YES BANK Credit Card Payment via Billdesk

Last Updated : June 4, 2025, 4:05 p.m.

YES Bank credit card payments through BillDesk offer a secure, flexible, and convenient way to pay your credit card bills online. You don’t need a YES Bank account—just use any bank’s net banking platform to clear your dues with ease. Whether you're managing your first credit card or multiple cards, BillDesk provides a hassle-free, remote solution that saves time and effort.

This guide will walk you through how to pay YES Bank credit card bill through BillDesk, highlight its benefits, compare it with other payment options, and answer the most frequently asked questions.

What is BillDesk?

BillDesk is a popular online payment gateway company based in Mumbai. It operates under the supervision of the Reserve Bank of India (RBI) and is regulated by the Payments and Settlements Systems Act, 2007. BillDesk provides a centralized platform where users can view and pay multiple bills, including credit card bills, eliminating the need to visit multiple websites or stand in queues.

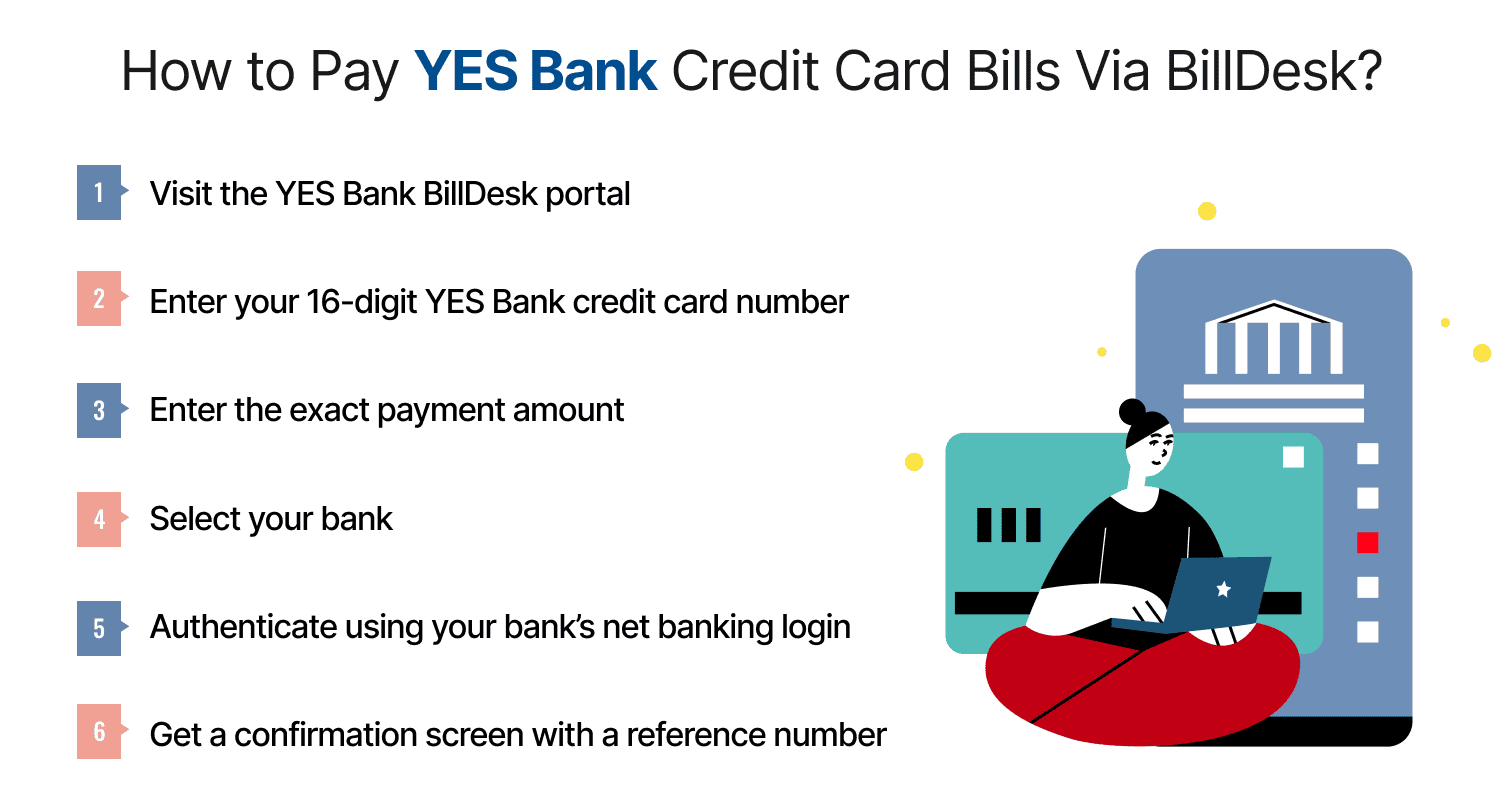

How to Pay YES Bank Credit Card Bills Via BillDesk?

Follow these simple steps for YES Bank credit card payments through BillDesk:

- Visit the YES Bank BillDesk portal (YES Pay Now). Access it via the YES Bank official website or search "YES Bank BillDesk credit card payment" in your browser.

- Enter your 16-digit YES Bank credit card number.

- Enter the exact payment amount – total due, minimum amount due, or a custom amount.

- Select your bank from the supported net banking options such as HDFC, ICICI, SBI, Axis, etc.

- Authenticate using your bank’s net banking login (OTP or password-based verification).

- Get a confirmation screen with a reference number . Save or screenshot it for records.

Payments typically reflect in your credit card account within 2–3 working days. To avoid late fees, it’s recommended to pay at least 3 days before your due date.

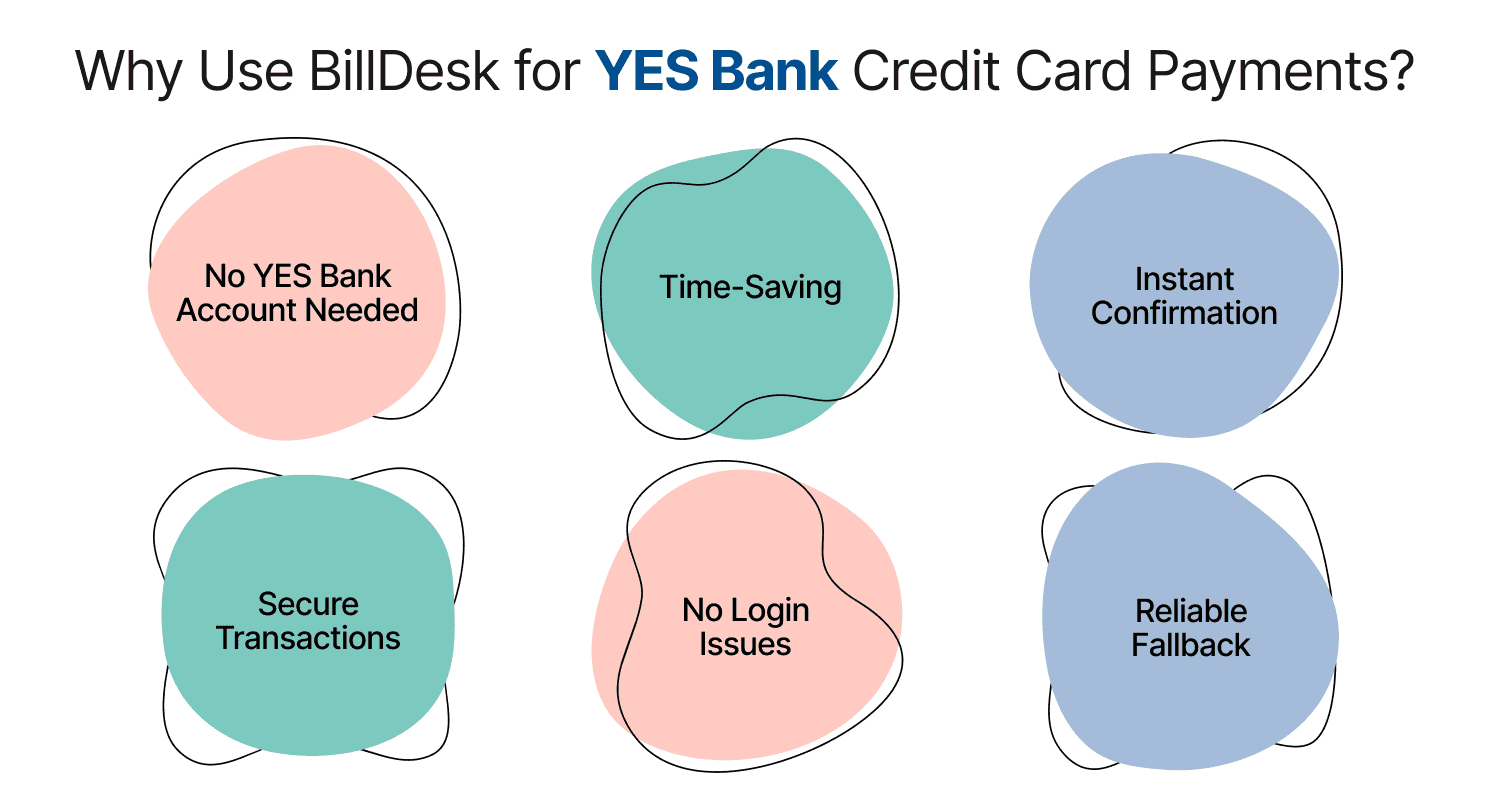

Why Use BillDesk for YES Bank Credit Card Payments?

Thousands of users choose YES Bank credit card bill payment through BillDesk for several reasons:

- No YES Bank account needed – Pay using any Indian bank account.

- Time-saving – No need to visit bank branches or ATMs.

- Instant confirmation – Procure digital receipt with reference ID.

- Secure transactions – Encrypted and compliant with RBI rules.

- No login issues – Perfect when you forget YES Bank login credentials.

- Reliable fallback – Ideal when the YES Bank mobile app is down.

