How to Link Aadhaar with ICICI Bank Account Online?

Last Updated : Sept. 11, 2024, 3:55 p.m.

If you hold an ICICI Bank account but haven't linked it to your Aadhaar yet, we are here to help you with how to link Aadhaar with ICICI Bank Account. The Government of India has made it mandatory that all the benefits and subsidies will be sent to the bank account linked to your Aadhaar/UID number. ICICI Bank, with over 4,850 branches and 13,792 ATMs, handles millions of accounts. Here's a quick guide to Aadhaar Seeding and linking with your accounts at ICICI Bank by telling you different ways featuring simple steps.

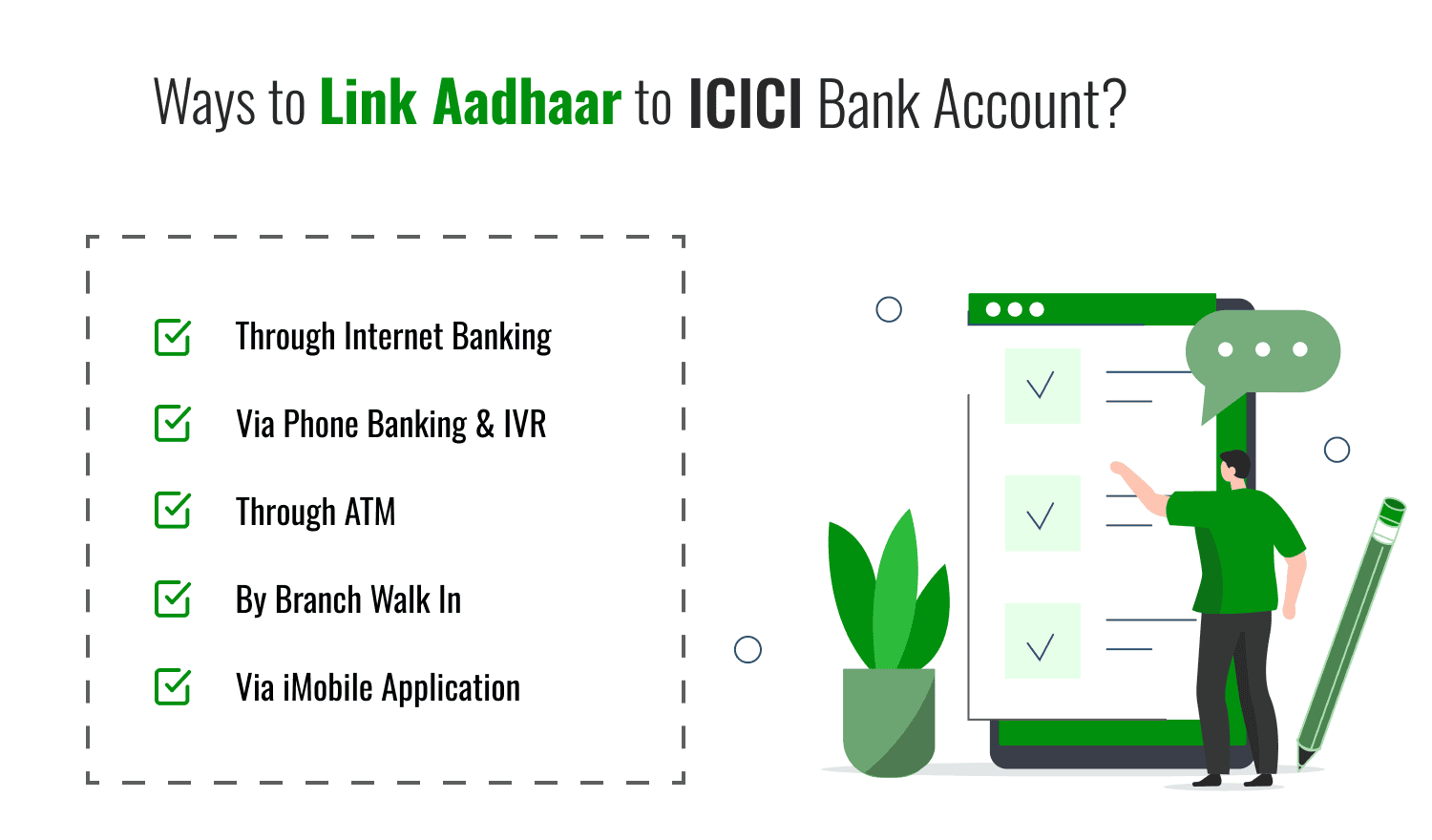

Ways to Link Aadhaar to ICICI Bank Account

There are several modes by which you can link your Aadhaar card to your ICICI Bank account. These include-

- Through Internet Banking

- Via iMobile Application

- Via Phone Banking & IVR

- Through ATM

- By Branch Walk In

Link Aadhaar Card to ICICI Bank through Netbanking

Follow these simple steps to link your Aadhaar Card to ICICI Bank through Netbanking -

- Click here to update your Aadhaar details in your bank accounts.

- Log in using your ICICI Internet Banking User ID and Password.

- Enter your 12-digit Aadhaar number, then re-enter it for confirmation, and click 'Submit.'

Through these easy steps, you can link Aadhaar with your ICICI Bank account easily. However, if you do not hold the rights to Net Banking, you then need to request the same at the nearest bank branch or the 24×7 customer care. After getting access to Internet Banking, you can follow the steps mentioned above to link Aadhaar with your bank account.

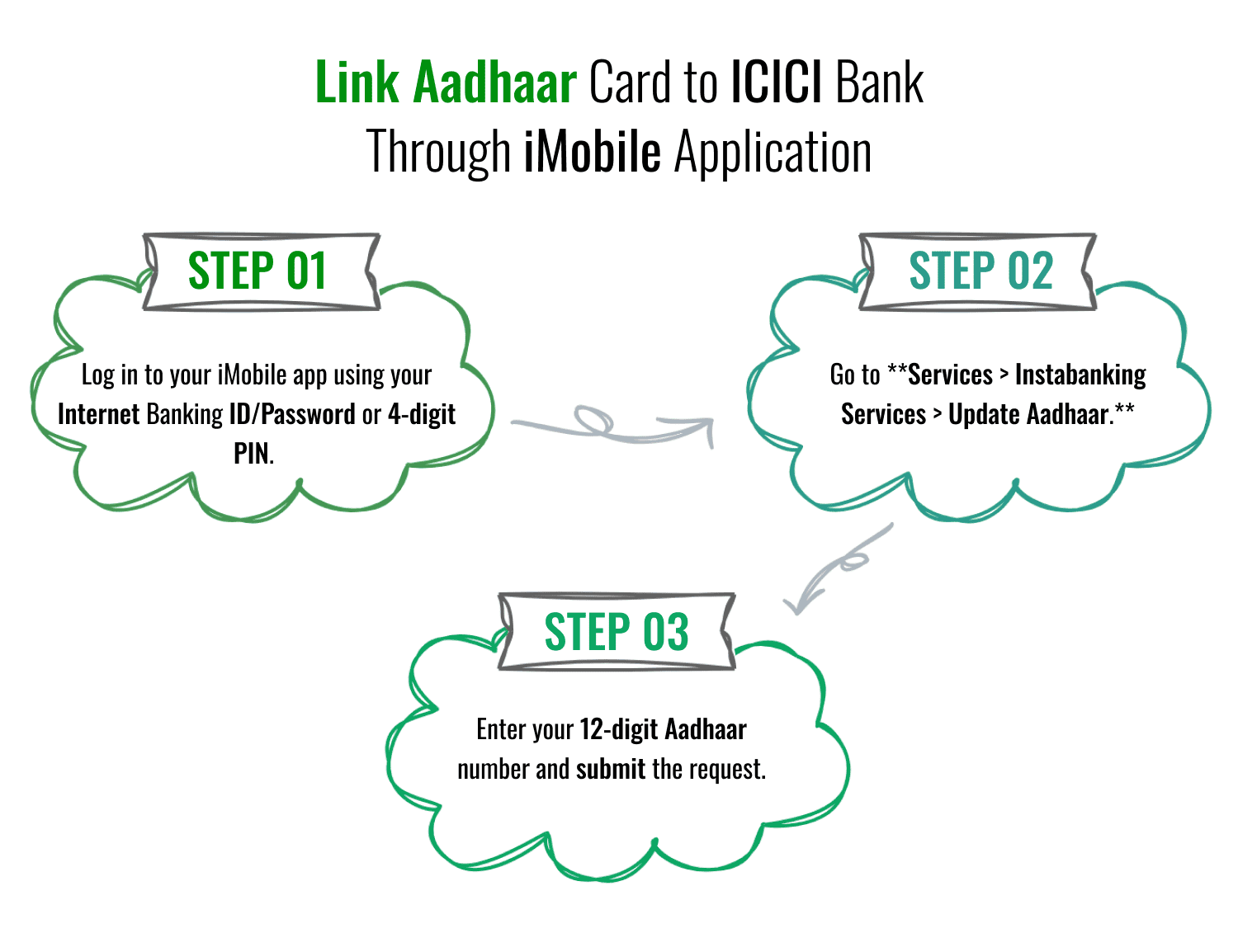

Link Aadhaar Card to ICICI Bank Through iMobile Application

To download the iMobile app, visit the app store or SMS **iMobile** to 5676766 for the download link, or follow the steps from which you can easily link your Aadhaar Card to your ICICI Bank account through the iMobile application.

- Log in to your iMobile app using your Internet Banking ID/Password or 4-digit PIN.

- Go to **Services > Instabanking Services > Update Aadhaar.**

- Enter your 12-digit Aadhaar number and submit the request.

*After submitting your Aadhaar number, they will contact you to assist with iMobile activation. Please ensure that your mobile number is registered for mobile banking and has GPRS enabled.*

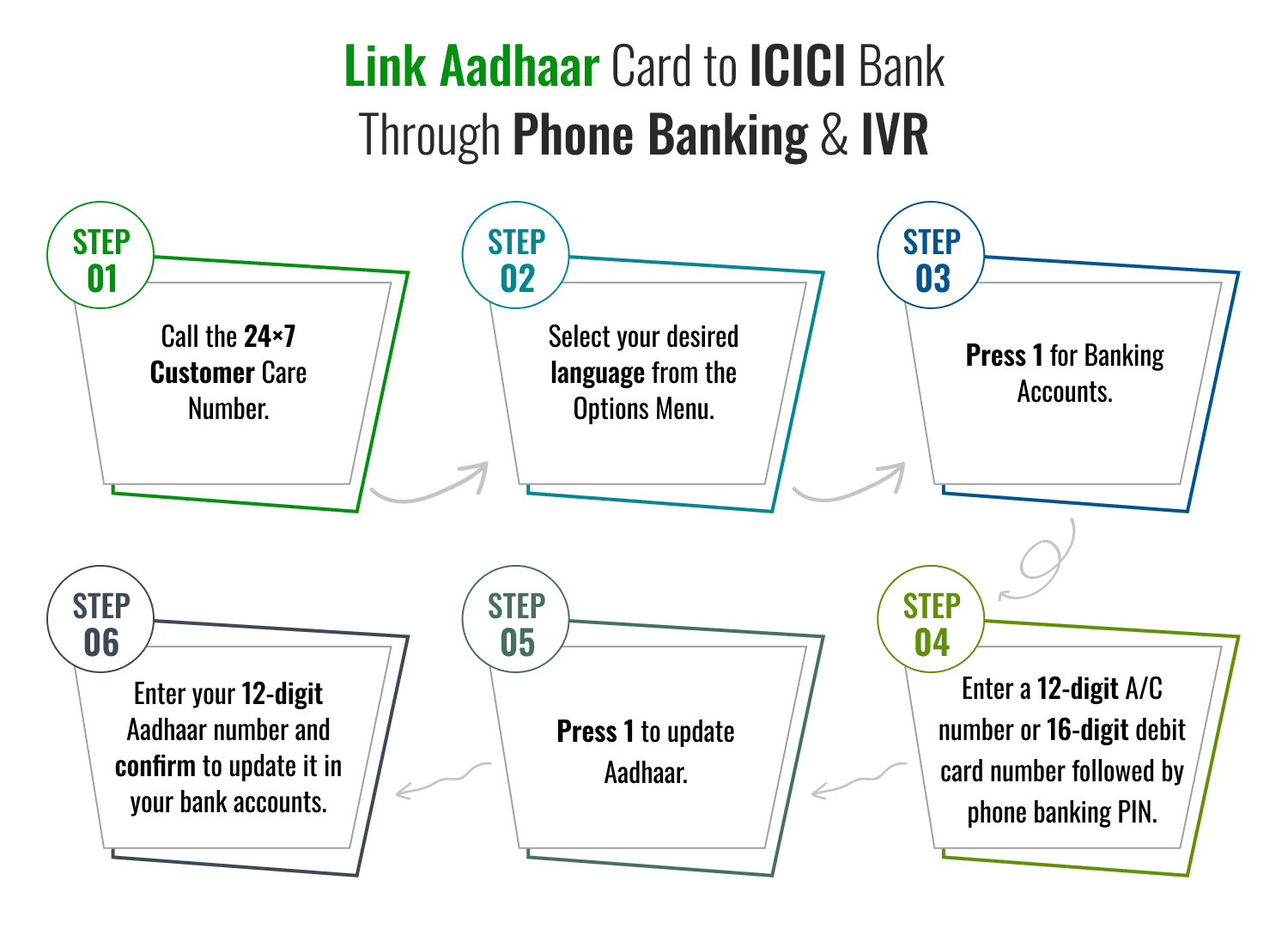

Link Aadhaar Card to ICICI Bank Through Phone Banking & IVR

You can use phone banking services to update your Aadhaar with your ICICI Bank account. Check out the steps you need to follow here.

- Call the 24×7 Customer Care Number .

- Select your desired language from the Options Menu.

- Press 1 for Banking Accounts.

- Subsequently, enter your 12-digit account number or 16-digit debit card number followed by your phone banking PIN.

- Press 1 to update Aadhaar.

- Enter your 12-digit Aadhaar number and confirm to update it in your bank accounts.

- Alternatively, you can press Option 5 in the Self-Banking Menu or press 9 to speak to the customer care executive.

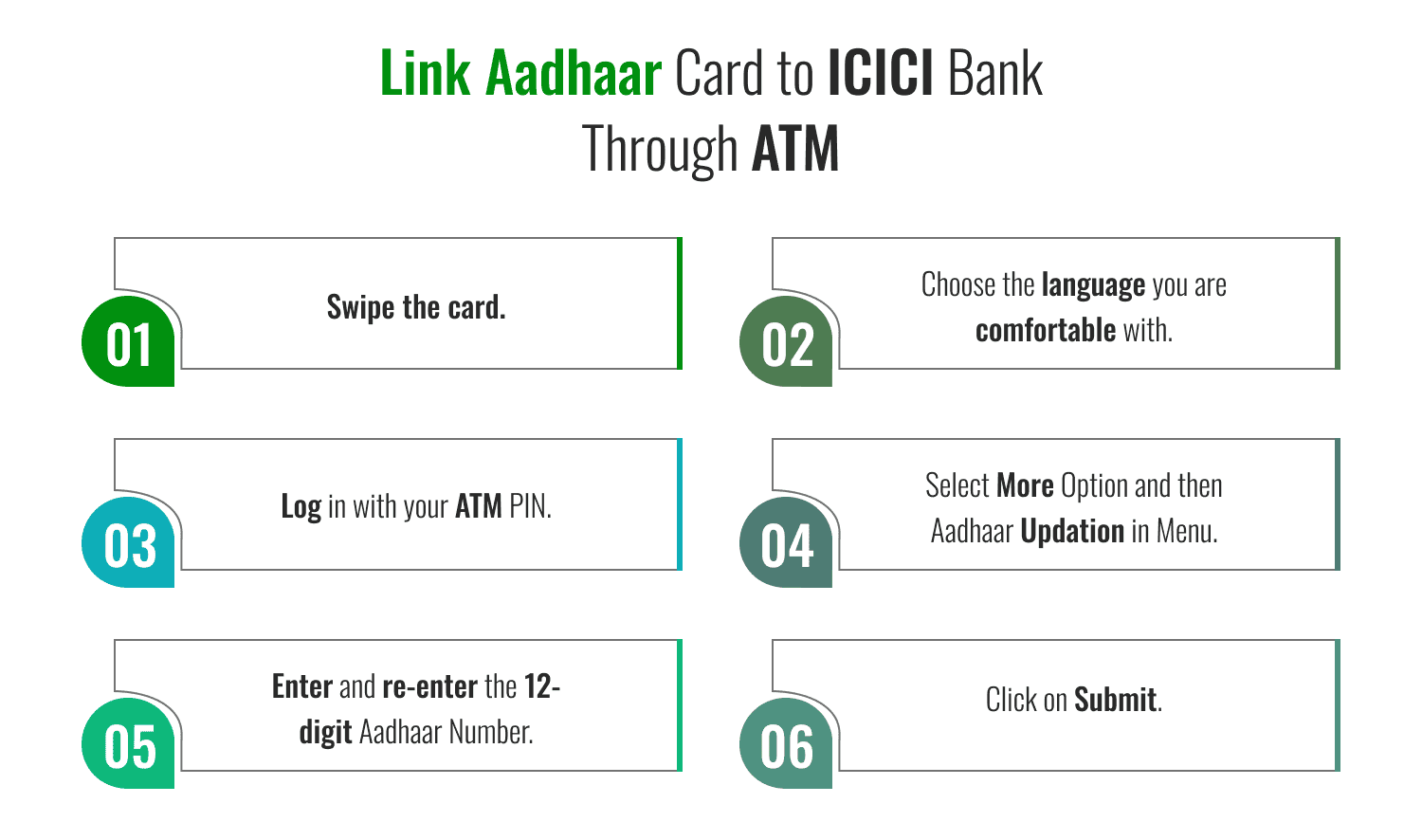

Link Aadhaar Card to ICICI Bank Through ATM

Head straight to the nearest ICICI Bank ATM and update your Aadhaar number with a bank account. Just follow the easy steps mentioned below and serve your purpose.

- Swipe the card.

- Choose the language you are comfortable with.

- Log in with your ATM PIN.

- Select More Option and then Aadhaar Updation in Menu.

- Enter and re-enter the 12-digit Aadhaar Number.

- Click on submit.

Link Aadhaar Card to ICICI Bank Through Branch Visit/Walk-In

Here is the way from which you can visit the nearest branch of ICICI and link your Aadhaar Card:

- Please visit any nearby ICICI Bank branch.

- Request a 'Stay Connected' form from the Lobby Manager or the 'May I Help You' desk.

- Fill in the necessary details such as your Customer ID, Bank Account Number, and Point No. (E) for Aadhaar Updation (Unique Identification Number).

- Provide a self-attested copy of your Aadhaar card along with the original for verification by the bank official.

How to Link Aadhaar to ICICI Bank Credit Card?

If your Aadhaar is linked to your ICICI Bank savings account, your ICICI credit card will automatically be linked to your Aadhaar. If not, you'll need to first link your Aadhaar with your account using one of the methods mentioned above.

How To Check Aadhaar Seeding Status with ICICI Bank Account?

You can check the linkage of Aadhaar Seeding with your ICICI Bank account. Wanna know how? Just tune in to the steps described below.

- Visit https://uidai.gov.in/ to check the status of your Aadhaar linking with your bank account.

- Click on the “My Aadhaar” tab and select “Bank Seeding Status.”

- You will be redirected to the login page.

- Click on “Login,” and enter your 12-digit Aadhaar number along with the security code (captcha). Then, select “Send OTP.”

- You will receive an OTP on your mobile number registered with your Aadhaar card.

- After logging in successfully, the next window will display.

- Click on “Bank Seeding Status” to view the details of your bank account linked with your Aadhaar.

Note – This service is available on your mobile number also if your Aadhaar Card is linked. Also, If you have multiple bank accounts, you can then check the status of them with the bank.

Benefits of Aadhaar Card Link with ICICI Bank

These are some benefits of linking an Aadhaar card with ICICI Bank account -

- Seamless Government Benefits : Direct receipt of government subsidies, pensions, and benefits like LPG subsidies, scholarships, and welfare schemes into your bank account.

- Streamlined Services : Easier and quicker access to various ICICI Bank services, such as loan approvals and account management, with Aadhaar serving as a primary identity proof.

- Simplified KYC Process : Aadhaar simplifies the Know Your Customer (KYC) process, reducing the need for additional documentation and making account updates and transactions smoother.

- Enhanced Security : Another benefit of linking Aadhar with an ICICI bank account is that it Improves security and verification for banking transactions, which reduces the risk of identity theft or fraud.

- Quick Resolution : Linking Aadhaar Card with faster resolution of banking queries and issues, as Aadhaar serves as a universal identification tool for the bank.

Frequently Asked Questions (FAQs)

Why is it important to link Aadhaar with my ICICI Bank account?

How can I link my Aadhaar with my ICICI Bank account online?

Can I link Aadhaar with my ICICI Bank account by visiting a branch?

How do I check if my Aadhaar is linked to my ICICI Bank account?

What should I do if I face issues linking my Aadhaar to my ICICI Bank account?

Aadhaar

- Check Aadhaar Update History

- Aadhaar Card Services

- Aadhaar Services on SMS

- Documents Required for Aadhaar Card

- Aadhaar Card Status

- E-Aadhaar Card Digital Signature

- Aadhaar Card Authentication

- Aadhaar Card Online Verification

- Lost Aadhaar Card

- Aadhaar Card Not Received Yet

- Aadhaar Virtual ID

- Retrieve Forgotten & Lost Aadhaar Card UID/EID

- Aadhaar Card Address Validation Letter

- Get Aadhaar Card for Non-Resident Indians

- Get Aadhaar e-KYC Verification

- Aadhaar Card Seva Kendra

- Aadhaar Card Features

- Aadhaar Card Online Corrections

- Change Photo in Aadhaar Card

Link Aadhaar Card

- Link Aadhaar Card to Bank Account

- Link Aadhaar Card to IRCTC Account

- Link Aadhaar Card to Income Tax Return

- Link Aadhaar Card with EPF

- Link Aadhaar Card with Driving Licence

- LInk Aadhaar to Caste Certificate

- Link Aadhaar with BPCL

- Link Aadhaar Card with LPG Gas

- Link Aadhaar Card with Ration Card

- Link Aadhaar Card with HP Gas

- Link Aadhaar Card with NPS Account

- Link Aadhaar Card with Mutual Funds

- Link Aadhaar Card with Demat Account

- Link Aadhaar Card with HDFC Life Insurance

- Link Aadhaar Card with SBI Life Insurance

Link Aadhaar to Mobile Number

Aadhaar Enrollment Centers

- Aadhaar Card Enrollment Centres

- Aadhaar Card Enrolment Centers in Delhi

- Aadhaar Card Enrolment Centers in Bangalore

- Aadhaar Card Enrolment Centers in Mumbai

- Aadhaar Card Enrolment Centers in Ahmedabad

- Aadhaar Card Enrolment Centers in Hyderabad

- Aadhaar Card Enrolment Centers in Ranchi

- Aadhaar Card Enrolment Centers in Indore

- Aadhaar Card Enrolment Centers in Kanpur

- Aadhaar Card Enrolment Centers in Patna

- Aadhaar Card Enrolment Centers in Surat

- Aadhaar Card Enrolment Centers in Lucknow

- Aadhaar Card Enrolment Centers in Bhopal

- Aadhaar Card Enrolment Centers in Jaipur

- Aadhaar Card Enrolment Centers in Ghaziabad

- Aadhaar Card Enrolment Centers in Faridabad

- Aadhaar Card Enrolment Centers in Noida

- Aadhaar Card Enrolment Centers in Gurgaon

- Aadhaar Card Enrolment Centers in Kolkata

- Aadhaar Card Enrolment Centers in Pune

- Aadhaar Card Enrolment Centers in Chennai

- Aadhaar Card Enrolment Centers in Chandigarh