Can I Get a Loan Against My Provident Fund for Marriage?

Last Updated : July 31, 2024, 3:35 p.m.

Marriage is one beautiful thing that brings together a lifelong partnership between not only the bride and groom but also their respective families. The popular 3 Bs (Band, Baaja and Baaraat) show the magnitude of this event and people want everything to be perfect from guest accommodation, jewelry, food to even the rituals. A fat Indian wedding can cost around INR 15-20 lakh on average. Given such tall expenses, the families start saving at the earliest. They save on their daily routine and even go on to take a loan from a bank or non-banking finance company (NBFC) to make the D-day memorable forever.

But do you know that you can take a loan against your Employees Provident Fund (EPF) for marriage ? Yes, it’s possible! The best part is that you don’t need to return it. The reason being it is not treated as a loan. It’s rather a withdrawal from your provident fund corpus and different from a loan from the lender that charges interest on the same. How much can you withdraw from your provident fund? When can you withdraw from your provident fund? This post will answer all! So, let’s keep reading.

Quick Look at the EPF Contribution

You must have been seeing a certain portion of your salary getting deducted towards the provident fund every month. Around 12% of your basic salary and dearness allowance is deducted by your employer who marks it as your contribution to the provident fund. The employer also makes a matching contribution. These contributions also earn you interest whose interest presently stands at 8.50% per annum..

Conditions that should be availed by an individual applying for an advance for the purpose of marriage :-

- Employee can withdraw up to 50% of his EPF amount.

- The EPF member, his or her children, and siblings may withdraw funds for marriage.

- EPFO Members should have completed at least 7 years of his service.

- You can withdraw only upto 3 times.

How to Apply for a Loan Against EPF for Marriage?

This will require visiting the official website of the EPFO and filling the Form 31 . To access the form, you must have an online account. You must have created your Universal Account Number (UAN) by mentioning your personal details. If you haven’t, you can create it by clicking on Know Your UAN on the EPFO unified member portal . Mention the details correctly and you will get your UAN . You will also need to create a password for login. So, just log in with your UAN and password, go to Form 31, fill in the details and get the amount sanctioned for marriage. You will need to accompany that form with a wedding card for the same.

How Much Should I Withdraw for Marriage?

The EPFO allows withdrawal upto 50% of the employee share along with interest as stated above. It was also mentioned that EPF withdrawals don’t bear any interest liability for you. But provident fund corpus is basically to ensure you retire with a significantly high corpus and live comfortably during your retirement days. So, if you want to withdraw from EPF for marriage, show discretion while deciding on the amount you should withdraw. The amount of money which you decide to withdraw from your EPF Account will be dependent upon the amount you may have in your account as a balance or the time remaining or left in your retirement. So, if you are 20-25 years away from retirement and have a decently large sum in your EPF account, you can withdraw 20%-30% of the same. You can also use other savings which you have contributed or accumulated i.e savings account or as a fixed deposit. Even then, if you are short of meeting the required expenses by some amount, think of applying for a personal loan or take help from your relatives to cover the gap.

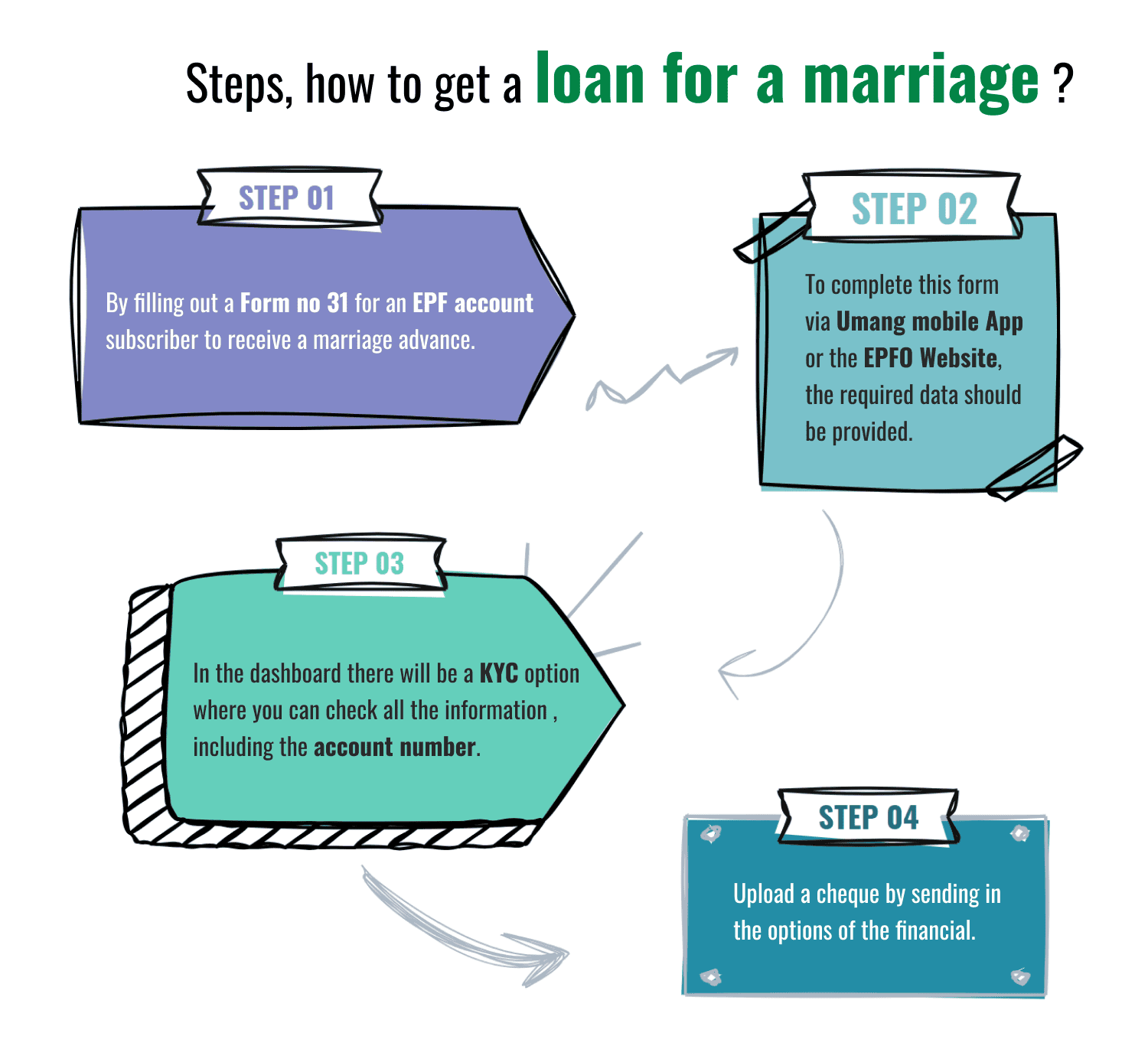

Steps, How to Get a Loan for a Marriage?

Step 1 - By filling out a Form no 31 for an EPF account subscriber to receive a marriage advance.

Step 2- To complete this form via Umang mobile App or the EPFO Website , the required data should be provided.

Step 3 - In the dashboard there will be a KYC option where you can check all the information , including the account number.

Step 4: Upload a cheque by sending in the options of the financial.

Frequently Asked Questions (FAQs)

How to get a loan for Marriage?

How Much Can I Withdraw from My Provident Fund for Marriage?

Can I Withdraw for Marriage Only Once or More Than That?

Is There Any Condition for Withdrawal from EPF?

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates