fill out a cash deposit slip with your credit card details

- Submit the slip along with cash at the teller counter

- Collect the receipt as proof of payment

Note: Cash payments can only be made at branches with teller facilities.

3. Standard Chartered Credit Card Payment via ATM

If you have a Standard Chartered Bank account, you can pay your credit card bill through ATMs.

Process:

- Insert your Standard Chartered debit card in the ATM

- Enter your PIN

- Select “Credit Card Payment” from the menu

- Enter your credit card number and payment amount

- Confirm the transaction and collect the receipt

Advantages:

- Convenient for Standard Chartered Bank account holders

- Available during ATM operational hours

- Instant transfer of funds

4. Standard Chartered Bank Credit Card Payment through Auto Debit / Standing Instructions

Set up automatic payments from your bank account.

Process:

- Download and fill out the auto debit forms (Form A, Form B, and Form C)

- Submit Form A to your bank and Forms B and C to Standard Chartered Bank

- Attach a photocopy of a cancelled cheque

- Choose either the minimum amount due or the total amount due for automatic debit

Advantages:

- Never miss a payment

- Set and forget convenience

- No need for manual intervention every month.

5. Standard Chartered Bank Credit Card Payment through Phone Banking

Request a fund transfer through Standard Chartered’s phone banking service.

Process:

- Call the Standard Chartered phone banking helpline

- Authenticate yourself through the verification process

- Request a transfer from your Standard Chartered account to your credit card

- Confirm the transaction

Advantages:

- Available 24/7

- Useful for users who prefer speaking to a banking representative

- No additional charges.

Processing Time for SCB Credit Card Payment Methods

| Payment Method | Processing Time |

|---|---|

Online Banking | Immediate to 24 hours |

NEFT | Same day to the next working day |

RTGS | Same day (during RTGS hours) |

UPI | Immediate to 24 hours |

Cheque | 2-3 working days |

Cash | Same day to the next working day |

ATM | Immediate to 24 hours |

Auto Debit | On the specified date |

How to Choose the Best Standard Chartered Credit Card Payment Method?

For Convenience

- Mobile Banking/Online Banking: Ideal for regular payments without leaving home

- UPI: Perfect for quick payments on the go

- Auto Debit: Best for those who might forget due dates

For Last-Minute Payments

- Online Banking/UPI: Instant transfers

- NEFT/RTGS: Same-day processing (during banking hours)

- Cash at Branch: Same-day processing (during banking hours)

For Large Payments

- RTGS: Designed for amounts ₹2 lakh and above

- Online Banking: No limit restrictions (subject to bank policies)

- Cheque: When transaction documentation matters, opt for our traditional cheque payment method.

For Those Without Internet Access

- Cash Payment: At the branch teller

- Cheque Payment: Drop at the collection boxes

- Phone Banking: Assistance available over the phone

Fees and Charges for SCB Credit Card Payment Methods

Most Standard Chartered credit card payment methods are free of charge. However, be aware of the following:

- Late Payment Fee: In the range of Rs. 100 to Rs. 1,200 based on the outstanding amount

- NEFT/RTGS: Your bank may charge a nominal fee (Typically Rs. 5 - Rs. 50) for outward NEFT/RTGS transactions

- Cheque Bounce Fee: Approximately Rs. 500 per returned cheque

- Cash Payment: No additional charges

- ATM Payment: No additional charges

- UPI: Generally free (check your bank’s policies)

Important Tips

- Always Pay Before Due Date: Make payments at least 3-4 days before the due date to avoid late payment charges

- Keep Proof of Payment: Save receipts, screenshots, or transaction references

- Check Statement Regularly: Verify that your payments are correctly reflected in your statement

- Maintain Sufficient Funds: Ensure an adequate balance in your account for auto-debits

- Consider Auto Payment: Set up standing instructions for at least the minimum due amount to avoid missing payments

- Payment Allocation: If you have multiple Standard Chartered cards, specify which card to credit when making payments

- Contact Customer Service: If your payment doesn’t reflect within the expected time frame, contact customer service immediately.

Conclusion

Managing your Standard Chartered credit card payments effectively is a crucial aspect of maintaining financial health. With the multitude of payment options available—From digital solutions like UPI, mobile banking, and NEFT to traditional methods such as cash and cheques—cardholders can select what works best for their specific circumstances. Regardless of which method you choose, the key is to ensure timely payments to avoid late fees, maintain a strong credit score, and benefit from interest-free periods. Standard Chartered Bank's flexible payment infrastructure is designed to accommodate various lifestyles and preferences, making credit card bill payments as seamless as possible. By understanding all available options and planning your payments strategically, you can transform what might seem like a monthly chore into a simple, stress-free financial routine.

Frequently Asked Questions (FAQs)