EPFO Unified Portal

Last Updated : July 27, 2024, 2:51 p.m.

To make provident fund administration more efficient and user-friendly for both employers and employees, the Employee Provident Fund has introduced the Unified Portal. Workers can access a variety of services through the Unified Portal with their recently assigned UAN.

The Indian government established the Employees' Provident Fund Organisation (EPFO) as a statutory entity. Its primary goal as the nation's largest social security agency is to help people save money for retirement, among other things. Founded in 1952, under the jurisdiction of the Ministry of Labour and Employment EPFO has been operated.

EPFO Unified Portal keeps an eye on the contributions made to the provident funds by the employees from various companies. If a company has an employee strength of 20 or above employees then it has to be registered with EPFO. On the other hand, if one is drawing a salary of ₹15000 or below then it is mandatory for him to register himself with the EPF Account.

Well, there are a lot of other things as well that are related to EPFO. So, you must explore the various portals and know about EPFO’s Website.

How EPFO was Originated and About EPFO

The Employees' Provident Funds (EPF) Ordinance, passed in 1951, established the Employees' Provident Fund (EPF). The EPF Funds Act, 1952 eventually took the role of the EPF Ordinance. In order to give employees of factories and other institutions provident funds, the EPF Bill was presented to the parliament in 1952.

- Employees’ Provident Fund Scheme 1952

- The Employees’ Deposit Linked Insurance Scheme 1976

- Employees’ Pension Scheme 1995

These days, the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 (commonly known as The Act) is the law that regulates employees’ provident fund. All of India is covered by the Act, with the exception of Jammu & Kashmir.

About EPFO

EPFO maintains more than 19.34 crore accounts and is one of the largest social security organizations in the world. The EPFO consists of the Central Board of Trustees, Employees’ Provident Fund having representatives of central and state government, employers, and employees. EPFO has its office located at 135 different locations in India.

EPFO helps you to accumulate funds for your future and it gives interest to the accumulated amount. However, you can even take partial withdrawals for things like marriage, medical expenses, education, and building a home. When you retire or pass away, the accumulated fund will be paid to you in one lump payment once the partial withdrawals have been subtracted.

How EPFO Works

In the EPF Scheme, the employee and the employer make an equal contribution towards the scheme. Once the employee retires, he is entitled to receive the accumulated sum of money with interest. The employee and the employer contribute 12% of the basic salary to the EPF.

The 12% contribution of the employee goes to the EPF account and in the 12% contribution of the employer, 8.33% is contributed to employees’ pension scheme and 3.67% is contributed to the EPF account. PF currently has an interest rate of 8.25%.

Functions Of EPFO

For registered establishments in India, which includes covered employees as well as foreign workers, administrative support has been provided to the Central Board of Trustees by EPFO in managing provident fund, pension, and insurance schemes.

The operations of EPFO comprise

- This act has been applied all over India excluding Jammu and Kashmir

- Upkeep of personal accounts

- Resolution of disputes

- 0 Financial investment

- It makes sure that pension payments should arrive on time.

- Updating documentation

EPFO Home Page

The EPFO Home Page is available in both languages and is Hindi and English. You can access the home page in both languages. There is a service column that offers various online services of EPFO like Principal Employers CAIU Portal, Pensioners’ portal, TRRN Query Search International Workers Portal, and eKYC Portal. You can also know about EPFO, its mission, vision, and schemes on the EPFO home Page.

In the What’s New Column, you can see the latest updates related to EPFO and you can contact EPFO through WhatsApp and other social media links present on the home page.

EPF and its Significance

According to the Constitution of India, Part IV that is Directive Principles of State Policies(DPSPs) states that, the State must, to the extent of its financial resources, it ensure that the citizens of india will have the access to public assistance , all the opportunities related to employment, including education at the time of unemployment, old age , illness or unjustifiable want.

According to this assertion, a dynamic social security program was required in light of the shifting environment. In an effort to give employees and their dependents a respectable life after their job tenure ended, the legislation for a provident fund was enacted.

New Plans and Rewards for EPFO Contribution in the 2024 Budget

A system of employment-linked incentives was unveiled by Nirmala Sitharaman. According to her, these programs will be centered on first-time employee recognition and will be based on enrolment in the EPFO. In all formal industries, new hires will be paid a month's salary upon joining the workforce. Three installments of a one-month pay, up to ₹15,000 , would be given as a direct benefit transfer (DBT). A monthly salary of ₹1 lakh will be the eligibility threshold for this benefit, which is anticipated to assist 2.1 crore young people.

Tabs on EPFO Home Page

| Tabs | Details |

|---|---|

| Services | For Employers, For Employees, For International Workers, For Pensioners-Locate Jeevan Pramaan Centre, Locate on EPFO Office, and Who’s Who |

| Establishment | List of Exempted Establishments, Perfor. Evaluation of Exempted Esst, Current Defaulting Establishments, Exempted Return Manual, and Provisional Monthly Estimate of Payroll |

| EPFO Corner | Chief Executive Officer, Central Government Industrial Tribunal, EPF Training Institutes, MIS, Nrakas, For Office Use |

| Miscellaneous | Ease of Doing Business, Downloads, Recruitments, Tenders/Auctions, Citizen’s Charter, RTI Act, operational Statistics, and Integrity Pledge-Central Vigilance Commission |

| PM-SYM | PM-SYM Scheme, Enrolment in PM-SYM, Common Service Centres, and FAQ |

| Videos, Directory, Dashboards, and ABRY | |

EPFO Login Portal

The Universal Account Number (UAN) must first be activated in order to access the EPFO portal. This may be done quickly and easily on the portal itself.

After Logging in users can easily perform various activities.

EPFO Unified Portal

You can log in and manage your EPF account through this portal. You will have to enter your Username and Password in order to get access to your EPF account. This portal allows your permanent login I.D. and password as per your choice after you have made your first login. If in case you forget your password then you can make use of the Forget Password link and take the necessary steps to recover your password.

The EPFO unified portal will send a new password on your registered mobile number So that you can make a hassle-free login. The individual can even go for the Employer Sign in by clicking on that link.

In case your account has been locked as a result of repeatedly typing the incorrect password , use the unlock account link. The EPFO Unified Portal also provides access to the following additional significant links:

- Common Registration Under (EPFO & ESIC)

- Common ECR (EPFO & ESIC)

- Employees’ Provident Fund Organization, India

- Pradhan Mantri Rojgar Protsahan Yojna (PMRPY)

- Shram Suvidha Portal

- Employer Registration for Pre-olre Establishments

- Uncovered Principal Employer Registration

EPFO Member Portal

You can use the EPFO Member Portal for managing your EPF account and You can manage the following things from the EPFO Member Portal.

- EPF Accounts

- Update KYC

- Service Details

- EPF Passbook

- Submit Online Claims

- Download UAN Card

- EPF Balance Check

You can use the EPFO Member Portal only if you have activated the UAN and a password. and you can’t log in to the EPFO member portal without having a Universal Account Number. If you don’t have UAN then you can click on the link Activate UAN and follow the further steps.

You can click on the Know Your UAN link if you have forgotten your Universal Account Number.

EPFO Member Home

All the individuals registered on EPFO can log in through the EPFO Member Home. This page will ask you for the UAN number and password through which you can easily see all the details related to your EPF account. On the other hand, individuals can use only one mobile number for one registration. One can access their passbook through the EPFO member home but the facility of passbook is not available for the members who have an exemption under the EPF scheme 1952.

The EPFO member home also keeps you updated about the notices issued by EPFO. You can see the various updates and information and download them in the form of a PDF file. The notices you will find on the Member Home Page are:-

- You can see the notices about linking Aadhaar Card to your EPF Account.

- Check the benefits of the Unorganised workers registering on the e-Sharm Portal.

- You will always need an Aadhar for filming ECR.

- You can check all the important notices about EDLI.

- The Member Home page also gives you the link to download a PDF that has all the information about linking your Bank Account with UAN.

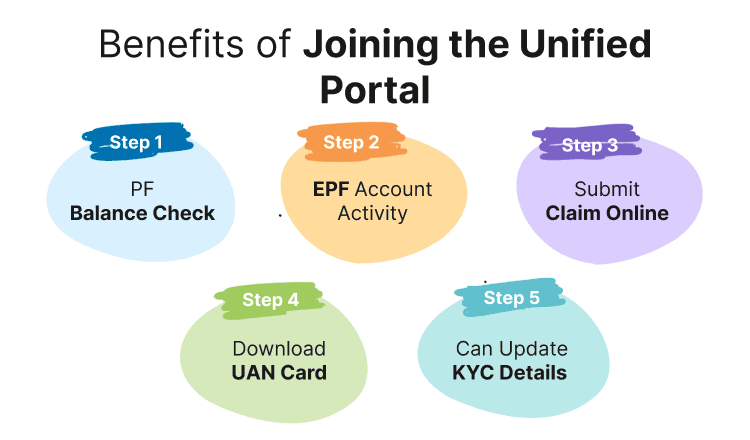

Benefits of Joining the Unified Portal

After logging in to the Unified Portal and connecting UAN to Aadhaar, the user will have the following capabilities:

- PF Balance Check - Workers with a UAN connected to a KYC who have registered on the Unified Portal can conveniently check their PF balance at any time.

-

EPF Account Activity -

An SMS regarding any credits or debits to the employee's EPF account would be sent. Workers with UANs can also check the balance of their EPF account by calling 9718397183 on a missed call or by using the EPF mobile app.

-

Submit Claims Online -

Workers with UANs enabled for Aadhaar can file claims with EPFO directly. Going to the employers for claims attestation would not be necessary. Moreover, employees can submit all applications online for EPFO services.

-

Download UAN Card -

The Unified Portal enrollees have the ability to download their own UAN Card. Likewise, the latest passbook is available for printing at any moment via the Unified Portal

.

- Can Update KYC Details - Workers who have registered on the Unified Portal are able to change their cellphone number or KYC information at any time. In order to combine the accounts, all employer IDS can also be listed under the UAN on the Unified Portal.

Important Links

There are some important links present on the Unified Portal Page that can help you to do various activities. You can see the links that are available on the Unified Page below:-

- Common Registration Under (EPFO & ESIC)

- Common ECR (EPFO & ESIC)

- Employees’ Provident Fund Organization, India

- Pradhan Mantri Rojgar Protsahan Yojna (PMRPY)

- Shram Suvidha Portal

- Employer Registration for Pre-olre Establishments

- Uncovered Principal Employer Registration

Bottom Line

Now, we think that you have grabbed a deep knowledge of EPFO and some of its important portals and You can make use of the various EPFO portals to resolve all your queries online. These online portals will help you to manage your EPF account and you can even make partial withdrawals online.

The EPFO Unified Portal monitors the donations that employees from different companies make to the provident funds. An organization is required to register with EPFO if it employs 20 people or more. Well, you can see the steps to activate UAN and member login in our next blog. Thanks for reading and we hope now you have a clear picture of EPFO.

Frequently Asked Questions (FAQs)

Is it necessary to update KYC details on EPFO Unified Portal?

What are the Benefits of Joining EPFO Unified Portal?

Is it mandatory to upload documents on the Unified EPFO Portal?

How Long does it take to approve KYC documents?

How often do I need to check the EPFO Unified Portal to check the document status?

Can Employers with hold EPF balance while switching jobs?

Can you have two UAN on the EPFO Unified Portal?

Is UAN mandatory for online claims?

Who allots UAN?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- Standard Chartered Personal Loan Interest Rates

- SBFC Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates