How to Link Aadhaar Number with PAN Card Online?

Last Updated : Sept. 16, 2024, 6:37 p.m.

It's essential to link your Aadhaar with your PAN card, as not doing so will make your PAN inoperative. This link is also necessary for conducting any banking transactions above Rs. 50,000. The process is simple, and below are the steps you can follow to ensure your PAN is connected to your Aadhaar.

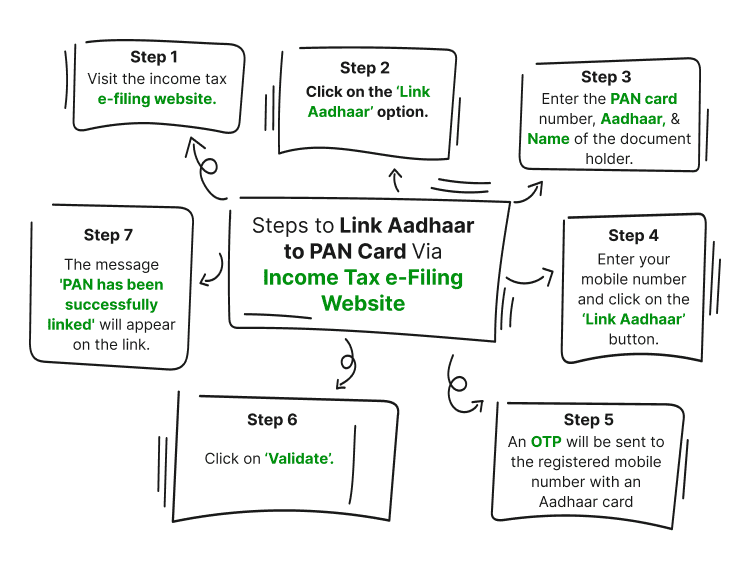

Steps to Link Aadhaar to PAN Card Via Income Tax e-Filing Website

Here are the steps you need to follow to link your Aadhaar with your PAN card using the e-filing website:

Step 1: Visit the income tax e-filing website .

Step 2: Click on the ‘Link Aadhaar’ option.

Step 3: Enter the PAN card number, Aadhaar, and name of the document holder.

Step 4: Enter your mobile number and click on the ‘Link Aadhaar’ button.

Step 5: An OTP will be sent to the registered mobile number with an Aadhaar card

Step 6: Click on ‘Validate’.

Step 7: The message 'PAN has been successfully linked' will appear on the link.

If the names on the two documents differ, the linkage might fail. To resolve this, the PAN card holder must update their name on either the PAN database or by visiting a PAN application center operated by NSDL eGov or UTITSL for biometric Aadhaar authentication.

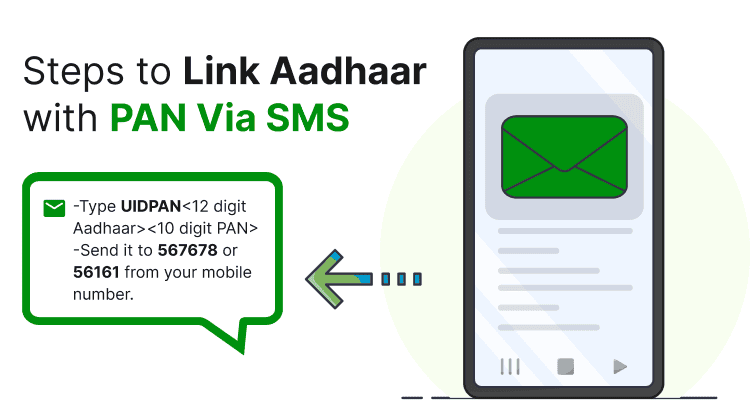

Steps to Link Aadhaar with PAN Via SMS

The Central Board of Direct Taxes (CBDT) in its notification dated June 29, 2017, provided additional methods for linking PAN and Aadhaar. You can also perform this task using your mobile phone at your convenience in terms of time and location. However, your mobile number must first be updated in your Aadhaar. If your Aadhaar is already linked to your mobile number, you can follow these steps:

- Type UIDPAN<12 digit Aadhaar><10 digit PAN>

- Send it to 567678 or 56161 from your mobile number.

For example, if your Aadhaar number is 111122223345 and your PAN is ABCPA9999Q. Then you are required to send an SMS to 567678 or 56161 as UIDPAN 111122223345 ABCPA9999Q

There are no additional charges by NSDL and UTI for this but the normal SMS charges as levied by the mobile operator will be applicable.

Having Trouble Linking Your Aadhaar with PAN?

The Income Tax Department has introduced a simplified one-page form that allows taxpayers to manually apply for linking their Aadhaar with their PAN card, in addition to the existing online and SMS options. Here are the steps you should follow:

- Clearly state your PAN and Aadhaar numbers.

- Ensure the spelling on both documents matches.

- Include a signed declaration that the Aadhaar number provided in the application has not been used to link with any other PAN.

What Happens If You Don't Link Aadhaar with Your PAN Card?

Failing to link your Aadhaar with your PAN can lead to several complications:

- Your Income Tax Return (ITR) will not be processed.

- A notice may be issued under ITR Section 142(1).

- A penalty of ₹5,000 may be imposed for not filing the ITR on time.

- You won’t be able to claim or carry forward capital losses, business losses, etc.

- No refunds will be given if your ITR is not processed.

- Interest under sections 234A, 234B, and 234C may be levied based on the tax payable

It’s important not to delay or disregard this mandate. Link your Aadhaar with your PAN using the information provided in this article to avoid these issues.

How to Check the Aadhaar and PAN Card Linking Status?

If you're unsure whether your PAN and Aadhaar cards are linked, you can follow these steps to check:

- Visit the Income Tax e-filing portal.

- On the homepage, under the quick links, click on ‘‘Link Aadhaar Status.’’

- Then enter your PAN and Aadhaar number.

- Click on the ‘’View Link Aadhaar Status’’ option.

- Your Aadhaar-PAN link status will appear on the screen.

Frequently Asked Questions (FAQs)

What steps should I take if I missed the deadline to link my Aadhaar with my PAN card?

Can I still link my Aadhaar with my PAN card after it becomes inoperative?

How long does it take to link Aadhaar with PAN after submitting the request?

Is linking Aadhaar with PAN mandatory for Non-Resident Indians (NRIs)?

What are the consequences of not linking Aadhaar with PAN?

Aadhaar

- Check Aadhaar Update History

- Aadhaar Card Services

- Aadhaar Services on SMS

- Documents Required for Aadhaar Card

- Aadhaar Card Status

- E-Aadhaar Card Digital Signature

- Aadhaar Card Authentication

- Aadhaar Card Online Verification

- Lost Aadhaar Card

- Aadhaar Card Not Received Yet

- Aadhaar Virtual ID

- Retrieve Forgotten & Lost Aadhaar Card UID/EID

- Aadhaar Card Address Validation Letter

- Get Aadhaar Card for Non-Resident Indians

- Get Aadhaar e-KYC Verification

- Aadhaar Card Seva Kendra

- Aadhaar Card Features

- Aadhaar Card Online Corrections

- Change Photo in Aadhaar Card

Link Aadhaar Card

- Link Aadhaar Card to Bank Account

- Link Aadhaar Card to IRCTC Account

- Link Aadhaar Card to Income Tax Return

- Link Aadhaar Card with EPF

- Link Aadhaar Card with Driving Licence

- LInk Aadhaar to Caste Certificate

- Link Aadhaar with BPCL

- Link Aadhaar Card with LPG Gas

- Link Aadhaar Card with Ration Card

- Link Aadhaar Card with HP Gas

- Link Aadhaar Card with NPS Account

- Link Aadhaar Card with Mutual Funds

- Link Aadhaar Card with Demat Account

- Link Aadhaar Card with HDFC Life Insurance

- Link Aadhaar Card with SBI Life Insurance

Link Aadhaar to Mobile Number

Aadhaar Enrollment Centers

- Aadhaar Card Enrollment Centres

- Aadhaar Card Enrolment Centers in Delhi

- Aadhaar Card Enrolment Centers in Bangalore

- Aadhaar Card Enrolment Centers in Mumbai

- Aadhaar Card Enrolment Centers in Ahmedabad

- Aadhaar Card Enrolment Centers in Hyderabad

- Aadhaar Card Enrolment Centers in Ranchi

- Aadhaar Card Enrolment Centers in Indore

- Aadhaar Card Enrolment Centers in Kanpur

- Aadhaar Card Enrolment Centers in Patna

- Aadhaar Card Enrolment Centers in Surat

- Aadhaar Card Enrolment Centers in Lucknow

- Aadhaar Card Enrolment Centers in Bhopal

- Aadhaar Card Enrolment Centers in Jaipur

- Aadhaar Card Enrolment Centers in Ghaziabad

- Aadhaar Card Enrolment Centers in Faridabad

- Aadhaar Card Enrolment Centers in Noida

- Aadhaar Card Enrolment Centers in Gurgaon

- Aadhaar Card Enrolment Centers in Kolkata

- Aadhaar Card Enrolment Centers in Pune

- Aadhaar Card Enrolment Centers in Chennai

- Aadhaar Card Enrolment Centers in Chandigarh