Comparison Table: BillDesk vs Other YES Bank Payment Methods

| Payment Method | Processing Time | Best For |

|---|---|---|

BillDesk | 2–3 working days | Anyone with any bank account |

YES Net Banking | Instant | YES Bank account holders |

YES Mobile App | Instant | On-the-go users with YES Bank account |

NEFT | Same day/1 day | Scheduled payments from other bank accounts |

IMPS/UPI | Instant | Small-value instant payments |

Auto-debit Setup | On due date | Hands-free recurring payments |

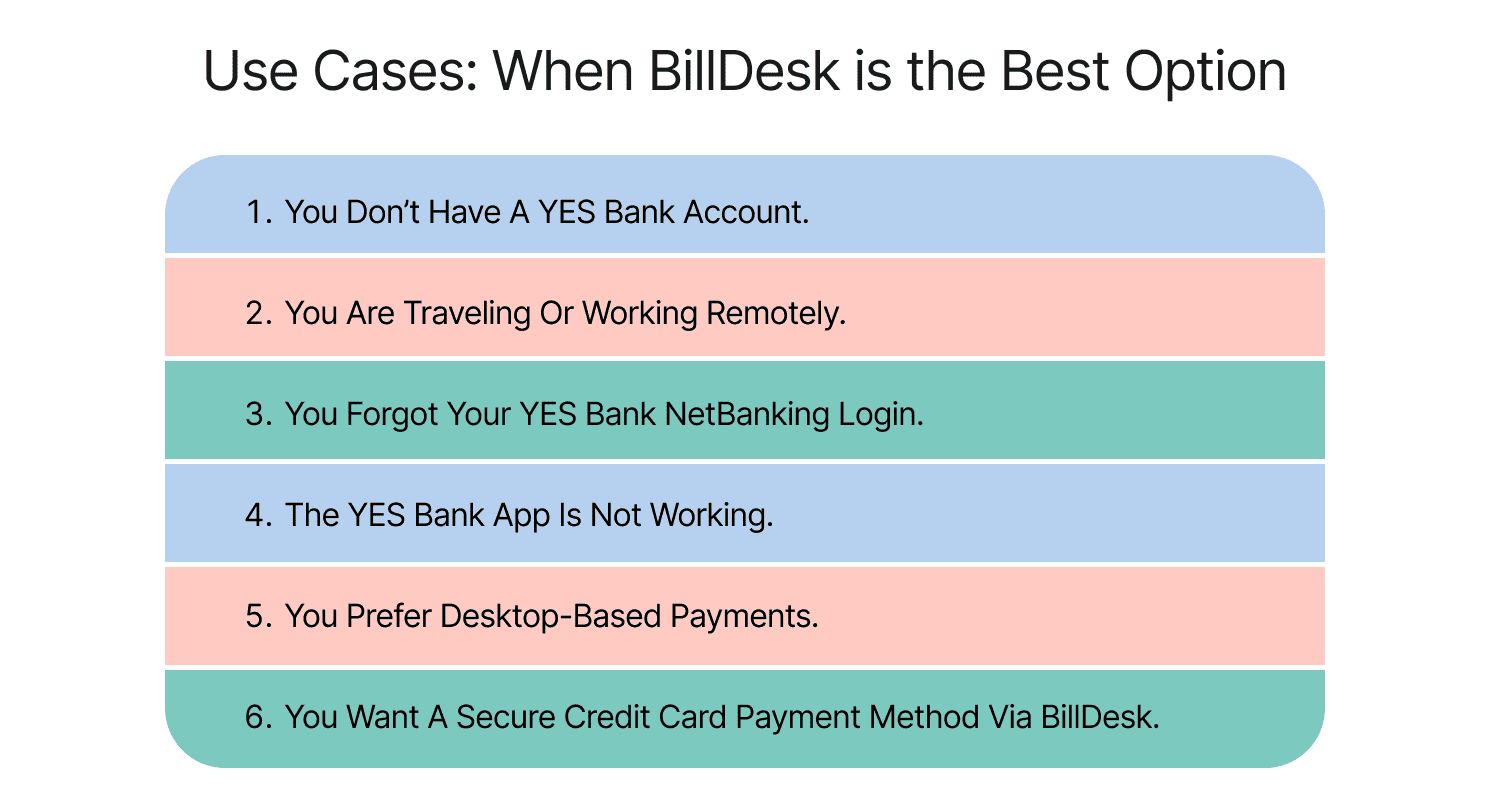

Use Cases: When BillDesk is the Best Option

- You don’t have a YES Bank account.

- You are traveling or working remotely.

- You forgot your YES Bank NetBanking login.

- The YES Bank app is not working.

- You prefer desktop-based payments.

- You want a secure credit card payment method via BillDesk.

Common Mistakes to Avoid When Paying via BillDesk

- Entering the wrong credit card number – Double-check all digits.

- Paying at the last minute – Payments may take 2–3 days to reflect.

- Not saving your transaction reference number .

- Using outdated browsers – Use the latest version for smooth performance.

Make Smarter Credit Decisions with Wishfin

Explore more smart tools on Wishfin:

Wishfin is your one-stop platform for everything from credit score management to credit card and loan comparisons—empowering you to make financially sound decisions.

Final Thoughts

Using YES Bank credit card payments through BillDesk is a smart, secure, and accessible way to handle your credit card dues. Whether you're paying from an HDFC, ICICI, or SBI account, BillDesk allows seamless bill payments—without needing YES Bank login credentials.

The service is ideal for those who value flexibility and want to avoid late fees, app issues, or in-branch visits. Just remember to pay at least 2–3 days before your due date and always keep your transaction reference number safe.

Frequently Asked Questions (FAQs)