YES BANK Credit Card Payment Through NEFT

Last Updated : June 2, 2025, 5:44 p.m.

If you want to make YES Bank credit card payments through NEFT, this guide will show you exactly how to do it safely and quickly. NEFT is a convenient digital payment method that allows you to transfer funds from any bank account directly to your YES Bank credit card . Whether you bank with SBI, HDFC, ICICI, or any other bank, this step-by-step process will help you avoid late fees and maintain a strong credit score.

What is NEFT and Why Use It for YES Bank Credit Card Payments?

NEFT (National Electronic Funds Transfer) is an electronic funds transfer system maintained by the Reserve Bank of India (RBI) that allows one-to-one funds transfer from any bank account to another across India. It’s secure, cost-effective, and widely accepted.

Why Use NEFT for YES Bank Credit Card Payments?

| Benefit | Description |

|---|---|

Pay from Any Bank | Transfer funds from any bank account across India |

No Extra Charges | Most banks offer NEFT free via net banking |

24x7 Availability | NEFT works round the clock, including holidays |

Secure & Trackable | Regulated by RBI with transaction reference number |

Timely Payments | Helps prevent late fees and safeguards your credit score |

How to Make YES Bank Credit Card Payments through NEFT?

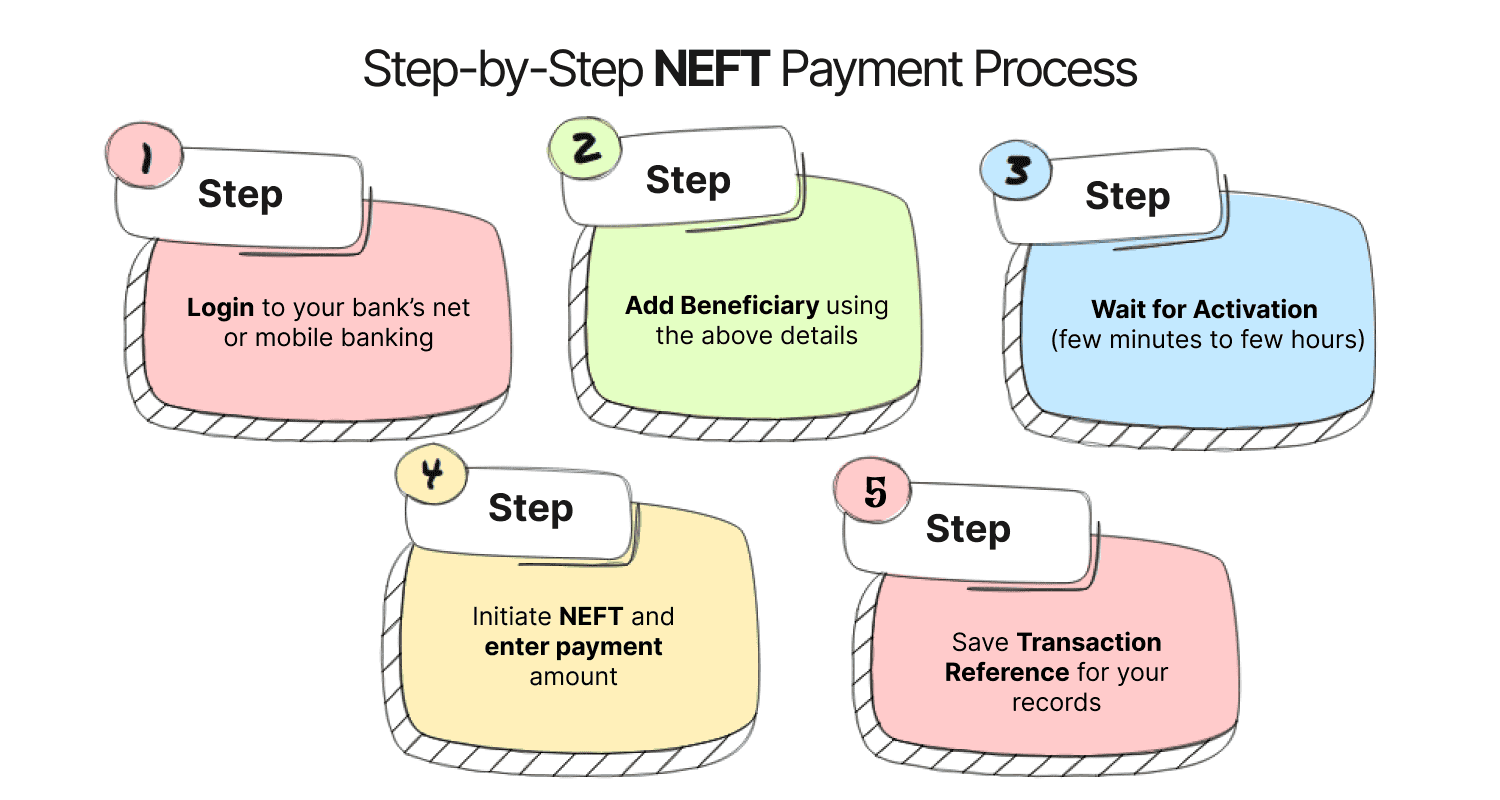

- Log in to your net or mobile banking from any bank (Excluding YES Bank).

- Add your YES Bank credit card as a beneficiary. You will be required to enter your 15-digit card number and IFSC code YESB0CMSNOC (Note the zero).

- Wait for beneficiary activation (usually a few minutes to a few hours).

- Initiate the NEFT transfer with your credit card bill amount.

- Save the transaction reference number for your records.

Details Required for YES Bank Credit Card Payments through NEFT

| Field | Value |

|---|---|

Beneficiary Name | Your Name (as on credit card) |

Account Number | 15-digit YES Bank credit card number |

IFSC Code | YESB0CMSNOC (note the zero after YESB) |

Bank Name | YES Bank Ltd. |

Branch | Mumbai |

Account Type | Current |

Step-by-Step Guide: Make YES Bank Credit Card Payments through NEFT

Step 1: Log in to Your Bank’s Net or Mobile Banking

Access your internet or mobile banking from your bank account (Not YES Bank).

Step 2: For NEFT transfer, add a new beneficiary

Navigate to Funds Transfer > NEFT > Add Beneficiary. Enter the details as shown above carefully.

Step 3: Wait for Beneficiary Activation

Depending on your bank, this can take anywhere from a few minutes to a few hours.

Step 4: Initiate the NEFT Transfer

Select your beneficiary, enter the amount, and confirm the payment.

Step 5: Save the Transaction Reference

Take a screenshot or note down the transaction ID for future reference and proof of payment.

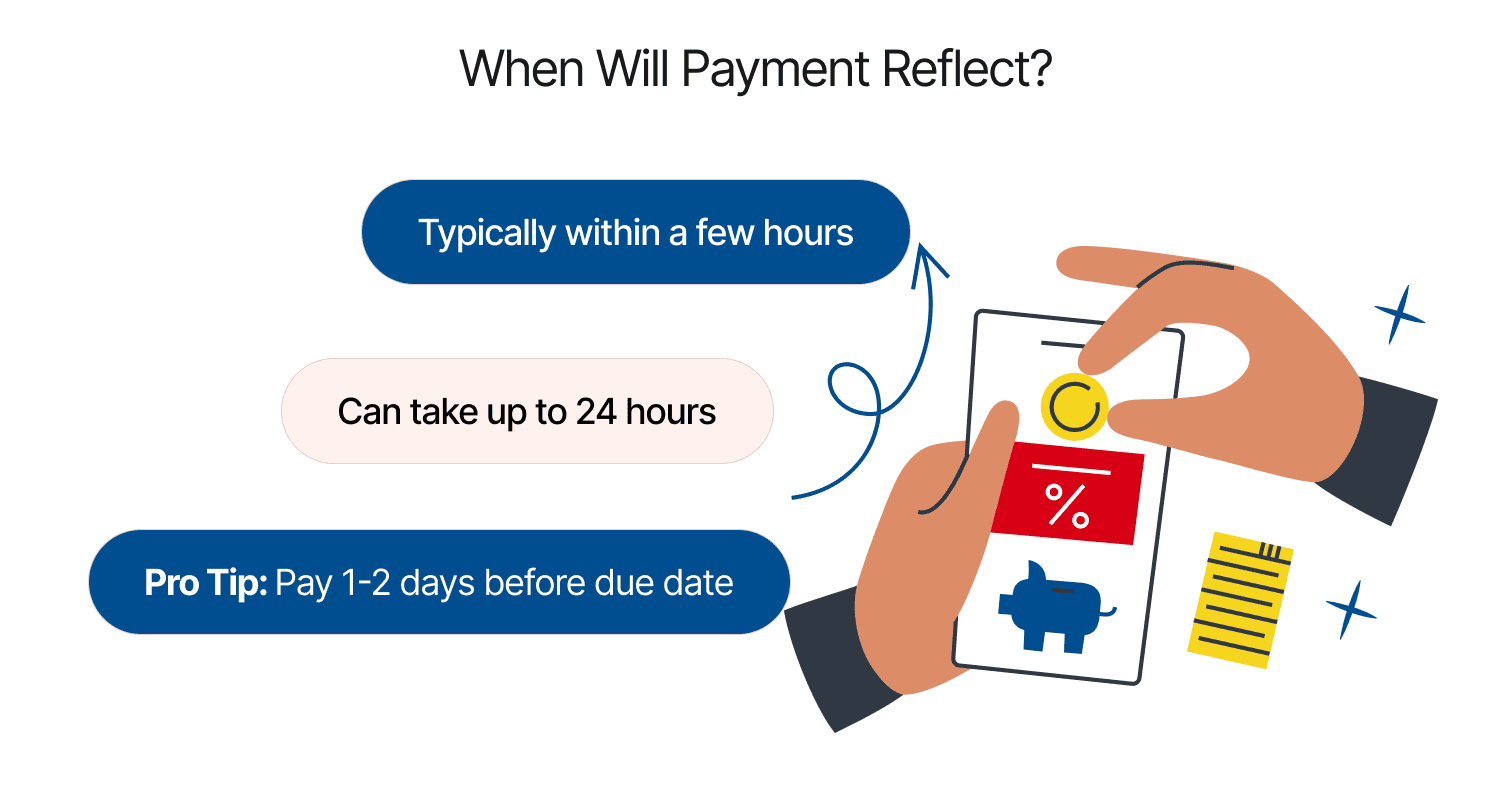

When Will YES Bank Credit Card Payments through NEFT Reflect?

NEFT payments are processed 24x7, including weekends and holidays. Your payment usually reflects within a few hours but may take up to 24 hours.

Pro Tip: Always pay at least 1-2 days before your due date to avoid late fees and credit score damage.

Is It Safe to Make YES Bank Credit Card Payments through NEFT?

Yes, NEFT is a highly secure payment method regulated by the RBI. Ensure you enter the correct IFSC code (YESB0CMSNOC) and your 15-digit credit card number to avoid payment delays or failures.

What To Do If Your NEFT Payment Fails?

- Double-check you entered the correct IFSC code and credit card number.

- If the transaction fails, the amount will typically be refunded within 1-2 business days.

- If issues persist, contact your bank or YES Bank customer care for assistance.

- You can also check the payment status in your bank’s transaction history.

Benefits of Making YES Bank Credit Card Payments through NEFT

- No service charges on most online NEFT transactions.

- Available 24x7 including holidays.

- Payments accepted from any bank across India.

- Supports large transactions in one go.

- Fully digital and paperless process.

- Trackable via transaction reference number.

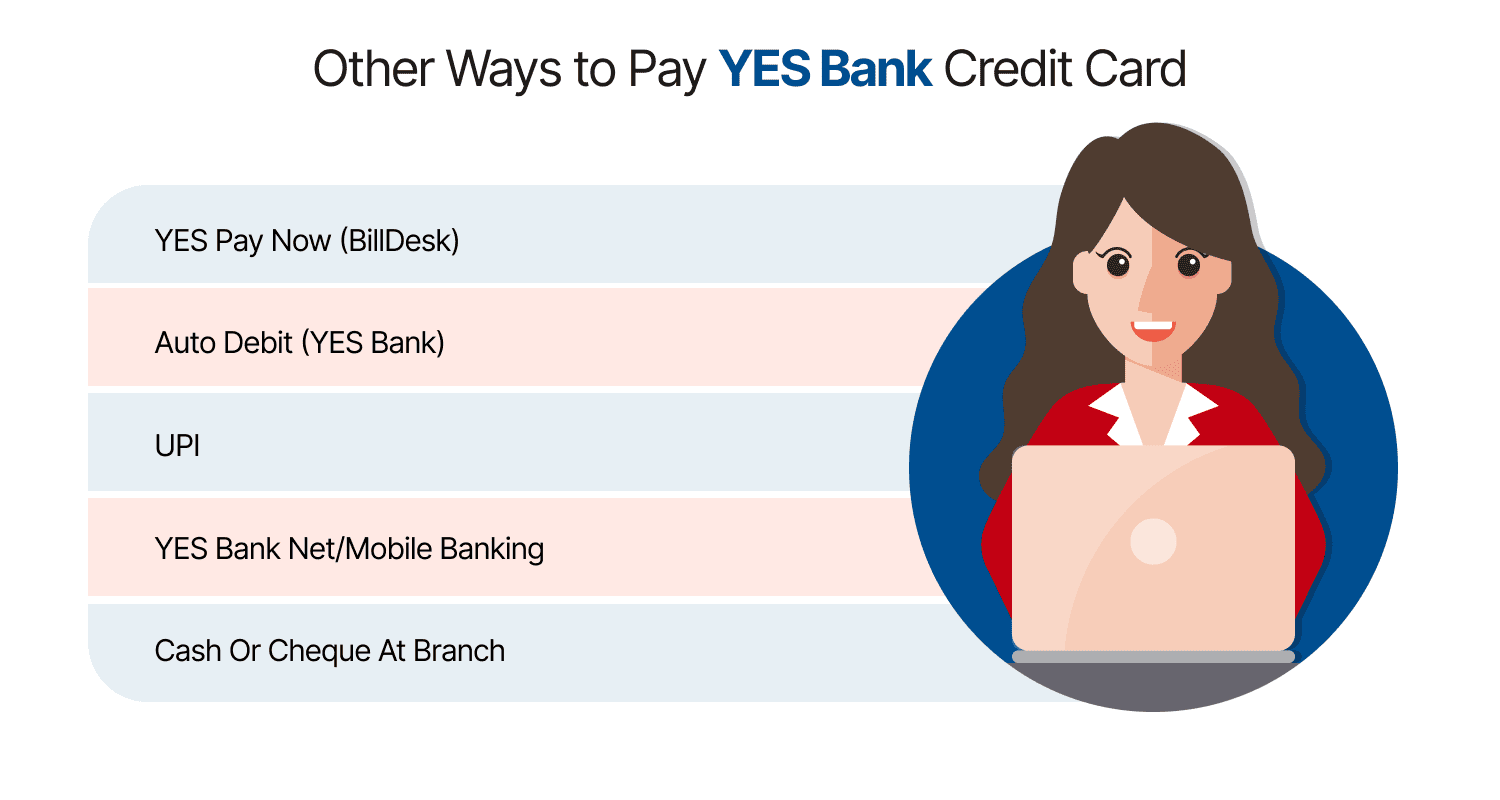

Other Payment Options for YES Bank Credit Card Bills

Besides NEFT, you can also pay your YES Bank credit card bill through:

- YES Pay Now (BillDesk)

- Auto Debit from YES Bank account

- UPI payments

- YES Bank Mobile & Internet Banking

- Cash or cheque at YES Bank branches

Boost Your CIBIL Score with Timely NEFT Payments

Consistently making your YES Bank credit card payments on time using NEFT helps you avoid penalties and builds a positive credit history, boosting your CIBIL score . A strong credit score makes you eligible for better loans, credit cards, and financial offers.

Conclusion

Making YES Bank credit card payments through NEFT is a simple, secure, and convenient way to manage your credit card bills—especially if you bank with other banks. Use the step-by-step process above to pay on time, save money on late fees, and protect your credit score.

Frequently Asked Questions (FAQs)